Chapter 4 - Tax administration needs to change

Inland Revenue’s website has won the top government website eight times in the annual New Zealand NetGuide Awards.

Inland Revenue already offers a range of digital services, including website, mobile apps, text, software-enabled filing, email, social media, and voice recognition technology. Customer satisfaction with online channels is relatively high.

There is already significant use of digital services to meet tax obligations:

- In December 2014, 86% of payments were made electronically.

- As at 30 June 2014, 1.7 million active customers were registered for myIR, Inland Revenue’s web- based digital service channel. MyIR allows customers to update their own information and file returns digitally.

Voice ID is an example of Inland Revenue’s innovative use of digital technology. Voice ID uses voice recognition technology so individuals can identify themselves at the beginning of a phone call to Inland Revenue, eliminating the need to answer personal security questions. This gives customers access to automated self-service functions even outside office hours.

These examples suggest a relatively high level of willingness to adopt new digital services offered by Inland Revenue.

INLAND REVENUE’S CURRENT DIGITAL SERVICES HAVE LIMITATIONS

Despite positive progress, Inland Revenue’s digital services have significant limitations:

- digital services are not available to cover all customer interactions;

- even when digital services are available for customers, they do not always generate a positive customer experience;

- they exist as stand-alone services, and are not integrated with other activities that customers carry out, such as dealing with their bank or using their business accounting software;

- they do not integrate with most other government services; and

- they do not always provide the same level of functionality as other channels.

Despite high overall satisfaction with Inland Revenue’s existing digital services, in-depth research found that customers:

- have difficulty accessing and using Inland Revenue information they need;

- find Inland Revenue’s transactional processes time-consuming, disconnected and confusing;

- regularly use multiple service delivery channels to undertake one interaction;

- are uncertain whether they have done the right thing; and

- are frustrated that information is not shared and is inconsistent across Inland Revenue’s different digital services.

The limitations outlined above are largely a consequence of the technology used to administer the tax system. The core technology Inland Revenue operates on is 25 years old and predates most of the digital innovations that customers currently take for granted. In addition, Inland Revenue’s role has expanded from simply collecting tax in a paper-based world to managing the collection of tax and the delivery of income-related social policies such as student loan repayments, Working for Families tax credits and KiwiSaver. Adding social policy services to 25-year-old technology has resulted in an extremely complex intertwined system which is expensive, risky and time consuming to make further changes to.

Inland Revenue’s ageing technology platform has also imposed significant limitations on its ability to deliver targeted services, and innovative policy approaches.

Current tax legislation, including the Tax Administration Act 1994, also originated in a paper-based environment. It needs to be modernised to ensure it does not inhibit the uptake of digital services. This is further discussed in Chapter 7.

GOVERNMENT HAS BEGUN THE CHANGE

The Government recognises that the improvements it wants to achieve in the way businesses and individuals interact with government cannot be achieved without a fundamental redesign of the tax administration system, enabled by digital technology.

The early design stage of this work has already begun, and the results of this consultation will help to shape the redesign.

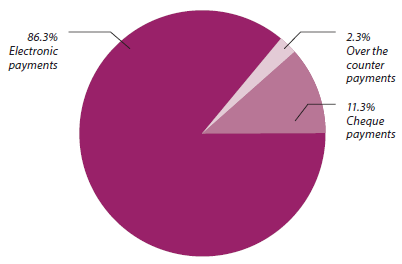

THE MAJORITY OF PAYMENTS ARE MADE VIA DIGITAL CHANNELS

The proportion of electronic payments Inland Revenue received in December 2014 was 86% which shows a 19% increase compared with December 2013. A significant contributor to this has been the removal of a previous rule which provided a timing advantage to those who paid by cheque.

| 95% | 1.3 million | 19 million |

| of customers are 'satisfied' with Inland Revenue's online channel (2013-14 figures) | customers were registered with Voice ID by January 2015. Around 60-70 per cent of people who call IRD on any day are now enrolled with Voice ID. This means New Zealand has the high- est level of voice biometrics per capita in the world. | visits were made to the Inland Revenue website (www.ird.govt.nz) in 2013-14 |