Quarantining excess expenditure

(Clause 19)

Summary of proposed amendments

Broadly, the new rules will quarantine excess expenditure when the gross income derived from the asset is less than 2 percent of the cost of the asset. The quarantined expenditure will be denied as a deduction in the current income year and can be used in a later year when there are sufficient profits derived from the asset.

The new rules will apply to quarantine expenditure incurred by the person who holds the asset, group companies, corporate shareholders and non-corporate shareholders.

Application date

The amendments will apply from the beginning of the 2013–14 income year.

Key features

New sections DG 16 and DG 18 contain the rules that quarantine excess expenditure. The rules apply when the gross income derived from the asset, excluding income from associated persons, is less than 2 percent of the cost of the asset or, in the case of land, the rateable value (or its cost on acquisition, if that occurs later).

“Excess expenditure” is defined as the amount of apportioned deductions and previously quarantined amounts that exceed the income derived from the asset. Excess expenditure can be incurred by the person or company that holds the asset, group companies, corporate shareholders and non-corporate shareholders.

Section DG 16 – Asset-holding person or company

Section DG 16 applies to the person or company that holds the asset. It operates to quarantine excess expenditure that would otherwise be deductible in years when the person’s gross income from the asset is less that 2 percent of the cost or, in the case of land, the rateable value (or its cost on acquisition, if that occurs later). Excess expenditure is the amount by which the person’s total deductions under sections DG 7, DG 8 and DG 11, plus previously quarantined amounts exceed the income derived from the asset (including income from associates).

The excess expenditure is denied as a deduction in that year and cannot be used to offset income from other sources. The quarantined expenditure must be carried forward and may be an allowable deduction in future years if the requirements of section DG 17 are met. (This is discussed in more detail later in this Commentary.)

Example

Company A owns a mixed-use asset that costs $500,000 and derives $5,000 from non-associates and $6,000 from associates for the use of the asset in an income year. Expenditure in that income year (after apportionment) is $12,000. Therefore, Company A has $1,000 of excess expenditure ($12,000 – $11,000). Since the income from the asset, excluding income of $5,000 from associates, is less than 2 percent of the cost of the asset, the excess expenditure incurred by Company A is quarantined and denied as a deduction in the current year. The amount quarantined may be an allowable deduction in a later income year if the requirements of section DG 17 are satisfied.

It is possible for a company that holds a mixed-use asset to be in profit, but for the activity to be in overall loss (because group companies and/or shareholders’ interest deductions exceed the company profit). In this situation, no expenditure incurred by the company will be quarantined. However, section DG 18 may apply to quarantine apportioned interest expenditure incurred by group companies and/or other shareholders.

Income derived from the asset that exceeds the deduction allowed under sections DG 7, DG 8 and DG 11 (including previously quarantined amounts), is referred to as the “outstanding profit balance”. The outstanding profit balance is then used in section DG 18 to determine how much group company or shareholder-apportioned interest expenditure will be quarantined.

Section DG 18 – Group companies and other shareholders

Section DG 18 applies to quarantine excess interest expenditure incurred by group companies (under section DG 12) and other shareholders (under sections DG 13 and DG 14) when the income derived from the asset is below the percentage threshold.

The amount quarantined is the amount of interest expenditure calculated under sections DG 12, DG 13 and DG 14 (including previously quarantined amounts), which exceeds the outstanding profit balance (or person’s share of the outstanding profit balance if the person is not a group company), calculated under section DG 16. The shareholder’s share of the outstanding profit balance is the shareholder voting interest, or market value interest, if applicable, expressed as a percentage multiplied by the outstanding profit balance.

If the outstanding profit balance is zero under section DG 16, all of the group companies’ and other shareholders’ interest expenditure identified under sections DG 12 to DG 14 will be quarantined.

Section D 18 first applies to group companies, until no other group companies exist that have apportioned interest expenditure, and then to other shareholders, until no other shareholders exist that have apportioned interest expenditure. As each group company or shareholder applies the section, the outstanding profit balance reduces by the amount of apportioned interest expenditure that is not required to be quarantined.

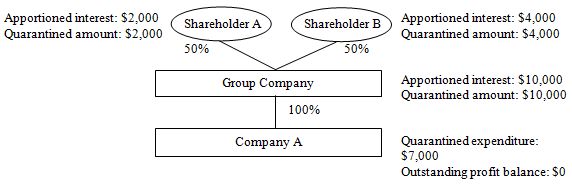

The example below demonstrates the application of section DG 18 when the outstanding profit balance is zero:

Example

Building on the previous example, Company A is 100 percent owned by another company (Group Company). The Group Company has apportioned interest expenditure under section DG 12 of $10,000. Group Company has two equal natural person shareholders, Shareholder A and Shareholder B who have apportioned interest expenditure under section DG 13 of $2,000, and $4,000 respectively. As Company A’s expenditure exceeded the income derived from the mixed-use asset, the outstanding profit balance is zero, and therefore, Group Company, Shareholder A and Shareholder B are required to quarantine all of their apportioned interest expenditure.

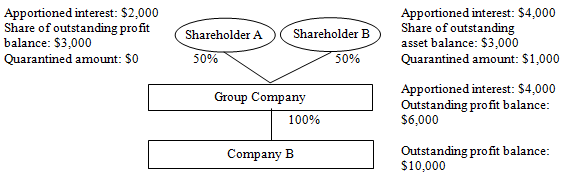

The example below demonstrates the application of section DG 18 when an outstanding profit balance has been calculated under section DG 16:

Example

Company B has an outstanding profit balance of $10,000. Company B is 100 percent owned by Group Company, which has apportioned interest expenditure under section DG 12 of $4,000. Group Company has two equal natural person shareholders, Shareholder A and Shareholder B who have apportioned interest expenditure under section DG 12 or DG 13 of $2,000, and $4,000 respectively.

Section DG 18 requires that Group Company apply that section first and since the outstanding profit balance exceeds Group Company’s expenditure, it is not required to quarantine any of its apportioned interest expenditure. The outstanding profit balance is then reduced by the deductions claimed by Group Company. The new outstanding profit balance is $6,000 ($10,000 – $4,000).

Section DG 18 then requires Shareholder A and Shareholder B to apply the section. Each shareholder’s share of the outstanding profit balance is $3,000 ($6,000 x 50 percent). Shareholder A is not required to quarantine any interest expenditure and Shareholder B is required to quarantine $1,000 of interest expenditure ($4,000 – $3,000).

Notification

To enable the operation of section DG 18, new section 30D of the Tax Administration Act 1994 requires companies to provide shareholders with information to enable them to calculate the correct amount of expenditure that is required to be quarantined.

Background

There is a concern that assets that earn only low levels of income may consistently incur losses, despite the apportionment of expenditure. Some owners of these assets are likely to hold the asset primarily for private enjoyment. Other owners may genuinely hold the asset to earn profits, but be in loss in one particular year due to circumstances outside their control, such as a poor rental season.

It is not practical for the tax rules to distinguish between these two situations in the year in which they occur. However, quarantining excess expenditure in particular years when the owner of a mixed-use asset earns low levels of income from the asset avoids the need to make such a distinction. Asset owners who are consistently incurring excess expenditure are very likely to be owners who hold the asset primarily for private enjoyment. They may never have the opportunity to use the quarantined amounts. Owners who genuinely hold their asset for income-earning purposes can still use quarantined amounts in future profitable income years.

Since expenditure can be incurred by group companies and other shareholders, the proposed new rules also quarantine expenditure outside the company that holds the asset. There would otherwise be an incentive to shift borrowings on assets subject to the rules to outside the company holding the asset to avoid quarantining.

Lastly, to prevent owners influencing gross income in order to satisfy the 2 percent threshold, and therefore gain access to excess expenditure arising from the asset to offset against other income, the rules exclude income from relatives and associates as defined in section DG 3.