Chapter 8 - Treatment of losses

8.1 The current land sale rules allow the cost of property disposed of in a taxable sale to be deducted without limitation. It is not relevant that it may exceed the proceeds of disposal.

8.2 Prima facie this is the correct outcome. Enabling losses to be claimed in circumstances when gains are taxable ensures symmetry and avoids economic distortions. If losses are not able to be claimed it would mean that risky assets would be undervalued and this would result in investment decisions being affected by tax.

8.3 However, an unrestricted ability to use losses from the bright-line test raises risks:

- It creates an incentive for taxpayers with unrealised losses before the two-year date to accelerate sales to fall within the two-year bright-line period, and an incentive for taxpayers with unrealised gains at that time to defer the sale of property after two years.

- This raises revenue risks as taxpayers are given the opportunity to maximise claimable losses and minimise taxable gains. This is especially the case as a taxpayer who falls within the bright-line test may be able to deduct otherwise non-deductible expenses.

Ring-fencing losses

8.4 To minimise these risks, we suggest ring-fencing losses claimable due to the bright-line test, so they are only able to be offset against taxable gains on other land sales.

8.5 This proposed ring-fencing would apply where the sale is taxable solely because it is covered by the bright-line test. The ring-fencing would not apply if the sale is taxable under any of the other land sale rules.

8.6 Ring-fencing losses reduces the revenue risk referred to above, as taxpayers have less incentive to accelerate sales if they do not have offsetable gains and less incentive to defer sales if they have ring-fenced losses.

8.7 Ring-fencing does create a risk of a new distortion as gains and losses are not taxed symmetrically. As a result, it may discourage economically efficient activity when a person does not have any offsetable gains. We think this risk is minor.

8.8 Ring-fencing will not affect persons who buy and sell on a frequent basis as they are allowed to claim losses normally under the other land sale rules. For those who are not selling on a frequent basis, denying losses is unlikely to impose a large cost as they perform a relatively small economic function in the housing market.

Losses from transfers to associated persons

8.9 When a property has declined in value it is possible for a person to transfer a property to an associated person in order to recognise the loss under the bright-line test without any real economic transaction occurring.

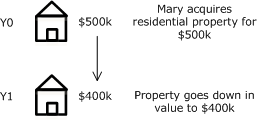

Example: Transfer to associated person

Mary wants to realise the loss in the property to reduce her tax liability on her other incomes but does not want to lose control over the property.

To achieve this Mary transfers the property to her partner Ned for $400k.

8.10 To prevent this, we suggest that a person should not be able to recognise a loss under the bright-line test arising from a transfer of property to an associated person.