Chapter 7 - Reverse hybrids

- Recommendation 4

- Recommendation 5

- Application in New Zealand

- Recommendation 5.3: Information reporting

7.1 A reverse hybrid is an entity where some or all of whose income is (or can be):

- in its establishment country, treated as derived by its investors (generally its owners); and

- in an investor country, treated as derived by the entity.

7.2 A New Zealand limited partnership may be an example of such an entity. For New Zealand tax purposes, the income of a New Zealand limited partnership is taxable to the partners. However, if a partner is resident in a country that treats the partnership as an entity separate from the partners for its tax purposes (for example, because it has separate legal personality) the partnership is to that extent a reverse hybrid. Look-through companies can also be reverse hybrid vehicles in New Zealand (though recent proposed law changes will limit the ability for conduit income to be earned through a look-through company). A New Zealand trust may also be a reverse hybrid. For New Zealand tax purposes, income which is treated as beneficiary income is taxed to the beneficiary, not the trustee. However, if the beneficiary is resident in a country which does not recognise trusts, the income may not be treated by the beneficiary’s residence country as derived by the beneficiary, particularly if it is not actually distributed to the beneficiary.

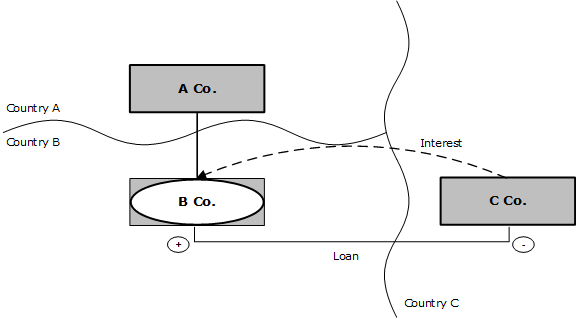

7.3 An example of a reverse hybrid giving rise to a hybrid mismatch is in Figure 2.5 (repeated below from Chapter 2).

Figure 7.1: Payment to a reverse hybrid (repeated Figure 2.5)

Branches as reverse hybrids

7.4 When a country does not tax its residents on income from foreign branches, a mismatch of rules between that country and the country where a branch is located can lead to a reverse hybrid result. This can occur if a payment to a person is treated in the residence country as non-taxable because it is attributed to a foreign branch, but in the branch country the payment is also not taxed, because the branch country either:

- does not treat the person as having a branch; or

- treats the payment as not attributable to the branch.

7.5 Accordingly, Recommendations 4 and 5 are also applicable to branches in these situations. The branch is analogous to the reverse hybrid entity, and the head office to the investor.

Recommendation 4

7.6 Recommendation 4 is when a D/NI payment is made to a reverse hybrid, and the payment would have been included in income if it were made directly to the investor; the payer country should deny a deduction for the payment. The Recommendation also applies if the payment would have given rise to a hybrid mismatch under the hybrid financial instrument rule if made directly to the investor. As with the disregarded payments rule, this rule can apply to any deductible payment.

7.7 Taxation of an investor in its home country on a subsequent distribution by the reverse hybrid of the income does not prevent a payment being subject to disallowance under this Recommendation (Final Report, paragraph 156).

7.8 Many trusts – for example, most family trusts, do not have investors as such. For the purposes of this rule, an investor is any person to whom income is allocated by a reverse hybrid. So it would include any person who is allocated beneficiary income.

7.9 The Recommendation will not apply if the reverse hybrid establishment country taxes as ordinary income the income allocated to the non-resident investor – for example, on the basis that the reverse hybrid is carrying on business in the establishment country.

7.10 The rule only applies if either:

- the investor, the reverse hybrid and the payer are members of the same control group; or

- the payment is under a structured arrangement to which the payer is a party.

7.11 The definitions of a control group and a structured arrangement are in Chapter 12.

7.12 There is no defensive rule for reverse hybrids. This is on the basis that if a country adopts Recommendation 5, there is no need for a defensive rule.

Recommendation 5

7.13 Recommendation 5 contains three further recommendations regarding tax rules for reverse hybrids as follows:

- Countries should ensure that their CFC and other offshore investment regimes are effective to prevent D/NI outcomes arising in respect of payments to a reverse hybrid in which their residents are investors.

- Countries should tax reverse hybrids established in their own country to the extent that their income is allocated to non-residents who are not taxable on the income because they are resident in a country that treats the reverse hybrid as fiscally opaque. This recommendation would only apply if the non-resident investor is in the same control group as the reverse hybrid.

- Countries should introduce appropriate tax filing and information reporting requirements on tax transparent entities established within their country in order to assist non-residents and tax administrations to determine how much income has been attributed to their investors.

7.14 The proposed application of Recommendations 4 and 5 in New Zealand is considered below.

Application in New Zealand

Recommendation 4

7.15 From a New Zealand perspective, it will be New Zealand payers rather than New Zealand payees who are affected by New Zealand legislating for this recommendation. There do not seem to be any particular New Zealand-specific issues raised by Recommendation 4 that have not already been discussed in relation to the other Recommendations. Implementing the rule will simply involve denying a deduction if the necessary conditions are satisfied.

Submission point 7A

Submissions are sought on whether there are any issues relating to implementing Recommendation 4 in New Zealand.

7.16 From the perspective of other jurisdictions making payments to New Zealand, we note that a foreign investor PIE would seem to be a reverse hybrid, depending on the treatment of the investors in their home countries (see Final Report, paragraphs 161 and 162). However, a payment to a foreign investor PIE would not be subject to disallowance in most cases, due to the scope limitation of Recommendation 4.

Recommendation 5.1: CFC and other offshore investment regimes

7.17 This recommendation is for New Zealand to ensure that a payment to a CFC that is fiscally transparent in its establishment country with respect to the payment is caught by the CFC regime, that is, that it is taxed to New Zealand investors in the CFC, if those investors are subject to tax under the CFC regime. In this way, the CFC regime would be used to turn the reverse hybrid into an ordinary fiscally transparent entity, at least insofar as it allocates income to New Zealand investors.

7.18 One way to address this would be to treat any person who has an interest in a CFC, as determined under subpart EX, to derive an amount of income from the CFC equal to the amount allocated to that person by the reverse hybrid for income tax purposes in its establishment country, and which is not taxed in the establishment country because of that allocation. This figure will already have been calculated by the CFC, and so should be readily available to the investor. In the case of an entity that is only partially transparent only the untaxed income would be subject to the CFC regime.

7.19 This is the approach suggested in paragraph 173 of the Final Report. It would override the rules which generally apply to the calculation of CFC income. In particular:

- attribution would not be limited to the types of income specified in section EX 20B, being generally passive or base company income;

- the exemption for non-attributing Australian CFCs would have to be amended such that reverse hybrid entities established in Australia would be excluded from the exemption;

- the amount of income taxable in New Zealand would be determined under the tax rules of the establishment country, rather than under New Zealand tax rules. This is different from the approach taken for foreign entities which New Zealand treats as fiscally transparent – for example, foreign general partnerships. An investor’s taxable income in such entities must be calculated under New Zealand income tax rules. While this ensures that income from foreign sources is determined in the same way as income from domestic sources, it does require an additional element of compliance, and can lead to either double taxation or double non-taxation, either on a temporary or permanent basis; and

- the amount allocated to an investor would not be determined by reference to the investor’s income interest as calculated under New Zealand tax rules, but by reference to the investor’s percentage share of the entity’s income as determined by the rules of the establishment country (though the two would usually be the same or very similar).

7.20 This recommendation would also apply to the attributable foreign income method under the foreign investment fund (FIF) regime. It would not seem necessary to apply it in relation to the other FIF methods, which already tax on an accrual basis. While there are certain exemptions from the FIF regime, these do not seem to be available to a reverse hybrid, because all of them require that the non-FIF entity is liable to tax either in Australia or in a grey list country. This requirement might need to be modified to ensure that the exemptions are not available to partially transparent entities.

7.21 Trusts established in a foreign jurisdiction with a New Zealand resident settlor are already fully taxable, that is, it is not possible for such a trust to be a reverse hybrid. However, if a payment received by a foreign or non-qualifying trust which has foreign trustees is:

- attributed to a New Zealand beneficiary under the laws of that foreign country and therefore not taxed in that country; and

- not taxed by New Zealand, for example, because it is treated by New Zealand as trustee income that is not subject to New Zealand tax,

the foreign trust is to that extent a reverse hybrid.

7.22 The mismatch could be resolved by treating such a payment as beneficiary income for New Zealand tax purposes. This should not be problematic from an administrative perspective, since the records of the trust in the establishment country would generally reflect in some way the allocation of the income to the beneficiary.

7.23 Alternatively, New Zealand could depart from the OECD’s approach and achieve the intention of Recommendation 5.1 through a different type of rule.

7.24 The UK has drafted a narrower rule than that in Recommendation 5.1. Its rule includes an amount in the income of a UK investor which is derived through a reverse hybrid only to the extent of a D/NI mismatch in respect of a payment to the reverse hybrid that is not counteracted in another jurisdiction.[55] This rule resembles the “defensive” parts of other OECD recommendations, such as the hybrid financial instrument rule (Recommendation 1) and the disregarded hybrid payments rule (Recommendation 3). However, this rule is more complex in that it requires the investor to determine whether or not a particular payment has given rise to a D/NI outcome and whether or not that has already been counteracted.

7.25 Australia already has a set of rules that seek to counteract mismatches arising from reverse hybrid entities established in other countries.[56] These rules provide that a specified list of foreign entities are treated as partnerships under Australian law to the extent that they are tax-transparent in their establishment jurisdiction. The rules therefore link the tax treatment in Australia to the overseas tax treatment and ensures that the untaxed income of the foreign entity will flow through to its Australian investors on an apportioned basis.

7.26 New Zealand taxes residents on the income they derive through foreign branches, so Recommendation 5.1 does not require any change in that respect.

Submission points 7B

Submissions are sought on whether it would be best for New Zealand to:

- follow the OECD’s Recommendation 5.1 and amend its CFC rules as discussed above; or

- adopt a more limited approach as in the UK; or

- link the New Zealand tax treatment of income earned through a foreign entity to the treatment in the jurisdiction where that entity is established, as Australia has done on a limited basis.

If the OECD approach is to be followed, how could New Zealand’s CFC regime best be adapted to impose New Zealand tax on income allocated to a New Zealand resident by a reverse hybrid?

Submissions are also sought on the desirability or otherwise of changes to New Zealand’s trust and FIF regimes for the purpose of implementing Recommendation 5.1.

Recommendation 5.2: Taxation of reverse hybrids established in New Zealand

7.27 Under this rule New Zealand would tax the foreign source income of (for example) a New Zealand partnership as if it were a company, to the extent that income is allocated to a non-resident 50 percent partner who treats the partnership as fiscally opaque. The ownership threshold is necessary to the example because the scope of the recommendation is limited to investors who are in the same control group as the reverse hybrid. If New Zealand turned off its transparency in this kind of case, neither payer nor investor country would need to apply their reverse hybrid rule to that payment. This approach would also apply to payments that are not deductible (and therefore not subject to Recommendations 4 or 5.1). A dividend paid by a foreign company to a New Zealand partnership with a majority foreign owner who treats the partnership as exempt would be subject to New Zealand tax on the same basis as if the partnership were a company.

7.28 This rule could apply to limited and general partnerships, and to foreign investor PIEs, to the extent those entities derive foreign sourced income which is allocated to foreign investors. It could also apply to a New Zealand foreign trust (a trust with a New Zealand trustee but no New Zealand settlor, and usually no New Zealand assets), to the extent that the trust allocates foreign income as beneficiary income to a non-resident beneficiary in the same control group as the trust.

7.29 There is also an argument in favour of New Zealand taxing the foreign source trustee income of a New Zealand trust to the extent that that income is not taxed in any other country. The non-taxation of foreign-sourced trustee income of a New Zealand foreign trust is premised on the non-residence of the settlor. The trustee income is, in a sense, allocated to the non-resident settlor for the purpose of determining New Zealand’s right to tax. Accordingly, if the settlor is in the same control group as the trust, it would seem logical to apply Recommendation 5.2 to tax the trustee income, if it is not taxed to the settlor or any other person.

7.30 The definition of a “control group” is discussed in more detail in Chapter 12. The definition is designed to apply to partnerships and trusts as well as to corporate groups. Example 11.1 of the Final Report demonstrates that:

- the power to appoint a trustee of a trust is treated as a voting interest in the trust;

- where a settlor’s immediate family are the beneficiaries of a trust, they will be treated as holding equity interests in the trust, and these equity interests will be deemed held by the settlor under the “acting together” test.

7.31 This rule also suggests that New Zealand should tax the non-New Zealand source income of a non-resident if the non-resident’s home country:

- treats the income as attributable to a New Zealand branch; and

- on that basis, exempts it from tax.

Submission points 7D

Submissions are sought on whether and to what extent reverse hybrid entities established in New Zealand should (or should not) become taxable on their income under the principle of Recommendation 5.2. In particular, should trustee income earned by a New Zealand foreign trust be subject to New Zealand tax if the requirements of Recommendation 5.2 are met?

Submissions are also sought on the proposal to tax income treated by another jurisdiction as attributable to a New Zealand branch, and accordingly not subject to tax, as taxable in New Zealand, even if it otherwise would not be.

Recommendation 5.3: Information reporting

7.32 Recommendation 5.3 is that countries should have appropriate reporting and filing requirements for tax transparent entities established in their country. This involves the maintenance by such entities of accurate records of:

- the identity of the investors (including trust beneficiaries);

- how much of an investment each investor holds; and

- how much income and expenditure is allocated to each investor.

7.33 Recommendation 5.3 states that this information should be made available on request to both investors and the tax administration.

7.34 Naturally, New Zealand’s record-keeping and reporting requirements are focussed on ensuring compliance with the obligation to pay New Zealand tax. They are not generally designed to provide information regarding the derivation of income that New Zealand does not tax. However, the requirements vary. Taking the simple example of a tax transparent entity which is established under New Zealand law but has no New Zealand owners or assets:

- For a general and a limited partnership, there is a requirement to file an IR7 and also an IR7P. The IR7 requires overseas income to be recorded, and the IR7P requires the partners to be identified and the allocation of income to them. This seems to satisfy the requirements of Recommendation 5.3.

- A look-through company is subject to the same record keeping and return filing requirements as a New Zealand partnership. It also must allocate its income and deductions between its owners (Tax Administration Act, section 42B(2)).

- For a New Zealand foreign trust (one where the settlor is not New Zealand resident), the trust is required to keep records allowing the Commissioner to determine its financial position (Tax Administration Act, section 22(2)(fb) and (m). It must keep records of settlements made on and distributions made by the trust. It is also required to keep particulars of the identity of the settlor and distributees, if known (Tax Administration Act, section 22(7)). The trust also has to provide the identifying particulars of the trust and the address of the New Zealand resident trustees (Tax Administration Act, section 59B). There does not seem to be any requirement for the trust to file a tax return if it has no New Zealand source income.

- For a foreign investor PIE, a return must be filed in the prescribed form (TAA section 57B). In order for foreign investors to not be subject to New Zealand tax at 33% on the PIE’s foreign income, they must provide to the PIE their name, date of birth, home address, and tax file number in their home country and New Zealand (Tax Administration Act, section 28D).

7.35 With the exception of trusts, New Zealand seems to already be compliant with Recommendation 5.3. The record-keeping and disclosure requirements for New Zealand foreign trusts was separately dealt with by the Government Inquiry into Foreign Trust Disclosure Rules, released on 27 June 2016.[57]

55 Section 259GD, Schedule 10, Finance (No. 2) Bill 2016.

56 Division 830, Income Tax Assessment Act 1997.

57 http://www.treasury.govt.nz/publications/reviews-consultation/foreign-trust-disclosure-rules