Interest expenditure

(Clauses 15, 16, 17, 19 and 66)

Summary of proposed amendments

The proposed new rules require that when a close company holds an asset subject to the rules, any interest expenditure incurred in relation to debt within the company, where the debt is equal to or less than the cost (or rateable value if land) of the asset, will be subject to apportionment.

If the debt within the company is less than the cost of the asset, the rules may require group companies, corporate shareholders and non-corporate shareholders, if applicable, to apportion interest on the shortfall of debt.

Application date

The amendments will apply from the beginning of the 2013–14 income year.

Key features

Sections DG 11, DG 12, DG 13 and DG 14 contain the rules that track interest expenditure within and outside of close companies that hold mixed-use assets.

Asset-holding company

Section DG 11 applies to a close company that holds a mixed-use asset. It requires the company to compare the value of its interest-bearing debt to the value of the mixed-use asset. Interest on debt that is equal to or less than the value of the mixed-use asset is apportioned, under the apportionment formula in section DG 9(2). Interest on debt that exceeds the value of the asset would be subject to existing interest deductibility rules.

The asset value is either the cost of the asset or, in the case of land, the rateable value (or its cost on acquisition, if that occurs later). The company’s debt value is the average outstanding amount of debt at the beginning and end of the year.

Example

Company A holds a mixed-use asset with a cost of $100,000. The company has a total interest-bearing debt of $75,000. The company is required to apportion the interest expenditure on the $75,000 of debt.

Company B holds a mixed-use asset with a cost of $100,000. The company has a total interest-bearing debt of $150,000. The company must apportion the average interest expenditure on the $100,000 of debt. Interest on the remaining $50,000 is subject to existing interest deductibility rules.

If the company’s interest-bearing debt is less than the value of the asset, that shortfall is referred to as the “net asset balance”. Using the first example above, Company A has a net asset balance of $25,000 ($100,000 – $75,000).

Group companies

If there is a net asset balance after the application of section DG 11, section DG 12 applies to apportion interest expenditure incurred by group companies, if that is applicable.

A group company is defined by reference to the loss grouping rules, being a company that has a 66 percent common voting interest in the company that holds the mixed-use asset. The group of companies is also treated as a wholly owned group.

Section DG 12 requires group companies to compare the value of its interest-bearing debt to the net asset balance. Interest on debt that is equal to or less than the net asset balance is apportioned, under the apportionment formula in section DG 9(2). Interest on debt that exceeds the net asset balance would be subject to existing interest deductibility rules.

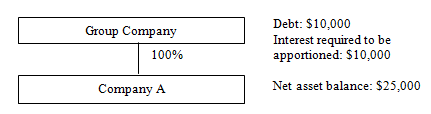

Example

Building on the earlier example, Company A is 100 percent owned by another company (Group Company). The Group Company has total interest bearing debt of $10,000. Company A attributes the net asset balance of $25,000 to the Group Company. Group Company must apportion all of its interest expenditure.

The net asset balance reduces by the amount of debt in relation to which interest is required to be apportioned. Using the example above, the net asset balance is now $15,000 ($25,000 – $10,000).

Section DG 12 applies to all group companies until the net asset balance is reduced to zero, or there are no longer any group companies in relation to which interest can be apportioned.

Corporate shareholders

If after the application of sections DG 11 and DG 12 a net asset balance remains, section DG 13 applies to apportion interest expenditure incurred by corporate shareholders that are not group companies. It requires corporate shareholders to compare the value of the company’s interest-bearing debt to the shareholder’s share of the net asset balance. Interest on debt that is equal to or less than the shareholder’s share of the net asset balance is apportioned, under the apportionment formula in section DG 9(2). Interest on debt that exceeds the shareholder’s share of the net asset balance would be subject to existing interest deductibility rules.

The shareholder’s share of the net asset balance is the shareholder’s voting interest, or market value interest (if applicable) expressed as a percentage multiplied by the net asset balance.

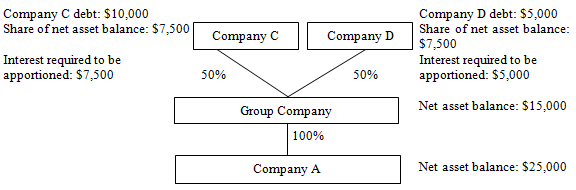

Example

Building on the previous example, Group Company has two corporate shareholders, Company C and Company D who have total interest-bearing debt of $10,000 and $5,000 respectively. Each company’s share of the net asset balance is $7,500 ($15,000 x 50 percent). Therefore, Company C is required to apportion interest in relation to $7,500 of debt, and Company D is required to apportion interest in relation to $5,000 of debt.

The shareholders’ share of the net asset balance reduces by the amount of debt in relation to which interest is required to be apportioned. Using the example, above Company C’s share of the net asset balance is reduced to zero, and Company D’s share of the net asset balance is reduced to $2,500 ($7,500 – $5,000).

Section DG 13 applies first to corporate shareholders that have a shareholding in the close company that holds the asset, and corporate shareholders that have a shareholding in a group company that has a voting interest in the close company that holds the asset. If a net asset balance remains, the section then applies to their shareholders, and so on, until the net asset balance is reduced to zero, or there are no longer any corporate shareholders in which interest can be apportioned.

Non-corporate shareholders

If after the application of sections DG 11, DG 12 and DG 13, a net asset balance remains, section DG 14 applies to apportion interest expenditure in relation to interest-bearing debt held by non-corporate shareholders. It requires non-corporate shareholders to compare the value of its interest-bearing debt to the shareholders’ share of the net asset balance. Interest on debt that is equal to or less than the shareholders’ share of the net asset balance is apportioned, under the apportionment formula in section DG 9(2). If the non-corporate shareholder is an individual (natural person), the interest expenditure that is subject to apportionment is only the interest expenditure incurred to purchase shares in the company.

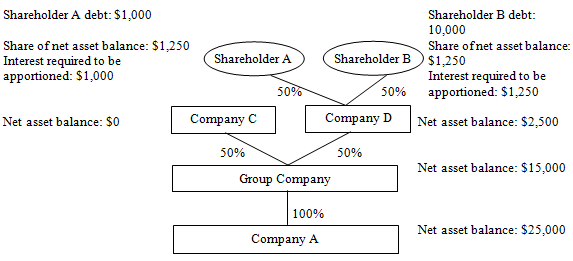

Example

Building on the previous example, Company D has two natural person shareholders. Shareholder A borrowed $1,000 and Shareholder B borrowed $10,000 to purchase 50 percent each of Company D. Shareholder A and Shareholder B’s share of the net asset balance is $1,250 each ($2,500 x 50 percent). Shareholder A is required to apportion interest in relation to $1,000 of the debt that was incurred to purchase a share in Company D, and Shareholder B is required to apportion interest in relation to $1,250 of the debt that was incurred to purchase a share in Company D.

Since Company C’s net asset balance is zero, the rules do not require further interest expenditure to be apportioned by Company C’s shareholders.

Notification

To enable the operation of sections DG 11, DG 12, DG 13 and DG 14, new section 30D of the Tax Administration Act 1994 requires companies to provide their shareholders with information to enable them to calculate the correct amount of allowable interest expenditure.

Background

Interest expenditure relating to mixed-use assets is an expense which must be apportioned like any other. This is straightforward for entities that are not companies. Tracing rules are currently used to identify interest expenditure that is related to the mixed-use asset for entities other than companies. The rules work by identifying what money has been borrowed and look at how that money has been applied. The proposed new rules apply the same approach to interest deductions incurred by entities that are not companies.

However, two specific issues arise when mixed-use assets are held in companies. The first issue arises because current legislation provides that all interest incurred by companies is fully deductible, unless a specific limitation applies. Consequently, rules are required to track interest on debt in companies and allocate it to mixed-use assets so it can then be apportioned. If this were not done, mixed-use assets funded by debt could be shifted into companies to avoid the apportionment of interest expenditure.

The second issue arises because an alternative to the company borrowing funds to acquire the asset is for a shareholder to borrow money and use it to subscribe for shares in the company. The overall economic effect is the same – funds have been borrowed and used to acquire a mixed-use asset – but the borrowing is outside the company. Without specific rules, interest on such debt would be outside the apportionment rules. Current law typically provides a deduction when funds are borrowed to acquire shares.

To ensure that this kind of structuring is not used to circumvent the proposed new rules, and to capture all relevant interest deductions when complex structuring has been entered into for other commercial reasons, the new rules will track interest incurred by the company’s shareholders and other companies which could loss-group with the company which owns the asset.