Dividend integrity and personal services income attribution

A Government discussion document

Hon Grant Robertson

Minister of Finance

Hon David Parker

Minister of Revenue

March 2022

Chapter 1 – Introduction

- Problem

- Scope of review

- Dividend integrity

- Personal services attribution

- Proposed solutions

- Making a submission

Summary

The Government recently introduced and implemented a new top personal income tax rate of 39% for income earned over $180,000. Tax rates on other types of taxpayers, including companies and trusts, remain unchanged at 28% and 33% respectively.

The motivation for this reform was to raise extra revenue in a way that is progressive and does as little as possible to increase taxes on low to middle income earners. The integrity measures proposed in this discussion document are intended to support this objective by limiting the ability of individuals to avoid the top 39% rate (or the second-highest personal income tax rate of 33%) by diverting their income through entities taxed at a lower rate.

The Government’s work on integrity measures to support the 39% personal income tax rate is being progressed in tranches. Tranche one, which is the focus of this discussion document, concerns dividend integrity and income attribution measures. Tranches two and three will consider trust integrity and company income retention issues and integrity issues with the taxation of portfolio investment income.

This discussion document proposes:

- That any sale of shares in a company by the controlling shareholder be treated as giving rise to a dividend to the shareholder to the extent that the company (and its subsidiaries) has retained earnings.

- That companies be required, on a prospective basis, to maintain a record of their available subscribed capital and net capital gains, so that these amounts can be more easily and accurately calculated at the time of any share cancellation or liquidation.

- That the “80 percent one buyer” test for the personal services attribution rule be removed.

The closing date for submissions on the proposals in this discussion document is 29 April 2022.

1.1 The New Zealand economy is faring relatively well despite the economic disruption caused by the COVID-19 pandemic. However, the ability to continue to face the challenges of COVID-19 and to rebuild the economy will in large part depend on a strong tax base. To continue to be able to provide much-needed support to individuals and businesses, it is crucial that tax revenues remain strong and stable. The Government’s objective is to ensure the continuity of revenue streams by ensuring that the tax system is a fair and progressive one, and that everyone pays their fair share of tax.

1.2 To this end, the Government introduced a new top personal tax rate of 39% for income earned over $180,000. For this and other tax rates to be effective, it is important that suitable integrity measures are in place to ensure the tax rules are not circumvented.

1.3 The level of taxes paid on income from an investment or activity can vary depending on the entity structure used. There are many good reasons for the use of entities, such as companies and trusts. However, using companies means high income taxpayers can sometimes reduce the amount of their income that is subject to either the 33% personal income tax rate or the new 39% top personal income tax rate.

1.4 Potential adverse integrity impacts arising from taxpayers structuring to avoid the 33% and 39% rates include reduced tax revenue, as well as a negative impact on voluntary compliance if taxpayers perceive that avoidance is widespread.

1.5 Some of the integrity impacts arise from a difference between the top personal tax rate and the company tax rate. Even with a top personal tax rate of 39%, the gap between the company tax rate and the top personal rate of 11 percentage points is smaller than the gap in most OECD countries. However, New Zealand is particularly vulnerable to a gap between the company tax rate and the top personal tax rate because of the absence of a general tax on capital gains.

1.6 There will always be an arbitrage incentive unless the company and personal tax rates are aligned. However, alignment of company and personal tax rates is not the norm internationally. The arbitrage incentive could instead be addressed by increasing the company rate to the level of the top personal rate, but this is not desirable for economic reasons. For this reason, integrity measures are needed.

1.7 The biggest area of concern relates to closely-held companies and trusts that are used to earn income on behalf of relatively high income individuals, particularly those who earn income that is taxed at the top personal tax rate of 39% (or who would have income taxed at the top personal rate if they earned the income directly rather than through an entity).

1.8 There is much less concern with widely-held and listed companies. This is because they are not under the control of an individual, and so generally cannot be used as a conduit to achieve a lower tax rate on what is really the individual’s own income.

1.9 The scale of the tax benefit for 33% marginal rate taxpayers is significantly smaller than for taxpayers on the top rate of 39% (a differential of five percentage points versus 11 percentage points). Individuals on the 33% personal tax rate also typically have less total income to divert through other entities than individuals on the top rate, and hence the integrity concerns in relation to the latter group are greater. While the Government’s main concern is the integrity of the 39% tax rate, the proposals in this document can affect taxpayers at any personal tax rate in situations where some of or all their income is being earned through entities.

Problem

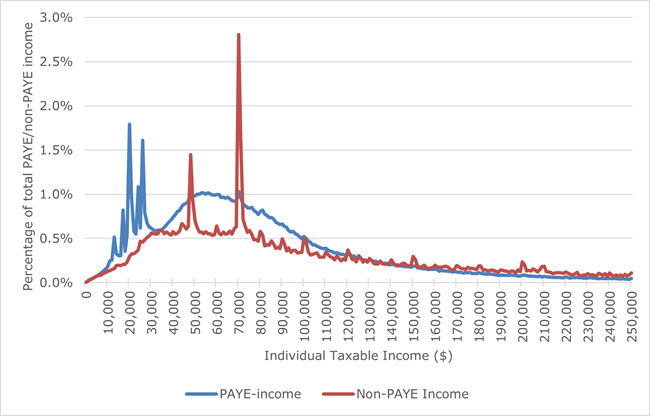

1.10 The bunching of self-employed people at the tax thresholds in Figure 1 suggests that structures may be currently used by some taxpayers to avoid the 33% rate, although bunching at the $180,000 threshold for the 39% rate is not evident.

Figure 1: Taxable income distribution: PAYE and non-PAYE income (year ended 31 March 2020)

1.11 Inland Revenue analysed existing data it holds on 350 high wealth individuals (individuals and families with more than $50 million in net assets) and found that they used or controlled 8,468 companies and 1,867 trusts.[1] For 2018, these 350 individuals paid $26 million in tax, while their companies and trusts paid $639 million and $102 million respectively, showing a significant amount of income earned through lower tax rate entities.

1.12 The Government considers that the current tax settings will lead to further integrity pressures. Evidence to support that expectation comes from the increased avoidance of the top personal tax rate that occurred in 2000 in response to the increase in the top personal rate to 39%.

1.13 Increased structuring may have unintended impacts on:

- Revenue: Tax collected is reduced by increased structuring activity. This is due to the direct impact of taxpayers being able to earn their income through lower-taxed entities, such as trusts and companies. It is also because an inconsistent rate structure makes it harder for courts to find tax avoidance when the different rates mean it is difficult to determine whether a structure undermines what Parliament contemplated.

- Social capital and the integrity of the tax system: Perceptions of arbitrary outcomes, such as when some taxpayers can structure to avoid the 39% rate, will erode public confidence in the integrity of the tax system and the perception that all taxpayers are treated fairly.

- Horizontal and vertical equity: In the absence of integrity measures, more income of high-wealth individuals and others with substantial capital income is likely to flow to lighter-taxed entities. This suggests that the impact of the 39% personal tax rate will disproportionately fall on less wealthy salary and wage earners.

1.14 In light of these integrity risks, the Government is reviewing the current settings to see if changes are required, particularly to support the integrity of the new top personal tax rate of 39%.

Scope of review

1.15 Work in this area will focus on improving the integrity of the rules relating to sales of shares and the attribution of income from personal services. It will also consider how to improve the integrity of trust and company income retention rules.

1.16 The review of the current settings is being progressed in tranches. Tranche one, which is the focus of this discussion document, concerns dividend integrity and income attribution measures relating to the use of closely-held companies and trusts by high income individuals.

1.17 The policy options considered in this document for tranche one would not attribute all income earned through companies and trusts to individuals and tax it at their individual personal tax rates. However, they would create the potential for a significant amount of income (a large proportion of which is derived by comparatively few families and individuals) to be recharacterised and taxed at the appropriate rate.

1.18 Tranche two will consider trust integrity and company income retention issues. Inland Revenue will be receiving more specific information from trustees for the 2021–22 and later income years under provisions in the recently enacted amendments to the personal income tax rate legislation. This additional information could help to inform in more detail how trusts are used and what measures could be considered to prevent under-taxation from the use of trusts.

1.19 Income retention measures would address the current situation where taxpayers can achieve a deferral of tax by investing through a company (including in cases where eventual distributions are taxed at the 39% rate).

1.20 A possible tranche three could consider integrity issues for the taxation of portfolio investment income, such as Portfolio Investment Entity (PIE) taxation. However, given that PIEs are used by large numbers of low- and middle-income New Zealanders, and their taxation is a component of savings policy as well as tax policy, this is not as urgent a concern as the tranche one and tranche two issues.

1.21 The motivation for the recent introduction of the 39% top personal income tax rate was to raise extra revenue in a way that is progressive and does not increase the tax burden on low to middle income earners. The Government intends that any legislative measures arising from the review of the integrity of the 39% rate will be broadly consistent with this objective and with current tax policy settings.

1.22 The current tax policy settings are a top personal income tax rate of 39%, a 28% company tax rate, a 33% trustee rate (pending the upcoming review as part of tranche two of the use of trusts to avoid the top personal tax rate) and no general capital gains tax. The integrity measures proposed in this discussion document are consistent with these broader settings. This document does not consider options such as aligning the top personal income tax rate with the company and trustee rates or introducing a capital gains tax. Rather, the measures proposed focus on mechanisms that divert the income of a taxpayer on the 33% or 39% rate through channels that allow it to be taxed at a lower rate.

Dividend integrity

1.23 This document firstly considers two issues with the current law and practice regarding income of companies received by shareholders. Distributions from companies are intended to be taxable income to the shareholders (dividends), unless excluded because they are either returns of contributed capital or a distribution on liquidation of net capital gains. Under the imputation system, taxable distributions from New Zealand companies can carry with them a credit for New Zealand income tax paid by the company. However, because the corporate tax rate is lower than the top personal tax rate and the trustee rate, there is often a residual tax liability for the shareholder (or the paying company, where RWT is imposed).

1.24 Current law and practice offer a number of routes for shareholders to directly or indirectly realise cash (or other property) relating to earnings of a company without triggering any tax liability. The first issue considered in this document is sales of shares. A sale of shares offers an alternative way for a shareholder to realise cash, often but not always representing the earnings or capital gains of the company, with no, or a substantially deferred, tax cost.

1.25 When a company is sold, the purchaser’s payment to the vendor includes the value of assets funded by retained earnings. Under current law, this payment is generally on capital account. Because a change of ownership will eliminate imputation credits, any subsequent distribution of the retained earnings will be taxable to the purchaser. However, if the purchaser adopts the simple expedient of acquiring 100 percent of the target using a holding company, this taxation is permanently eliminated by the inter-corporate dividend exemption.

1.26 Secondly, practical issues arise when a company cancels shares or is liquidated. At this point, the company’s available subscribed capital (ASC)[2] and (in the case of a liquidation) net capital gains need to be determined, in order to determine the amount of the dividend on liquidation. However, there is currently no requirement for a company to have kept any record of these amounts during its life. This can make accurately determining the amount of a dividend on share cancellation or liquidation highly problematic.

Personal services attribution

1.27 This document also considers the scope of the personal services attribution rule and whether it may need to be expanded in light of recent developments such as the introduction of the new top personal tax rate of 39%. The personal services attribution rule applies in certain circumstances when income from “personal services” performed by an individual is earned through an entity, such as a company or a trust. The rule attributes the income from personal services to the individual who performs the services, thereby ensuring the income is taxed at the individual’s marginal rate of personal income tax, rather than at the company rate of 28% or the trustee rate of 33%.

1.28 There is a risk that taxpayers on the 39% personal tax rate will use trusts and companies to obtain a lower tax rate on what is in fact personal services income. This is an issue both for taxpayers providing personal services to a single customer and taxpayers providing personal services to multiple customers. In each case, the economic reality is that the taxpayer is performing work and being paid for it – the entity is a conduit for the taxpayer’s income-earning activity. Consequently, the taxpayer should be taxed on their personal services income at the applicable marginal rate. However, currently, the legal structure used allows tax to be paid at a lower rate.

Proposed solutions

1.29 This discussion document suggests a number of ways to address these issues and improve the integrity of the 39% personal tax rate and the dividend definition. In particular, it proposes:

- That any sale of shares in a company by the controlling shareholder be treated as giving rise to a dividend to the shareholder to the extent that the company (and its subsidiaries) has retained earnings. This will trigger a residual tax liability for the shareholder. The company should also have an increase in its ASC. This ASC increase will address a current inequity in the imputation credit continuity rules and prevent double taxation upon liquidation.

- That companies be required, on a prospective basis, to maintain a record of their ASC and net capital gains, so that these amounts can be more easily and accurately calculated at the time of any share cancellation or liquidation. These accounts would be similar to the imputation credit accounts already required to be kept but would have fewer entries.

- That the “80 percent one buyer” test for the personal services attribution rule (that is, at least 80 percent of the associated entity’s income from personal services during the income year is derived from the supply of services to one buyer in particular and/or an associate of the buyer) be removed.

1.30 This discussion document also poses the following questions in relation to the personal services attribution rule:

- Should the 80 percent threshold for the “80 percent one natural person supplier” test (that is, at least 80 percent of the associated entity’s income from personal services is derived from services that are performed by the working person and/or a relative of theirs) be reduced to 50 percent?

- At what level should the threshold for the substantial business assets test (currently the lower of $75,000 or 25% of the associated entity’s income from personal services for the income year) be set?

Making a submission

1.31 The Government invites submissions on the proposals in this document, including the specific questions asked and any other issues raised in the document.

1.32 Include in your submission a brief summary of the major points and recommendations you have made. Please indicate if officials from Inland Revenue can contact you to discuss the points raised, if required.

1.33 The closing date for submissions is 29 April 2022.

1.34 Submissions can be made:

- by email to [email protected] with “Dividend integrity and person services income attribution” in the subject line, or

- by post to:

Dividend integrity and personal services income attribution

C/- Deputy Commissioner, Policy and Regulatory Stewardship

Inland Revenue Department

PO Box 2198

Wellington 6140

1.35 Submissions may be the subject of a request under the Official Information Act 1982, which will result in their publication unless there are grounds under that Act for the information to be withheld. Please clearly indicate in your submission if any information should be withheld on the grounds of privacy, or for any other reason (contact information such as an address, email, and phone number for submissions from individuals will be withheld). Any information withheld will be determined using the Official Information Act 1982.