IR2019/255 – Tax policy report: 2019–20 refresh of the tax policy work programme

| Date | 9 May 2019 |

|---|---|

| Reference | IR2019/255 |

| Document type | Tax policy report |

| Title | 2019–20 refresh of the tax policy work programme |

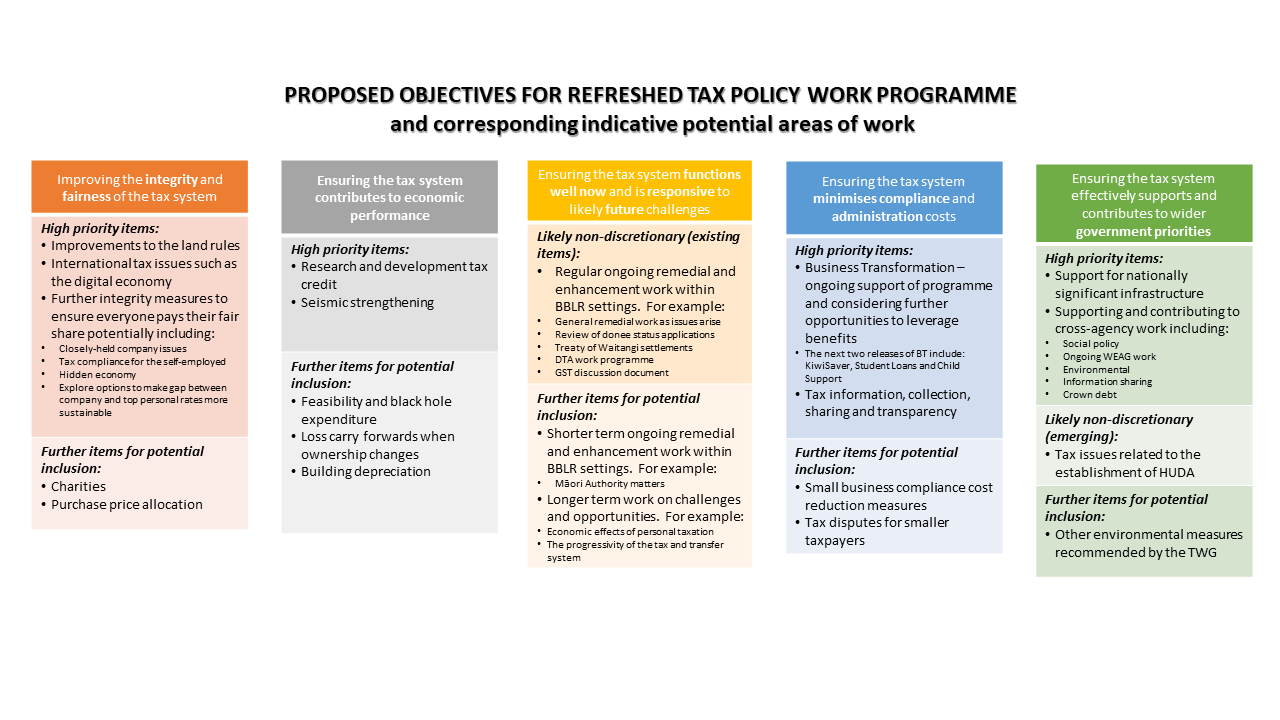

| Downloads | PDF (471 KB; 9 pages) DOCX (371 KB; 9 pages) PPTX (47 KB; 1 slide) - source for diagram |

| Contents |

Tax policy report: 2019–20 refresh of the tax policy work programme

| Date: | 9 May 2019 | Priority: | Medium |

| Security level: | In Confidence | Report number: | IR2019/255 T2019/1375 |

Action sought

| Action sought | Deadline | |

|---|---|---|

| Minister of Finance | Note the contents of this report Discuss report at meeting on 13 May 2019 |

13 May 2019 |

| Minister of Revenue | Note the contents of this report Discuss report at meeting on 13 May 2019 |

13 May 2019 |

Contact for telephone discussion (if required)

| Name | Position | Telephone | |

|---|---|---|---|

| Emma Grigg | Policy Director, Inland Revenue | [Withheld under section 9(2)(a) of the Official Information Act 1982] |

|

| Mark Vink | Manager, Tax Strategy, The Treasury | ||

9 May 2019

Minister of Finance

Minister of Revenue

2019-20 Refresh of the tax policy work programme

Purpose

1. This report is intended to assist Ministers’ consideration of the high-level objectives and process for the next tax policy work programme (TPWP). In particular officials would like to gauge Ministers’ views on:

(a) The proposed overarching objectives of the next TPWP;

(b) The approximate resource weighting for the TPWP;

(c) The fiscal approach Ministers would like to take for the next work programme; and

(d) The process and timing for consultation and communication.

2. We are currently undertaking a prioritisation exercise for the individual items that could form part of the work programme. We will report to you further on this.

Background

3. At a meeting with you on 30 April 2019, we discussed our intention to begin reviewing potential items for inclusion in a refreshed TPWP for 2019-20. This year, we are taking a top-down approach to refreshing the TPWP. We have considered the potential objectives of the refreshed TPWP, and the possible items of work which would contribute to or support these objectives.

4. In its response to the Tax Working group (TWG) recommendations, the Government indicated that a number of TWG recommendations would be considered as high priority items on the refreshed TPWP, while others would be considered for inclusion more generally. Further, the Government noted that several recommendations were items of work which were already underway, including work involving other agencies.

5. Therefore, possible items for inclusion in the next TPWP will be drawn primarily from recommendations of the TWG, Government priorities, and a list of policy items that officials are aware of – this includes both existing items on the work programme and emerging issues.

6. An A3 is attached to this report which provides a high-level picture of what the refreshed TPWP could look like.

Objectives of the refreshed TPWP

7. As the TWG found, New Zealand’s tax system is generally sound and working well. The TWG made a number of recommendations aimed at improving the fairness, balance and structure of the system. Many of these recommendations are being considered for the refreshed TPWP. To support the ongoing strength of the tax system, we consider that the refreshed TPWP needs to contain a mix of items which ensure that the system not only functions well now but is responsive to likely future challenges.

8. In light of this, we have organised the general structure for the refreshed work programme into the following overarching objectives, which items on the TPWP could contribute to or support. These objectives are based primarily on what we understand the Government’s objectives to be, including from our conversations with Ministers.

- Improving the integrity and fairness of the tax system

- Ensuring the tax system contributes to economic performance

- Ensuring the tax system functions well now, and is responsive to likely future challenges and opportunities

- Ensuring the tax system minimises compliance and administration costs

- Ensuring the tax system effectively supports and contributes to wider government priorities

9. The third objective is aimed at ensuring our tax system continues to function well for the 21st century and beyond. While we have made this a separate objective, it cuts across all objectives, and will be a feature in all projects. Trade-offs will need to be considered within projects, and there is a need to ensure that policy solutions are fit for purpose now and for the future. For example, exploring options to make the gap between the company tax rate and top personal rate more sustainable would be an example of improving the integrity and fairness of the tax system, while at the same time ensuring that the tax system functions well now and is responsive to likely future challenges.

Components of the refreshed TPWP

Items that will be included

TWG recommendations (high priority items) and Government priorities

10. A significant component of the next TPWP will be items that the Government has indicated, in its response to the TWG report, should be progressed as high priority items in the TPWP. These recommendations relate to:

- Land and housing – this includes options for taxing vacant land by land-bankers, reviewing the current tax rules for land speculators and requiring IRD numbers when transferring a main home.

- Infrastructure – this includes understanding the Government’s wider agenda on infrastructure and how the tax system could facilitate or contribute to this agenda.

- Seismic strengthening – this includes considering whether the current tax settings are appropriate in relation to seismic strengthening. Progressing this will involve making decisions, for example, about the relative treatment of those who have already progressed seismic strengthening (and not received tax benefits) and those who have not.

- Improving the integrity of the tax system – this includes a potential range of measures to ensure everyone pays their fair share. We will report to you further on which specific measures we recommend prioritising for this work.

11. The refreshed TPWP will also include items which contribute to or support Government priorities, coalition and confidence and supply agreement items.

Existing work programme items

12. A mix of items which are on the current work programme will be rolled over to the refreshed TPWP. Some items will be included because they are still ongoing or are non-discretionary. Others are items which are on hold – that is, they were deprioritised for higher priority projects – but we now consider that they should be reprioritised under a refreshed work programme. Examples include:

- International tax – this includes the work on a potential digital services tax and the DTA programme. (Ongoing)

- Business transformation (BT) – we will continue to support Inland Revenue’s BT programme and also consider opportunities to further leverage off the benefits provided by BT – for example opportunities under BT for the self-employed. (Ongoing)

- Research and development tax credit. (Ongoing)

- GST discussion document – GST issues arise from time to time that require a policy response. It is important for the health of the GST system to address these issues. This item has been on hold since mid-2018. We expect the discussion document to be largely revenue neutral. (May be reprioritised)

Emerging issues

13. Since the last TPWP refresh, new issues or issues that were not previously on the work programme have emerged. Some of these emerging issues are non-discretionary and will need to be added to the work programme. The new issues include:

- Considering the tax consequences arising from the establishment of the Housing and Urban Development Authority (HUDA)

- Supporting the Government’s response to the Welfare Expert Advisory Group (WEAG)

Items that will be considered for inclusion

14. The rest of the work programme will be drawn from the remaining TWG report recommendations and the list of discretionary items we are aware of (both on the current work programme and emerging issues). We are currently undertaking a prioritisation exercise of all these items and will report to you further on the outcome of this work.

15. Recommendations of the TWG that the Government has already agreed will not be progressed are not being assessed.

Resourcing the work programme

16. The high priority items that will be included in the next work programme are likely to take up a significant amount of available tax policy resource. This means there are constraints on how many additional measures beyond these items that can be included, at least in the short-term. We will undertake further work on this and report back to you.

17. In addition to the high priority items, we consider it is important to commit resources to general maintenance and remedial policy items. These are necessary to ensure a well-functioning tax system. We also consider it important to carve out some resource to focus on long-term stewardship projects. Both of these focus areas will likely require approximately 20 per cent each of total resources.

18. Our initial assessment is that we will be at capacity when taking into account:

- The high priority items from the TWG;

- General maintenance and remedial items;

- The stewardship function; and

- Any rollover items from the current work programme.

19. However, we will have the options to manage this capacity by flexing the timing of delivery of various items. Once we have direction from you on your highest priorities, we will advise you on realistic timing and, depending on how acceptable our proposed timing is, what trade-offs may be required to achieve your objectives.

Fiscal implications

20. Some of the items proposed for inclusion, including some of the high priority items such as seismic strengthening and infrastructure support have with fiscal costs. We would like to discuss with you the approach to the potential fiscal implications of the work programme.

21. The following table provides you with an indication of items being considered for the refreshed TPWP that may have significant fiscal impacts:

| Items which could potentially raise revenue | Measures is likely to significantly reduce revenue |

|---|---|

| International tax issues such as the digital economy | Support for nationally significant infrastructure |

Further integrity measures to ensure everyone pays their fair share, including:

|

Research and development tax credit (already included in forecasts) |

| Purchase price allocation | Seismic strengthening |

| Improvements to the land rules | Small business compliance cost reductions |

| Feasibility and black-hole expenditure ($5m-$50m per annum depending on design and as cost increases over time) | |

| Loss carry forwards when ownership changes (fiscal cost depends on design, costing for the TWG proposal was approximately $50 million per annum) | |

| Building depreciation (up to $300m per annum) |

Next steps

Timelines

22. Officials would like to discuss the proposed work programme objectives with you at the Joint Ministers meeting of 13 May. If Ministers are comfortable with the direction of the work programme, we will undertake a prioritisation exercise, which will involve assessing all the possible items for inclusion on the refreshed TPWP against our resourcing capacity. We will bring the outcome of this exercise back to you in the form of a detailed draft work programme, for your consideration at the joint meeting on 11 June. This will take into account the consultation referred to below.

Consultation

23. While we have not done any formal consultation, discussions on items for possible inclusion on the work programme were heavily canvassed with stakeholders during the TWG process. We understand issues that are particularly important to business stakeholders (specifically, the Corporate Taxpayers Group (CTG) and Chartered Accountants Australia and New Zealand (CA ANZ)) include:

- Feasibility and blackhole expenditure;

- Cross-border employment;[1]

- Building depreciation;

- Loss continuity;

- Small business compliance costs;

- Disputes.

24. Given the ongoing resource constraints on the work programme, it will be important to ensure that stakeholder expectations are managed appropriately.

25. We would like to discuss with you our proposed approach for consulting with stakeholders on the proposed refresh of the TPWP. In particular, we would like Ministers’ approval to undertake limited consultation with key stakeholders (including CA ANZ, CTG, and a representative group of civil society) on the proposed direction of the next TPWP, before our next meeting with you on 11 June.

Communications

26. Once Ministers agree to a refreshed TPWP, we will prepare a Cabinet paper for Cabinet’s noting. This will likely be in July 2019. Following Cabinet consideration, we will discuss with you how you would like to publicly announce the refreshed work programme.

Revenue Strategy

27. The Government will also be updating its revenue strategy as part of the Fiscal Strategy section of the Minister of Finance’s Budget document. The revenue strategy has been revised to reflect the Government’s response to the TWG and is attached to this report as an appendix.

Recommended action

We recommend that you:

(a) Note the contents of this report

Noted Noted

(b) Agree to discuss this report at the next joint-tax meeting on 13 May 2019

Agreed/Not agreed Agreed/Not agreed

Mark Vink

Manager

The Treasury

Emma Grigg

Policy Director

Inland Revenue

Hon Grant Robertson

Minister of Finance

/ /2019

Hon Stuart Nash

Minister of Revenue

/ /2019

Appendix

[Withheld under section s 18(d) of the Official Information Act 1982]

[1] This item is about ensuring that definitions of tax residency are not an undue impediment to the temporary movement of employees overseas, or temporary movement of offshore employees to work in New Zealand.