Chapter 3 - Living in a digital world

WHAT DOES “DIGITAL” MEAN?

Digital technology is a way to transfer, process, record, generate and display information electronically. It includes, but is not limited to, internet-enabled systems, email, text, apps, and social media. This discussion document uses “‘digital”’ as shorthand for any electronically enabled technology; in whatever form that might take today and in the future.

In July 2013 the Government set ten challenging results for the public sector over the next five years. Result 9 requires the cost to business in dealing with government to reduce by 25%. Result 10 requires New Zealanders to be able to complete their transactions with the government easily in a digital environment.

Digital services are evolving fast. The internet and the mobile phone have transformed communication, business processes and our lifestyles.

NEW ZEALANDERS ARE EMBRACING THE CHANGE

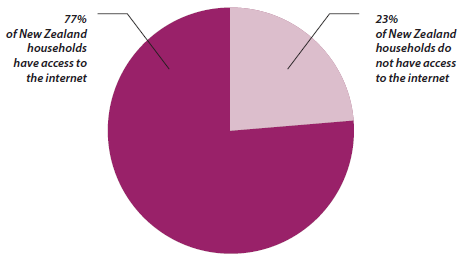

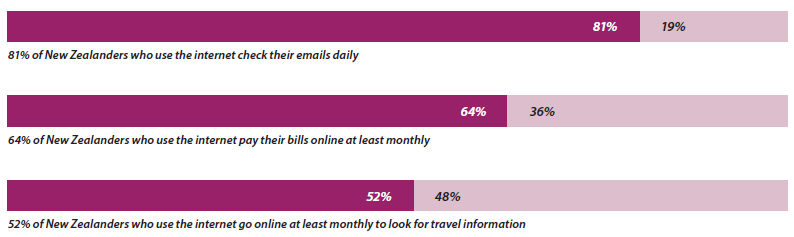

Internet use in New Zealand households is relatively high. According to the 2013 Census, 77% of households have access to the internet. The World Internet Project's 2012 research found that New Zealanders who use the internet use it extensively:

- 81% check emails at least daily;

- 64% pay bills online at least monthly; and

- 52% go online at least monthly to look for travel information.

In a recent research led by Tufts University on digital evolution among 50 countries, New Zealand is ranked as one of the nations that have shown high levels of digital development in the past and this is expected to continue.

THE GOVERNMENT’S VISION FOR NEW ZEALAND

The Government recognises that digital technology can improve customers’ experience of government services and reduce the cost of providing these services for everyone.

Its vision for New Zealanders is for them to be able to “complete their transactions with government easily in a digital environment”. This vision includes the commitment to help customers to manage their transactions digitally, and provide alternatives for those who cannot.

For business, the Government’s target is to cut the costs of dealing with government by 25% by 2017. Greater use of digital services is considered to be a key enabler in meeting that target. The Government’s intent in promoting greater use of digital services is to improve the service offered by government and not simply to shift costs from government to the private sector.

PENETRATION OF INTERNET IN NEW ZEALAND HOUSEHOLDS

(Statistics NZ, 2013 census)

THE WORLD INTERNET PROJECT (2012) REPORT FOUND THAT:

INCREASING ELECTRONIC TRANSACTIONS IN NEW ZEALAND

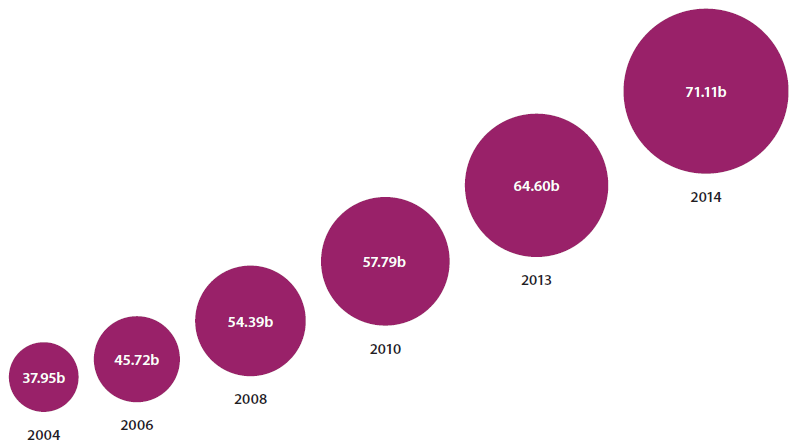

Industry sources indicate that approximately two-thirds of total spending in New Zealand is done electronically on eftpos and credit cards. This is significantly higher than the international average. Just over 32% of worldwide consumer retail spending was card-based, according to 2012 research by Moody’s Analytics.

According to Statistics New Zealand, New Zealanders’ use of electronic card transaction is growing.

POSSIBLE DEVELOPMENTS FOR THE TAX ADMINISTRATION SYSTEM

The digital technology already exists to transform the way individuals, families and businesses interact with Inland Revenue (see Appendix 1: other tax jurisdictions' digital approaches). For example, digital technology could be used to:

- allow customers to access services and information faster and at a time that is convenient for them, through whatever devices might be appropriate for that type of interaction;

- allow customers to receive immediate confirmation that their obligation to provide information or make a payment has been discharged;

- provide information already held by Inland Revenue – for example, from banks – in tax returns so businesses and individuals do not have to supply it;

- share information from other government agencies so businesses and individuals do not have to supply it again;

- integrate tax processes into normal “life” processes. For example, a migrant could receive an IRD number at the same time they were granted a work visa;

- integrate tax interactions into business software so businesses do not have to provide information separately for their tax requirements. For example, an employer could meet their PAYE obligations as part of paying wages through payroll software;

- proactively inform customers of obligations or entitlements and inform customers about services that might be useful to them;

- provide a “real time” view of a customer’s tax and related social policy information; and

- enable shortfall payments and debt to be collected from subsequent income periods.

THERE COULD BE SIGNIFICANT BENEFITS FOR NEW ZEALANDERS

If digital services are secure and designed to make it easy for customers to use them, increased digital service delivery could deliver the following benefits to customers:

- Greater convenience: Digital services can provide customers with the immediacy and convenience of access to information and services any time and anywhere. Interactions can take place through multiple digital channels, such as mobile, apps and through business software.

- Greater speed and confidence: Responses and notifications could be delivered through digital channels in addition to those delivered now, and faster than those currently delivered.

- Reduction of effort: The ability to integrate with other systems and pre-populate information could reduce the effort required by customers to fulfil their tax and social policy obligations.

- Improved, more rapid and responsive customer services: Digital services could make the monitoring and capturing of a customer’s experience, satisfaction and perception of the services they have received much easier, and allow Inland Revenue to improve its services.

- Reducing the cost of the tax administration system: Reduced tax administration costs could allow Inland Revenue to provide better targeted services, the Government to increase spending in other areas and reduce government spending overall. Others involved in the tax administration system – such as tax agents and accountants – could focus on higher-value services such as supporting business growth rather than routine tax compliance.

- Improved delivery of services across government. Some information collected by Inland Revenue is used by other government agencies – such as ACC, which uses employment information to calculate levies. Faster, more accurate information which other agencies can use could enable the delivery of better services by them to their customers, and greater efficiencies across government.

QUESTIONS FOR READERS

- Do you agree that the benefits set out could result from the greater use of digital services in tax administration?

- Are there other benefits which could be gained from improving and introducing more secure digital services?