Other policy matters

- Annual setting of income tax rates

- Demergers – company splits by Australian ASX-listed companies

- Bank account requirement for IRD numbers

- Petroleum mining decommissioning

- Schedule 32 overseas donee status

- Trustee capacity

- Pharmac rebates and GST

- Lloyd’s of London – tax simplification

ANNUAL SETTING OF INCOME TAX RATES

(Clause 3)

Summary of proposed amendment

The Bill sets the annual income tax rates that will apply for the 2017–18 tax year. The annual rates to be confirmed are the same that applied for the 2016–17 tax year.

Application date

The provision will apply for the 2017–18 tax year.

Key features

The annual income tax rates for the 2017–18 tax year will be set at the rates specified in schedule 1 of the Income Tax Act 2007.

DEMERGERS – COMPANY SPLITS BY AUSTRALIAN ASX LISTED COMPANIES

(Clauses 8, 45, 63, 172(3) and 182)

Summary of proposed amendment

Amendments to the dividend rules in the Income Tax Act 2007 are proposed so that certain transfers of shares received by New Zealand shareholders as a result of a company split (demerger) by a listed Australian company are not treated as a dividend.

Application date

The amendments will apply for the 2016–17 and later income years.

Key features

New section CD 29C proposes that the transfer by an Australian Stock Exchange (ASX) listed company of shares in a subsidiary company is not a dividend.

New section ED 2B sets out the conditions needed for section CD 29C to apply and the tax consequences for taxpayers who hold the ASX-listed company’s shares as revenue account property. The new section also provides for the adjustment of available subscribed capital amounts.

Consequential changes are proposed to sections FC 2 and YA 1. Schedule 25 is also to be consequentially amended.

Background

A demerger occurs when a corporate group splits off part of itself and distributes that part to its shareholders. As a consequence, companies that were grouped under a single shareholding are separated into two different shareholdings.

Demergers, which do not involve a distribution of income, should not give rise to taxation consequences. However, under the Income Tax Act’s current dividend rules, the full value of the shares in the demerged (spun-out) company is treated as a dividend (even though there is no distribution of income and the shareholder’s economic ownership does not change). In practice, the amount of the dividend is usually significant, as it will equal a significant percentage of the corporate group’s total market value.

The proposed amendments in the Bill deal with demergers by certain ASX-listed companies. The limited scope of the amendments is intended to deal with where the tax problems with demergers are the most immediate. Consideration of a more comprehensive set of rules for demergers by New Zealand and non-resident companies generally would need to be separately prioritised under the Government’s tax policy work programme.

Detailed analysis

Scope of the proposed amendments

The proposed amendments apply to shares and stapled securities issued by Australian-resident companies listed on the ASX. A company is considered an ASX-listed Australian company if it has shares included in an index that is an approved index under the ASX Operating Rules. From the 2017–18 income years, the scope of the ASX-listed Australian company definition will be widened to include a company included on the official list of ASX Limited, in line with the changes to the term made by the Taxation (Transformation: First Phase Simplification and Other Measures) Act 2016.

The requirement that the Australian company maintain a franking credit account means that the proposed amendment does not apply to unit trusts. Unit trusts are not generally taxed as companies under Australian tax law and distributions from unit trusts are not taxed as dividends in Australia.

To ensure that the proposed changes are not used to effect an in-substance distribution of income, proposed section ED 2B(1)(d) requires that the transfer is not a dividend under the Australian Income Tax Assessment Act 1936. Taxpayers can refer to statements from the Australian Taxation Office or the company’s demerger documents to help determine this.

As different countries have different taxation rules for companies and dividends, the scope of the provision is limited to companies that are resident in Australia. Australian tax law already includes anti-avoidance rules that are designed to prevent abuse and ensure that any relief from dividend taxation applies to demergers that do not involve an in-substance distribution of income.

Treatment of shareholders

Proposed section ED 2B sets out the consequences for taxpayers affected by a demerger that holds the shares as revenue account property. The new section sets out the rules for determining a new cost base for shares in the splitting company and shares in the new company. For pragmatic and compliance reasons, it is proposed that available subscribed capital amounts should be unchanged for the splitting company, and set at zero for the new company.

BANK ACCOUNT REQUIREMENT FOR IRD NUMBERS

(Clause 244)

Summary of proposed amendment

Currently, offshore persons applying for an IRD number generally need to provide the Commissioner with evidence of a functional New Zealand bank account. Due to practical issues associated with this requirement, the proposed amendment gives the Commissioner a discretion to issue IRD numbers in cases where there is no New Zealand bank account but the Commissioner is satisfied with the applicant’s identity.

Application date

The proposed amendment will apply from the date of enactment of the Bill.

Background

Section 24BA of the Tax Administration Act 1994 provides that the Commissioner must not allocate an IRD number in response to an offshore person’s request unless the Commissioner first receives a current New Zealand bank account number for the offshore person. This section is subject to a limited number of exceptions. A bank account is not required when:

- A person requires an IRD number only because they are a non-resident supplier of goods and services under the Goods and Services Tax Act 1985.

- A reporting entity under the Anti-Money Laundering and Countering Financing of Terrorism Act 2009 has conducted customer due diligence procedures for the offshore person.

The bank account requirement is also simplified for non-resident seasonal workers. They can use the NSW tax code for the first month of their employment, even though they may not have an IRD number and/or a New Zealand bank account. After that month, an IRD number must be provided for the NSW tax code to continue to apply, and a bank account is then required.

The current bank account requirement has however caused practical issues in a number of cases. Significant delays or inability to obtain a New Zealand bank account in some cases have made it difficult for people to comply with their New Zealand tax obligations. The requirement can also impose undue compliance costs in some cases.

The proposed amendment provides the Commissioner with a discretion to issue IRD numbers to offshore persons who do not have a New Zealand bank account, if she is satisfied with the identity of the offshore person.

PETROLEUM MINING DECOMMISSIONING

(Clauses 17–21, 33–38, 48–52, 57, 95, 99, 100, 102–104, 113, 172(8), (44), (45), (47) and (49), 265 and 266)

Summary of proposed amendments

The tax rules for petroleum mining currently include a “spread-back” process which allows prior income tax periods to be reopened to include losses arising from decommissioning expenditure incurred in the current year. This method ensures that decommissioning expenditure, which is a large cost incurred near or at the end of production, does not result in a loss carried forward that would be of no value to the petroleum miner unless it had income from another source.

As the spread-back requires Inland Revenue to amend assessments for previous periods it incurs high compliance and administration costs and is considered an outdated process. A number of other issues have also been identified where the current petroleum mining decommissioning rules are not sufficiently detailed or arrive at an incorrect outcome.

As well as correcting the identified issues, the spread-back mechanism for deducting decommissioning costs is proposed to be replaced with a refundable credit similar to other refundable credits already included in the Income Tax Act 2007, most relevantly the refundable credit for mineral mining rehabilitation expenditure.

Application date

The proposed replacement of the spread-back with a refundable credit and other related provisions will apply for the 2018–19 and later income years.

The proposed repeal of the terminating provisions in sections IZ 2 and IZ 3 and consequential changes will also apply for the 2018–19 and later income years.

The proposed correction of the cross-reference in section IS 5(1)(a) will apply for the 2008–09 and later income years to align with the commencement of the Income Tax Act 2007.

The proposed change to confirm credit use-of-money interest (UOMI) does not arise for the loss spread-back will apply to income tax returns filed after the introduction date of the Bill. This provision will be repealed for the 2018–19 and later income years along with the other spread-back provisions, as noted above.

Key features

Refundable credit

The main effect of the proposals in the Bill is to replace the existing spread-back process for petroleum mining decommissioning with a refundable credit. As part of these amendments a number of further refinements to the existing legislation have been included.

Under the proposed new rules, a petroleum miner will be eligible for a refundable credit for the following amounts:

- any decommissioning expenditure in the year it is incurred; and

- any development expenditure that has not been deducted at the time commercial production ceases.

The refundable credit will be calculated by multiplying the qualifying expenditure by the petroleum miner’s current tax rate. The maximum refundable credit will be limited to income tax paid by the petroleum miner, or a consolidated group it is a member of, in prior years. The exception to this is when a petroleum miner is decommissioning operations outside New Zealand, in which case the maximum refundable credit will be limited to income tax paid on petroleum mining operations outside New Zealand.

To prevent a petroleum miner from temporarily ceasing commercial production in order to access a refundable credit, any expenditure qualifying for a refundable credit will be added back as income if production restarts.

Use-of-money interest

When a petroleum miner uses the spread-back process it receives a refund of income tax paid in prior years. This is a mechanism for recognising the tax benefit of expenditure incurred in a current period rather than a reduction in tax payable in those prior years. Accordingly, it was never intended that these refunds should be eligible for credit UOMI. The current provisions do not reflect this intent. The Bill therefore proposes to introduce a provision to ensure credit UOMI is not paid on any refunds arising from the current spread-back process.

Terminating provisions

Sections IZ 2 and IZ 3 are terminating provisions to preserve concessionary treatment that applied to petroleum miners before the rules changed in 1990. These provisions, and a number of consequential provisions, are now redundant and are proposed to be repealed.

One of these consequential provisions is the section YA 1 definition of a “petroleum mining company”. The Bill proposes to remove this definition and several provisions that employ it. Under the proposals in the Bill, one instance of “petroleum mining company” will remain in the Income Tax Act 2007 – in the section YA 1 definition of a “controlled petroleum mining holding company”. This usage was not intended and will not rely on the “petroleum mining company” definition. Instead it will continue to rely on the ordinary meaning of the words as a company that undertakes petroleum mining.

Background

The tax rules for petroleum mining split the life of a petroleum field into two distinct phases: exploration and development. “Exploration” is generally done under a prospecting or exploration permit and involves looking for oil and gas reserves that can be extracted in commercially feasible quantities, whereas “development” is done under a mining permit and involves the extraction of oil or gas for commercial production.

“Exploration expenditure” is deductible when incurred whereas “development expenditure” is spread over either seven years or under the reserve depletion method which spreads the deduction over the remaining life of the field.

A petroleum miner will incur significant decommissioning expenditure before relinquishing its mining permit. Decommissioning is what happens to wells, installations and surrounding infrastructure when a petroleum field reaches the end of its economic life. Offshore decommissioning usually involves:

- the plugging and abandoning of wells;

- removal of equipment; and

- the complete or partial removal of installations and pipelines.

The policy underlying the current tax rules recognises that this expenditure is an unavoidable consequence of the production process and that industry-specific timing rules should allow deductions for this expenditure to be effectively offset against income derived in earlier periods.

In the absence of industry-specific tax rules a petroleum miner may pay tax in earlier periods then incur decommissioning expenditure which would be carried forward as a loss to future periods. Unless the petroleum miner had income from other sources, such as a separate field, this loss would never be utilised. The petroleum mining rules recognise that this would be inappropriate and would discourage petroleum exploration and development. Or, it could encourage a petroleum miner to decommission a field that still contained economically recoverable reserves to ensure that any deductions could be offset against the higher income amounts that are derived in earlier years of a field’s life.

To address this issue, a petroleum miner can request that the Commissioner reopen earlier tax years to claim a deduction for losses arising “because of the relinquishment of the permit”. This process is referred to as a “spread-back”. Deductions are spread back to a previous year to the extent taxable income was returned generating a refund of tax, and if those deductions exceed the amount of profit the remainder is carried back another year and so on.

Historically, there were a number of spread-back provisions, for both income and deductions, in the Income Tax Act 2007. These spread-backs are viewed as an outdated approach that results in high compliance and administration costs. Many spread-back provisions have been removed as part of previous reforms and there are no remaining provisions that spread back deductions equivalent to the petroleum decommissioning rules.

The need to amend the petroleum mining rules is an opportunity to modernise the decommissioning rules in a manner that is broadly consistent with existing policy but reduces compliance and administration costs.

Detailed analysis

Amount of the refundable credit

Under the proposed amendments a refundable credit will only be available to a petroleum miner for qualifying deductions. The deductions that can qualify for a refundable credit are expenditure on decommissioning or any previously undeducted development expenditure at the time petroleum mining operations are permanently ceased.

To the extent a petroleum miner has a loss that is equal to or less than the qualifying deductions this amount is multiplied by the petroleum miner’s tax rate. For example, a petroleum miner with a $1,000,000 loss for a year, including $800,000 of decommissioning expenditure, could qualify for a refundable credit of $800,000 x 28% = $224,000.

The refundable credit will be capped at the amount of income tax paid by the petroleum miner, and any consolidated group it is a member of, in all previous years.

If the refundable credit arises from petroleum mining operations outside New Zealand, the amount of the refundable credit will be limited to New Zealand tax paid on those operations. No similar ring-fencing is proposed for petroleum mining operations within New Zealand.

Any losses that did not qualify for a refundable credit would continue to be carried forward, subject to satisfying ordinary rules.

Relinquishment of a permit

The current spread-back process is driven off either the year in which a petroleum permit is relinquished or expenditure is incurred because of the relinquishment of the petroleum permit.

This restriction causes a number of issues where the law is either unclear if a spread-back is available or disallows a spread-back when there is no good policy reason to do so. These issues include:

- when a petroleum miner is required to undertake actions that are akin to removal or restoration operations while production is still continuing;

- when a petroleum miner has undertaken removal or restoration operations as part of a wind-up phase when production has ceased but there is a delay in relinquishing the permit; and

- when a petroleum miner incurs removal or restoration expenditure before surrendering acreage from a petroleum mining permit but does not relinquish the entire permit.

The Bill proposes that the requirement for a permit to be relinquished is replaced. Instead, a refundable credit will be available in the year qualifying decommissioning expenditure is incurred. In addition, a refundable credit will be available to the petroleum miner for any previously undeducted development expenditure in the year commercial production ceases.

Decommissioning

The definition of “removal or restoration operations” will effectively be replaced by the new definition of “decommissioning”. This change arises predominately due to the removal of the relinquishment of a permit criterion, as discussed above.

The proposed definition of “decommissioning” is intended to cover actions undertaken by (or on behalf of) a petroleum miner to transition from the commercial production of petroleum to the eventual relinquishment of the permit. These actions can be undertaken at any point during the life of the permit area and will no longer be linked directly to the relinquishment of the permit.

It is intended that, except as noted below, the definition of “decommissioning” does not apply to an exploration well. Expenditure on abandoning an exploration well will continue to be deductible under section DT 1(1) but will generally not meet the definition of “decommissioning” so will not qualify for a refundable credit.

Actions to abandon a well that was drilled as an exploration well will only meet the definition of “decommissioning” in the following circumstances:

- Exploration wells that have been subsequently used for commercial production. These wells will have triggered sections CT 3 and DT 7 and will meet the definition of a “commercial well” in paragraph (b)(i) of the decommissioning definition.

- Exploration wells that are geologically contiguous with, and abandoned as part of an arrangement that includes decommissioning a commercial well. Such wells are used, or are suspended for potential future use, to support the extraction from commercial wells, and it may be commercially sensible for them to be abandoned at the same time that the commercial well is decommissioned.

In addition to the actions above, the decommissioning definition also includes the ongoing monitoring of a commercial or exploratory well that had itself met the “decommissioning” definition.

Petroleum mining operations

The definition of “petroleum mining operations” in section CT 6B is proposed to be amended by removing the “removal or restoration operations” criteria. The equivalent of “removal or restoration operations” in the proposed legislation is “decommissioning”. However, decommissioning has not been added to the definition of petroleum mining operations as the proposed definition of decommissioning uses the term “petroleum mining operations” so including decommissioning as part of petroleum mining operations would create a circular reference. So that the scope of petroleum mining operations is broadly maintained, a number of references within the Income Tax Act 2007 to petroleum mining operations are proposed to have “and decommissioning” added.

Ceasing commercial production

A petroleum miner who meets the other requirements will be entitled to a refundable credit for any previously undeducted development expenditure. This entitlement will be triggered once a petroleum miner permanently ceases commercial production. The definition of “petroleum mining operations” will be amended to exclude removal or restoration operations so that decommissioning will not be part of petroleum mining operations. As a consequence, in most instances, a petroleum miner that ceases commercial production will do so while continuing to undertake decommissioning, and production will cease in a period prior to the relinquishment of the permit.

“Commercial production” is not a defined term but is already used in a number of places in the Income Tax Act 2007. It aligns with the term used in section DT 6 as “petroleum produced in commercial quantities on a continuing basis under a petroleum permit”. Petroleum extracted from an exploration well or under an exploration permit would not be treated as commercial production as it is not intended to be extracted on a continuing basis.

Undeducted development expenditure will arise when a petroleum miner spreads development expenditure:

- under the default method and ceases commercial production within seven years of development expenditure being incurred; or

- under the reserve depletion method and ceases production before extracting all of the petroleum included in the probable reserve amount in the formula in section EJ 12B(3).

The justification for allowing a refundable credit when commercial production ceases is that at this point the petroleum miner will no longer be deriving an enduring benefit from this development expenditure in future years even if the petroleum permit has not yet been relinquished.

Restarting commercial production

To prevent a petroleum miner from temporarily ceasing production in order to obtain a refundable credit before restarting production, a provision will add back as income amounts of undeducted development expenditure qualifying for a refundable credit in the year commercial production restarts. This income will then be spread, consistent with other development expenditure, in a similar manner to that which already applies for the claw-back of exploration wells used for commercial production.

This provision will apply when production is restarted to the extent that petroleum assets that were used in the original commercial production are reused in the resumed commercial production. This provision will not apply when a petroleum miner restarts production in the same area using entirely new assets.

Notification requirements

A petroleum miner must notify Inland Revenue before filing a return that includes a refundable credit. A separate email address for the petroleum mining desk within the Assurance area of Inland Revenue will be set up for this notification to be sent to. Further details on this notification process will be set out in a Tax Information Bulletin shortly after enactment of the Bill.

This requirement has been included in the proposed legislation due to the potential size of a refundable credit and also because a petroleum miner that has finished decommissioning may no longer have a presence in New Zealand if the refundable credit was subsequently found to be incorrect.

Aside from being before filing the return of income, no specific time will be specified for this notification to be provided. However, officials expect that providing the notification as soon as possible prior to the return being filed may assist in facilitating a timely refund.

A petroleum miner that did not satisfy the notification requirement may be prevented from accessing a refundable credit in which case any losses would be carried forward in the standard manner.

Interaction with imputation credit accounts

A petroleum miner that is an ICA company will be required to have a sufficient credit balance in its imputation credit account to obtain a refund from a refundable credit. This arises under the existing legislation, as a refundable credit is a refund of overpaid tax under section RM 2(1B) and a refund of overpaid tax for an ICA company is restricted by section RM 13.

Farm-out arrangements

Farm-out arrangements are an existing feature in the petroleum mining rules where another party undertakes work for the petroleum miner in exchange for an interest in the permit or the profits arising from the permit. A farm-in party is already entitled to a deduction for farm-in expenditure, that if it were incurred by a farm-out party would be petroleum development expenditure, exploratory well expenditure, or prospecting expenditure.

To the extent a farm-in party incurs decommissioning expenditure or has unamortised development expenditure upon the cessation of commercial production these deductions will also be eligible for a refundable credit. For the avoidance of doubt a number of provisions are proposed to specifically allow for this treatment by a farm-in party.

As with a petroleum miner, a farm-in party with unamortised development expenditure will only be eligible for a refundable credit when commercial production in a permit area ceases. If a farm-in party ceases production in that permit area but commercial production continues by a petroleum miner or another farm-in party no refundable credit will be available.

SCHEDULE 32 OVERSEAS DONEE STATUS

(Clause 183)

Summary of proposed amendments

The Bill proposes to amend the Income Tax Act 2007 by adding five charities to the list of donee organisations in schedule 32.

Application date

The amendments will come into force on 1 April 2017.

Key features

It is proposed to add five charitable organisations to schedule 32 of the Income Tax Act 2007, making donors to the following charities eligible for tax benefits on their donations.

- Byond Disaster Relief New Zealand

- Flying for Life Charitable Trust

- Médecins Sans Frontières

- Tony McClean Nepal Trust

- Zimbabwe Rural Schools Library Trust.

Background

Donors to organisations listed in schedule 32 are entitled, as individual taxpayers, to a tax credit of 331/3% of the monetary amount donated, up to the value of their taxable income. Companies and Māori Authorities may claim a deduction for donations up to the level of their net income. Charities that apply funds towards purposes that are mostly outside New Zealand must be listed in schedule 32 of the Income Tax Act 2007 before donors become eligible for these tax benefits.

Detailed analysis

The five charitable organisations proposed to be added to schedule 32 are engaged in the following activities:

Byond Disaster Relief New Zealand

Byond Disaster Relief New Zealand was formalised in 2015 to carry out New Zealand’s operations under the United Kingdom charity Byond Disaster Relief banner. The New Zealand charity’s purposes are directed at providing sustained support and assistance to communities in the immediate aftermath of a natural disaster (emergency relief and supplies) and early long-term recovery. Their work focuses on supporting the rebuild and repair of infrastructure, particularly damaged schools, hospitals and medical clinics. The New Zealand trust has been involved in the responses to the recent Nepal earthquake and the 2016 cyclones and typhoons affecting Vanuatu and Fiji.

Flying for Life Charitable Trust

Established in 2009, Flying for Life Charitable Trust is the humanitarian aid arm of Mission Aviation Fellowship New Zealand (a charity that has been in existence since 1959). Flying for Life’s objectives are directed at the relief of poverty and providing emergency responses to natural disasters in the form of mobile (aviation) medical assistance and supporting aid agencies with transport of personnel and freight. Flying for Life’s largest project is focused on Papua New Guinea. It is also currently active in Africa, Timor Leste, Bangladesh and Mongolia.

Médecins Sans Frontières New Zealand Charitable Trust

Formed in 1971, Médecins Sans Frontières (also known as “Doctors Without Borders”) is a humanitarian organisation focused on providing emergency medical assistance to people affected by armed conflicts, epidemics, natural disasters and exclusion from healthcare around the world. The Médecins Sans Frontières New Zealand Charitable Trust was incorporated on 9 March 2016. The New Zealand trust activities are directed at raising funds in New Zealand to support Médecins Sans Frontières’ projects in nearly 70 countries around the world.

Tony McClean Nepal Trust

The Tony McClean Nepal Trust is active in the Lamjung district of Nepal. The Trust’s efforts are directed at improving education outcomes and the district’s infrastructure. Projects include providing the means for communities to access clean drinking water, reducing air pollution in homes through flued wood burners and funding the salaries of teachers and health care professionals in Lamjung. More recently, the Trust has been involved in providing disaster relief in the region following the 2015 Nepal earthquake.

Zimbabwe Rural Schools Library Trust

The Zimbabwe Rural Schools Library Trust, established in 2013, provides education and reading resources to underprivileged rural schools in Zimbabwe.

TRUSTEE CAPACITY

(Clauses 77(1), (2), and (4), 172(5), 172(35), 173, 175, 176, 185, 187(10), 264(1), and 309, and schedule 1)

Summary of proposed amendment

The Bill proposes to introduce a general rule into Part Y of the Income Tax Act 2007 to distinguish between a trustee’s personal or body corporate capacity, and their separate trustee capacity. A number of exceptions to this general rule are proposed where it would be contrary to the policy intent of the provisions to exclude a corporate or natural person trustee. There are also a number of proposed consequential amendments to the Income Tax Act 2007, the Tax Administration Act 1994, and the Goods and Services Tax Act 1985 resulting from the general trustee capacity amendment.

Application date

The amendments will apply from the date of enactment.

Key features

The key changes proposed in the Bill relate to the following:

Income Tax Act 2007

- The introduction of a general rule to recognise that a person acting as a trustee of a trust is acting in a capacity that is separate from their other capacities.

- An amendment to the “company” definition in section YA 1 excluding a company acting in its capacity as trustee.

- An amendment to the “natural person” definition in section YA 1 excluding a natural person acting in their capacity as trustee.

- A number of consequential amendments of a rationalising nature resulting from the general trustee capacity amendment.

- An amendment to the “close company” definition in section YA 1 to allow trustees to continue to qualify as shareholders of a close company.

- An amendment to section HD 15 (asset stripping of companies) to ensure the provision applies to a company that is acting in the capacity of trustee.

- An amendment to the residence rules in sections YD 1 and YD 2 to ensure that the residence rules for natural persons and companies continue to apply to these persons acting in the capacity of trustee.

Tax Administration Act 2007

- Introducing a new definition of “natural person” to exclude a natural person acting in their capacity as trustee except for the purposes of the definition of qualifying resident foreign trustee and the serious hardship provisions in sections 177 and 177A.

Goods and Services Tax Act 1985

- The introduction of a provision into the GST associated person definition to associate a trustee and a person with the power to appoint or remove that trustee.

Background

The measure is intended to address the uncertainty surrounding the application of the voting interest test for corporate trustees as a result of two recent High Court decisions, Concepts 124 Ltd v Commissioner of Inland Revenue [2014] NZHC 2140 and Staithes Drive Development Ltd v Commissioner of Inland Revenue [2015] NZHC 2593. These decisions have changed how the voting interest test, which is used to measure the ownership of companies, including their association, is applied to corporate trustees. In both cases, the High Court held that the voting interests in the relevant companies were held by the legal owner of shares, and effectively ignored the capacity in which those shares were held. This means that the voting rights attached to shares owned by a corporate trustee are attributed to that trustee’s natural person shareholders in their personal capacity.

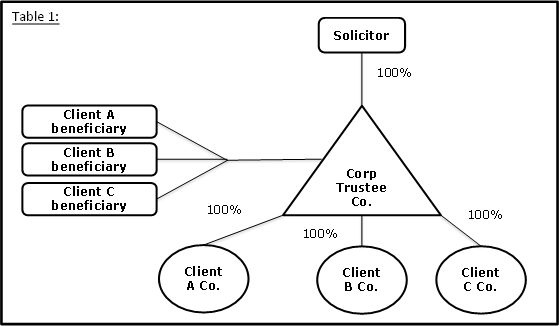

Applying this approach may lead to overreach of the application of the associated person rules. For example, if a solicitor holds shares in a trustee company, which in turn holds shares in a number of unrelated client companies on trust for unrelated beneficiaries, the otherwise unrelated client companies would be associated for tax purposes (see Table 1). This could also be the case for other trustee companies that hold shares in companies for otherwise unrelated trusts.

While the High Court’s decision resulted in the correct outcome in these cases (that the companies were associated), the approach is inconsistent with the stated policy intention, which is that corporate trustees should be treated as ultimate shareholders and not looked-through.

The Bill proposes an amendment to align the legislation with the original policy intent as reflected in Tax Information Bulletin No 5, November 1989; Tax Information Bulletin Vol 3, No 7, April 1992; and Tax Information Bulletin Vol 21, No 8, 2009. The proposed amendment addresses this by introducing a general rule for trustee capacity, and some consequential changes to defined terms and operative provisions. The general rule confirms that a person’s trustee capacity is separate from a person’s other capacities.

Detailed analysis

General rule - general trustee capacity amendment

Proposed section YA 5 will provide the core rule to distinguish between a trustee’s personal, body corporate, or other capacity, and their separate trustee capacity. The proposed amendment will clarify that when a person is acting in the capacity of trustee of a trust, they are treated, for income tax purposes, as acting in that capacity and not in their personal, body corporate, or other capacities.

The proposed amendment clarifies that:

- any reference to “company” in the Income Tax Act does not include a corporate trustee (subject to any identified exceptions); and

- any reference to “natural person” in the Income Tax Act does not include a natural person trustee (subject to any identified exceptions).

Officials consider that the amendment is consistent with the policy intent of most of the rules referring to companies and natural persons. Officials have also identified some specific exceptions to the general rule which are explained below.

The proposed amendment will also address the overreach that may arise as a result of the High Court decisions by ensuring that if a person is the trustee of more than one trust, the person is acting in a different capacity for each trust. In particular, the amendment will ensure that a corporate trustee is not looked-through, including for the purpose of association.

“Company” and “natural persons” definitions

As part of the introduction of the general trustee capacity rule, the Bill proposes amendments to the section YA 1 definitions of “company” and “natural person”.

“Company”

The amendment to the definition of “company” in section YA 1 introduces a new limb which excludes corporate trustees from the definition. Under this proposed rule, if a company is acting in its capacity as corporate trustee, it will be treated, for tax purposes, as a trustee (and not a company).

This is consistent with the policy intent of most of the rules referring to companies. For example, the various company loss grouping and dividend provisions are not intended to apply to a company acting in its capacity as trustee. Also the exemption in section CW 9 for dividends derived from a foreign company would not apply to dividends derived by a corporate trustee resident in New Zealand.

Another consequence of the general rule is that corporate trustees will not be able to apply the automatic interest deduction for companies in section DB 7. Like other non-corporates, they will need to satisfy the general permission to claim a deduction for interest expenditure under section DB 6.

“Natural person”

Similarly, the amendment to the definition of “natural person” introduces a new limb which excludes natural person trustees from the definition. Under this proposed rule, if a natural person is acting in their capacity as natural person trustee, they will be treated, for tax purposes, as a trustee (and not a natural person).

Exceptions to general rule

Officials have also identified a number of exceptions to the general rule which are explained below.

“Close company” definition

In response to the general trustee capacity amendment, the Bill proposes an amendment to section YA 1 to include trustees (natural person or corporate) in the definition of “close company”. The amendment recognises that many close companies are owned in family trust structures.

As a consequence of this change, a minor amendment to section DG 3 is proposed to remove the reference to natural person trustees – as the clarification will no longer be necessary.

Asset stripping of companies

The Bill proposes an amendment to section HD 15 (asset stripping of companies) to ensure the provision applies to a company acting in its capacity as trustee. The amendment is consistent with Inland Revenue’s view that section HD 15 applies to corporate trustees. Section HD 15 authorises the Commissioner of Inland Revenue to recover income tax from the directors and shareholders of a company who have entered into an arrangement or transaction to deplete the company’s assets so that it is unable to satisfy its tax liabilities. Without the proposed amendment, a corporate trustee could enter an arrangement to deplete its assets so that it is unable to satisfy its tax liabilities, and the Commissioner would have no means of recovering any of the corporate trustee’s unpaid income tax from its directors or shareholders.

Residence rules

The Bill proposes an amendment to the residence rules in subpart YD of the Income Tax Act to clarify that both the natural person residency test in section YD 1, and the company residency test in section YD 2, continue to apply to trustees. Without this amendment, there would be no means of testing trustee residence.

Along with this amendment, the Bill proposes to align section YD 1 with its original policy intent by replacing all references to “person” in the section with “natural person”. This clarifies the current practical application of section YD 1 to natural persons only.

Consequential amendments

A number of consequential amendments to the Income Tax Act are proposed to ensure the core rule applies consistently throughout the Act. These amendments either remove or replace phrases that will no longer be necessary given the general trustee capacity rule, or they repeal provisions that will no longer be necessary as a result.

The proposed consequential amendments affect the following provisions:

- CQ 5(1)(d) (When FIF income arises)

- DG 3(3) (Meaning of asset for this subpart)

- DG 14(1)(b)(i) (Interest expenditure: non-corporate shareholders)

- DN 6(1)(d) (When FIF loss arises)

- EX 68(1)(a) (Measurement of cost)

- FE 3(1)(a) (Interest apportionment for individuals)

- FE 4(1), paragraph (c) of the definition of excess debt entity

- FE 4(1), definition of natural person

- HA 7(1)(a) (Shareholding requirements)

- MA 1 (What this subpart does)

- OB 1(2)(ii) (General rules for companies with imputation credit accounts)

- RE 11(1) (Notification by companies)

- RE 12(5)(a)(ii) (Interest)

- YA 1, paragraphs (a) and (b) of the definition of initial provisional tax liability

- YA 1, paragraph (a)(i) of the definition of “look-through counted owner”

- YA 1, paragraph (c) of the definition of “look-through interest”

- YB 3(5) (Company and a person other than company)

- Schedule 1, part D, clause 4 (Basic tax rates: income tax, ESCT, RSCT, RWT, and attributed fringe benefits)

Tax Administration Act 1994

The Bill proposes a new “natural person” definition in section 3 of the Tax Administration Act 1994 to exclude a natural person acting in their capacity as trustee, consistent with the position under the Income Tax Act. The “company” definition in the Income Tax Act 2007 will continue to apply to the Tax Administration Act 1994 by virtue of section 3(2).

The proposed amendment includes a carve-out to ensure all references to “natural person” in the “qualifying resident foreign trustee” definition and both sections 177 and 177A (serious hardship provisions), include a natural person trustee. The proposed carve-out is consistent with Inland Revenue’s policy that the hardship provisions in the Tax Administration Act 1994 are applicable to natural person trustees as natural person trustees are personally liable for trustee debts.

Goods and Services Tax Act 1985

The Bill proposes new section 2A(1)(hb) in the Goods and Services Tax Act 1985. This will provide a mirror provision to section YB 11 of the Income Tax Act 2007, by providing a test associating a trustee and a person with the power to appoint or remove that trustee. This will help ensure that there would be association in similar situations to those that arose in the above High Court decisions.

The proposed provision excludes a person holding the power of appointment or removal from the associated person test if they hold their position by virtue of their position as a provider of professional services. This carve-out is consistent with the equivalent test in section YB 11 of the Income Tax Act.

PHARMAC REBATES AND GST

(Clauses 308 and 310)

Summary of proposed amendment

The amendment addresses current uncertainty around the GST treatment of rebates paid to Pharmac under an agreement to list a pharmaceutical on the Pharmaceutical Schedule. The amendment would ensure that the GST treatment for rebates paid to Pharmac is the same regardless of whether the rebates relate to pharmaceuticals purchased for use in the hospital setting (hospital rebates) or purchased for use in the community setting (community rebates).

Application date

The amendment will apply to rebates paid to Pharmac on or after 1 July 2018.

Key features

Section 25 of the Goods and Services Tax Act 1985 (the GST Act) is being amended to exclude rebates paid to Pharmac (either acting on its own account or as an agent for a public authority) under a Pharmac agreement, from altering the previously agreed consideration for the supply of pharmaceuticals.

The amendment would mean that regardless of the rebate, pharmaceutical suppliers and recipient DHBs will not have to make the necessary GST adjustments required under section 25 of the GST Act.

The terms “Pharmac”, “Pharmac agreement”, and “Pharmaceutical” are defined in proposed section 25(7) of the GST Act and are linked to the definitions and concepts in the New Zealand Public Health and Disability Act 2000.

Background

Under section 25 of the GST Act, suppliers and recipients are required to make adjustments when the agreed consideration for the supply of goods and services changes – for example, because of an offer of a discount or otherwise. The adjustments ensure that the correct amount of GST is returned and claimed on the supply. Credit and debit notes are used to adjust GST if a tax invoice or GST return has already been issued.

Currently, rebates are paid to Pharmac (acting as agent for GST-registered DHBs) under a Pharmac agreement for a range of different circumstances, including when the pharmaceutical supplier wishes to provide a discount on a confidential basis. These rebate payments are passed onto DHBs in full. Owing to the unique way pharmaceuticals are publicly purchased in New Zealand, these rebates paid by suppliers to Pharmac can have different GST treatments depending on whether the pharmaceuticals are purchased in the community setting or the hospital setting.

Community rebates (which relate to pharmaceuticals purchased for use in the community by pharmacies) are not subject to GST as these payments are not considered to alter the previously agreed consideration for the supply of pharmaceutical products. In other words, there is not a sufficient connection between the rebate payment and the original purchase of the pharmaceuticals. Conversely, hospital rebates (which relate to pharmaceuticals purchased by DHBs for use in hospitals) are considered to alter the previously agreed consideration for the supply of pharmaceuticals and, therefore, are subject to GST.

The different GST treatment gives rise to uncertainty and compliance costs for Pharmac and their suppliers in having to differentiate, for GST purposes, between community and hospital rebates and has become unworkable in practice.

In the 2015–16 financial year, community rebates comprised 93 percent of all Pharmac rebates, while hospital rebates made up the remaining 7 percent. The proposed amendment clarifies the current uncertainty associated with the different GST treatments. It would also minimise the administrative costs of change to Pharmac and its suppliers by aligning the GST treatment of hospital rebates with 93 percent of Pharmac rebates that are already not subject to GST.

The fiscal impact of the rebates is neutral under either setting. In the hospital setting the supplier grosses up the rebate payments by the GST amount, and the subsequent adjustments made by the supplier and DHBs cancel each other out.

LLOYD’S OF LONDON – TAX SIMPLIFICATION

(Clauses 16, 43, 62, 76, 78, 91, 172(31), (33), (38), (55) and (69), 179 and 180(1))

Summary of proposed amendments

Amendments to the Income Tax Act 2007 are proposed to simplify tax compliance obligations for Lloyd’s of London (Lloyd’s) in connection with the taxation of life insurance business carried on in New Zealand.

Application date

The amendments will apply to Lloyd’s term life insurance policies sold on and after 1 April 2017.

Key features

Collectively the proposed amendments create a special presumptive tax on premiums received by Lloyd’s from the sale of term life insurance policies in New Zealand. Tax would be assessed and returned by Lloyd’s authorised New Zealand agents.

The presumptive tax would be calculated on the basis of 10 percent of gross premiums. The tax rate applicable to this income would be 28%, consistent with the current rate of company tax. This approach is consistent with the policy framework for taxing general insurance sold to the New Zealand market by non-resident insurers.

New section YD 8B determines when the sale of life insurance by Lloyd’s has a source in New Zealand. The new section specifies that 10 percent of the gross premium has a source in New Zealand if the life insurance policy is offered or was offered and entered into New Zealand. The section also specifies the special tax rules that apply to the New Zealand sourced income and the type of life insurance policies affected. The section applies to term life insurance policies – life insurance policies that insure life risk only. Profit participation policies and savings product policies are not within the scope of the proposed amendments.

New section CR 3B treats the portion of the premium that has a source in New Zealand as taxable income.

New section DW 3B denies deductions for any expenditure or loss that has a nexus to income under section CR 3B.

Section EY 10 is being amended to ensure that the life insurance taxation rules do not apply to Lloyd’s in respect of any income to which section CR 3B applies. This change ensures that section EY 48 does not have application to Lloyd’s New Zealand life business.

New section HR 13 sets out the obligations on Lloyd’s under the Income Tax Act 2007 and treats Lloyd’s underwriters as one person. This section establishes that Lloyd’s is a New Zealand taxpayer in respect of income that is treated as having a source in New Zealand. This section allows for the operation of section HD 17B in connection with the payment and return of tax by Lloyd’s authorised agents.

New section HD 17B treats an agent for Lloyd’s as responsible on Lloyd’s behalf for:

- calculating the tax payable on income under section CR 3B;

- paying the required amount of tax; and

- providing the necessary returns of income.

The obligation on the agent under section HD 17B is limited to the premiums the agents is required to pay to Lloyd’s. The section ensures that the agent is only responsible for the Lloyd’s business it facilitates, not the entire extent of Lloyd’s New Zealand life business. Section HD 17B also ensures that banks and other non-bank deposit takers are not treated as an agent of Lloyd’s to the extent that they facilitate payment of any life insurance premiums.

Section HD 3 is being consequentially amended in respect of the obligations on Lloyd’s agents under section HD 17B.

Schedule 1 is being amended to specify that the tax rate on income under section CR 3B is 28%.

Background

Lloyd’s is an insurance market, not an insurance company, and has regulatory approval from the Reserve Bank of New Zealand to underwrite life risk in New Zealand. Members of Lloyd’s, both corporate and individuals, join together in syndicates to insure risk.

The current taxation rules for non-resident life insurers would mean that each Member would be required to obtain an Inland Revenue number and file an annual tax return for any life business in New Zealand. The cost of compliance and associated administration cost under current tax law is considered to be disproportionate to the projected tax revenue involved and could act as a barrier to enter the New Zealand life insurance market.

The proposed amendments seek to reduce compliance and administration costs with an associated immaterial fiscal impact relative to the status quo. Precedent exists in tax and prudential supervision law in New Zealand and Australia to accommodate Lloyd’s unique business structure.

Tax policy officials propose to review in 2020, and periodically thereafter, whether the proposed amendments fairly reflect the tax that should be paid on profit Lloyd’s makes from selling life insurance in New Zealand.