Apportionment of mixed-use expenditure

(Clause 19)

Summary of proposed amendments

This is the key element of the proposed new rules. Expenses which are neither solely private in nature nor eligible to be deducted in full will be required to be apportioned by dividing the income-earning use by the total use (income-earning use plus private use) of the asset. The resulting amount will be an allowable deduction.

Application date

The amendments will apply from the beginning of the 2013–14 income year.

Key features

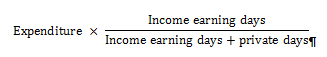

Section DG 8 applies to apportion the expenditure incurred by persons that hold a mixed-use asset and section DG 9 sets out the method for apportioning expenditure relating to the asset. Under section DG 9(2), the amount of deductible expenditure, including depreciation, will be calculated as:

Example

A boat is chartered for 30 days and used by its owners for 30 days. Fifty percent of the general expenditure will be deductible (30 days income-earning use / 60 days total use).

The expenditure subject to the formula is the total expenditure incurred minus purely income-earning expenditure under section DG 7 (discussed earlier) and purely private expenditure.

“Income-earning days” is defined in section DG 9(3)(b) as the total number of days or other appropriate unit the asset is used to earn income at or above market value. This excludes any days on which the asset is used by the owner, unless that use is an incident of ordinary commercial use (as described in the definition of private use under section DG 4).

“Private days” is defined in section DG 9(3)(c) as the total number of days or other appropriate unit the asset is in active use and is not regarded as an income-earning day. For example, days when the owner of a holiday home rents it out to friends and family at below market value will be regarded as private-use days.

Example

The owner of a boat uses the boat for private enjoyment. The owner also charters the boat to unrelated parties on an arm’s-length basis. The unrelated parties pay market value and the owner skippers the boat during the time the boat is chartered. The owner’s private use of the boat is not regarded as an income-earning day and is, therefore, regarded as a “private-use day”. The chartering to unrelated parties is regarded as an “income-earning day”, even though the owner skippers the boat, as the type of use by the owner is part of the ordinary commercial use of the boat.

The unit of measurement used in the formula is a unit that achieves the most appropriate apportionment of expenditure. This might be by reference to days, nights, or hours depending on the asset and how that asset is used.

Example

The owner of a holiday home rents it out during the year. The owner charges rent by reference to the nights it is occupied. Consequently, the appropriate unit of measurement the owner should use in the formula is nights.