Annex 2 – Issues Relating to the Determination and Attribution of Branch Equivalent Income

2 Attribution of Branch-equivalent Income

Determination of an Annual Income Interest

Income Interests where there is Indirect Ownership

Minimum Interest for the Attribution of Income

Transition Rule

Changes of Residence

3 Calculation of the Income of a Controlled Foreign Company on a Branch-equivalent Basis

3.1 Opening Balance Sheets

3.2 Calculation of Annual Income

3.3 Conversion Rules

3.4 Differing Balance Dates

3.5 Losses

3.6 Dividends Received by a Controlled Foreign Company

3.7 Foreign Tax Credits

3.8 Treatment of Dividends from Tax Paid Income

1 Introduction

1.1 As noted in the Committee's report, we favour a taxation regime that only requires taxpayers with interests in excess of a minimum level in controlled foreign companies to report income on a branch-equivalent basis. The amount of income to be reported would be determined by applying the attribution rules to the total annual income of the company, computed on the basis of New Zealand tax rules.

1.2 Income attributed under this regime would be included in a taxpayer's assessable income and taxed at personal or corporate rates applicable to income derived by the taxpayer. The Committee is still considering appropriate rules for the treatment of losses.

1.3 The two aspects of the international tax regime addressed in this annex will be details of the attribution rules and guidance for taxpayers on procedures for computing the income of a controlled foreign company on a branch-equivalent basis.

2 Attribution of Branch-equivalent Income

Determination of an Annual Income Interest.

2.1 The annual branch-equivalent income of a controlled foreign company would be attributed to a taxpayer on the basis of the income interest held by the taxpayer. A taxpayer's income interest in a controlled foreign company is the basis upon which income is attributed under the proposed regime. It is computed by reference to the control interest held by the taxpayer and the nominee of the taxpayer as described in Annex 1.

2.2 The Committee considers that a taxpayer should be required to include in assessable income only income to which he or she can reasonably be considered to have access. Consistent with this view, control interests in a foreign company held by associated persons of the taxpayer and attributed to the taxpayer for the purpose of determining his or her control interest should be excluded when determining the income interest held by the taxpayer.

2.3 As would be the case in determining a control interest, indirect interests held by a taxpayer would be taken into account when determining an income interest held by a taxpayer. However, an income interest would be computed by reference to the actual interests held at each tier in a chain of controlled foreign companies rather than deemed interests as would be the case when determining a control interest. The calculation of an income interest held indirectly is explained below in paragraphs 2.11 to 2.14.

2.4 In addition to the important differences between an income interest and a control interest described above an income interest differs from a control interest in the following respects:

a it excludes rights held by the taxpayer to acquire a future interest in a foreign company in circumstances described in paragraph 2.5 below; and

b it takes account of the varying levels of interest in a controlled foreign company the taxpayer may have held during the course of the company's accounting year.

2.5 To avoid attribution of the undistributed income of a controlled foreign company, taxpayers may hold rights to acquire interests in a foreign company in the form of options or other contingent interests. Rights held by a taxpayer that entitle the taxpayer to acquire a future interest in the company are taken into account when determining a control interest (as explained in Annex 1). It is the Committee's view that such rights are also to be taken into account when determining an income interest in relation to any accounting year of a foreign company in which the company derives a taxable profit. For this purpose, however, a taxpayer may exclude any rights to acquire interests in the company pursuant to normal commercial transactions where the rights, such as options or convertible debt, are acquired or are exerciseable by the taxpayer at fair market value.

2.6 Taking account of the varying levels of interest held during the accounting year of a controlled foreign company is considered to be more equitable than attributing income on the basis of the income interest held at the end of its accounting year. The former approach will reflect more accurately an interest built up by a taxpayer during the course of a controlled foreign company's accounting year.

2.7 The first step in establishing the level of a taxpayer's income interest would be to calculate the interest in the company for each period during its accounting year in which the control interest remained unchanged. The income interest in each period would be determined according to the rules for determining an ownership interest set out in Annex 1 subject to the modifications set out in paragraphs 2.1 to 2.5 above.

2.8 The next step would be to pro-rate the income interest determined for each period by the proportion of the year (or part-year where the non-resident entity has an accounting period of less than a year) the interest remained unchanged. A taxpayer's overall income interest will be the sum of the pro-rated interests computed for each period in the non-resident entity's accounting year. In respect of any accounting year of a controlled foreign company, income attributable to a resident is derived by multiplying the income interest computed for that year by the annual branch-equivalent income for that accounting year (or part-year as appropriate).

2.9 The pro-rating of interests for any relevant period during the accounting year of the controlled foreign company would be on the basis of the number of days in that period as a proportion of 365, or the number of days in the controlled foreign company's accounting period if this is less than a year.

2.10 The method for determining the level of a taxpayer's interest in a non-resident entity for the purpose of attributing income is illustrated in the example set out below:

Example

Taxpayer X holds an interest in Nonresco, a controlled foreign company. A summary of X's control interest during Nonresco's accounting year, modified to conform with the adjustments set out in paragraphs 2.1 to 2.5 above, is:

- 33 percent for the first three months;

- 50 percent for the next six months;

- 66 percent for the last three months.

X's interest is computed as follows:

Pro-rated interest for the first 3 months = 33% x 25% = 8.3%

Pro-rated interest for next 6 months = 50% x 50% = 25.0%

Pro-rated interest for last 3 months = 66% x 25% = 16.5%

Total Income Interest = 49.8%

If Nonresco's branch-equivalent income for its relevant accounting year was (say) $100, $49.80 would be attributed to X on the basis of X's interest.

Income Interests where there is Indirect Ownership.

2.11 If a controlled foreign company is a second or lower tier company, its income will be attributed directly to New Zealand residents in accordance with their direct and indirect interest in the controlled foreign company. For this purpose, an income interest is determined by multiplying the taxpayer's income interest in the top tier controlled foreign company by the top tier company's income interest in the second tier controlled foreign company company and so on. A taxpayer would multiply income interests in controlled foreign companies at each tier until the lower tier company either was not a controlled company, or the taxpayer's income interest fell below the minimum level of interest for income attribution.

2.12 The procedure for determining an indirect income interest in a controlled foreign company held through a series of higher tier controlled foreign companies contrasts with that for determining a control interest down a corporate tier described in Annex 1. Under the latter approach, a higher tier controlled foreign company is considered to hold a 100 percent control interest in any lower tier foreign companies it controls.

2.13 Ordinarily, a taxpayer should not be required to multiply an income interest held in a company that is not a controlled foreign company by income interests that the foreign company has in other foreign companies. This is because it is impossible, in normal commercial circumstances, for a taxpayer to 'look through' a company that is not a controlled foreign company to trace indirect interests. However, the Committee is considering a rule aimed at situations where five or fewer taxpayers structure their indirect interests in order to collectively hold more than 50 percent of an income interest in a foreign company but hold a control interest of less than 50 percent. Such a rule might require a taxpayer to multiply an interest in a top tier foreign company that is not a controlled foreign company by an income interest the top tier company holds in a lower tier foreign company where there was such an arrangement and its application resulted in the lower tier entity becoming a controlled foreign company.

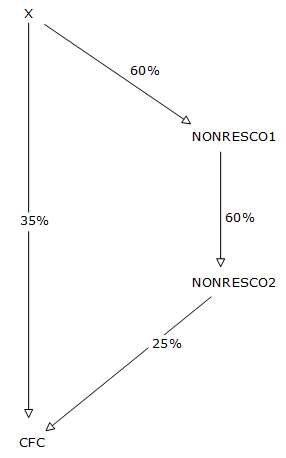

2.14 The following example illustrates the operation of these rules:

X, a resident company, holds a 60 percent income interest in Nonresco1, a controlled foreign company. Nonresco1 has a 60 percent income interest in Nonresco2 which in turn, has an income interest of 25 percent in CFC. X also holds directly an income interest of 35 percent in CFC. X's income interest in CFC held indirectly through Nonresco1 and Nonresco2 would be 9 percent (i.e. 60% x 60% x 25%) which, when combined with X's direct interest of 35 percent, gives an overall income interest held by X of 44 percent.

Minimum Interest for the Attribution of Income

2.15 The Committee considers that where an income interest of a taxpayer in a controlled foreign company is below 10 percent, branch-equivalent income of the company should not be attributed to the taxpayer.

2.16 To prevent fragmentation of shareholding in order to fall below this threshold, constructive ownership rules that combine the interests of associated persons of any taxpayer with those of the taxpayer, will be used to determine whether a taxpayer's interest is above the minimum threshold. This means, for example, that if a taxpayer held a five percent income interest in a controlled foreign company and associated persons of the taxpayer held income interests of another five percent, the income interest of the taxpayer for the purpose of applying this test will be ten percent. As the interest of the taxpayer is above the minimum threshold, branch-equivalent income of the controlled foreign company would be attributed to the taxpayer and persons associated with the taxpayer.

2.17 While the interest held by a taxpayer and associated persons of the taxpayer would be combined when applying the minimum interest test, income would be attributed to the taxpayer, and persons associated with the taxpayer, on the basis of the interests held by each individually.

Transition Rule

2.18 Whether an income interest is above the minimum threshold for attribution needs to be determined having regard to the proposed transitional measures. To determine whether income interests are above the minimum threshold, a taxpayer would take into account all income interests held irrespective of whether they were acquired before or after 17 December 1987. However, during the transitional period, should it apply, income would be attributed to the taxpayer only on the basis of income interests acquired after 17 December 1987.

2.19 For example, a taxpayer may have an income interest of 15 percent in a controlled company resident in a country that is not on the transitional list of designated low tax jurisdictions. The transitional provisions would therefore apply. The taxpayer's income interest in the company as at 17 December was 8 percent and the taxpayer acquired a 7 percent income interest in the company after 17 December. Income of the controlled foreign company would be attributed to the taxpayer on the basis of the 7 percent income interest acquired after 17 December during the transitional period.

Changes of Residence

2.20 The CD proposed on page 20 that a person would not be a resident of New Zealand for the purposes of income attribution where the person had been a resident of New Zealand for a cumulative period of less than 24 months in the immediately preceding 15 years.

2.21 The Committee will review this proposal together with the appropriate treatment under the regime of persons who become, or cease to be New Zealand residents. The rules for determining residence in the Income Tax Act, particularly as they relate to individuals, will also be reviewed to ensure that they do not provide scope for unacceptable avoidance of the regime by taxpayers.

3 Calculation of the Income of a Controlled Foreign Company on a Branch-equivalent Basis.

3.1 Opening Balance Sheets

3.1.1 In order for taxpayers to compute the income of controlled foreign companies on a branch-equivalent basis, some of the opening balance sheet items will need to be restated, in the foreign currency, but as if New Zealand tax rules applied. The proposals set out below are designed to reduce compliance costs where there is little, if any, revenue consequence.

3.1.2 The rules which follow in relation to the opening values of fixed assets and trading stock give the taxpayer the option of choosing opening values in accordance with either New Zealand tax rules or the tax rules of the country of residence or income source of the foreign company. Whichever option a taxpayer elects to use, he or she would be required to use the same basis for determining the opening values of both fixed assets and trading stock to ensure the consistent application of whichever option is chosen.

Fixed Assets

3.1.3 The opening tax value of fixed assets for the year in which the taxpayer commences reporting on a branch-equivalent basis should be, at the taxpayer's option either:

a the depreciated tax value determined in accordance with the tax rules of the country of residence of the company, provided that the value does not exceed current market value; or

b the depreciated tax value determined in accordance with New Zealand tax rules.

Trading Stock, including Livestock

3.1.4 The opening tax value of trading stock should be, at the taxpayer's option either:

a the tax value determined in accordance with the tax rules of the country of residence of the company; or

b the tax value determined in accordance with New Zealand tax rules.

This opening value of trading stock should be deemed to be cost for the purpose of subsequent value for branch-equivalent income determination.

Financial Arrangements

3.1.5 The opening tax value of financial arrangements should be, at the taxpayer's option either:

a market value; or

b adjusted base price, being acquisition price plus accrued expenses less payments in the case of issuers, and acquisition price plus accrued income less payments received in the case of holders.

Prepayments

3.1.6 If under New Zealand income tax rules a resident incurs a deductible expense in the accounting year of the foreign controlled company preceding the accounting year in which income is assessed to the resident on a branch-equivalent basis, the taxpayer should not be permitted to include an adjustment for prepayments in respect of the expense in the opening balance sheet. However, if a deduction would not have been permitted in respect of the previous accounting year under New Zealand tax rules, an opening adjustment to the balance sheet for prepayments in respect of the deduction should be permitted.

Specified Leases

3.1.7 Specified leases entered into by a controlled foreign company after 1 April 1988 would be brought into the balance sheet for the purpose of computing branch-equivalent income as if New Zealand tax rules had applied from the commencement of the lease. Specified leases entered into before that date should be disregarded.

3.2 Calculation of Annual Income

3.2.1 There are two basic approaches to the calculation of annual income on a branch-equivalent basis. One is to apply New Zealand tax rules and conversion to New Zealand currency on a transaction-by-transaction basis. The other is to apply New Zealand tax rules to items in the profit and loss account in the foreign currency, and convert the net annual income to New Zealand currency as a second step. The latter method is implicit in the CD, and the Committee considers that it is preferable on the grounds of minimising compliance costs.

3.2.2 In general, the application of New Zealand tax rules within the branch-equivalent regime as recommended should not impose undue compliance costs on New Zealand taxpayers. There are at least two types of provision, however, which may need amendment.

3.2.3 Specific references to "New Zealand" in the Income Tax Act will need to be reviewed to determine whether the relevant provision: offers a benefit or concession intended to be confined to New Zealand; contains a definition of New Zealand source income; or limits the scope of the tax net. Such provisions may need to be modified in the context of the branch-equivalent regime. As a general rule, provisions of the Income Tax Act that provide a specific tax concession for income sourced in New Zealand should not be taken into account when computing income on a branch-equivalent basis.

3.2.4 A review will also be undertaken by the Committee of the application of the associated persons provisions of the Income Tax Act. There does not, for example, seem to be any justification for determining the assessability of the income of controlled foreign companies to residents by reference to the activities of associated persons who are non-resident shareholders.

3.3 Conversion Rules

3.3.1 It is proposed that branch-equivalent income, expressed as a single figure in foreign currency, be converted into New Zealand currency at the average of the mid-monthly exchange rates for the relevant year. Exchange rate movements in respect of balance sheet items would not be taken into account in determining annual branch-equivalent income.

3.4 Differing Balance Dates

3.4.1 A taxpayer's share of the income of controlled foreign companies should be assessable in his or her income year in accordance with section 15(1) of the Income Tax Act. That is, a taxpayer would include the branch-equivalent income of a controlled foreign company in income for the income year ending with the 31st day of March nearest to the end of the foreign company's accounting year.

3.4.2 For interests in controlled foreign companies taxable from April 1 1988, or from the date when the regime may otherwise apply pursuant to the transitional provisions set out in the Committee's report, annual branch-equivalent income would be pro-rated to apply to that proportion of the foreign company's accounting year subsequent to the commencement date of the regime.

3.4.3 This means that a taxpayer would be required to compute income according to New Zealand income tax rules (including adjustments to the opening balance sheet set out in paragraphs 3.1.2 to 3.1.7) for the accounting year of the foreign company that straddles the date from which the regime applies.

3.5 Losses

3.5.1 Just as past profits would not be subject to the new regime, the Committee considers that there should also be no relief for past losses, except to the extent that the transitional measures recommended by the Committee will provide a period of adjustment and potential loss recoupment for taxpayers covered by them. With this limited exception, past losses should not be able to be brought forward into the first year of the branch-equivalent regime.

3.5.2 Quite apart from maintaining parity of treatment with past profits, another reason for not permitting past losses to be brought forward is that they will not have been computed according to New Zealand tax rules, and may well be the result of tax preferences in the foreign country which should not be brought through into the New Zealand tax base.

3.5.3 There should, however, be a limited amount of relief for current year losses. The CD (page 7) proposed that losses from interests in non-resident companies could be carried forward or offset against other branch-equivalent income, but not against other assessable income, while losses from interests in trusts could only be carried forward. As noted in our report, the Committee considers that these proposals could lead to a significant erosion of New Zealand tax revenue. Taxpayers could defer New Zealand tax by, for example, offsetting losses in high tax jurisdictions against profits in low tax jurisdictions, while at the same time carrying forward the losses to be offset against subsequent years' profits in the high tax jurisdictions.

3.5.4 One possibility being considered by the Committee would be to allow losses in respect of a taxpayer's income interest in a controlled foreign company to be either carried forward, or offset against the income in respect of income interests held by the taxpayer in a group of controlled foreign companies resident in the same jurisdiction, under the grouping provisions of sections 188 and 191. The Committee will report further on this issue.

3.6 Dividends Received by a Controlled Foreign Company

3.6.1 As noted in our report, it is necessary for non-portfolio dividends received by controlled foreign companies to be either subject to the withholding payment system or to be made assessable. This is necessary to prevent controlled foreign companies being used as dividend traps to avoid the domestic rules that apply to non-portfolio dividends. The Committee has yet to consider this issue in detail but considers that the treatment of dividends received by controlled foreign companies would be simplified if they were made assessable. However, to avoid the multiple levying of New Zealand tax on dividends, taxpayers would exclude dividends received by a controlled foreign company from another controlled foreign company in relation to which the taxpayer reports income on a branch-equivalent basis.

3.7 Foreign Tax Credits

3.7.1 The CD proposed that foreign tax credits be limited on an entity by entity and a source of income basis and be attributed on the same basis as the branch-equivalent income of a foreign company. It is immediately apparent that foreign tax should be creditable to a taxpayer on the same basis that the income of a controlled foreign company is attributed (i.e. on the basis of income interests held by taxpayers in controlled foreign companies). However, issues that the Committee has yet to discuss include:

a the character of foreign taxes that should be creditable;

b any adjustments to foreign tax credits over time (such as the recognition of timing differences);

c the nature and extent of any limitations for crediting foreign taxes.

The Committee will report on these issues in its next report.

3.8 Treatment of Dividends from Tax Paid Income

3.8.1 The Committee outlines in its report problems that may result from the adoption of the proposal in the CD that taxpayers should be able to deduct dividends they receive from accumulated income of a foreign company for the purposes of computing branch-equivalent income. We consider that the proposed imputation system may provide an appropriate means of affording relief for dividends received by taxpayers from the accumulated income of a foreign company that has been subject to New Zealand income tax. The Imputation Credit Account (ICA) records amounts of New Zealand tax paid by resident companies including that on the attributed income of controlled foreign companies. Appropriate balances in the ICA could, for example, be used to reduce or offset New Zealand tax at the shareholder level on dividends received by resident companies from controlled foreign companies in which they have income interests.

3.8.2 As an alternative to meeting a withholding payment liability in cash, consideration is being given to allowing resident companies the option of meeting withholding payment requirements in respect of dividends received from controlled foreign companies by:

a making appropriate reductions to ICA credit balances; or

b making an appropriate reduction in any carried forward loss of the recipient company.

In either case the reduction in tax benefit arising from the reduction in carried forward loss or the ICA balance will match the withholding payment liability.

3.8.3 In order to avoid multiple levying of New Zealand tax on income derived by an individual through a controlled foreign company, it would be necessary to require the individual to keep the equivalent of an ICA in respect of income attributed directly to him or her under this regime.

3.8.4 The Committee will report further on this aspect of the regime in Part 2 of its report.