Chapter 8 - Deductible hybrid payments

8.1 Recommendation 6 concerns payments that are deductible in two countries. A simple example is a payment made by a company’s foreign branch. If the company is resident in a country that, like New Zealand, taxes foreign branch income, this payment will often be deductible both in the branch country and in the residence country. The same outcome arises if expenditure is incurred by an entity which is fiscally transparent in a country where one or more of its owners is resident (such as a New Zealand unlimited liability company with a US owner).

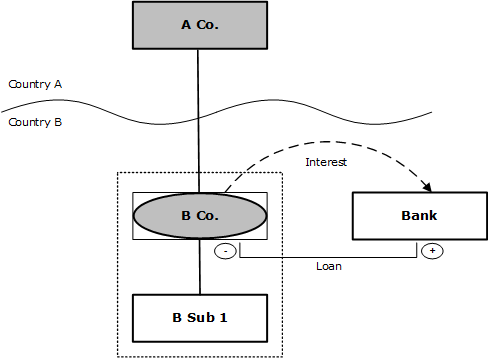

8.2 To the extent that such a payment is deducted in one country against income that is not taxed in the other country, the payment produces double non-taxation. This is shown in Figure 2.4, reproduced below.

Figure 8.1: DD arrangement using hybrid entity (repeated Figure 2.4)

8.3 The primary response in Recommendation 6 is for the parent country to deny a deduction for the payment, to the extent it exceeds dual inclusion income (income taxed in both countries). The parent country is the country where the payer is resident (in the case of a branch), or where an owner of the payer is resident (in the case of a hybrid entity). There is no limitation on the scope of this rule.

8.4 The secondary response (which applies only to deductions that are not subject to the primary response) is for the payer country to deny a deduction for the payment, to the extent it exceeds dual inclusion income. The defensive rule applies only if either the payer is a branch, the owner and the payer are in a control group, or the payer is party to a structured arrangement.

8.5 Where a foreign tax credit is available in the parent jurisdiction in relation to an item of dual inclusion income, the Final Report proposes that the foreign tax credit can only be used to the extent of the tax liability in the parent jurisdiction on the net dual inclusion income (dual inclusion income less deductions) that arises. This is discussed in Example 6.4 of the Final Report, in particular paragraphs 13 and 14.

Application to New Zealand

8.6 The primary response means that in most cases a New Zealand resident will not be able to claim an immediate deduction for a foreign branch loss except against income from the same country. This is because in most cases it will be possible for those losses to be used to offset non dual-inclusion income in the branch country. Unless it can be shown that such an offset is not possible, those losses will have to be carried forward and used either:

- to offset net income from the branch in future years;

- without restriction, if the losses have become unusable in the branch country, for instance because the branch has been closed down before the losses have been used or because of an ownership change. In this case the losses are referred to as “stranded losses”.

8.7 This denial extends to all forms of deductions – for example, it applies to depreciation and amortisation (Final Report, paragraph 192). It only applies to expenditure which is actually deductible. Thus, it will not apply to expenditure for which a deduction is denied under (for example) Recommendation 1 or Recommendation 4.

8.8 The secondary response will require New Zealand to introduce a rule denying both New Zealand branches of non-residents and non-resident owned New Zealand hybrid entities the ability to deduct expenditure against income which is not also taxable in the parent country, if that expenditure is not subject to the primary response in the parent country. Most obviously, this will deny such branches or entities the ability to group a loss against the profit of a commonly owned New Zealand entity (unless that entity is also a hybrid whose income is taxable in the parent country). It will also deny them a deduction for their expenditure against their own income if that income is for some reason not taxed in the parent country. An example is income earned through a reverse hybrid (see Example 6.1 of the Final Report).

8.9 As discussed in paragraph 200 and Example 6.5 of the Final Report, where the secondary response applies but the owner who is claiming a deduction in the parent country does not own all of the payer, the hybrid rules require the inclusion, in the payer country, of more than the amount which is deductible in both countries. This is necessary so that the amount of additional income allocated to that owner is sufficient to reverse the deduction.

Submission points 8

Submissions are sought on whether the denial of a deduction for foreign branch losses against New Zealand income should be matched by an exemption for active income earned through a foreign branch. This would put foreign branches of New Zealand companies in a similar New Zealand tax position to foreign subsidiaries.

Submissions are also sought on any other aspect of the proposals relating to implementation of the OECD’s Recommendation 6 in New Zealand.