Chapter 9 - Land-rich companies and trusts

9.1 The current land sale rules do not apply to the sale of shares in a land-rich company,[7] or to the change in terms of a land-rich trust[8] which effectively transfers the beneficial ownership of trust assets.

9.2 It is important that people cannot readily avoid the bright-line test through the use of trusts and companies. As a result, we think it is important to have a rule dealing with this issue. Two options for this are:

- a comprehensive set of rules that set out when a sale of shares in a land-rich company, or a change in the terms of a land-rich trust, should give rise to a taxable gain or loss; or

- a specific anti-avoidance rule for land-rich companies and trusts.

9.3 The key trade-off between these two options is between accuracy and simplicity.

9.4 A comprehensive set of rules would potentially provide a robust regime covering all land-rich companies and trusts. This would ensure that the tax treatment for residential property is identical no matter what legal form the property is held in. However, such a set of rules would be complex and require detailed legislation.

9.5 A specific anti-avoidance rule would be simpler and avoid the associated risks of increased compliance costs. It would, however, be less robust.

9.6 On balance, we favour a specific anti-avoidance rule in relation to land-rich companies and trusts used to circumvent the bright-line test. At present it does not appear that there are large volumes of residential property being traded through sales of companies or amendments to the terms of trusts. As a result, we think that a comprehensive set of rules would create additional complexity to target a relatively small problem.

9.7 If, over time, the use of land-rich companies and trusts that circumvent the bright-line test become more common this may need to be revisited.

Design of anti-avoidance rules

Companies

9.8 An anti-avoidance rule is suggested for the bright-line test that would deem a disposal of property held by a company to have occurred if there is a disposal of shares with the purpose or effect of defeating the intent and application of the bright-line test.

9.9 When this rule applies, the tax liability would be with the selling shareholder.

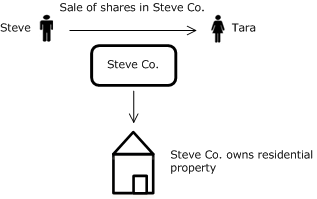

Example: Land-rich company

1 May 2016: Steve sets up Steve Co. Steve owns all of the shares in Steve Co.

2 May 2016: Steve Co. purchases residential property.

1 July 2016: Steve sells shares in Steve Co. to Tara.

If Steve had bought the property directly and sold it to Tara it would be subject to the bright-line test. The sale of shares has the effect of defeating the intent and application of the bright-line test and as a result any gain from the share sale is taxable under the bright-line test.

Trusts

9.10 An anti-avoidance rule is suggested for the bright-line that would deem a disposal of property held by a trust to have occurred if any of the following is done with the purpose or effect of defeating the intent and application of the bright-line test:

- a change in the trustees of a trust;

- a change in the beneficiaries of a trust;

- a change in the identity of any person who is able to appoint the trustee or the beneficiaries of a trust; or

- a change in the ownership of a corporate trustee.

9.11 When this rule applies, the income would arise either at the trust level (giving rise to liability to the trustee or settlor) or it could potentially be beneficiary income so that the relevant beneficiary would have a tax liability.

7 However, the sale of shares is taxable if acquired with the dominant purpose of resale.

8 “Change in terms” means any changes referred to in paragraph 9.10.