The taxation implications of company law reform

A discussion document

December 1993

Annex 4.1: Application of Tax Accounting Rules to an Amalgamation

Stage 1

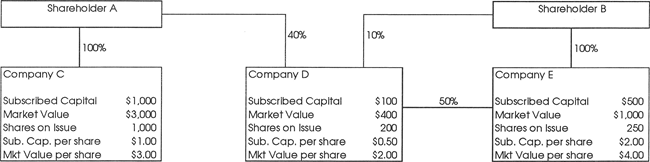

Start position:

Stage 2

A and B agree to amalgamate C Co, Do, and E Co into a new company, F Co. F Co Issues 2,000 shares in total to A and B in proportion to the market value of their direct holdings (double counting results if indirect holdings are Included, as the value of an indirect shareholding Is counted once as the market value of the subsidary company, and again as a share investment forming part of the value of the shareholding company).

In return for existing holdings In C Co and D Co, A is Issued shares In F Co with a market value of:

C Co's market value x A's shareholding, plus D Co's market value x A's shareholding, = $3,000 x 100% + $400 x 40% = $3,160

In return for existing holdings in D Co and E Co B Is issued shares in F Co with a market value of:

D Co's market value x B's shareholding, plus E Co's market value x B's shareholding, = $400 x 10% + $ 1,000 x 100% = $ 1,040.

The subscribed capital of F Co is the subscribed capital of C, D and E Co shares acquired by F Co in return for the F Co shares, excluding holdings by any of the amalgamating companies In each other =

Subscribed capital (C Co + D Co + E Co), less sub. cap. of D Co held by E Co = $1,000 + $100+ $500-($100 x 50%) = $1,550.

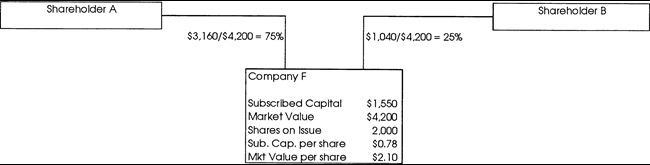

End position: