Chapter 4 – Better payment options

- Summary of proposals in this chapter

- Changes for child support payments

- Frequent repayment of student loans during the year

This chapter discusses proposed changes to:

- child support; and

- student loans for domestic borrowers with adjusted net income.

Summary of proposals in this chapter

- Child support liable parents who have employment income would have compulsory deductions from salary and wages or schedular payments.

- Child support liable parents who do not have compulsory deductions could have to pay more frequently and earlier than currently.

- Child support obligations could be met through payments made directly to third parties that are of direct benefit to the child, subject to conditions.

- Child support payments could be available for receiving carers as as soon as they are received (or deemed to be received) by Inland Revenue.

- Receiving carers would have options for how frequently they can receive payments, including at the same time as they receive Working for Families Tax Credits.

- Student loan borrowers with "adjusted net income" such as schedular, casual agricultural or election-day income would be required to use the SL tax code to make student loan repayments.

- Student loan borrowers with other forms of income to include as "adjusted net income" would be required to make more regular payments throughout the year.

Changes for child support payments

Alongside the proposals for shorter periods of assessment, the Government proposes to change the dates when liable parents must pay and when payments are made to receiving carers. The objectives are to get payments from or to customers as quickly as possible and minimise the chances of incurring debts. The changes in technology and the provision of employment information more frequently offer an opportunity to improve the timing of payments.

Currently, the child support annual assessment is divided equally into monthly amounts. Each monthly obligation is due from liable parents by the 20th of the following month (for example, the June monthly amount is due by 20 July). If the customer is a beneficiary or has a compulsory or voluntary wage deduction in place, child support payments are made alongside PAYE deductions through the payroll system. This could be weekly, fortnightly or monthly, depending on their pay frequency. Payments through wages are already the most common way of paying. Currently, approximately 73 percent of New Zealand resident liable parents who receive only salary and wage income pay their child support current liability and/or debt by way of employer deductions at some stage during the year.[12]

Once the information provided by employers confirms a deduction has been made from the customer’s pay, the child support amount is treated as being paid by the liable parent even if the employer has not yet passed the funds to Inland Revenue.[13]

If a liable parent is not a beneficiary or in debt, and therefore is not subject to a compulsory deduction, the liable parent is able to choose the means of payment that best suits them, as long as they pay by the 20th of the following month. If Inland Revenue receives the child support payment before the due date, the payment is deemed to be received on the day it is due.[14]

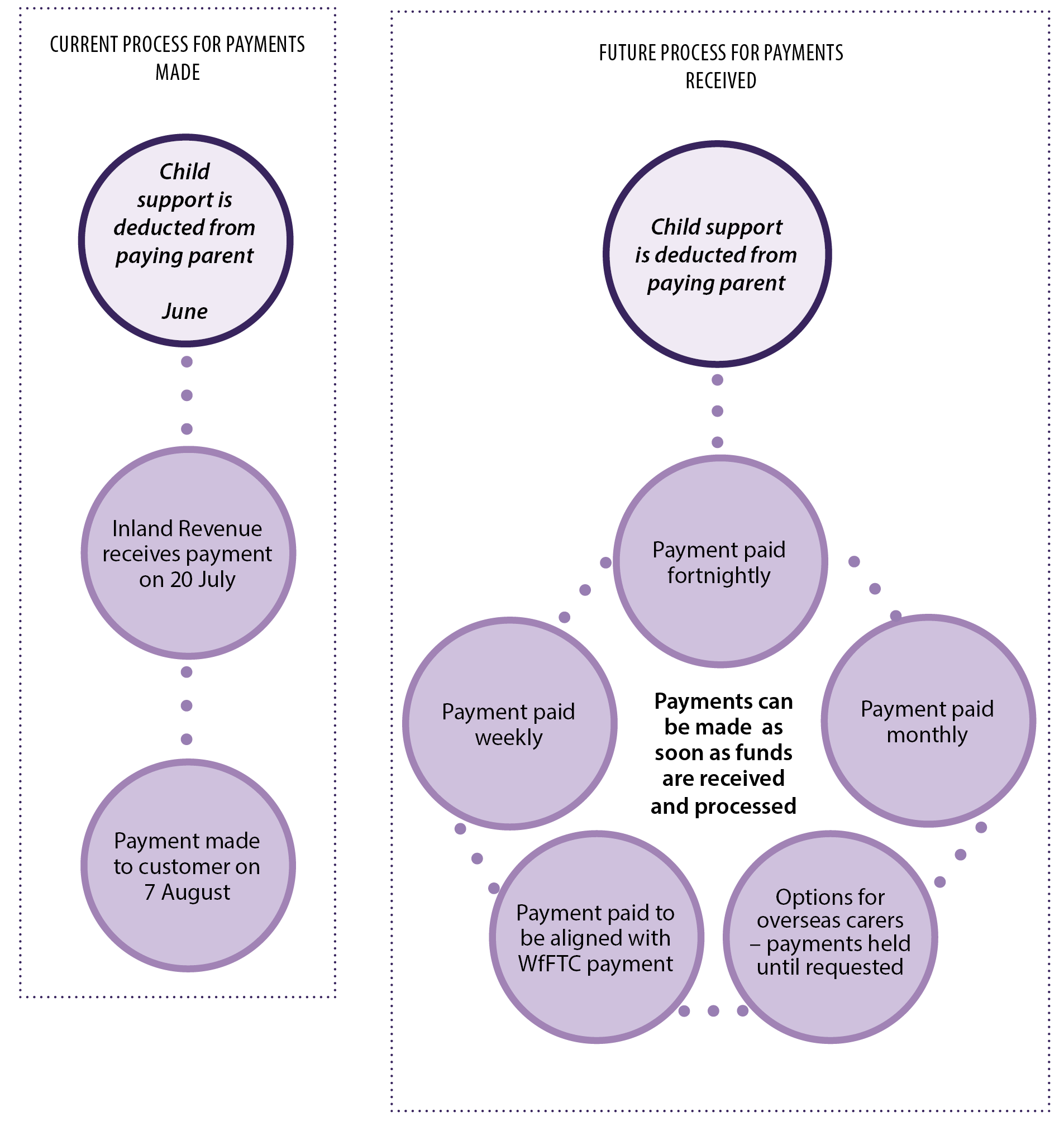

Once payment has been made by the liable parent, Inland Revenue generally passes that payment to the receiving carer on the 7th of the following month. So for the month of June the liable parent has until 20 July to pay to Inland Revenue and Inland Revenue has until 7 August to pass the money on. These dates are set out in legislation and took into account the due dates for employer monthly schedules and cheque clearance processes. They are no longer appropriate, and are inconsistent with how child support debt payments are received and paid out.

Current payment process for child support

Compulsory wage deductions for liable parents

Liable parent payment rates are particularly low when they first enter the child support scheme – only 24 percent make their first three payments on time. Once a liable parent is in debt, compulsory wage deductions can be applied, which significantly increases the number of payments made on time, reduces debt and ensures the carer receives payments.

The 2011 child support reforms proposed to introduce compulsory wage deductions on all domestic liable parents who were employees. This change was not implemented at the time, partly due to issues with making changes to Inland Revenue’s computer system (FIRST).[15]

The Government proposes that child support deductions from employees' wages be compulsory for all domestic liable parents in the same way as PAYE and student loan deductions.[16] This process could be automated to apply a deduction when a customer enters the scheme or when they move into work. This would be helpful for liable parents first entering the scheme and result in them getting their payments right from the start and avoid going into debt. It would also ensure consistent treatment between beneficiaries and non-beneficiaries.

It is expected that Inland Revenue would notify liable parents of their payment obligation and would instruct the employer to deduct child support payments. The Government is interested in whether there would be any particularly significant compliance issues from this proposal and, if so, how they could be addressed.

When expanding compulsory deductions was previously considered there were concerns about privacy, and some submitters did not want their employers to know they were in the child support scheme. At that time, the Office of the Privacy Commissioner considered that, on balance, the public benefit of making compulsory deductions appeared to justify the privacy impacts on compliant individuals, but that additional operational safeguards would be needed to minimise impacts on privacy if this change was implemented. There are no exemptions currently for compulsory wage deductions for beneficiaries or those in debt.

The Government is interested in whether there are specific circumstances that would justify an employer not being notified and the liable parent being able to make payment through some other means than compulsory wage deductions. Alternatively, are there ways to have compulsory wage deductions made while protecting a person’s privacy?

Payments from other income

For liable parents who do not have deductions from salary and wages, for example because they earn most of their income from investments such as shares or from business activities, the Government proposes to require earlier payments than currently.

The Government is interested in whether liable parents not subject to compulsory wage deductions should be required to make payments more regularly, for example fortnightly. If payments were more regular, what would a reasonable period be?

Recognising private payments

The 2011 child support reforms also agreed to allow private payments a liable parent made directly to third parties, such as boarding school fees, to be recognised as meeting part or all of their child support obligation. That is, instead of making a payment to Inland Revenue, the liable parent could pay someone who was providing goods or services for the direct benefit of the qualifying child.[17] There were several restrictions around this proposal, including that:

- parents and carers must agree in writing that the private payment meets or partially meets the child support obligation;

- the payment made is acceptable to Inland Revenue and of direct benefit to the qualifying child;

- the receiving carer is not receiving a main benefit;

- the liable parent or receiving carer does not have a child support debt;

- the care of the child is not shared between the parents; and

- the qualifying payment is at least 10 percent of the child support payable for the child.

The proposal was not implemented, partly due to issues with Inland Revenue’s FIRST system, and recognition that the criteria would mean few parents would be likely to take up the option. The Government is interested in whether this option should be reintroduced and whether more child support parents would use this option if some of the criteria were changed. For example, should this option be available if the liable parent or receiving carer has child support debt? Some criteria will remain, especially the requirement for agreement between parents and carers and the requirement not to be receiving a main benefit. Further detail on the original option can be found in Chapter 9 of the discussion document Supporting children (September 2010) and in the Child Support Amendment Bill commentary (2011).[18]

Making payment to receiving carers as soon as funds are received and processed

The Government proposes to clarify that Inland Revenue can make payments to receiving carers as soon as funds have been received and processed.

The Government is interested in whether receiving carers should be able to determine for themselves how frequently child support collected is paid to them. For example, some overseas receiving carers may prefer less frequent payments because they incur bank fees on international transfers or cheque deposits. Other receiving carers may want child support to be paid at the same time as their Working for Families Tax Credits.

Frequency of child support payments to receiving parent

Frequent repayment of student loans during the year

It is proposed that for domestic borrowers with salary and wages, the current system would continue, that is, New Zealand-based salary and wage earners have student loans repayments deducted from their income through their employers. The deductions are made at the same time and frequency as their PAYE and are treated as "full and final". That means for most there are no further payments to be made at the end of the tax year. For the year ending 31 March 2015, around 85 percent of student loan borrowers only had these wage deductions. Similarly, there would be no change to the repayment of student loans from overseas-based borrowers, which requires two instalment payments during the year, or to the situation of beneficiaries with student loans.

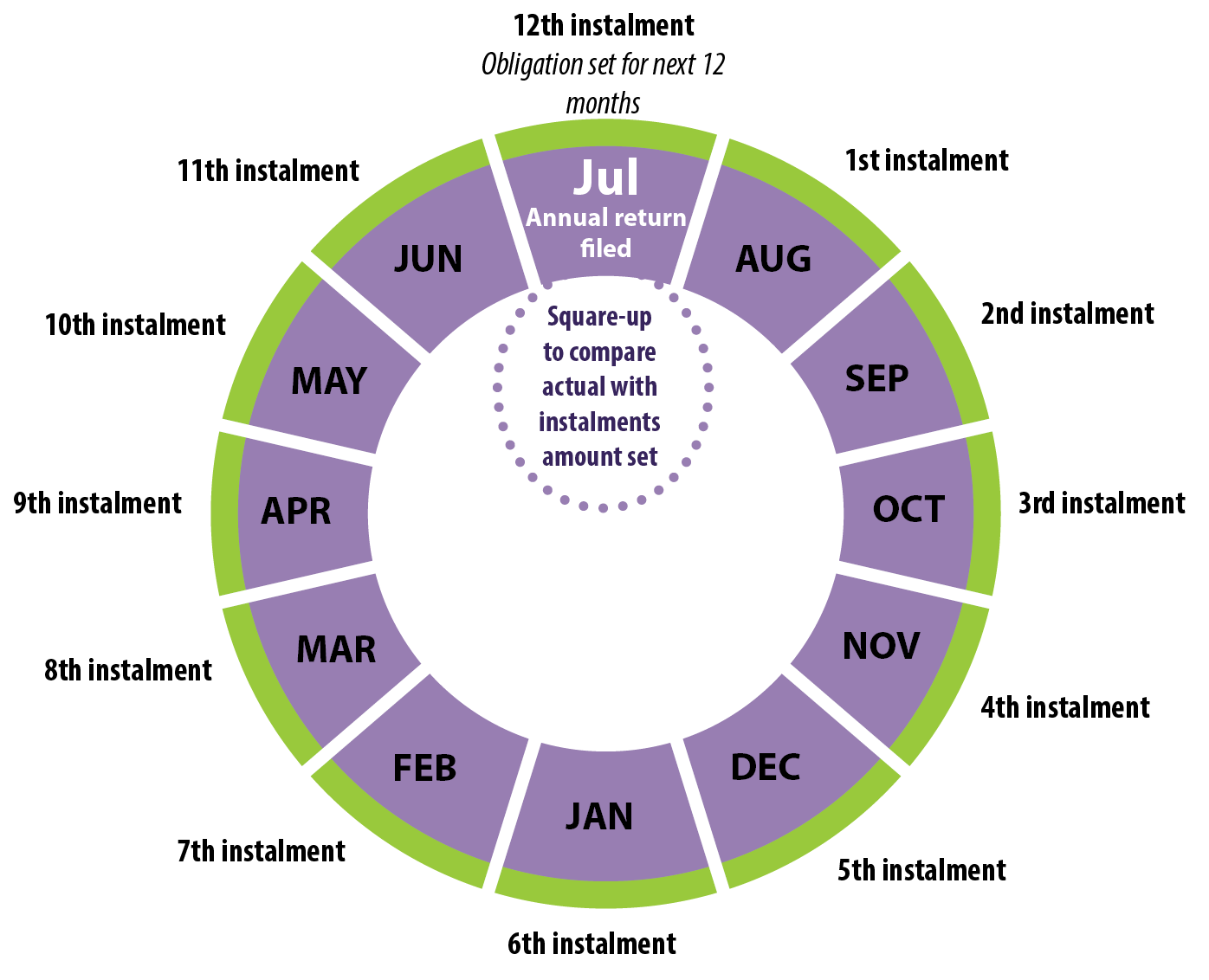

Currently, for domestic borrowers who earn other income ("adjusted net income"), at the end of the year their student loan assessment is based on the amount of that income for that year. Most borrowers have approximately 10 months to pay the obligation, otherwise late payment interest applies.

If domestic borrowers have an end-of-year assessment over $1,000, they are required to make additional repayments throughout the following year, similar to provisional tax, with payments required in three equal lump sums. Approximately 20 percent of student loan borrowers with adjusted net income are required to make these interim payments. To avoid the year-end bill and possibility of provisional payments, some borrowers make voluntary payments throughout the year.

Set student loan obligation on past year's information

The Government is seeking to improve the timeliness of student loan payments for domestic borrowers with adjusted net income. The following proposals would replace the current provisional payment rules. The frequency of the payments will depend on the type of adjusted net income the borrower earns.

Payments could be through extra deductions from salary and wages or other schedular income, or regular direct payments could be required. Most borrowers who have adjusted net income also have income from wages or schedular income. In the year ended 31 March 2015, 49 percent of borrowers who had an adjusted net income assessment also earned wages or salary, and 39 percent earned schedular income subject to withholding taxes.

Deductions from schedular, casual agricultural and election-day income

For adjusted net income that is similar to wages and salary, such as schedular, casual agricultural or election-day income, the Government proposes student loan repayments be deducted from these types of income.[19] As with other salary and wage earners, 12 percent would be deducted from income above the repayment threshold each payday. This proposed change will mean the vast majority of domestic borrowers will have regular student loan deductions from employment income.

At the end of the year there would be an assessment of the adjusted net income to determine whether the payments made during the year mean additional payments are still required or a refund is due.

Setting the repayment obligation using income information received during the year

For domestic borrowers with other sources of income such as investment income and business income, the Government proposes they would also make loan repayments during the year as their income is earned. The amount and frequency of payments during the year will be based on the income information provided.

For borrowers using the Accounting Income Method (AIM), the amount of the repayment could be based on the provisional information provided through AIM on their provisional income earned for the one or two month period.

Borrowers who have adjusted net income and are not using AIM could declare the amount of adjusted net income they consider they have received in the previous two months and make loan repayments accordingly. Alternatively Inland Revenue could use the borrower’s previous year’s assessment of adjusted net income to estimate their income for the year and calculate loan repayments with smaller repayments, being required more frequently.

At the end of the year there would be an assessment of that year’s adjusted net income to determine if there is an amount to pay or refund. Any additional obligation the borrower has after this assessment would be collected through additional regular payments in the following year. If the borrower had paid more than required, the overpayment could be offset against the loan or offered as a refund.

These proposals would reduce the end-of-year obligations for borrowers and reduce the likelihood of missed payments and late payment interest being charged.

The Government is interested in how often these extra repayments should be made during the year, if they are not made through extra wage deductions.

QUESTIONS FOR READERS

4.1 Child support – Do you support compulsory child support wage deductions for all liable parents with employment income?

4.2 Child support – Are there any particularly significant compliance costs to have compulsory deductions of child support from customers who receive employment income subject to withholding taxes? What are these?

4.3 Child support – If there were to be exemptions from this proposal, what reasons do you think would justify not having compulsory wage deductions? Are there other ways to have compulsory deductions while protecting a person’s privacy?

4.4 Child support – Should liable parents not subject to wage deductions be required to make child support payments more regularly? What would be an appropriate period of time?

4.5 Child support – Would you use a provision to make child support payments directly to third parties providing goods or services that directly benefit your child? Of the criteria previously considered, are there any that you believe should be changed to make this option available to more customers?

4.6 Student loans – Should student loan borrowers who earn schedular, casual agricultural and election-day income be required to have student loan repayments deducted from this income?

4.7 Student loans – How often should student loan extra repayments be made through the year to reflect adjusted net income received by a domestic student loan borrower? Would extra deductions from wages and salary make it easier for borrowers? What would be the impact on compliance costs?

12 Data from the tax year ending 31 March 2016. Approximately 63 percent of all domestic liable parents who earn salary and wage income and other types of income paid by employer deductions at some stage.

13 If the employer fails to pass the money on it becomes an employer debt to Inland Revenue.

14 Section 146(2) of the Child Support Act 1991.

15 FIRST is the heritage IT computer system being replaced by START as part of the modernisation of Inland Revenue’s systems.

16 Inland Revenue would continue to have the discretion not to apply a deduction if it was inappropriate to do so.

17 The Australian Child Support scheme has a similar "non-agency payments" option.

18 Supporting children – A Government discussion document on updating the child support scheme, (September 2010), available at http://taxpolicy.ird.govt.nz/publications/2010-dd-supporting-children/overview

Child Support Amendment Bill – Commentary on the Bill (October 2011), available at http://taxpolicy.ird.govt.nz/publications/2011-commentary-child-support/overview

19 80 percent of borrowers who had schedular income claimed no schedular expenses against their income, so their gross and net income was the same, and they were in the same position as salary and wage earners. They would be required to use an SL tax code in conjunction with their WT, CAE or EDW tax codes.