Chapter 3 - During the tax year

- Information about individuals is provided to Inland Revenue by others

- Some individuals provide information about themselves to Inland Revenue during the year

- What Inland Revenue does with the information it receives

- How Inland Revenue will help to ensure individuals get their tax and social policy payments right

A large number of individuals do not need to do anything once they have provided the correct tax code to their employer or bank (and this will continue).

In earlier Making Tax Simpler consultation documents, the Government proposed that more complete information from third parties should be provided to Inland Revenue throughout the year. Inland Revenue will check information when it is received and fix errors whenever possible, which will mean fewer over or under-payments for individuals during the year. This information will be displayed in digital accounts.

Increasingly, individuals will not have to do anything at the end of the year as more information is passed to Inland Revenue on their behalf. As the quality and frequency of information available to Inland Revenue improves, payments made by and to individuals during the year will be more accurate. In turn, this will reduce the number of individuals who have large refunds or tax to pay at the end of the year.

Information about individuals is provided to Inland Revenue by others

Inland Revenue receives a range of information about individuals from other people and/or organisations who are required to report it. A lot of this information is provided under specific information reporting requirements set out in tax legislation. Inland Revenue also receives other information, for example, about income, entitlements, relationships and transactions on an as-required or one-off basis.

Payers of some types of income are required to inform Inland Revenue about the income paid, the tax withheld and the recipient. In some cases this information is reported to Inland Revenue during the year, and in other cases it is required after the end of the year.

Not all types of income carry the requirement for the payer to report the amount and the recipients to Inland Revenue.

Reporting information about an individual imposes costs on the provider and this must be weighed against the benefit to Inland Revenue and the individual. Over time, the Government may require information about more types of income to be reported regularly, but that is not proposed in this discussion document.

Inland Revenue does not generally receive information about income that does not have tax deducted from it as part of regular information reporting systems. This document does not propose to alter this position at this time.

Rather than waiting until the end of the year and posting copies of their donations receipts or their income protection insurance to Inland Revenue, the Government proposes that individuals would be able to scan or photograph and upload copies of their receipts directly into myIR either during the year or at the end of the year.

Some individuals provide information about themselves to Inland Revenue during the year

Outside of the return filing process, under current settings some individuals are required to provide some information during the year. For example, if they are required to make provisional tax payments.

When an individual starts a new job they must choose a tax code and their employer then withholds tax at a rate based on their expected annual income. It is currently the individual’s obligation to update Inland Revenue if a change in their circumstances means they should change to a different code. The onus is on the individual to be aware of circumstances that would require a change in code.

Individuals can also claim tax credits for gifts of $5 or more made to donee organisations such as charities.[7] These can currently be claimed by filling in a claim form and submitting this to Inland Revenue with receipts. Individuals can also claim for the cost of income protection insurance. Rather than waiting until the end of the year and posting copies of their donations receipts or their income protection insurance to Inland Revenue, the Government proposes that individuals would be able to scan or photograph and upload copies of their receipts directly into myIR either during the year or at the end of the year.[8] This information would then be available to be used by Inland Revenue in determining an individual's tax position.

What Inland Revenue does with the information it receives

Receiving information, whether directly from individuals or from third parties, allows Inland Revenue to ensure that individuals pay the right amount of tax and receive the correct social policy payments. It also helps other government agencies to accurately assess a range of entitlements and can be used for statistical analysis by the Government and community.

After the information is received, Inland Revenue:

- checks its accuracy;

- proposes adjustments to future withholding or past periods if necessary;

- includes it in an individual’s account to:

- provide a picture of their income position;

- assist them with any return filing obligation;

- prompt them to take any steps they need to; and

- compares the information to other information it already holds about an individual.

The Taxation (Annual Rates for 2017–18, Employment and Investment Income, and Remedial Matters) Bill contains proposed changes about the frequency with which information about income must be provided to Inland Revenue. These changes relate to PAYE, interest income, New Zealand-sourced dividends and Maori authority distributions.

As at 1 December 2016 there were almost two million customers with active myIR accounts.

At any point in time a myIR account will give an individual a personalised and complete view of their income position and social policy entitlements that Inland Revenue has received information about.

Getting more detailed income information more frequently will enable Inland Revenue to help individuals get their tax and social policy payments right. Inland Revenue will be able to act sooner to correct mistakes during the year, which should reduce the number and size of year-end issues. Inland Revenue will also be able to provide a greater number of taxpayers with a complete and accurate picture of their income position at the end of the tax year. That is why the Government has proposed that more information be provided to Inland Revenue during the year.

Inland Revenue will process the information and let the individuals or third parties know if any errors or omissions need to be fixed.

Giving individuals visibility of their income and payments

All the information Inland Revenue receives about an individual will be held in their tax account, which an individual can view through myIR.

As information is received, it will be added to an individual's myIR account.

This can save the individual time if they choose to or need to file a return at the end of the year, as information received before the person files would already be shown.

Information received later cannot be used to help an individual complete a return, but can be used by Inland Revenue to check whether all the necessary information was provided by the individual in their return.

As at 1 December 2016 there were almost two million customers with active myIR accounts. The myIR account will show income earned, obligations, entitlements, liabilities and personal details. Inland Revenue would progressively add information to the account as it is received.

The individual and anyone else they have authorised to see it are the only ones who can access their myIR account. At any point in time a myIR account will give an individual a personalised and complete view of their income position and social policy entitlements that Inland Revenue has received information about.

Actions that Inland Revenue can take to stop errors will mean fewer people end up with tax to pay or refunds at the end of the year, and therefore that fewer people will need to interact with Inland Revenue.

If an individual receives income that is not shown on their myIR account, this means that either it is not required to be reported to Inland Revenue by a third party, or it is required but has either not been reported or cannot be linked with the individual. If it was not able to be linked with the individual, it is likely the income is being taxed at the higher non-declaration rate.

Income information will generally be shown as totals, however further details will also be available to be viewed. For example, total income for the year-to-date would be shown and an individual could view this by employer or time period if they wanted to.

The individual would not be able to directly alter any income information in myIR during the year, but would be able to at the end of the year. Third parties can update Inland Revenue at any time about information they have provided, and as the displayed information is based on information received from third parties, any corrections the third party makes to that information will flow through the system and be updated in the appropriate myIR accounts.

How Inland Revenue will help to ensure individuals get their tax and social policy payments right

As Inland Revenue analyses information about an individual, it may become apparent that the individual is not using the best tax code for their personal circumstances. Inland Revenue will automatically calculate whether the tax that is being remitted by the withholder is likely to match their end-of-year tax liability.

The nature of the withholding tax system (the use of tax codes based on expected annual income), means that mistakes made in selecting codes, or unexpected changes in income can lead to refunds or tax to pay at the end of the year. Actions that Inland Revenue can take to stop errors will mean fewer people end up with tax to pay or refunds at the end of the year, and therefore fewer people will need to interact with Inland Revenue.

Inland Revenue monitors information provided by employers about income they have paid and tax they have withheld. When an individual is using the wrong tax code (such as using the main job "M" tax code for two jobs) Inland Revenue contacts the employer asking them to change the tax code. If the employer does not correct the tax code in their next monthly schedule, Inland Revenue follows up with them. Individuals are contacted by phone or in writing, advising them of the possible discrepancy and what action they can take to remedy the situation. At the same time Inland Revenue advises them what actions will be taken if there is no response to the correspondence.

Inland Revenue can also identify situations when a systemic error seems to be occurring on the part of the withholder, for example, they are inadvertently using an outdated PAYE code table. Inland Revenue can intervene to ensure the information provider corrects this error.

In some cases individuals use a withholding tax rate that is not incorrect per se, but will not match their end-of-year tax liability. Inland Revenue could do more in these circumstances to help the individuals during the year so that they do not have to wait until the end of the year for a refund, or receive a tax bill at the end of the year. The benefit of changing to a different tax rate sooner is that it should better approximate the person’s ultimate tax liability, and therefore reduce the size of a debt or refund position the person would otherwise be in at the end of the year.

Similarly, an individual might have selected a withholding tax rate at their bank that is higher or lower than their marginal tax rate. If Inland Revenue thinks a resident withholding tax rate being used is not consistent with a person’s marginal tax rate, it already has the ability to provide a new rate for the payer to use.[9]

Inland Revenue will notify an individual if the tax rate or code they are using does not reflect their marginal tax rate and suggest they change it to ensure they do not significantly over-or under-pay their tax during the year. The proposed process in these cases is that Inland Revenue would notify the individual that the tax rate does not match their likely end-of-year tax liability. If no response is received, Inland Revenue would instruct the payer to change the tax rate being used. Inland Revenue would notify the individual that the payer had been instructed to change the rate.

The ability for Inland Revenue to help people get things right is dependent on it receiving quality information in a timely manner rather than receiving it when it is too late to help. This is a major reason behind the Government’s recommended changes to the timing of information about PAYE and investment income. It will still be the individual’s responsibility to let Inland Revenue know if their circumstances change materially, but if Inland Revenue has more regular and timely income information it will be better placed to help individuals.

Inland Revenue will proactively contact more individuals during the year to ensure the tax withheld during the year more closely matches their likely end-of-year liability.

Special tax codes

Over-and under-payments can still happen even when an individual is using the correct tax code. Some individuals, for example, those who have multiple jobs, might be better off using a special tax code tailored to their personal circumstances instead.

For some people the standard tax codes do not result in the right amount of tax being deducted during the year. In this case individuals can apply for a special tax code.

Special tax codes can be applied to:

- salary/wage income;

- NZ Superannuation; and

- schedular income sources.

A special tax code cannot be applied to an income-tested benefit payment, such as Jobseeker Support.

Individuals can apply to Inland Revenue for a special tax code. They currently have to fill out a special tax code application and post it to Inland Revenue. Inland Revenue calculates an appropriate tax rate to be used and issues a special tax code certificate to the individual.

The individual then has to advise their employer that they want the special tax code applied to their income. A special tax code is only valid until the end of the tax year. Each individual who receives a special tax code certificate also receives a personal tax summary to complete, or is required to file an IR3 at the end of the year.

For the 2015 tax year, only 7,975 individuals used a special tax code.

This process will be modernised so an individual who wants a special tax code can request one online rather than by completing a paper form.

If Inland Revenue identifies that an individual would be better off using a special tax code, it would contact them, explain why, and suggest a special tax code.

The disadvantages of the current rules about special tax codes are that an individual first needs to know about special tax codes, secondly needs to realise that using one would benefit them, and thirdly needs to be able to estimate their likely annual income. For the 2015 tax year, only 7,975 individuals used a special tax code.

This process will be modernised so an individual who wants a special tax code can request one online rather than by completing a paper form.

Inland Revenue will also send a message to the employer or other payer at the same time containing the details of the special tax code, so if the individual chose to change to the code, they would not have to show a copy of the certificate to their employer.

If Inland Revenue identifies that an individual would be better off using a special tax code, it would contact them, explain why, and suggest a special tax code. It would still be up to the individual to decide to change their tax code. This is because the individual will be in the best position to evaluate how their circumstances might change over time.

A special tax code is still based on expected annual income. While it takes the progressivity of the income tax scales into account, it can still result in a refund or tax to pay if income is variable or does not remain at the level the individual predicted. For this reason, the Government is not proposing to mandate the use of a special tax code.

Special tax codes are particularly useful for individuals who are receiving a benefit and working. Staff from the Ministry of Social Development will be able to advise clients of the simple online application process.

An example of when a special tax code is useful is when secondary income results in an income tax threshold being crossed. In this case, an individual will have more tax withheld than they need to during the year. This is explained in the diagram on page 23.

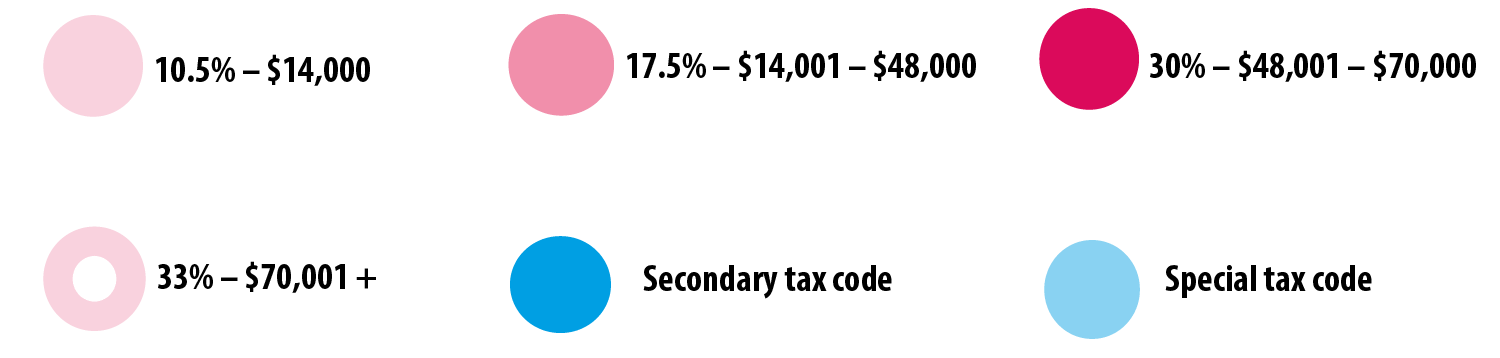

Secondary tax codes are an integral part of the PAYE system. They aim to ensure that a person earning a given amount of PAYE income from multiple sources pays the same amount of tax as a person earning the same amount of PAYE income from a single source.

Secondary tax codes ensure tax is withheld from secondary incomes at the person’s marginal tax rate. This is usually higher than their average tax rate, which is applied to their main job. The progressive nature of the personal income tax scale means that this is appropriate. By applying the person’s marginal tax rate, secondary tax codes prevent inappropriate multiple claims of the lowest (or lower) tax rates for people with concurrent sources of PAYE income, which would result in tax owing at the end of the tax year.

If secondary income results in an income tax threshold being crossed, Inland Revenue would suggest the individual uses a special tax code instead of their secondary tax code in order to ensure the individual is not over-taxed during the year. From the information held about the individual’s income, Inland Revenue would suggest an appropriate rate.

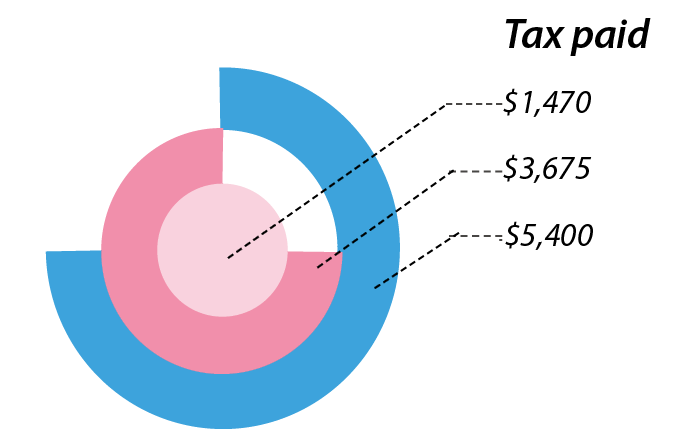

Tax rates and secondary tax codes

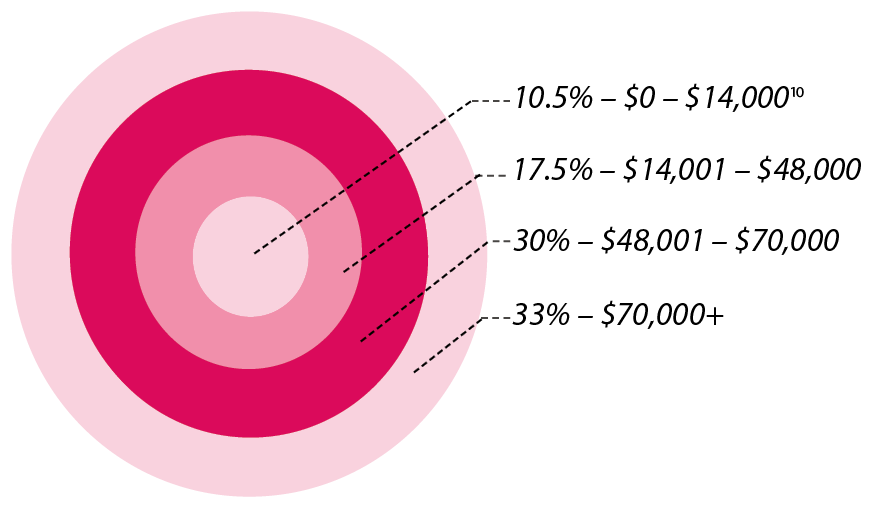

1 - New Zealand has a progressive rate system for individuals’ income tax. The rate of tax increases as income increases. The part of a person’s taxable income that falls into a band is taxed at the rate for that band.

[10]

[10]

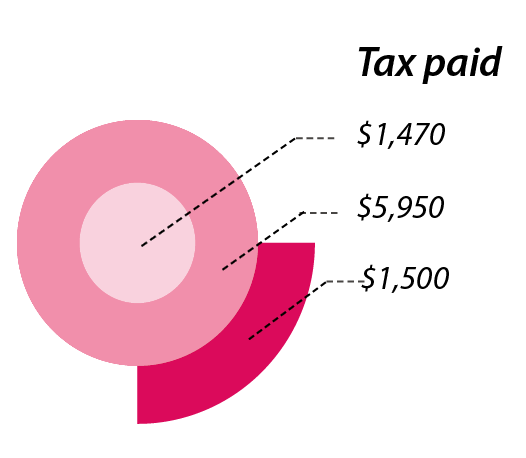

2 - This example shows a person with one job and a salary of $53,000. Total tax paid is $8,920.

3 - This example shows a person with two jobs, earning $48,000 from their first job and $5,000 from their second job ($53,000 total). A secondary tax code means that they pay the same amount of tax as a person who earns the same amount of money from one job. Total tax paid is $8,920.

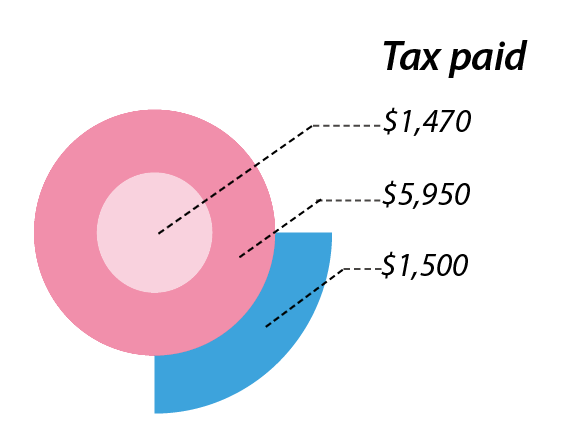

4 - It would be unfair if a second job was taxed at the rate for the first band, because part of the person’s first job was already taxed at that lower rate. If this happened, a person earning income from two jobs would pay less tax than a person earning the same amount of income from one job. Total tax paid is $7,945.

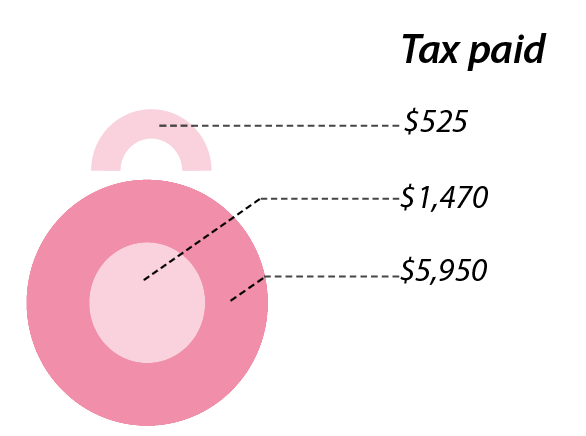

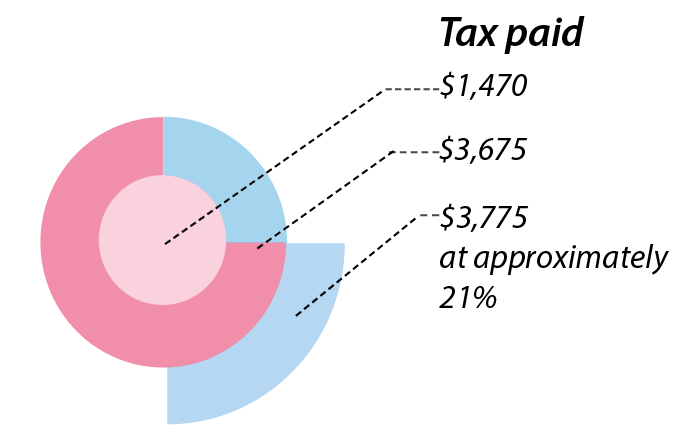

5 - When income from a second job takes a person’s total income over a tax threshold however, the person will have more tax withheld during the year than is necessary. This example shows a person with two jobs, earning $35,000 from their first job and $18,000 from their second job ($53,000 total). Total tax paid is $10,545.

6 - A special tax code can be used to ensure that no more tax is withheld than is necessary. The person in the previous example would be better off using a special tax code. Total tax paid is $8,920.

HAYLEY

Hayley works 20 hours a week at a clothes store earning $16 an hour, and is also receiving the Jobseeker Support benefit. The Ministry of Social Development always uses a primary tax code for anyone receiving a benefit, even when the benefit is not the person’s largest source of income.

This means Hayley uses a secondary tax code for the income from her job. This results in her being overtaxed during the year.

Hayley’s income per week after tax using a secondary tax code for her job:

Benefit = $42.13

Work = $264[11] using the S tax code

Hayley’s income per week after tax if she used a special tax code:

Benefit = $42.13

Work = $279.55

Using a special tax code Hayley would receive an extra $15.55 per week, or $808.60 extra during the year rather than having to wait until the end of the year to get this refunded.

Sarah has two jobs, giving her a total annual income of $55,000 ($35,000 from her main employer, and $20,000 from her second employer). The combination of these two sources of income means that her total income will cross the income tax threshold at $48,000.

Sarah’s tax codes are:

- M for her main job

- SH for her secondary income

The secondary tax code taxes the total $20,000 from Sarah’s second job at her marginal rate of 30%, even though income between $24,000 and $48,000 is usually taxed at 17.5%. This means $13,000 of her income from her second job is being taxed at 30% rather than 17.5%, so she is being overtaxed by 12.5% on that portion of her income.

Sarah’s second employer would withhold $1,625[12] more tax during the year than was necessary to meet Sarah’s ultimate tax liability (which could be refunded to Sarah at the end of the year).

If Sarah used a special tax code instead of the SH secondary tax code she would have an extra $31.25 per week in her take home pay, rather than having too much tax withheld and having to wait for a refund.

Sarah would be better off using a special tax code than a secondary tax code.

Future possibilities:

- Sarah will be able to apply for a special tax code online. Inland Revenue would notify her second employer to use the special tax code rather than the secondary tax code.

- If Sarah does not apply for a special tax code but Inland Revenue notices that the income from her second job is likely to take her income over a tax threshold it would notify Sarah and suggest she might like to use a special tax code. It would explain the difference that it would make for Sarah.

QUESTIONS FOR READERS

3.1 Do you agree that Inland Revenue should instruct a payer to change a withholding tax rate if the individual does not respond to Inland Revenue? If not, why not?

3.2 Do you support the proposal that Inland Revenue should only suggest special tax codes, rather than insist that an individual should use one? If not, why?

3.3 Do you agree that if an individual applies for a special tax code Inland Revenue should tell their employer what the code is?

3.4 If Inland Revenue thinks an individual would benefit from using a special tax code, should Inland Revenue just tell the individual or their employer too?

3.5 Can you think of other areas where Inland Revenue should work during the year with other agencies that pay income to individuals to help individuals get their tax right? If so, what are the areas and agencies?

7 The amount of this credit is 33 1/3% of the total qualifying gifts made in the year, with the limitation that the total donations claimed for cannot be more than the person’s taxable income for the year.

8 myIR is Inland Revenue’s web based digital service channel.

9 Section 25A of the Tax Administration Act.

10 Changes to the tax thresholds were announced in Budget 2017 and are due to come info effect from 1 April 2018.

11 These numbers do not take the ACC earner levy into account.

12 These numbers do not take the ACC earner levy into account.