Chapter 1 - Overview

Introduction

Inland Revenue is conducting a large scale transformation programme, which provides an opportunity to make changes to New Zealand’s tax administration system to meet current and future needs. This includes re-shaping the way Inland Revenue works with taxpayers, and looking at possible changes to the Tax Administration Act 1994. This document discusses how to improve the administration of income tax for individuals, particularly those who only earn salary or wages and/or investment income that has been subject to withholding tax at source.

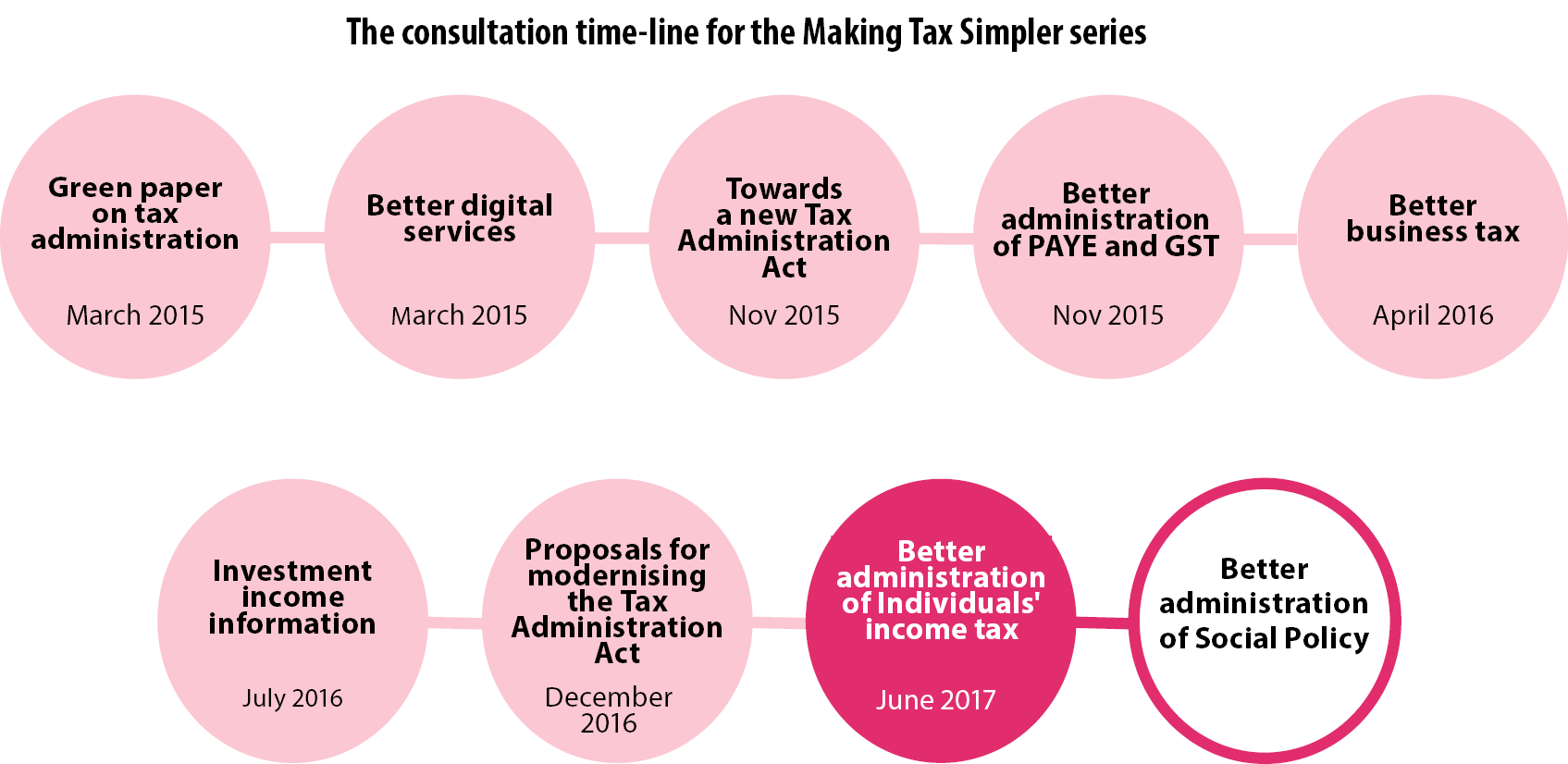

The Government released a consultation paper called Making Tax Simpler: A Government Green Paper on tax administration (the Green Paper) in March 2015. This set out its ideas for modernising New Zealand’s tax administration. The ideas presented in the Green Paper were in the early stages of development, and each area canvassed in that document would be consulted on separately. In relation to individuals’ filing obligations, the initial option outlined for consultation in the Green Paper was for all individuals to interact with Inland Revenue. Having considered the submissions received on the Green Paper and carrying out further work, the Government is not proposing that all individuals should have an obligation to interact with Inland Revenue on an end-of-year basis (i.e. have to provide an income tax return).

The Better Administration of PAYE and GST and the Investment Income Information discussion documents contained proposals to require income payers to provide more information, more often to Inland Revenue about who they paid. These documents were released for consultation in November 2015 and July 2016 respectively. Changes to legislation as a result of the proposals in both those documents are contained in the Taxation (Annual Rates for 2017–18, Employment and Investment Income, and Remedial Matters) Bill, which is currently before Parliament. This document contains proposals about how Inland Revenue should utilise information during the year to ensure that the right amount of tax is being withheld, and how end-of-year reporting obligations could be simplified for individuals that earn certain types of income.

This consultation focuses on how the Government can make tax obligations more simple, open and certain for individuals. This document discusses some proposed changes and, if they go ahead, proposals for how Inland Revenue could work with individuals to ensure the right amount of tax is paid, and that individuals receive the correct entitlements.

What this document covers

Chapter 2 outlines the framework for how individuals’ income is taxed in New Zealand and recaps the proposal that was in the Green Paper. Chapter 3 discusses proposals for what could occur during the tax year. Chapter 4 sets out two options about which individuals should have to provide information to Inland Revenue at the end of a tax year. The first is an improvement on the status quo and the second would further simplify the rules. Chapter 5 contains proposals for what could occur at the end of the tax year, and is relevant to both the options in chapter 4. Chapter 6 then discusses what happens if an error is discovered after the end of the tax year. The chapters describe Inland Revenue’s actions, as well as proposing which individuals would be required to provide information to Inland Revenue about their tax position.

Some of the things described in this discussion document happen already. They are set out here alongside the proposals to give a fuller picture of what the future would look like if the proposals are adopted.

…the Government is not proposing that all individuals should have an obligation to interact with Inland Revenue on an end-of-year basis (i.e. have to provide an income tax return).

This document contains proposals about how Inland Revenue should utilise information during the year to ensure that the right amount of tax is being withheld.

…two options as to which individuals should have to provide information to Inland Revenue at the end of a tax year. The first is an improvement on the status quo, and the second would further simplify the rules.

Summary of proposals

During the year – chapter 3

- Inland Revenue will monitor the information it receives to help individuals get their tax payments right, and contact them to suggest changes.

- Inland Revenue will make information held about an individual available to that individual during the year.

- Individuals will be able to upload copies of donation receipts to myIR during the year.

At the end of the year – chapter 4

- The discussion document sets out two options about which individuals should have to provide information to Inland Revenue at the end of a tax year.

Improved status quo

- With better, timelier third-party information, Inland Revenue will better target the issue of personal tax summaries.

Alternative approach

- Individuals would have to provide information to Inland Revenue if they earn income other than reportable income, as they do now. Inland Revenue would use information from previous years to prompt individuals to add information in future years.

- Individuals would not have to provide any information to Inland Revenue if they only earn “reportable income”:

- This is currently PAYE income.

- Changes to legislation in the Taxation (Annual Rates for 2017–18, Employment and Investment Income, and Remedial Matters) Bill in relation to investment income information will add interest income, and New Zealand-sourced dividends and Maori authority distributions from 1 April 2018 and 1 April 2020 respectively.

- On the basis of information it holds about reportable income, Inland Revenue would calculate whether people are due a refund or have tax to pay.

- If refunds or amounts of tax to pay are above specified thresholds, Inland Revenue would issue the refund or request payment. If the amounts are smaller than these thresholds Inland Revenue will not take any action.

- The document asks if the current $5 threshold for refunds should be retained for refunds by cheque, or if all refunds should be issued, no matter how small.

- The document notes the current $20 threshold for small amounts to pay and also the current threshold for not having to file ($200 of income, which can be up to $66 of tax). It asks what factors the Government should take into account in setting a specified threshold for amounts of tax to pay.

At the end of the year – chapter 5

- Individuals would be able to provide details about donations they would like to claim at the same time as they check or provide information about their income.

- This document proposes that income tax refunds should be direct credited, rather than issued by cheque unless that would cause undue hardship.

After the end of the year – chapter 6

- Individuals can ask Inland Revenue to change a return if they believe it does not correctly reflect their tax position.

Next steps

Following consideration of the submissions received about the proposals in this discussion document, the Government will refine the proposals and consider what items to proceed with. It will also consider when it would be best to implement any changes. These proposals would require changes to legislation and an amending bill is likely to be introduced to Parliament and considered in 2018. There will be further opportunity to comment on the legislative changes as part of the Parliamentary process.

How to make a submission

You can make a submission:

online at:

www.makingtaxsimpler.ird.govt.nz

by email to:

[email protected], with “Making Tax Simpler: Better administration of individuals’ income tax” in the subject line.

by post, to:

“Making Tax Simpler: Better administration of individuals’ income tax”

C/- Deputy Commissioner, Policy and Strategy

Inland Revenue Department

PO Box 2198

Wellington 6140

The closing date for submissions is 28 July 2017.

Submissions may be the subject of a request under the Official Information Act 1982, which may result in their release. The withholding of particular submissions, or parts thereof, on the grounds of privacy, or commercial sensitivity, or for any other reason, will be determined in accordance with that Act. Those making a submission who consider that there is any part of it that should properly be withheld under the Act should clearly indicate this.