NRWT: Related party and branch lending – NRWT changes

AGENCY DISCLOSURE STATEMENT

This Regulatory Impact Statement (RIS) has been prepared by Inland Revenue.

It provides an analysis of options to ensure the correct amount of non-resident withholding tax (NRWT) is paid at the appropriate time on related party lending, lending that is economically equivalent to related party lending, and lending by unrelated parties which have a New Zealand branch.

Inland Revenue has identified a number of arrangements that have been entered into by taxpayers to remove, reduce or defer an NRWT obligation that would otherwise arise if a more conventional loan arrangement were entered into. In some instances, an existing anti-avoidance provision has applied to arrive at a tax treatment consistent with the policy intention but this is not possible for all arrangements. Because of the sophistication of existing financial products an almost infinite variety of different arrangements may be constructed, including many that may be designed in the future if a comprehensive solution is not introduced.

The options in this RIS are intended to comprehensively cover both known and potential avoidance arrangements. They are designed to impose NRWT on a timely basis on related party interest and amounts equivalent to related party interest.

There is a key constraint on the analysis. The fiscal cost estimates of the options are based on the amount of foreign direct investment and conservative assumptions on interest rates compared with NRWT collected over a number of years[1]. Fiscal estimates of the individual options are not available as the modelling estimates the amount of NRWT officials expect should be paid compared to what is paid, rather than what is avoided by particular structures. Furthermore, the fiscal costs of each option cannot be determined on a stand-alone basis as the introduction of rules that removed the tax advantage of a particular arrangement could encourage taxpayers to adopt another arrangement.

A range of options have been considered and measured against the criteria of economic efficiency, fairness, and certainty and simplicity. There are no environmental, social or cultural impacts from the recommended changes.

Inland Revenue is of the view that, aside from the constraint described above there are no other significant constraints, caveats and uncertainties concerning the regulatory analysis undertaken.

None of the policy options identified are expected to restrict market competition, unduly impair private property rights or override fundamental common law principles.

Carmel Peters

Policy Manager

Policy and Strategy

Inland Revenue

1 December 2015

STATUS QUO AND PROBLEM DEFINITION

Non-resident withholding tax rules

1. Non-resident withholding tax (NRWT) is required to be withheld on certain payments of interest, dividends and royalties. This RIS is concerned with NRWT on interest.

2. In general, New Zealand imposes tax on the worldwide income of New Zealand-residents and the New Zealand-sourced income of non-residents. An interest payment made by a New Zealand resident to a non-resident is an example of New Zealand-sourced income of a non-resident. Although the standard approach is to impose income tax on income it can be difficult to enforce and collect tax from non-residents. To ensure tax on this income is paid, New Zealand (like many other countries) imposes a withholding tax on interest payments. The payer of the interest withholds NRWT from the interest payment and pays it to Inland Revenue, and the balance is paid to the non-resident lender.

3. The NRWT rate on interest is 15% but this rate is usually reduced to 10% for lenders whose home country has a double tax agreement (DTA) with New Zealand. These rates are consistent with international tax practice. The lender will often be taxable on the interest income in their home country and allowed a tax credit for the NRWT withheld in New Zealand. This means that their income tax liability in their home country will be reduced by the NRWT withheld.

4. NRWT is only required to be withheld on arrangements where a number of definitions are met, including “interest”, “money lent”, “paid” and “non-resident passive income”. The increasing sophistication of financial transactions has allowed the development of arrangements that are economically equivalent to debt from a related party, but do not trigger a liability to withhold NRWT on interest payments. In addition, the financial arrangement rules in the Income Tax Act 2007 mean that for New Zealand borrowers, finance cost deductions are calculated on an economic accrual basis. This means deductions can arise even when there is no interest, money lent, or payment that would trigger NRWT for the lender.

Related-party and third-party lending

5. NRWT is one of several areas of tax law that distinguish between related parties and third parties.

6. A “related party” is one that is associated, as that term is defined in the Income Tax Act 2007. Association recognises that there is, or may be, an ongoing relationship between two entities and covers a wide variety of relationships such as a person with their close relative, a company with its majority shareholder, or a trustee with its trust. The most common relationship between related parties is one company that, directly or indirectly, owns at least 50% of another company.

7. A “third party” is one that is not associated and recognises that two entities are not directly involved with each other. For the purposes of the problem definition, a common third party relationship arises when an individual or company borrows from a bank in which they have no ownership.

8. The distinction between related parties and third parties recognises that the incentives and behaviours of related parties may be different than an otherwise equivalent transaction involving third parties. For example, a person that lends to a related party may be willing to not receive interest payments as they are happy instead to hold an increased receivable from the borrower; whereas, a bank would expect interest payments as they do not wish their exposure to the borrower to increase beyond the agreed amount.

Approved issuer levy rules for third party lending

9. In certain circumstances, approved issuer levy (AIL) can replace NRWT on third party lending. AIL is a payment by the borrower that allows the rate of NRWT to be reduced to zero. Paying AIL is voluntary and applies at a lower rate of 2%. Unlike NRWT, however, AIL cannot be offset against the lender’s income tax liability in their home country.[2]

10. AIL is levied on third party lending. Applying AIL to third party lending helps ensure that taxes on interest do not push up interest rates in New Zealand too much. There is international evidence that NRWT on third party lending may largely be passed through as a cost to domestic borrowers in higher interest rates rather than being absorbed by foreign borrowers. This is because a very large and important group of foreign lenders including foreign margin lenders may have little or no scope to claim credits for NRWT. (Foreign financial institutions are often described as margin lenders because their profits are made on a small margin between borrowing and lending rates. Because NRWT is levied on the gross interest paid abroad, little may be creditable if gross interest is very large compared to the interest margin).

11. Other countries often have different ways of dealing with this concern and some exempt certain lenders from NRWT. A difficulty with that approach can be in identifying who should be exempt and who should not be. New Zealand’s approach of allowing borrowers of third party debt means to elect to pay AIL means that domestic interest rates may be bid up very slightly (by one fiftieth, e.g., from 5.0% to 5.1%) but this avoids the need to make different rules for different third party lenders. In practice it is very difficult to identify exactly which foreign lenders will and which will not be sufficiently sensitive to tax for NRWT to drive up domestic interest rates.

12. AIL would not be required and indeed would not be in New Zealand’s best interest if there were a sufficiently large pool of foreign third party lenders who could absorb the costs of NRWT without this being passed on in higher interest rates. Allowing AIL in this circumstance would reduce domestic taxes and increase the cost of borrowing to New Zealand as a whole because the cost of borrowed funds to New Zealand as a whole is the interest paid by New Zealand borrowers net of any domestic taxes that our Government collects on these payments. However, there is unlikely to be this large enough pool of foreign third party lenders and this appears to be borne out by international empirical evidence. Our AIL regime for third party debt is a pragmatic response.

Requirement to pay NRWT on related-party lending

13. The AIL option is not available to related parties. This is consistent with international tax practice including, for example, the OECD model which applies a withholding tax of 10% to related party interest. Officials consider that this treatment remains appropriate.

14. Unlike the case of third party debt the majority of related-party lenders are likely to be foreign taxpaying companies. These will often be able to absorb the costs of NRWT without this necessarily pushing up the cost of capital (i.e., the hurdle rate of return they require to invest in New Zealand). Under OECD conventions New Zealand has a right to levy NRWT in this case. This is justifiable given that New Zealand provides the infrastructure that foreign-owned business operating in New Zealand make use of. Failing to levy tax in this situation would put upward pressure on other tax rates in New Zealand which would create their own costs and be likely to provide a greater burden on New Zealanders.

15. Even where these taxes are not able to be absorbed by a particular investor, there remains a good reason for continuing to levy NRWT on related party interest. Taxes collected on international investment are a source of national income. If we levy lower taxes on one group of foreign direct investors than another, there will be incentives for investment to be undertaken by those paying the lowest amount of New Zealand tax. For a given amount of international investment into New Zealand, this will tend to lower national income. This provides strong grounds for trying to levy tax on different related-party investors into New Zealand that are as neutral and consistent as possible.

16. AIL has never been available as an option for related party lending and officials consider that this continues to be a sensible approach.

17. There is another consideration too. Related party debt is a close substitute for non-deductible equity. Borrowers are entitled to income tax deductions for interest payments on debt but not dividend payments on equity. As a result, there is an incentive for non-residents to invest in their New Zealand related party by way of debt to reduce their New Zealand tax liability. NRWT, along with thin capitalisation rules[3], support a more balanced investment.

18. There is a balancing consideration. The company tax rate, NRWT on interest paid to related parties and thin capitalisation rules can all combine to increase the cost of capital which will discourage investment to some extent. An important goal is ensuring that New Zealand’s tax rules are not too onerous and do not discourage investment too much so that New Zealand continues to be a good place to invest. At the same time there are no easy solutions here. There will be costs associated with just about any form of tax and taxes are necessary to finance the government services that New Zealanders expect.

19. The reforms discussed in this RIS are not aimed at overturning the current basic rules applying to third-party and related-party lending into New Zealand but instead at ensuring that they apply in a more consistent and neutral way. In particular, our basic framework involves levying tax on interest paid to a single foreign controller of a domestic company for standard debt contracts. The framework involves a balancing of competing considerations including cost of capital issues and the benefit of consistency and neutrality. There is, for example, no attempt to allow AIL or a lower rate of NRWT if a single foreign controller is unlikely to be able to claim credits for NRWT and this pushes up the cost of capital. The aim of the current reform is apply consistent rules in situations that are economically equivalent but where NRWT can currently be walked around.

The problem

20. The main problem is that the tax rules for related party lenders are not being applied on a neutral and consistent basis. This problem arises because:

- There are problems with definition and recognition of income under the NRWT rules;

- Current restrictions on related parties, or those who are economically equivalent to related parties, accessing the AIL rules are not sufficiently robust, which allows structuring into the AIL rules when the policy intention is that the interest payments should be subject to NRWT.

- The AIL requirements are limited, which allows certain New Zealand taxpayers to borrow from non-resident associates and use the AIL rules even though this interest does not meet the legislative requirements.

- Current exemptions from the NRWT rules relating to onshore branches are so wide in scope that they exempt certain interest payments that are not consistent with the policy intention for the taxation of New Zealand-sourced income earned by non-residents.

21. We consider it is in New Zealand’s best interest to maintain the NRWT rules but that they should apply consistently to economically equivalent transactions. Applying the rules more neutrally and consistently will help ensure that investment is undertaken in ways which will generate the best return to New Zealand as a whole rather than in ways where it is possible to sidestep NRWT. Allowing NRWT to be sidestepped in the case of related party lending provides incentives for assets to migrate to firms paying lower amounts of tax in New Zealand. This is likely to be economically inefficient and unfair. The reforms that are proposed are aimed at reducing these distortions.

Scale of the problem

22. Inland Revenue estimates that the amount of NRWT paid is approximately 75% of the amount that should be paid. This allows an inference that the current law provides an uneven playing field where a small number of foreign-owned firms that are not paying NRWT are subject to less tax than their competitors.

23. The Government currently collects around $180 million per annum from the combined NRWT and AIL rules applying to interest. For the 2014 year this was $135 million NRWT on interest and $47 million AIL.

24. The 2014 Statistics New Zealand international investment position data shows that debt instruments held by direct investors in New Zealand entities were approximately $49 billion.

OBJECTIVES

25. The main aim of the reform is to ensure that New Zealand’s tax rules for related party lenders are applied on a neutral and consistent basis. This would mean having rules that ensure the return received by a non-resident lender from an associated borrower (or a party that is economically equivalent to an associated borrower) will be subject to NRWT and, at a time, that is not significantly later than when income tax deductions for the funding costs are available to the borrower.

26. The desired outcome is that amounts that are economically equivalent to related party debt should be taxed consistently with more use of standard debt instruments as originally anticipated by the existing NRWT rules. For example, bonds where interest payments are made regularly (including where the interest is capitalised into the debt) should have a similar NRWT treatment to zero-coupon bonds that pay no interest for 30 years with a very large interest payment built into the final payment on maturity.

27. The options in this RIS have been subject to consideration by tax policy officials for a number of years, as the deficiencies in the NRWT rules are widely known. This project is not part of, but is consistent with, the approach taken by the OECD base erosion and profit shifting (BEPS) work.

28. The criteria against which the options will be assessed are:

- Economic efficiency: The tax system should, to the extent possible, apply neutrally and consistently to economically equivalent transactions. This means the tax system should not provide a tax preferred treatment for one transaction over another similar transaction or provide an advantage to one business over another. This helps ensure that the most efficient forms of investment which provide the best returns to New Zealand as a whole are undertaken. At the same time there is a concern that taxes should not unduly raise the cost of capital and discourage inbound investment.

- Fairness: Taxes should not be arbitrary and should be fair to different businesses. Neutrality and consistency across economically equivalent transactions is likely to also promote fairness.

- Certainty and simplicity: Although the NRWT rules are necessarily complicated, they should be as clear and simple as possible so that taxpayers who attempt to comply with the rules are able to do so.

29. While all criteria are not equally weighted they are important. Any change (except for the status quo) would have to improve neutrality and consistency of treatment. This will tend to promote economic efficiency and fairness. At the same time, the measures will also tend to increase the cost of capital in some circumstances so there are trade-offs to consider. Due to the complexity of these transactions, the sophistication of taxpayers who enter into them and the rules that cover them, and the fact that taxpayers are generally able to choose to enter into more simple transactions as an alternative to those dealt with by these rules, officials would see economic efficiency and fairness as the most important criteria.

30. The options do not deal with all tax issues arising from related-party debt. In particular, they do not deal with cross-border hybrid issues. The timetable for dealing with those issues is linked to the OECD’s BEPS timetable. Consultation is likely to commence on them by early 2016.

REGULATORY IMPACT ANALYSIS

31. A range of options and the status quo have been assessed in this RIS for addressing the problems identified in paragraph 20. Owing to the complexity of the NRWT rules and the variety of structures that must be covered by them it is not possible to design a single option to address the entire problem definition.

32. Two options are assessed as “general options” because they potentially address more than one of the identified problems. Eight options are grouped according to the specific problems they seek to address and this format is consistent with how these problems and options were presented in the May 2015 officials’ issues paper NRWT: related party and branch lending.

33. The options are:

- General options

- Option 1: Status quo

- Option 2: Specific anti-avoidance rules

- Problems with the definition and recognition of income under the NRWT rules

- Option 3: Extend definitions applying to the NRWT rules (preferred option)

- Option 4: More closely align NRWT with the financial arrangement rules (preferred option)

- Option 5: Defer income tax deductions until NRWT is paid

- Defining when payments are to a related person

- Option 6: Thin capitalisation style acting together test (preferred option)

- Option 7: Back-to-back and multi-party reconstruction rules (preferred option)

- Eligibility for AIL

- Option 8: AIL registration changes (preferred option)

- Option 9: Requiring upfront proof of non-association before allowing AIL

- How branches interact with the NRWT rules

- Option 10: Onshore branch changes (preferred option)

34. If a general option is relevant to one of the specific problems it will be mentioned in the discussion of that problem. Although the general options have not been separately listed in each specific category their exclusion is not intended to imply that the preferred option was the only available option.

General options

Option 1: Status quo

35. Under this option, the current NRWT and AIL rules would remain unchanged.

36. Some submitters suggested retaining the status quo for an undetermined period before considering options following or concurrent with the OECD’s BEPS project work. Officials did not consider that any additional information would arise from the BEPS project that would fundamentally alter the conclusions reached in this review. Therefore, officials do not support any deferral.

Assessment against criteria – status quo

37. The deficiencies in the current NRWT rules create an incentive for taxpayers to enter into complex arrangements to achieve tax benefits that would not be available under transactions that would otherwise be entered into but for the differing tax treatment. Therefore, this option would not meet the criteria of promoting economic efficiency or fairness.

38. Owing to the use of structures that are often challenged under existing anti-avoidance provisions this option would fail the criterion of promoting certainty and simplicity.

Option 2: Specific anti-avoidance rules

39. This option would introduce one or a series of anti-avoidance rules that would apply to arrangements which had either the intention or effect of removing or delaying an NRWT (or AIL) liability. This option would apply in addition to the existing anti-avoidance provisions.

40. To the extent the anti-avoidance rules are effective they would raise additional revenue.

Assessment against criteria – option 2

41. To the extent the anti-avoidance rules apply on a different (and uncertain) boundary to the status quo and the other options, this option would not fully meet neither the criterion of promoting economic efficiency nor that of promoting fairness.

42. An anti-avoidance rule that was intended to apply to a broadly similar range of transactions as the specific provisions considered in the other options would incur higher compliance and administration costs (for example due to the cost of tax disputes) than under the status quo and preferred options.

43. Anti-avoidance rules are generally a second best approach when compared with a more general principles-based approach. Such rules create uncertainty for taxpayers and Inland Revenue and can involve considerable expense, particularly when the disputes process is required before a reassessment can be made. This option would be associated with greater uncertainty and complexity, compared with the status quo.

Problems with definition and recognition of income under the NRWT rules

44. This problem relates to the inconsistencies in the rules for income tax and NRWT which allow borrowers to obtain income tax deductions for financing costs while deferring or removing the NRWT liability on interest payments or amounts that are economically equivalent to interest payments to a non-resident related party lender.

General options

45. The only general option that merits specific discussion here is option 2. Some submitters favoured the adoption of this option for addressing the specific problem. However, officials do not support this option on the basis that it would require specific anti-avoidance provisions to cover transactions where taxpayers would seek to argue that the arrangement was structured in a manner for commercial reasons in order to be effective. Even if these commercial reasons were accepted, it is possible for these transactions to be inconsistent with the policy intention underlying the interaction of the NRWT and financial arrangement rules.

46. For example, a New Zealand resident borrower with no or limited cash flow could borrow money from its parent using a zero coupon loan, or using a loan that capitalises interest. Both types of loan are commercially justified, but the former defers the NRWT on the interest until the loan is repaid, whereas the latter does not. From an economic efficiency and fairness standpoint this is not desirable. In order for this option to be effective it would have to apply comprehensively. This would result in an anti-avoidance provision applying in almost all of the same scenarios in which the preferred option applied but without providing the same degree of certainty.

47. Option 2 is likely to be less effective in promoting economic efficiency and fairness than the preferred options (option 3 and 4). There would also be greater compliance and administration costs of applying the provisions which would likely result in a higher burden on the economy for equal or less tax. For these reasons, this option is not preferred.

Option 3: Extend definitions applying to the NRWT rules

48. Under this option current definitions in the NRWT rules would be extended to apply to arrangements that are economically equivalent to those arrangements which are covered by the current definitions.

49. These extensions would apply to arrangements involving associated persons and for the purpose of the NRWT rules. Transactions with genuine unrelated parties have less scope to circumvent the existing rules as arms’ length lenders would usually require returns on their investment within reasonable timeframes; whereas, related parties can generate their return on investment in other ways, such as an unrealised increased value of their wholly owned subsidiary. Limiting these changes to the NRWT rules removes the need to consider the impact of these changes on other areas of tax law, which have not had similar concerns identified.

50. Because this option would result in more arrangements being subject to NRWT it would increase revenue.

Assessment against criteria – option 3

51. This option would achieve the criterion of promoting economic efficiency as it would impose NRWT on transactions that are not currently subject to NRWT but are economically equivalent to those that already are. A balancing consideration is that this option could increase the cost of capital but only for borrowers that are structuring around the existing rules and only to the level that applies to economically equivalent transactions. On balance officials consider this would promote economic efficiency.

52. The greater neutrality across economically equivalent transactions will achieve the criterion of promoting fairness.

53. The certainty and simplicity criterion would be met because taxpayers who have the ability to enter into such transactions would be able to apply the new rules with little difficulty. In addition, taxpayers would have an incentive to revert to less complex transactions which have the same tax treatment.

Option 4: More closely align NRWT with the financial arrangement rules

54. Under this option the NRWT and financial arrangement rules would be more closely aligned. This means NRWT would apply to income arising on an economic accrual basis when a transaction had a larger than acceptable level of deferral between accrued income and interest payments. The rules would not apply to arrangements involving third parties or related parties that had interest payments that broadly aligned with the economic accrual of that income, including when interest was paid on an arrears basis[4] after the balance date before which part of the income accrued in.

55. Currently, many transactions will eventually have the correct amount of NRWT paid but can achieve a significant timing advantage by deferring the timing of the interest payment compared to the economic accrual of the income under the financial arrangement rules.

56. As explained in option 3 this timing advantage generally only arises between related parties due to the different commercial pressures compared to unrelated party lending. Owing to the complexity of this option we only considered these changes in relation to certain related party transactions rather than a wholesale refocusing of the NRWT rules.

57. In order to broadly align the time when income and expenditure are recognised, the two options available are to accelerate the income or defer the deductions. These are considered under option 4 and option 5.

58. Option 4 involves determining which arrangements could be subject to these proposals and only capturing the subset of these arrangements where NRWT is paid beyond an acceptable deferral compared with the corresponding income tax deductions.

59. For these particular arrangements an amount of income that would be liable to NRWT would be calculated for the non-resident lender consistent with the deductions available to the borrower under the financial arrangement rules. In accordance with the existing rules this non-resident interest income should exclude foreign exchange movements.

60. Although this option would accelerate the payment of NRWT it would, when measured in the currency that the loan was denominated in, have no impact on the amount of NRWT payable on an arrangement, the amount of foreign tax credits available to the lender, and deductions available to the borrower.

61. This option would accelerate the payment of NRWT on transactions so that the timing is similar to income tax deductions and the NRWT treatment of other economically equivalent transactions. Consequently, there would be a revenue gain.

Assessment against criteria – option 4

62. This option would achieve the criterion of promoting economic efficiency as the liability for NRWT would broadly align with the economic accrual of the income and income tax deductions. It would increase the cost of capital in some circumstances but only to align this better with the cost of capital on economically equivalent transactions. It will mean economically equivalent borrowing will be taxed in a similar manner irrespective of the timing of interest payments.

The greater neutrality across economically equivalent transactions would also achieve the criterion of promoting fairness.

63. Owing to the complexity of this option it would prima facie only partially meet the certainty and simplicity criterion. However, these rules would only be applied by sophisticated taxpayers and the NRWT liability would broadly approximate their income tax deductions and so these rules could be applied correctly by almost all taxpayers. This option could provide an incentive for taxpayers involved in such arrangements to revert to less complex transactions that have the same tax treatment, but require less complex rules.

Option 5: Defer income tax deductions until NRWT is paid

64. This option would take the opposite approach to option 4, in that there would be no changes to the NRWT rules but would still require rules to identify certain funding arrangements which had an unacceptable deferral compared with the corresponding income tax deductions. The difference is, for these arrangements, changes would be required to either the financial arrangement rules or the provisions that allow a deduction for financial arrangement expenditure so that income tax deductions would be deferred until NRWT was paid. Rather than forfeiting income tax deductions, these deductions would be carried forward to a future period when NRWT was eventually paid.

65. This option has the advantage of leaving the NRWT rules unchanged so that borrowers do not face any tax liabilities that cannot be immediately met by way of reducing a payment to the lender. However, this option would create a number of income tax complications that officials consider are undesirable.

66. These complications include:

- The financial arrangement rules are designed to give an accurate measure of a person’s income or expenditure from financial arrangements in order that a person’s tax liability can be calculated. Deferring deductions would reduce this accuracy, which could in turn create difficulties. For example, deferral allows a company in tax loss to artificially preserve the interest deductions, in situations when it might otherwise be eliminated by an ownership change.

- If deferral were applied to a related party loan in a foreign currency, it would not make sense to apply deferral to the recognition of foreign currency movements on the loan, since these are not subject to NRWT in any event. Furthermore, if the loan is hedged, deferral of recognition of foreign currency movements could create a timing mismatch. Deferring part of the expenditure but not all would be complex.

- It would be difficult to integrate this option with the thin capitalisation regime. Deferral would prima facie mean that interest economically incurred in one year would give rise (or not) to an additional amount of income under the thin capitalisation rules depending on the borrower’s debt/equity ratio in the later year when the interest is paid, rather than in the year it economically accrues. That would not be desirable.

67. This option is not considered to be economically efficient as it changes the income tax treatment of interest deductions away from when they economically accrue. It also provides differing incentives for the lender to have NRWT paid on their behalf depending on the income tax position of the borrower.

68. This option would raise additional revenue but not as much tax as option 4. Although a small number of borrowers may have deductions deferred which would result in income tax at 28% rather than NRWT at 10%, in practice this would only occur when the borrower is in a tax loss so that the deduction deferral would not affect current year income tax payable.

Assessment against criteria – option 5

69. Economic efficiency and fairness would be improved over the status quo but these criteria are only partially met as full neutrality might not be achieved depending on the borrower’s income tax position as noted above. At the same time this option would increase the cost of capital in fewer circumstances.

70. These rules should only be introduced if the complications mentioned above are resolved. Although this might be possible it would result in even more complex rules than the other options so the certainty and simplicity criterion would not be met.

Defining when payments are to a related person

71. This problem relates to the ability of interest payments to unrelated parties to be subject to AIL instead of NRWT. There are numerous arrangements in which the ultimate lender and borrower are associated (or economically equivalent to associated) but any interest payment made by the New Zealand borrower is not paid to an associated non-resident and so AIL is available.

General options

72. A specific anti-avoidance provision (option 2) was suggested by some submitters to resolve the back-to-back and multi-party arrangement concerns (see below for explanation of these). However, such a provision is not favoured by officials. Although option 2 might meet the economic efficiency and fairness criteria by the same degree as the preferred option for addressing this problem it does so with much less certainty. As mentioned earlier, a specific anti-avoidance provision would likely have a greater impact on the cost of capital because of the additional cost of challenges as to whether the provision applied. Officials also consider that a specific anti-avoidance provision would not be a viable option for addressing the issue of “acting together”.

73. Some submitters favoured the status quo (option 1) over an acting together rule. There are commercial reasons why some taxpayers would be unable to substitute between other structures identified in this RIS and this structure, such as a desire to retain 100% ownership and control of a New Zealand subsidiary. However, officials consider this option would not meet the economic efficiency and fairness criteria. If two or more non-resident investors act together to control a New Zealand company this structure would be economically equivalent to a single non-resident investor with the same ownership. It would be economically inefficient for a business with a single owner to face a tax disadvantage compared to one with two or more owners that are acting in an otherwise equivalent manner.

Option 6: Thin capitalisation style acting together test

74. New Zealand borrowers can elect to pay AIL instead of withholding NRWT on interest payments to non-residents provided the borrower and lender are not associated. A lender and borrower will generally be associated if one company, directly or indirectly, owns 50% or more of the other. This is a measure of the extent to which the lender and borrower are commonly controlled.

75. However, if two or more companies, who are not associated with each other, but make decisions as if they were a single person, collectively hold 50% or more of the shares in, and lend to, a New Zealand company this can be economically equivalent to them controlling the New Zealand company without them being associated with it, so that AIL is still available on the shareholder loans.

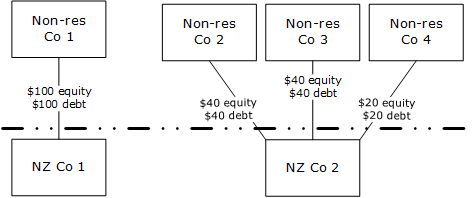

76. This can be shown in the following example:

77. In this example interest payments by NZ Co 1 to Non-res Co 1 would not be eligible for AIL as these companies are associated. Interest payments by NZ Co 2 to Non-res Co 2, Non-res Co 3 and Non-res Co 4 would be eligible for AIL as none of these companies is associated with each other or with NZ Co 2. When considered together Non-res Co 2, Non-res Co 3 and Non-res Co 4 are economically equivalent to Non-res Co 1 and so should be subject to the same tax treatment.

78. A similar issue existed for thin capitalisation before the introduction of non-resident owning body provisions for the 2015-16 and later income years. A non-resident owning body is made up of a group of non-residents[5] that have one or more characteristics which indicate they are acting together to debt-fund a New Zealand company. The owning body is essentially treated for thin capitalisation purposes as a single person with the ownership interests of the group.

79. This option would introduce a similar measure into the AIL rules. This would mean that if there is a group that is acting together, and if considered as a single entity would be associated with the New Zealand borrower, the borrower would be ineligible to pay AIL on interest to a member of the group. This option would not involve changes to the association rules and so a member of the group or the group as a whole would not become associated solely because of this option. This option would allow interest payments on lending which is not part of the group activity to qualify for AIL.

80. Other measures under this option include whether the group should comprise both residents and non-residents or only non-residents and whether ownership interests should be calculated based on the highest of the four ownership tests (which would be consistent with thin capitalisation) or the average of these tests (which would be consistent with the associated person rules).

81. It would be possible to define an acting together group including resident members but only apply the AIL restrictions to the non-resident members of that group (the resident members not deriving non-resident passive income). This was the proposal in the issues paper. However, submitters were opposed to this measure and considered that if an acting together test were adopted it should only apply to a group of non-residents. Submitters raised the possibility of the rules applying when non-residents only have an extremely minor interest in the New Zealand company. To meet this concern, officials revised the proposed measure so that it would only apply when a borrower is controlled by a group of non-residents who are acting together. This is consistent with the existing thin capitalisation test.

82. There are four shareholder decision-making rights which are the right to participate in decision making concerning: dividends; the company constitution; varying capital of the company and appointing directors. The existing thin capitalisation test looks at the highest of these four ownership interests while the existing associated person rules look at the average of these interests. As taxpayers would always prefer to not be treated as acting together, and the average interest test would be a more difficult threshold to breach than the highest interest test[6] the average measure would be the preferred option of potentially affected taxpayers.

83. The advantage of the average test is that it would generally more accurately reflect the control a shareholder has over a company. The disadvantage is that it would leave open the possibility of aggressive structuring. For example, having three of the decision-making rights over 50% and one much lower so that on average the shareholder and the company would be below 50% and so would not be associated.

84. As the existing AIL requirements rely on the associated person rules, and therefore the average of the shareholder decision-making rights, officials consider it is more consistent to also apply the average of the shareholder decision-making rights to the acting together requirements.

85. This option would impose NRWT instead of AIL on certain interest payments but only in relation to arrangements that are economically equivalent to those that are already subject to NRWT. This option would raise additional revenue.

Assessment against criteria – option 6

86. This option would promote economic efficiency by imposing NRWT on interest payments to groups of non-residents that are economically equivalent to a single related party lender. A balancing consideration is that this would increase the cost of capital but only to the level that applies to economically equivalent transactions. On balance officials consider this would achieve the criterion of promoting economic efficiency.

The greater neutrality across economically equivalent transactions will achieve the criterion of promoting fairness.

87. This option relies on a variant of the existing non-resident owning body definition in the thin capitalisation rules. Although this test complex it is an existing provision and for most taxpayers it would be clear whether it applies or not. Therefore, the certainty criterion would be met.

Option 7: Back-to-back and multi-party reconstruction rules

88. As the AIL rules apply the legal form of the associated person rules rather than their economic substance they currently do not apply when an associated borrower and lender interpose an unrelated party. For example, a New Zealand borrower could borrow from an unrelated finance company that has an agreement to be funded by a deposit from a non-resident that is associated with the New Zealand borrower. Although such an arrangement is vulnerable to the general anti avoidance rule, the exact parameters of this rule are uncertain and it is not desirable to rely on it when specific rules can sensibly be used.

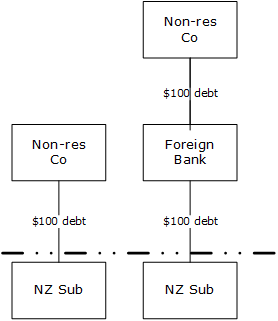

89. This arrangement can be shown in the following example:

90. In this example, if Non-Res Co lends money to its NZ Sub any interest payments would be subject to NRWT. However, if Non-Res Co puts money on deposit with a Foreign Bank and the Foreign Bank lends the same amount to NZ Sub the interest payment by NZ Sub would be eligible for AIL (subject to the non-application of an anti-avoidance rule).

91. Similar structures can also be applied to arrangements that are economically equivalent to, but are not, a loan that meets the necessary definitions for NRWT purposes. For example, a bank could lend to a New Zealand company then agree to sell the repayment obligation to the New Zealand company’s foreign parent. Economically, this arrangement is equivalent to a loan from the foreign parent to the New Zealand company, but is not currently subject to NRWT as it is not an interest payment on a loan from a related non-resident.

92. Option 7 involves introducing a specific set of tests that would identify arrangements that have the appearance of providing funding from a non-resident to an unrelated New Zealand borrower but the funding is ultimately provided by an associated party and the economic effect of the structure is in whole or part equivalent to a direct loan from that associated party. When these tests are met the tax treatment of the arrangement would be recharacterised to reflect the economic substance as a loan from an associated party.

93. If an arrangement is economically equivalent to a New Zealand borrower being partially funded by an associated non-resident and partially by a third party this option would only apply to the extent of the associated party funding.

94. While this option could slightly increase the cost of capital it would raise additional tax from taxpayers who are structuring around the existing NRWT rules.

Assessment against criteria – option 7

95. This option removes one avenue to enter into a tax avoidance arrangement and strengthens existing anti-avoidance provisions that might already apply to such a transaction. This option would achieve greater economic efficiency despite possibly pushing up the cost of capital slightly certain investors who circumvent the existing rules. However, the impact would be consistent with existing taxes already applying to equivalent transactions and, on balance, officials consider that this will satisfy the criterion of promoting economic efficiency. The greater neutrality across equivalent transactions will also satisfy the criterion of promoting fairness.

96. The effect of these rules would be similar to reconstructing under an anti-avoidance provision. However, the rules would provide greater certainty to taxpayers and Inland Revenue, as well as provide parliamentary guidance on how the anti-avoidance provisions should be applied to this type of transaction. Therefore, the certainty and simplicity criterion would be met.

Eligibility for AIL

97. AIL is not intended to be available for interest payments to associated parties. However, officials are aware of a number of instances where AIL has been paid by associated parties that claim to be unassociated. These instances can only be prevented if they are identified by Inland Revenue’s investigations unit which, outside of the larger cases, would not be cost effective.

General options

98. Submitters favoured the status quo (option 1) for addressing this problem, but officials did not.

99. The status quo would not meet the economic efficiency and fairness criteria, as taxpayers (particularly those with relatively low borrowing amounts) would be aware that their tax position could not be cost effectively audited to ensure it was correct. The tax system relies on voluntary compliance and if there is an incentive not to comply with the tax law it is not efficient for this to be retained.

Option 8: AIL registration changes

100. Option 8 would restrict who can register a security for AIL to replace the current rules which allows any person to register a security. This restriction would only allow security registrations where there was a low risk of the registration being on associated party lending. Two requirements would be needed to provide for this restriction namely; the borrower and/or lender must be subject to either regulatory or public oversight so that abuse of AIL would be highly unlikely, and the amount of the borrowing must be sufficiently large that further review by Inland Revenue could be cost effectively undertaken.

101. Officials consider that a publicly listed company undertaking a private placement and a closely held company borrowing from a foreign bank are examples of low risk registrations. These and many other examples would be able to continue to register securities under this option.

102. One disadvantage with this option is that it could restrict access to AIL for legitimate third party foreign borrowing, such as an individual borrowing from a foreign business associate. However, officials are not aware of a suitable distinction to draw between these cases and cases when AIL is accessed inappropriately. Officials expect that relative to the amount of lending that might continue to be eligible for AIL these transactions would be very small. This would be balanced against the extra tax paid by borrowers currently inappropriately accessing AIL.

Assessment against criteria – option 8

103. This option would promote both economic efficiency and fairness. This is because taxpayers who are choosing not to apply the existing law would no longer have this choice and they would have to pay a consistent amount of NRWT like other taxpayers with economically equivalent arrangements.

104. The certainty and simplicity criterion would be met as taxpayers would be able to determine whether they or their lender are on the list of approved borrowers and/or lenders.

Option 9: Requiring upfront proof of non-association before allowing AIL

105. Under this option the registration process would include a requirement that would provide that the borrower and lender are not associated. Inland Revenue would confirm this requirement is met before completing the registration or, alternatively, rely on the existing legislation and apply greater audit resources to ensure that when AIL has been paid the parties are not associated.

106. Confirming this information, under either approach, would be time consuming because taxpayers who are willing to pay AIL when they know it is not available are often willing to provide incomplete or incorrect documentation to suggest their tax position is correct. Inland Revenue would usually have to seek documentation from foreign tax jurisdictions using information exchange facilities in a DTA which can be a time consuming process. If New Zealand does not have a DTA with a foreign country it would be much more difficult, if not impossible, to obtain this documentation.

107. A further complication is the low value of many AIL payments. For example, during the 2014 calendar year there were 1,667 taxpayers who paid AIL; however, 1,299 of these paid less than $1,000 and 1,468 paid less than $5,000.

108. This option would have a lower impact on the cost of capital for the limited number of borrowers who are borrowing from third parties but will not meet any of the categories in the approved list. However, it would impose much more significant compliance and administration costs on all borrowers, including those who would easily meet the categories in the approved list.

109. Although this option is likely to result in a small increase in tax paid this would be more than offset by the additional resource requirements to implement it which would either require additional funding or the refocusing of resources from other areas where they can be more cost effectively employed.

Assessment against criteria – option 9

110. This option would meet the economic efficiency and fairness criteria provided the review by Inland Revenue is comprehensive and arrives at the correct outcome. It would provide certainty to taxpayers who should be aware that they are borrowing from associated parties and the lender is liable for NRWT. To the extent Inland Revenue is unable to accurately determine whether all borrowers and lenders are associated (as is currently the case) the economic efficiency and fairness criteria would not be satisfied. Therefore, this option would only partially meet these criteria.

111. To the extent the review by Inland Revenue is comprehensive this option would increase certainty as all approved issuers would be aware their securities would be reviewed to ensure they are not with related parties. Therefore, this criterion would be met.

How branches interact with the NRWT rules

112. An interest payment is not non-resident passive income if the non-resident recipient has a New Zealand branch. This rule is known as the onshore branch exemption, which has existed since the introduction of NRWT in 1964. The exemption was intended to cover the situation at the time when most of New Zealand’s banking sector operated as New Zealand branches of foreign parents. This meant that New Zealand mortgage borrowers did not need to have a different tax treatment depending on whether they borrowed from a New Zealand bank or a New Zealand branch of a foreign bank.

113. However, the legislation did not take into account borrowing from a foreign company with a New Zealand branch that was not involved in the lending transaction. Under the current legislation the existence of the New Zealand branch that is not involved in the arrangement means interest payments which are not to the branch are not subject to AIL or NRWT. This is the case even when the structure is otherwise identical to a structure that would generate non-resident passive income and the lack of non-resident passive income results in a permanent reduction of New Zealand’s tax base.

114. The branch rules create an incentive for a foreign lender to establish a New Zealand branch or to channel funding through a foreign company that has a New Zealand branch. As these transactions are economically equivalent to lending by a foreign company that does not have a New Zealand branch officials consider the tax treatment of the two transactions should be the same.

General options

115. In certain instances, a specific anti-avoidance rule (option 2) could be effective as it would correctly tax a structure that had been entered into to avoid NRWT or AIL. However, there would be many arrangements that have legitimate commercial reasons for why a particular structure was entered into. Option 2 would not be economically efficient or fair if it did not apply to all transactions and would not certain or simple if there was an uncertain boundary between where the anti-avoidance rule applied and where it didn’t. Option 2 would not less efficient compared with measures aimed at correcting the legislation that causes the issue.

Option 10: Onshore branch changes

116. Option 10 would alter the onshore branch exemption so that non-resident passive income arises on an interest payment to a foreign company, unless the interest is paid to the New Zealand branch of the foreign company[7].

117. Additional tax would only be imposed on transactions involving non-residents with New Zealand branches that are not involved in the transaction that are economically equivalent to transactions that are already subject to tax. This option would raise additional revenue.

Assessment against criteria – option 10

118. This option would be economically efficient and fair as all interest payments by a New Zealand resident to a non-resident would be subject to NRWT or AIL irrespective of whether the non-resident had a New Zealand branch that is not involved in the transaction. At time the cost of capital may rise but only to the level that applies to economically equivalent transactions.118. Borrowers from lenders with a branch would be aware they were borrowing from the branch if this is the case and the existence of a branch not involved in the transaction would become irrelevant. Therefore, the certainty criterion would be met.

Scope of option – borrowing from foreign banks

119. The onshore branch exemption also applies when a New Zealand resident borrows from a foreign bank with a New Zealand branch[8] (usually to acquire or refinance foreign property). The onshore branch exemption in this situation means the New Zealand borrower does not have to pay AIL or withhold NRWT and instead the foreign bank pays New Zealand income tax on the lending margin on that loan. Officials estimate that there are approximately 3,000 borrowers who do not have an AIL or NRWT obligation because of the onshore branch exemption.

120. Officials consider that the application of the onshore branch exemption is not a permanent solution to this issue as the majority of foreign banks do not have a New Zealand branch[9]. However, officials do not consider it is possible to develop a robust solution to this issue as part of the current project. Therefore, the option to restrict the onshore branch exemption as covered above should not apply if the New Zealand branch holds a banking licence and the borrower is not associated with the non-resident.

Summary of impact analysis

| Option | Main objective and criteria | Benefits | Costs/risks |

| Option 1 – status quo |

|

|

|

| Option 2 – specific anti-avoidance rules |

|

|

|

| Option 3 – extend definitions applying to the NRWT rules (preferred option) |

|

|

|

| Option 4 – more closely align NRWT with the financial arrangement rules (preferred option) |

|

|

|

| Option 5 – defer income tax deductions until NRWT is paid |

|

|

|

| Option 6 – thin capitalisation style acting together test (preferred option) |

|

|

|

| Option 7 – back-to-back and multi-party reconstruction rules (preferred option) |

|

|

|

| Option 8 – AIL registration changes (preferred option) |

|

|

|

| Option 9 – requiring upfront proof of non-association before allowing AIL |

|

|

|

| Option 10 – onshore branch changes (preferred option) |

|

|

|

Key:

Criterion (a) – economic efficiency, criterion (b) – fairness, criterion (c) – certainty and simplicity, criterion

121. The fiscal estimate of the preferred options is $33 million per annum once fully implemented. As noted in the Agency Disclosure Statement this fiscal estimate cannot be broken down into an estimate for each individual option due to data limitations as well as the ability for taxpayers to substitute between structures that currently circumvent the NRWT rules. In comparison the status quo would maintain the current revenue amount which in the 2014 year was $180 million. The fiscal estimate for options 2, 5 and 9 which are the non-preferred options also cannot be individually calculated; however, we expect these would be revenue positive but to a lesser amount than the preferred options.

122. The combined effect of the preferred options is to improve economic efficiency by applying a consistent tax treatment to economically equivalent related party funding transactions. This will remove the current tax incentive to enter into complex transactions to achieve a more beneficial tax treatment.

123. There would be no direct increase in administration costs from implementing preferred options 3, 4, 6, 7, and 10, as they would rely on taxpayers using existing NRWT and AIL forms and systems. Option 5, which is not a preferred option, would also have no direct effect on administration costs. Option 8 would require the AIL security registration form to be amended to include the additional information but the impact of this measure would be minimal. The administration costs for options 2 and 9 would impose additional administration costs from the Commissioner of Inland Revenue being required to confirm that those options are being complied with. The combined effect of the preferred options would increase compliance which should reduce administration costs overall, as less resources would be required to identify and review complex funding structures.

CONSULTATION

124. The main consultation has been through the NRWT: related party and branch lending officials’ issues paper, which was released in May 2015. Officials have consulted further with a number of submitters to attempt to address the concerns raised. We have also consulted with the Ministry of Business, Innovation and Employment and Callaghan Innovation. For the most part, we have addressed the main feedback from consultation in the analysis section of this RIS.

125. One of the major concerns raised by submitters was that increasing NRWT might increase the cost of capital to New Zealand, on the basis that it would increase the before tax return which foreign investors would require from their New Zealand investments.

126. As has been noted above, the cost of capital is only one element in a broader economic efficiency story. While the cost of capital will be likely to rise in some circumstances this will only be to the level that applies in situations that are economically equivalent. The greater neutrality achieved across different investors and different transactions will tend to promote both fairness and economic efficiency.

127. However, a number of changes have been made to the issues paper proposals which are intended to minimise their effect on the cost of capital. These changes include:

- Further refinement of the safe-harbour calculations for whether NRWT is required to be paid on an accrual basis;

- Limiting the acting together changes so they only apply when the New Zealand borrower is controlled by non-residents that are acting together; and

- Additions to who can register a security for AIL including a category for a lender which makes over $500,000 of interest payments per annum.

128. Another major concern was the ability for foreign lenders to claim foreign tax credits for NRWT paid on an accrual basis, under a DTA. Submitters did not identify any specific instances where this would be a problem but expressed that it may arise. Officials have conducted further analysis of this and have not identified any areas of concern over the ability to claim a foreign tax credit due to NRWT being imposed on an accrual basis.

CONCLUSIONS AND RECOMMENDATIONS

129. It is recommended that a number of complementary changes be introduced to the NRWT and AIL rules. Options 3, 4, 6, 7, 8 and 10 when considered as a package should result in a coherent NRWT system that applies to interest payments made to associated parties and other entities that are economically equivalent to associated parties.

IMPLEMENTATION

130. Changes to the NRWT rules would mainly require amendments to the Income Tax Act 2007 and Tax Administration Act 1994. These amendments would be included in a tax amendment bill, which is currently planned for introduction in March 2016.

131. Implementing these changes would require updating a small range of communication and education products.

132. The new rules will be communicated to taxpayers by way of Inland Revenue’s publication Technical Information Bulletin after the legislation giving effect to the new rules has been enacted.

133. The new rules will be administered by Inland Revenue as part of its business as usual processes.

Application dates

134. Options 3, 4, 6 and 7 should apply to arrangements entered into after enactment of the legislation and all arrangements entered into before the enactment date should apply the new rules from the first day of the taxpayer’s income year after the date of enactment.

135. Option 10 should not apply until the start of the sixth income year after the date of enactment for all existing arrangements entered into by a New Zealand borrower where the interest is not subject to NRWT because of the onshore branch exemption but under the new rules would be eligible for AIL. The proposed delay is intended to recognise that the New Zealand borrower has entered into third party funding on commercial terms which cannot easily be cost effectively restructured and the New Zealand borrower often will not have sufficient information to determine if the onshore branch exemption will continue to apply or whether AIL will now be required.

136. The recommended application date for option 10 when a New Zealand borrower is borrowing from an associated non-resident should be the enactment date of the legislation. This option should apply to arrangements entered into both before and after the date of enactment.

137. The AIL registration process in option 8 should apply to AIL registrations after the date of enactment. Interest paid on arrangements registered for AIL before the date of enactment, that do not meet the new requirements, will be subject to AIL on any interest payments made more than one year after that date.

138. Appropriate transitional rules should ensure that the new rules apply to existing arrangements on a prospective basis only.

MONITORING, EVALUATION AND REVIEW

139. In general, Inland Revenue monitoring, evaluation and review of tax changes would take place under the generic tax policy process (GTPP). The GTPP is a multi-stage policy process that has been used to design tax policy (and subsequently social policy administered by Inland Revenue) in New Zealand since 1995.

140. The final step in the process is the implementation and review stage, which involves post-implementation review of legislation and the identification of remedial issues. Opportunities for external consultation are built into this stage. In practice, any changes identified as necessary following enactment would be added to the tax policy work programme, and proposals would go through the GTPP.

[1] Statistics New Zealand data on direct investment debt instruments and NZD equivalent BBB rated 5 year interest rates between 2001 and 2014. Statistics New Zealand direct investment is defined as 10% or more of voting shares in a company. While this definition is different to association for tax purposes it is likely to have a significant degree of overlap.

[2] This is mainly because AIL is paid by the borrower not the lender and, unlike NRWT, AIL is not an income tax.

[3] Thin capitalisation rules restrict the proportion of related party debt that a New Zealand subsidiary of a non-resident owned group can have.

[4] Interest is typically paid on an arrears basis. This means that it is paid at some point after being earned. For example, a 5 year loan that makes its first interest payment at the end of the first year on income accrued up to that date.

[5] It can also include certain New Zealand resident trusts.

[6] Except when all four decision-making rights are the same in which case both tests have the same outcome.

[7] Separate rules would apply to New Zealand branches of non-residents which held a banking licence. This is discussed further below, and is also considered in the AIL RIS (NRWT: Related party and branch lending – bank and unrelated party lending).

[8] It also requires the New Zealand borrower to not have a permanent establishment in that other country, which will be the case in most instances.

[9] Although very few foreign banks have a New Zealand branch these branches represent the foreign banks that New Zealand residents are most likely to borrow from. Therefore, officials consider it likely that the majority of lending by foreign banks to New Zealand residents when measured by the value of lending is covered by the onshore branch exemption.