Annex 1 – Control Interests of Residents in Controlled Foreign Companies

1 Introduction

2 Interests to which the Regime Applies

3 Measurement of a Control Interest

4 Nominees and Trustees

5 Indirect Control Rules

6 Constructive Ownership Rules

7 De-facto Control and Anti-avoidance Rules

1 Introduction

1.1 Under the branch equivalent ("BE") regime, the income of controlled foreign companies would be assessed to their New Zealand resident shareholders in proportion to the interest held by each shareholder.

1.2 In order to determine whether income will be assessed in New Zealand on the basis of an interest held in a foreign company, a taxpayer will be required to establish:

a first, whether the interest held is within the ambit of the regime; and

b second, if so, whether the interest held directly or indirectly, by the taxpayer, either individually or combined with the interests held by other residents, is sufficient for the rules for attributing the income of the foreign company to apply.

2 Interests to which the Regime Applies

2.1 As outlined in the Consultative Document ("CD"), the regime will apply to interests in companies that are not resident in New Zealand or that are resident in New Zealand but, by virtue of the provisions of a double tax agreement, are not subject to tax in respect of foreign source income. The definition of a company will include entities that have a legal personality and existence distinct from that of their members.

2.2 The BE regime should apply to residents in respect of their interests in foreign companies. The control test advocated by the Committee would determine that a foreign company would be a controlled foreign company if five or fewer New Zealand residents owned 50 percent or more of its equity. This test requires taxpayers to determine their respective proportions of the equity of a foreign company.

2.4 The proportion so calculated for each resident is termed the resident's control interest. For this purpose, the Committee favours no minimum shareholding threshold for a resident's control interest to be taken into account when determining whether a company is a controlled foreign company. However, as explained in Chapter 2, taxpayers with interests in a controlled foreign company below a minimum threshold would not be required to include any part of that controlled foreign company's income in their assessable income.

2.5 A foreign company would be a controlled foreign company if, at any time in the foreign company's accounting year, the sum of the control interests held by five or fewer New Zealand residents is greater than or equal to 50 percent. The Committee favours applying the test to determine control at any time in the year to prevent taxpayers 'de-controlling' by disposing of interests in controlled foreign companies through permanent sale to non-residents before the end of each accounting year of a foreign company. By disposing of interests in this manner taxpayers could accumulate income in the non-resident company and sell their interest for a tax free capital gain. Other countries with CFC regimes tend to apply the control test to interests held at the end of a foreign company's accounting year. However, this test does not provide an avoidance opportunity because, unlike the position in New Zealand, capital gains taxes in these countries ensure that a taxpayer is taxed on any gains realised on the disposal of interests in foreign companies during an accounting year.

3 Measurement of a Control Interest

3.1 A control interest measures the proportion of a foreign company's equity or profits over which a resident is considered to have control. This includes control interests held through nominees of the taxpayer and control interests held indirectly by the resident through other controlled foreign companies. Taxpayers could avoid the 50 percent control by five or fewer residents test by fragmenting shareholding or by exercising de facto control of a foreign company. The control test would therefore need to be supported by constructive ownership rules to include, in the control interest of a resident, control interests held by persons associated with the resident. In addition, de facto control rules will be needed to deal with situations where taxpayers can exercise control over the distribution of a foreign company's income or capital but do not fall within the formal control tests.

3.2 To prevent avoidance of the control test, determination of a control interest in a foreign company needs to take account of interests held by a taxpayer in a number of ways. For the purpose of determining whether a company is a controlled foreign company, the Committee considers that the control interest attributable to a taxpayer should include:

a any interest in the foreign company held directly by the taxpayer;

b any interest in the foreign company held indirectly by way of another foreign company in which the taxpayer has an interest;

c an interest held directly or indirectly by a nominee of the taxpayer; and

d an interest in the foreign company held directly or indirectly by associated persons of the taxpayer.

3.3 The Committee favours an approach for measuring a control interest based on that set out in section 191 of the Income Tax Act 1976 for measuring a "prescribed proportion" of the equity of two or more companies. We propose that the control interest in a company held by a resident be the proportion of:

a paid-up capital;

b nominal value of the allotted shares;

c entitlement to profits (including the entitlement to distributions on winding-up, whether from the capital or from the profits of the company); or

d the voting power;

e where appropriate, combinations of the above whichever is the highest.

3.4 The taxpayer would be required to take into account all classes of shares held when determining a control interest as well as rights to acquire equity in the foreign company whether in the form of options, convertible debt or other contingent interests.

4 Nominees and Trustees

4.1 Interests in companies in the names of trustees and nominees are a particular form of beneficial ownership. Interests held by nominees or by bare trustees would therefore be attributable to their beneficial owners. Nominee rules would also attribute a control interest to a shareholder who has an arrangement with another person to resume ownership of shares at a subsequent date (through so called "warehousing" of shares).

4.2 The Committee's general approach to the taxation of trusts is that their tax treatment should be determined by reference to the residence of settlors (see Annex 4). In accordance with this preferred approach, the Committee considers that a control interest in a controlled foreign company held by trustees of discretionary trusts should be attributed to any New Zealand resident who has settled property on the trust. In this context, the trustees of the discretionary trust settled by the resident would be considered to be nominees of the resident. A settlement of a trust is defined in Annex 4.

5 Indirect Control Rules

5.1 To determine accurately the level of a taxpayer's control interest in a foreign company, control interests held in the foreign company indirectly by a taxpayer through another controlled foreign company would need to be combined with control interests held directly by the taxpayer.

5.2 Indirect control interests held through a chain of controlled foreign companies would be determined by multiplying the taxpayer's control interest in the top tier controlled foreign company by the top tier company's control interest in the second tier controlled foreign company and so on. The indirect control test would 'look through' each controlled foreign company in a corporate tier in this manner until the combined control interest of the taxpayer and four other residents in the foreign company is less than 50 percent (i.e. the lowest tier foreign company is not a controlled foreign company).

5.3 For the purposes of tracing control down a corporate tier, a resident with a direct control interest in a first tier controlled foreign company of more than 50 percent would be deemed to hold a 100 percent control interest in the foreign company. Similarly, where a higher tier controlled foreign company in which a taxpayer has an interest controls a lower tier foreign company (i.e. its control interest is 50% or more) the higher tier company would be deemed to hold a 100 percent control interest in the lower tier company. This rule is necessary to prevent taxpayers avoiding the 50 percent control threshold in respect of an interest in a particular foreign company by interposing between themselves and the company in question a series of controlled foreign companies in which the control interest held by the taxpayers is less than 100 percent.

5.4 The effect of the procedure for tracing control down a corporate tier described in paragraph 5.3 is that, where a controlled foreign company holds a control interest of less than 50 percent in a foreign company, the control interest held by the controlled foreign company would be considered to be held by its New Zealand resident shareholders.

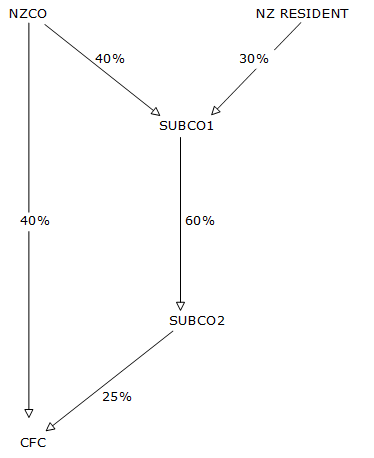

5.5 The following example illustrates the operation of the indirect control rules.

NZCO, a company resident in New Zealand has a 40 percent control interest in SUBCO1, a non-resident company in which another resident holds a control interest of 30 percent, making SUBCO1 a controlled foreign company. NZCO also holds a direct control interest of 40 percent in CFC, another non-resident company. SUBCO1 holds a 60 percent control interest in SUBCO2, which in turn holds a 25 percent control interest in CFC. NZCO would determine its indirect control interest in CFC by multiplying its control interest in SUBCO1 by SUBCO1's control interest in SUBCO2, and SUBCO2's control interest in CFC. As SUBCO1's control interest in SUBCO2 is 60 percent, SUBCO1 would be deemed to hold a 100 percent control interest in SUBCO2 for the purposes of computing NZCO's indirect control interest in CFC. NZCO's control interest in CFC held indirectly would therefore be 10 percent (i.e. 40% x 100% x 25%). NZCO's aggregate control interest in CFC would be 50 percent, being the sum of its direct control interest (40 percent) and its indirect control interest (10 percent).

5.6 In the example set out in paragraph 5.5, if SUBCO1 was not a CFC, NZCO would not be required to multiply its control interest in SUBCO1 by any of SUBCO1's control interests. Similarly, if SUBCO2 was not a controlled foreign company, NZCO would not be required to multiply its control interest in SUBCO2 by any of SUBCO2's control interests. However, where five or fewer New Zealand residents have an indirect income interest in a foreign company of 50 percent or more, a rule described in paragraph 2.13 of Annex 2 will apply to make the company a controlled foreign company.

6 Constructive Ownership Rules

6.1 The Committee considers that constructive ownership and control rules are necessary in order to prevent avoidance of the regime by spreading ownership of foreign companies among a number of associated persons. For the purpose of determining the control interest in a foreign company held by a New Zealand resident, constructive ownership rules would attribute to the resident ownership and control rights that in fact or in law belong to his or her associates or relatives.

6.2 Constructive ownership rules should only apply for the purposes of the control test and to determine the minimum level of interest before income is attributed to a taxpayer (described in Annex 2). Constructive ownership rules would not apply for the purpose of determining the basis on which income would be attributed.

6.3 Persons considered to be associated for the purposes of the controlled foreign company rules would include, as a minimum:

a any two persons with shared interests;

b any two companies which consist of substantially the same shareholders;

c any two persons who are relatives connected within the second degree of relationship;

d any company and any person (other than a company) who are associated persons within the meaning of section 8(1)(b) of the Income Tax Act;

e a partnership and any person who is a partner in the partnership.

6.4 The associated persons rule in conjunction with the constructive ownership rule may be illustrated by way of example. Suppose four New Zealand residents together own 40 percent of Nonresco, a non-resident company. A fifth New Zealand resident owns a further 2 percent. However, the fifth resident has four children, each of whom also owns 2 percent. In these circumstances, the shareholding of the children will be attributed to the fifth resident whether the children are resident in New Zealand or abroad. Nonresco would thereby be considered to be a controlled foreign company.

6.5 A further example of the operation of the associated persons rule in the context of constructive ownership provisions is a large New Zealand company with many shareholders that establishes a foreign associated company, with the same shareholders as the New Zealand company, holding interests in the same proportion. If the shares of the two companies are 'stapled' (that is, they may be transferred only if kept together) the companies have a relationship that is somewhat similar to a holding company and subsidiary. The subsidiary would be a controlled foreign company, but, in the absence of special rules, the stapled associated company would not, unless by chance it was controlled by five or fewer New Zealand residents. However, the associated persons rule treat the two companies as one person as they have shared interests.

6.6 The Committee is reviewing the definitions of associated persons and nominees in the Income Tax Act to make the definitions more consistent and effective, where necessary.

7 De-facto Control and Anti-avoidance Rules

7.1 The Committee favours an anti-avoidance rule as part of the control test that would apply to taxpayers who exercise de facto control of a foreign company. Residents who are entitled to call for or prevent the distribution of the profits of a foreign company, or who have the power to call for the wind-up of a foreign company would be deemed to have a 50 percent control interest and the company would therefore be a controlled foreign company, irrespective of the proportion of the equity of the company held by New Zealand residents. The anti-avoidance rule would also be aimed at arrangements, such as voting trusts and understandings, which have the effect of defeating the intent and application of the control test. The Committee considers that these anti-avoidance rules will support the nominee rules.

7.2 Taxpayers will include all the interests they hold in a foreign company to compute a control interest, irrespective of whether these were acquired before or after 17 December 1987. However, in respect of investments in countries that are not on the transitional list of specified low tax jurisdictions, income would be attributed during the transitional period only in respect of interests acquired after 17 December (see Annex 2) .