Allocating quarantined expenditure

(Clause 19)

Summary of proposed amendments

The proposed new rules allow expenditure that has been quarantined in previous income years to be allocated to income years when there are sufficient profits derived from the asset.

Application date

The amendments will apply from the beginning of the 2013–14 income year.

Key features

Sections DG 17 and DG 19 allow a deduction for expenditure previously quarantined under sections DG 16 and DG 18 in years when income from the asset exceeds deductible expenditure under sections DG 7, DG 8, and DG 11 to DG 14.

Section DG 17 – Asset-holding person or company

Section DG 17 applies to the person that holds a mixed-use asset. It allows the person a deduction for expenditure previously quarantined under section DG 16 in years when income from the asset exceeds deductible expenditure under sections DG 7, DG 8 and DG 11.

Previously quarantined expenditure which is allowed as a deduction is the lesser of the previously quarantined amount or the amount of company profit (current year income derived from the asset minus deductible expenditure under sections DG 7, DG 8 and DG 11).

Example

An owner of a mixed-use asset derives $12,000 from the use of the asset, and has $8,000 of deductible expenditure under sections DG 7 and DG 8 in the current income year. The owner also has $10,000 of quarantined expenditure from the previous income year. In the current income year, the owner is able to claim a deduction of $4,000 on previously quarantined expenditure ($12,000 – $8,000).

Company A holds a mixed-use asset and derives $15,000 from the use of the asset and has $4,000 of deductible expenditure under sections DG 7, 8 and 11 in the current income year. Company A also has $6,000 of quarantined expenditure from the previous income year. In the current income year, the company can claim all of its previously quarantined expenditure.

If income derived from the asset exceeds both deductible expenditure under sections DG 7, DG 8 and DG 11 and previously quarantined expenditure, the excess is referred to as the “outstanding profit balance”. Using the example above, Company A has a $5,000 outstanding profit balance ($15,000 – ($4,000 + $6,000)). The outstanding profit balance can then be used under section DG 19 to unlock previously quarantined expenditure incurred by group companies, corporate shareholders and non-corporate shareholders.

Section DG 19 – Group companies and other shareholders

Section DG 19 applies to group companies, corporate shareholders, and non-corporate shareholders when there is an outstanding profit balance calculated under section DG 17. This section allows a deduction for expenditure previously quarantined under section DG 18 in years where the outstanding profit balance exceeds apportioned current-year interest deductions under sections DG 12, DG 13 and DG 14.

Previously quarantined expenditure allowed as a deduction is the lesser of the previously quarantined amount or the amount of outstanding profit balance (or the shareholder’s share of the outstanding profit balance if the shareholder is not a group company) minus current-year apportioned interest deductions.

The shareholder’s share of the outstanding profit balance is the shareholder voting interest or market value interest, if applicable, expressed as a percentage multiplied by the outstanding profit balance.

Section DG 19 first applies to group companies until the outstanding profit balance has been reduced to zero or no other group companies exist that have previously quarantined expenditure. The section then applies to other shareholders until the outstanding profit balance has been reduced to zero or no other shareholders exist that have previously quarantined expenditure. As each group company or shareholder applies the section, the outstanding profit balance reduces by the amount of quarantined expenditure allowed.

Example

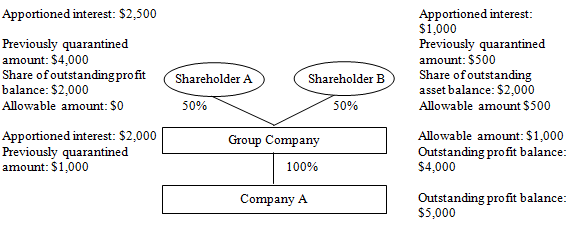

Building on the previous example, Company A has an outstanding profit balance of $5,000. Company A is 100 percent owned by Group Company, which has apportioned current year interest expenditure under section DG 12 of $2,000 and previously quarantined expenditure of $1,000. Group Company has two equal individual (natural person) shareholders, Shareholder A and Shareholder B, and has apportioned interest expenditure under section DG 14 of $2,500 and $1,000 respectively, and previously quarantined expenditure of $4,000 and $500 respectively.

Section DG 19 requires that Group Company apply that section first. Since the previously quarantined amount ($1,000) is less than the outstanding profit balance minus current year deductions ($5,000–$2,000), Group Company is able to claim a deduction in the current year for $1,000. The outstanding profit balance is then reduced by the deductions claimed by Group Company. The new outstanding profit balance is $4,000 ($5,000 – $1,000).

Section DG 19 then requires Shareholder A and Shareholder B to apply that section. Each shareholder’s share of the outstanding profit balance is $2,000 ($4,000 x 50 percent). Shareholder A is unable to claim a deduction in the current year for any previously quarantined amounts and Shareholder B is able to claim a deduction in the current year for $500.

Notification

To enable the operation of section DG 19, section 30D of the Tax Administration Act 1994 requires companies to provide shareholders with information to enable them to calculate the correct amount of previously quarantined expenditure that is allocated to the current year.

Background

In years when income from the asset is below the specified threshold, excess deductions are quarantined. The quarantined expenditure should then be allowed as a deduction in years when the income from the asset exceeds the current year expenditure.