The taxation implications of company law reform

A discussion document

December 1993

CHAPTER 2: SHARE REPURCHASES AND RELATED ISSUES

2.3 Current Rules for Taxing Share Cancellations

2.3.2 Problems With Existing Rules

2.4.1 Distributions Funded by Way of Capital Profits

Determining The Capital Gain Amount

2.4.2 New Anti-Dividend Substitution Rule

2.4.3 Reinforcing the "Slice Rule"

Commissioner's Residual Discretion

Treatment of Fixed Rate Shares

2.5 Mechanism for Taxing the Dividend Component of Share Repurchases

2.5.2 Off-Market Purchases by Resident Non-Qualifying and Qualifying Companies

Repurchase from Resident Non-Corporate Shareholder

Repurchase from a Resident Corporate Shareholder

Repurchase from a Vendor who Holds Shares on Revenue Account

Repurchase from a Non-Resident Shareholder

Repurchase from Tax Exempt Shareholder

2.5.3 On-Market Repurchase by a Resident Non-Qualifying Company

Repurchase from Resident Non-Corporate

Repurchase from Resident Companies

Repurchase from Tax-Exempt Entities

Repurchase from a Non-Resident Shareholder

Repurchase from a Vendor who is Holds Shares on Revenue Account

2.5.4 Repurchase by Non-Resident Companies

2.1 Background

The new Companies Act treats share repurchases as a distribution. When making a distribution under the new Companies Act a company is subject only to restrictions in the company's constitution and to satisfying the solvency test in section 4 of the Act. The term "distribution" is defined widely in section 2 of the Act to mean:

"(a) the direct or indirect transfer of money or property, other than the company's own shares, to or for the benefit of [a] shareholder; or

(b) the incurring of a debt to or for the benefit of [a] shareholder;

in relation to shares held by that shareholder, and whether by means of a purchase of property, the redemption or other acquisition of shares, a distribution of indebtedness, or by some other means."

There is no longer a restriction as to the fund or reserve out of which a distribution can be made. A distribution can now be made out of capital. The definition of a distribution recognises that, regardless of its form, a distribution by a company reduces the cushion of reserves available to creditors. The new Companies Act distinguishes between distributions in the form of "dividends" and other distributions, such as share repurchases and certain redemptions, because the administrative rules governing the payment of dividends differ in detail from those that govern other forms of distribution. However, the economic equivalence of all forms of distribution made by an on-going company is recognised so that all distributions, whatever their form, are subject to the same solvency test.

2.2 General Considerations

Share repurchases as provided for in the new Companies Act are not contemplated under existing tax rules. The closest existing analogy to a share repurchase is a share cancellation. Both reduce the capital of the company. Until such time as a company is registered under the new Companies Act, if it wishes to reduce its capital it will only be able to cancel shares. Accordingly, the treatment applied to cancellations should, as far as possible, parallel the tax treatment of repurchases.

The Valabh Committee considered the appropriate treatment of share repurchases in its two reports on The Taxation of Distributions From Companies, released in November 1990 and July 1991. The Committee proposed a mechanism by which the dividend component of share repurchases could be subject to tax. A number of submissions to that Committee argued that, except in certain circumstances, a repurchase should be treated in the same way as a sale of shares to a third party. That is, no tax consequences should arise if the shares repurchased were on capital account. Furthermore, submissions argued that to tax the dividend component of a share repurchase would mean that it would never be prudent for a company to repurchase its shares because it would have to pay a premium on the market price. This was seen as undermining the objectives of proposed company law reform.

The Valabh Committee considered these objections but maintained its earlier view that there is little difference in principle between the distribution of retained earnings as an ordinary dividend and the distribution of retained earnings by way of a share repurchase by a company. The effect on the company's retained earnings and shareholders' total wealth is the same in each situation. It logically follows that the overall tax consequences of each type of distribution should be identical. If this were not the case there would be an incentive for companies to characterise dividends as share repurchases (Valabh Committee (1991) p33).

The Valabh Committee also rejected the argument that treating share repurchases and other distributions in a consistent manner would undermine company law reform. As the Committee noted, this is no more true than to say that taxation of ordinary dividends undermines company law provisions allowing the payment of such dividends (ibid, p33).

The Government agrees with the Valabh Committee's general conclusions. There are three key questions to consider, however:

- What part of the repurchase proceeds should be tax-free in the hands of the shareholder? In particular, should distributions funded from capital profits be tax-free when made through repurchases?

- What ordering rule is to be used to determine the portion of the amount paid on the repurchase of shares that is tax-free?

- What is the most appropriate mechanism for taxing the dividend component of amounts distributed through a repurchase?

These issues are discussed below.

2.3 Current Rules For Taxing Share Cancellations

2.3.1 The Current Rules

Under current income tax law:

- A payment made to shareholders on cancellation of a share during the life of a company is taxable unless it represents a return of capital.

- Cancellation payments funded from a company's capital gains are taxable (except on a full liquidation). This is consistent with the rules for dividends generally. Dividends funded from capital gains are taxable.

- Rules apply to determine the contributed capital amount and qualifying share premium amount per share. This is the amount that can be returned tax-free. Where the company is being liquidated, capital profits can also be distributed tax-free. The formulae for determining these tax-free components are outlined in Annex 2.1.

- Rules also apply to determine when a distribution is in substitution for a dividend, in which case the full amount is taxable. These rules are contained in section 4A(1)(c)(ii) of the Income Tax Act.

Dividends are easily distinguished conceptually from a return of subscribed capital from a company to its shareholders. They are normally seen as a distribution of the profits of the enterprise to its owners. In a perfectly operating company tax system, imputation credits equivalent to full company tax would be attached to dividends. By contrast, a return of subscribed capital would be expected to be an unusual one-off event reflecting a distinct feature of a company at any point in time. To the extent that a company distribution to a shareholder consists merely of a return of the shareholder's investment, the distribution should not constitute a taxable dividend. While it is conceptually clear, there are difficulties in applying this "in principle" distinction in the operating commercial environment.

First, the funds actually held by the company are not necessarily equal to the amount an individual shareholder has invested. Many shares are likely to have been purchased on the secondary market at a price different from their issue price. With bonds, this issue is dealt with by taxing as income any gain made by the holder on the bond. However, the same treatment applied to shares would result in the taxation of gains on shares held on capital account. The approach adopted for shares therefore is to treat as a return of capital the amount invested in a company with respect to those shares by the original shareholder. Under existing law this amount is paid-up capital for tax purposes. When company law reforms become effective, it will be subscribed capital. The concept of subscribed capital is considered in more detail in Chapter 4.

Second, it is not uncommon for companies to issue bonus shares in lieu of dividends, or periodically seek new capital by offering new shares to existing shareholders. As the issue price of the new shares usually varies from the price of the initial shares, shares of the same class represent differing levels of investment in the company. Companies do not necessarily keep records tracing the issue price of specific shares. Thus, tax rules apply an averaging formula to compute the amount of capital attributable to shares in a class.

Third, allowing companies to determine the source of the distribution without constraint (other than in the course of a liquidation) would seriously undermine the dividend tax base since it would allow companies to substitute distributions funded from tax-free sources for taxable distributions of retained earnings.

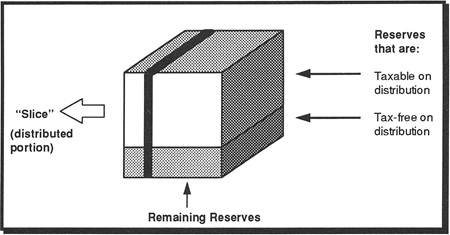

Consequently, the current rules identify the order in which the funds are sourced. Any amount over and above paid-up capital is deemed to be a distribution of revenue reserves and is taxed. Where the market price is paid for the share, the current rule results in a distribution arising from a share cancellation being deemed to come from both taxable and tax-free sources. This is referred to as the "slice rule". The Government considers the slice rule to be the most appropriate approach to determining the portion of the distribution that is tax-free.

Broadly, the aim of the slice rule is to base the non-taxable and taxable components of the share repurchase proceeds on the ratio between capital and the taxable reserves of the company.

Given the variation in accounting treatments, it is inappropriate to specify for tax purposes reserves that are taxable on distribution. Existing tax rules specifically define tax-free distributions. Distributions in excess of those nominated as being tax-free are taxable. Consistent with this approach, taxable reserves are the difference between the tax-free reserves and the market value of the company's shares. Existing rules on the full liquidation of a company reflect this treatment. Under those rules, all the proceeds of a distribution on a full liquidation (representing the market value of the company's underlying assets at that time) are taxable except for those specifically deemed to be tax-free.

Since any dollar distributed cannot be specifically identified as coming from either tax-free or taxable reserves, the slice rule has the advantage of being "even-handed" by assuming the distribution comes from both sources in proportion to their contribution to total market value.

2.3.2 Problems With Existing Rules

The existing rules that govern share cancellations have two key problems which give rise to a need to strengthen those rules so that they achieve their intent.

First, while the slice rule applies if the market price is paid for the share, the rules allow a company to pay less than market price. As a result, the entire distribution can be made tax-free by the company paying only the contributed capital per share. Shareholders are not penalised provided their respective interests in the company remain unchanged. Existing rules in practice therefore provide scope for subscribed capital to be distributed ahead of taxable reserves. For tax base maintenance reasons, the Government considers that it is appropriate that the slice rule apply in these circumstances.

Second, the test that determines when a cancellation is in substitution for a dividend is very difficult to apply because it is highly subjective. The test relies on identifying the distribution as being made "regularly, systematically or explicitly" in lieu of a dividend, which is very difficult for the Commissioner to determine. First, there may be some argument that "systematic" does not include a one-off cancellation. A more fundamental problem is that the test requires the Commissioner of Inland Revenue to determine what a company would distribute as an ordinary dividend in any particular year in the absence of an ability to cancel or repurchase shares. This has proved difficult to apply in practice, and in the case of a newly established company, or a company with a one-off gain, the test is particularly hard to administer. Since companies are expected to repurchase shares more frequently than they currently cancel shares, this weakness represents significant potential for dividend tax base erosion.

2.4 Proposed Changes

2.4.1 Distributions Funded by Way of Capital Profits

General Proposal

The Government, in determining what proportion of a distribution should be taxed as a dividend, has considered the appropriate treatment of distributions funded from capital profits. As noted above, under existing rules, distributions funded from capital profits are tax-free only when a company is fully liquidated. The Valabh Committee proposed that distributions funded from capital profits also be tax-free when effected by way of a share repurchase or redemption (Valabh Committee (1991), p37). The recommendation related only to non-qualifying companies. The qualifying company regime, aimed at small incorporated businesses, already provides that distributions funded from capital profits are tax-free when distributed to shareholders.

The arguments advanced by the Committee in favour of relaxing the existing rules and allowing distributions funded from capital profits to be tax-free on a repurchase or redemption of shares were that:

- There is no "in-principle" distinction between an amount distributed by way of a repurchase and distributions on the full liquidation of a company (when distributions from capital profits are tax-free).

- Rules aimed at preventing companies substituting tax-free repurchases for taxable dividends should be sufficient to protect the dividend tax base if the existing restriction is relaxed.

There are some arguments for not relaxing the rules. Under the new Companies Act, repurchases and dividends are subject to broadly similar rules, such as the solvency test, while rules applying on a full liquidation differ significantly. Also, the proposal to allow distributions sourced from capital profits to be tax-free creates an opportunity for on-going companies to provide a tax-free return to their shareholders by way of share repurchases not currently available. This could undermine the dividend tax base. Existing anti-dividend substitution rules are considered inadequate in this regard. The proposal also involves some increase in compliance and administration costs. Implementing it would require rules to attribute distributed capital profits to shares of a company (other than fixed rate shares) repurchased by a continuing company. For their part, companies would need to have adequate records that identify realised capital profits and losses, as well as any past distributions from those sources.

After careful consideration of this issue, the Government has determined on balance to support the Valabh Committee's recommendation that distributions by way of share cancellations or repurchases that are funded from realised capital profits be tax-free, so long as the distribution is of sufficient size to clearly not be in substitution for a dividend. For the reasons outlined above, the Government considers that such a change should be conditional upon the implementation of more robust rules to prevent the substitution of tax-free distributions for the payment of taxable dividends. These rules are discussed further below. Since the new rules will apply to share cancellations, they will affect companies registered under the Companies Act 1955 as well as the new Companies Act.

This change would not apply to fixed rate shares. Distributions upon the redemption or repurchase of fixed rate shares, other than those funded by subscribed capital, would continue to be taxable.

Determining the Capital Gain Amount

As noted above, it is necessary to apply rules to attribute realised capital profits to shares repurchased. Otherwise, there would be little constraint on a company targeting tax-free distributions funded from this source to particular shareholders, such as high-marginal rate taxpayers. The capital gain attributable to shares on a repurchase or redemption would be calculated by simply averaging the total realised capital gain reserves over the number of shares of all classes, other than fixed rate shares, on issue prior to the repurchase or cancellation. Capital gain reserves would be the sum of all realised capital gains, less capital losses and distributions previously funded from such reserves, since the creation of the company.

2.4.2 New Anti-Dividend Substitution Rule

In light of the weaknesses in the current law, the Government proposes to amend the legislation to achieve two objectives. The objectives are:

- to ensure that the slice rule applies even where less than the market price is paid for the share;

- to incorporate a more robust and effective anti-dividend substitution rule.

2.4.3 Reinforcing the "Slice Rule"

General Approach

A company making a share repurchase or redemption, or a distribution on liquidation, would continue to be able to determine the amount that is attributed to tax-free reserves on a similar basis to the current section 4A(1)(c) of the Income Tax Act, but with a key modification.

It is proposed to amend the section to ensure that the tax-free and dividend components of the distribution better reflect the composition of the company's value. As noted earlier, currently companies can make a pro rata cancellation that is entirely tax-free by cancelling shares for their par value despite the market price being many times that amount. Such a strategy could also be possible with off-market repurchases but unlikely with on-market repurchases as shareholders would not sell their shares on-market for less than the market value.

Under the proposed change, where the market value or more is paid for a share, the subscribed capital and capital gain amount in relation to the share could be returned in full. Where less than the market value is paid, those amounts would be reduced as follows:

price paid x (subscribed capital amount + capital gain amount)

market price

Section 4A of the Income Tax Act currently refers to the "returned capital amount". This term will be replaced by the term "subscribed capital amount", a concept that will reflect the capital position and shares on issue at any point in time, taking into account all previous capital subscriptions and reductions. The current formula refers to all shares and capital ever issued.

Example

Assume a company has 100 shares, all of one class, with subscribed capital of $0.50 per share. The market value of the company is $100.00 and its realised capital gain reserves are $20 (or $0.20 per share). The company repurchases 70 percent of the shares for $0.70 each through off-market repurchases. The tax-free component per share would be $0.49, that is:

| price paid market price |

x | tax-free amount | = | $0.70 $1.00 |

x | ($0.50 + $0.20) | = | $0.49 |

Determination of Market Value

It is envisaged that the Commissioner would exercise a discretion as to how market value would be calculated in the case of repurchases, having already the power to determine the market value of shares in several other contexts. At the request of the Government, the Commissioner has considered ways to reduce compliance costs involved in determining the market value, and is conscious of the need to approve or confirm market values of shares to enable the proposed measures to operate in a satisfactory manner. For example, in the case of non-listed companies it is envisaged that detailed valuations will not be required but that a written valuation by an independent competent valuer will suffice in most cases. This should reduce compliance costs. Submissions as to how to further reduce compliance costs consistent with the general objective would be welcomed.

2.4.4 Brightline Tests

The New Test

Under the slice rule, amounts distributed by way of share repurchases and redemptions would continue to be tax-free to the extent that they are considered to be returns of subscribed capital or realised capital gains. However, it is proposed to include in section 4A(1)(c) of the Income Tax Act two new tests that would allow this treatment only in circumstances where a "qualifying capital reduction" or a material reduction in a shareholder's interest (a "qualifying disproportionate reduction") occurs. These tests establish levels referred to as "brightlines". The tests are designed to give a clear, objective determination of when a distribution is a qualifying capital reduction or a qualifying disproportionate reduction as opposed to a deemed dividend. If the tests are not satisfied, the distributions would be taxable in full to the shareholder as dividends.

The tests will apply to repurchases other than "on-market repurchases". The slice rule would automatically apply to on-market repurchases, with the company rather than the shareholder being responsible for meeting the tax imposition (refer to section 2.5 for further details). On-market repurchases would be defined as repurchases where:

- The company acquires the repurchased shares through a broker in a recognised exchange (as defined in section 8B of the Income Tax Act for the purpose of determining interests in companies).

- The seller, as a result, is unaware of the identity of the purchaser at the time the offer to acquire is accepted.

The brightline tests specify that amounts distributed by way of repurchases, redemptions and cancellations (other than on-market repurchases) would be considered to be in lieu of taxable dividends, and would therefore be fully taxable as dividends, in the following circumstances:

- where a repurchase offer is made on a pro rata basis under the terms of the companies legislation and the amount ultimately distributed represents less than 15 percent of the market value of the repurchasing company's shares at the time the company first notified shareholders of the intended offer. To be pro rata the offer must apply to all shares of the company other than fixed rate shares (defined in the proposed section 4A(3) of the Income Tax Act);

- where a repurchase offer is made on a non pro rata basis, a shareholder's proportionate interest in the company after the repurchase or cancellation is more than 85 percent of the shareholder's pre-repurchase/cancellation interest. The shareholder's interest would include the interests of certain persons associated with the shareholder. This test would be applied to the aggregate of all shares in a company, other than fixed rate shares.

Sections 8A to 8D of the Income Tax Act, which measure voting and market value interests, would be used as the basis for establishing a shareholder's underlying interest in a company.

The tests of when a distribution is in lieu of a dividend have been designed to enable companies, for reasons such as downsizing of operations, to fund one-off distributions to all shareholders (or to selected shareholders in the case of disproportionate reductions) partly from tax-free reserves of the company.

The brightlines have been set at levels where it is clear a company would be returning capital rather than paying a dividend. The 15 percent of market value level represents approximately three times typical dividend yields. This represents a reasonable level for a robust anti-dividend substitution rule.

Commissioner's Residual Discretion

The Commissioner's discretion currently in the law will be rewritten as a backstop measure for use only when taxpayer behaviour defeats the purpose of the new rules.

Where there is either a qualifying disproportionate reduction or a qualifying capital reduction, the distribution will be considered to be in lieu of a dividend only if the Commissioner is of the opinion that the repurchase was made under an arrangement to acquire, redeem or otherwise cancel shares in lieu of the payment of a dividend. The factors to be considered by the Commissioner in this regard are outlined in the legislation.

A circumstance in which this residual discretion for the Commissioner should apply is where a company (likely to be a closely-held company) accumulates earnings until they represent 15 percent or more of the market value of the company. The company then makes a distribution, ostensibly as a result of a downsizing operation, but without reducing any of its core business. Similarly, successive disproportionate reductions that leave the respective interests of shareholders largely unchanged would also run foul of this rule.

Repurchase by Related Company

It is necessary to include rules to prevent a repurchase being characterised as a sale of shares to a third party by using, for example, related sibling companies or trusts to acquire shares. While it is considered that section 99(5) of the Income Tax Act is likely to catch such repurchases, it would be difficult to apply the section in relation to on-market repurchases, since it is not practical to deem a dividend to have been derived by the vendor. Accordingly, to cover the case of repurchases occurring on-market in the circumstances outlined above (or similar circumstances), a new section 4(12) will be inserted. This in effect provides for a debit to the Imputation Credit Account (ICA) of the company that issued the shares in respect of the dividend component of the repurchase. There would be no tax consequences for the vendor. Under section 4A(1)(cb) the amount paid to the vendor would be excluded from the dividend definition.

Treatment of Fixed Rate Shares

Fixed rate shares would be excluded from the brightline tests. They are more akin to debt instruments and usually do not carry an entitlement to the reserves of the company. This means that only subscribed capital in respect of such shares would be returned tax-free. The only exception would be when there is a plan or arrangement to redeem fixed rate shares in lieu of the payment of a dividend on other shares in which case the distribution would be fully taxed as a dividend. An anti-avoidance rule to deal with this situation is included in the draft legislation.

2.5 Mechanism for Taxing the Dividend Component of Share Repurchases

2.5.1 Introduction

How the dividend component of a share repurchase will be subject to tax will vary according to a number of factors, including:

- whether the repurchasing company is a resident or a non-resident company;

- whether the repurchase occurs on-market or off-market. Since it will not generally be possible for repurchasing companies to identify vendor shareholders at the time shares are acquired through the sharemarket, on-market share repurchases are likely to be from selected shareholders. Pro rata share repurchases will generally be confined to off-market transactions;

- whether the shareholder from whom shares are repurchased is a company, a non-corporate shareholder, a resident or is taxable on gains from the sale of shares.

Each of the above combinations results in different considerations that should be taken into account in determining how best to tax the dividend component of share repurchases. The proposals are discussed in more detail below, and are summarised in general terms in Annex 2.2.

2.5.2 Off-Market Purchases by Resident Non-Qualifying and Qualifying Companies

Background

The Valabh Committee made the following recommendations on the appropriate general mechanism for accounting for tax on the dividend component of a share repurchase:

- A company buying back its shares should be subject to fringe benefit tax (FBT) on the dividend component of the repurchase where that occurred on- or off-market.

- The company should be able to debit its imputation credit account (ICA) in satisfaction of the FBT liability.

- If insufficient ICA credits exist to satisfy FBT, then FBT should be actually paid with no credit to the ICA for that payment.

- All vendor shareholders should be exempt from tax on the dividend component of the repurchase price.

The Committee made its recommendations when non-cash dividends were subject to FBT and prior to the removal of the inter-corporate dividend exemption. This latter change means that where a company repurchases from a resident corporate vendor, the dividend component will be taxable. Where this occurs there is some argument that applying the Valabh Committee approach unaltered would operate harshly in relation to repurchases from corporate shareholders. In order to address this concern in respect of off-market repurchases, it is proposed that where shares are purchased by a qualifying or non-qualifying company off-market, the normal dividend distribution rules apply.

Repurchase from Resident Non-Corporate Shareholder

Where a company repurchases shares from a resident individual, the shareholder will be taxable on the dividend component of the sale proceeds.

Imputation credits may be attached by the company in accordance with ordinary rules, and the dividend will generally be subject to the resident withholding tax regime. This treatment is illustrated in Annex 2.3.

Repurchase from a Resident Corporate Shareholder

A corporate shareholder would be taxed in the same way as an individual on the repurchase of shares. A credit will arise to the vendor's imputation credit account equal to the amount of any imputation credit, or resident withholding tax credit, attached to the dividend component of the sale proceeds. In this way, the appropriate amount of tax would be levied on dividend income.

Repurchase from a Vendor who Holds Shares on Revenue Account

The interaction between taxing the dividend component of a share repurchase and taxing gains or losses on shares on revenue account has not been fully evaluated. Any changes that may be proposed as a result of further evaluation will be discussed with interested parties during the consultation period.

The proposal is that a vendor shareholder who holds shares on revenue account would be assessed on profits arising from the sale of the shares. The vendor would also be assessed on the dividend income arising from the repurchase. To ensure that both the dividend and the gain on share sales are not subject to tax, it is proposed that only the dividend component (excluding imputation credits) and the excess profit over the dividend, if any, should be assessable. Where a loss had been made on sale, it could be offset against dividend income.

Repurchase from a Non-Resident Shareholder

The purchasing company would be required to deduct from the purchase price non-resident withholding tax on the dividend component of that repurchase price.

Repurchase from Tax Exempt Shareholder

Where the vendor shareholder is tax exempt, the dividend would be exempt and therefore not subject to RWT. However, imputation credits must be allocated to the dividend in accordance with the imputation rules.

2.5.3 On-Market Repurchase by a Resident Non-Qualifying Company

Background

Where a company purchases on-market from a shareholder of the company, the normal dividend rules will be inappropriate because:

- The shareholder will be unaware of the identity of the purchaser.

- At the time of the acquisition, the purchaser will not know the identity of the vendor.

- Where shares (representing less than 5 percent of the company) are held by a nominee the purchaser may never know the identity of the beneficial owner of the shares.

The Valabh Committee's recommended approach to taxing the dividend component of a repurchase, outlined above, assumed a link between dividends and FBT. The regime that applied at that time levied FBT on non-cash dividends. This is no longer the case. In view of this, and because a situation in which a company would prefer to pay FBT rather then debit its ICA is unlikely to arise, it is proposed that the legislation simply provide for a debit to arise to the ICA of a company to cover tax due where shares are repurchased on-market.

Repurchase from Resident Non-Corporate

Where a company repurchases shares from a resident non-corporate, the company would debit its ICA in respect of the dividend component of the repurchase price.

The amount of the debit would be calculated in the same way as resident withholding tax on non-cash dividends. Where the purchasing company has insufficient credits in its ICA to absorb the debit at the time of purchase, it would make a payment of tax sufficient to square the account by 31 March (without penalty) or 20 June. In almost all circumstances, this payment would offset a future provisional tax liability. The vendor would not be taxed on the dividend component.

Repurchase from Resident Companies

Where a company repurchases on-market from a resident corporate shareholder, the repurchasing company will debit its ICA in payment of tax on the dividend component of the repurchase. Although the shareholder would not be taxed on the dividend component, that amount may be taxed again if it is distributed to shareholders of the vendor.

One mechanism by which this problem could be eliminated is to permit a credit to arise in the ICA of the vendor company. A corporate shareholder who sells shares to the company in which it holds shares would receive the same price for the shares as would have been the case had the shares been sold to a third party. In the former case, however, the shareholder would also receive imputation credits. The corporate shareholder who sells to the company should not be in a better position than one who sells to a third party. When the company sells its shares to a third party, it receives no such credit. Accordingly, allowing a credit to arise is inappropriate.

The other possible solution to this problem is to exempt from the ICA debit mechanism dividends on shares repurchased from corporate shareholders. There are two concerns about such an exemption from the ICA debit mechanism:

- Where shares are owned by a nominee company, the status of the beneficial owner should determine whether tax is payable. If the beneficial owner is a non-corporate, tax should be levied. However, companies will not typically know whether a corporate shareholder is a nominee, or the character of the beneficial owner.

- Because the repurchasing company has an advantage if shares are acquired from a corporate, there is some incentive to arrange for shares to be purchased by a corporate prior to sale to the company.

For these reasons, it is proposed that where shares are repurchased from a corporate, the repurchasing company would be liable for tax on the dividend component of the proceeds by way of a debit to its ICA. It should be noted that companies may be able to avoid these difficulties by repurchasing shares off-market. In that case, ordinary dividend rules would apply with imputation credits able to be attached to the dividend component of any share repurchase.

Repurchase from Tax-Exempt Entities

To make the share repurchase rules as simple as possible, no special rules for on-market repurchases from tax-exempt entities are proposed. Such repurchases would be treated in the same way as acquisitions from resident taxable entities. A debit to the ICA of the repurchasing company would arise in respect of the dividend component.

Repurchase from a Non-Resident Shareholder

It is proposed that a debit (calculated as outlined above for residents) arise in the ICA of a company that repurchases its shares on-market from a non-resident. There would be therefore no need to distinguish between non-resident and resident vendors.

An alternative approach would be to treat the dividend component as an ordinary non-cash dividend for non-resident withholding tax (NRWT) purposes. This means that no deduction of NRWT would be made from the sale proceeds. Instead, the repurchasing company would pay an amount of NRWT equivalent to the amount that would have been deducted under general rules. This mechanism would be more appropriate than a deduction of NRWT because it ensures that the vendor is in the same position as a vendor selling to a third party. However, this approach assumes that a repurchasing company is able to identify the vendor as a non-resident shareholder. Where shares are held by a nominee company, it would seem that such identification is impossible.

Accordingly, the approach proposed of debiting the ICA of the repurchasing company is simpler and is preferred. In addition, where a company has sufficient credits in its ICA, it may prefer to debit the ICA rather than pay NRWT.

Repurchase from a Vendor who Holds Shares on Revenue Account

Where a share trader sells on-market, the share trader will be liable for tax on any profit on sale of the shares. In addition, a debit will arise to the ICA of the repurchasing company in relation to the dividend component of the sale proceeds. However, as the vendor will not be able to identify the purchaser and the repurchasing company will not know whether the shares are held on revenue account, this appears unavoidable. Obviously, the problem would be reduced if shares are repurchased off-market, although this may not always be possible.

2.5.4 Repurchase by Non-Resident Companies

Off-market

The Valabh Committee considered that, while changes in our company law would have no impact on non-resident companies that repurchase shares, our tax law should address the consequence of a share repurchase permitted by other jurisdictions. Their proposal was that the rules should be consistent with the rules that apply to resident company share repurchases.

Adopting this approach, the ordinary dividend rules should apply to off-market repurchases by non-resident companies from resident shareholders. The Government agrees with this approach.

If the resident shareholder is an individual, the dividend component would be assessed to the shareholder. Where the shareholder is a corporate, foreign dividend withholding payment may be payable on the dividend.

On-market

Placing a liability for tax on a foreign corporate repurchasing shares on-market poses jurisdictional and administrative problems. Therefore, it is considered that no tax liability should be imposed where shares are repurchased by non-resident companies on-market.

2.6 Treasury Stock Option

During the course of developing the company law reforms, consideration was given to whether companies should be able to retain shares that they repurchased. This "treasury stock option" would enable companies to resell repurchased shares rather than be required to cancel them. However, this option was not included in the Companies Act.

The Valabh Committee had made proposals on how a treasury stock option might work from a tax perspective, but in the context of company law providing for treasury stock. In the absence of company law providing for a treasury stock option, it would be very difficult to provide a workable treasury stock option in the tax legislation. For this reason the Government has decided against including a treasury stock option in the tax legislation.

2.7 Summary of Proposals

The principal proposals outlined in this chapter are that:

- Distributions funded from realised capital profits will be tax-free when made through qualifying share repurchases or redemptions.

- Amounts distributed to shareholders on the repurchase, redemption, or other cancellation of shares that occur through off-market repurchases be fully taxable as dividends:

- where the offer to repurchase or cancel is pro rata and the amount ultimately distributed represents less than 15 percent of the market value of the shares of the company (i.e. it is not a qualifying capital reduction); or

- where the offer to repurchase or cancel is not made on a pro rata basis, a shareholder's proportionate interest in the company after the repurchase or cancellation is more than 85 percent of the shareholder's interest prior to repurchase or cancellation (i.e. it is not a qualifying disproportionate reduction).

- Where there is a qualifying capital reduction or a qualifying disproportionate reduction, the "slice rule" would apply to determine the dividend component of the distribution except where the Commissioner applied the residual discretion to deem the full distribution to be in lieu of a dividend.

- Where the slice rule applies the tax-free component of an amount distributed on a repurchase or cancellation is the sum of:

- the subscribed capital amount (broadly, the subscribed capital per share repurchased or cancelled); and

- the capital gain amount per share (broadly, the total realised capital profits of the company divided by the total number of shares on issue, other than fixed rate shares).

- Where less than the market value is paid for a share that is repurchased or cancelled, the subscribed capital amount and the capital gain amount attributable to the share will be reduced so that the tax-free component of the distribution is the amount of subscribed capital and capital gain over the market value of the share.

- Where a company purchases its shares off-market, the dividend component of the purchase is taxable to the vendor of the shares.

- Where a company purchases its shares on-market, the company is liable for the tax on the dividend component of the purchase price. This is met by way of a debit to its imputation credit account which is calculated in the same way as resident withholding tax on a non-cash dividend. The vendor is exempt from tax on the dividend component.