Chapter 2 - Changes to provisional tax to increase certainty

- Provisional tax

- Extending and increasing the current safe harbour

- Safe harbour for all taxpayers using the standard method

While income tax liabilities are generally determined on an annual basis, most taxpayers are required to make some form of interim tax payment during the year. For businesses, the most well-known, is provisional tax. For others interim payments are made through withholding taxes.

The principle underlying interim payments is that tax should be paid as income is earned. This better aligns the payment of tax with cashflow, ensures a more even flow of revenue to the Crown, and reduces the risk of non-payment. Interim payment systems can also assist taxpayers who find it difficult to budget for tax, by providing for deduction at source (e.g. PAYE or withholding tax) or for more frequent, smaller payments, such as provisional tax.

The tax system needs to be as fair and efficient as possible in raising the revenue required to meet society’s needs. New Zealand, like most other countries, faces long-term fiscal pressures stemming from an aging population, coupled with an increasing demand for high quality public services. As a result it is important to ensure high levels of tax compliance are maintained and, where possible, improved. The proposals in this chapter are intended to provide businesses with more flexibility and certainty in managing their provisional tax obligations.

Provisional tax

Where income is earned and is not subject to any withholding taxes, or the withholding taxes are not sufficient to cover the total liability, the provisional tax rules apply if a threshold is met.[1] In practice, most business taxpayers will be subject to the provisional tax rules as there are few other options to allow businesses to pay tax as they earn their income.

Broadly speaking, the current provisional tax rules generally require a taxpayer to meet their annual income tax liability by making three interim payments during the year. Interest applies to compensate taxpayers or the Crown in the event of over or underpayments.

Instalments can be calculated in the following ways:

- Standard (or “uplift”) method – provisional tax instalments are based on 105% of the prior year’s residual income tax (RIT) or 110% of the year before the prior year if the taxpayer has not filed their prior year’s tax return;

- Estimation method – the taxpayer estimates their provisional tax liability and pays instalments on that basis;[2] or

- GST ratio method – provisional tax payments are based on a ratio of residual income tax to GST taxable supplies. This method is only available to a subset of provisional taxpayers.

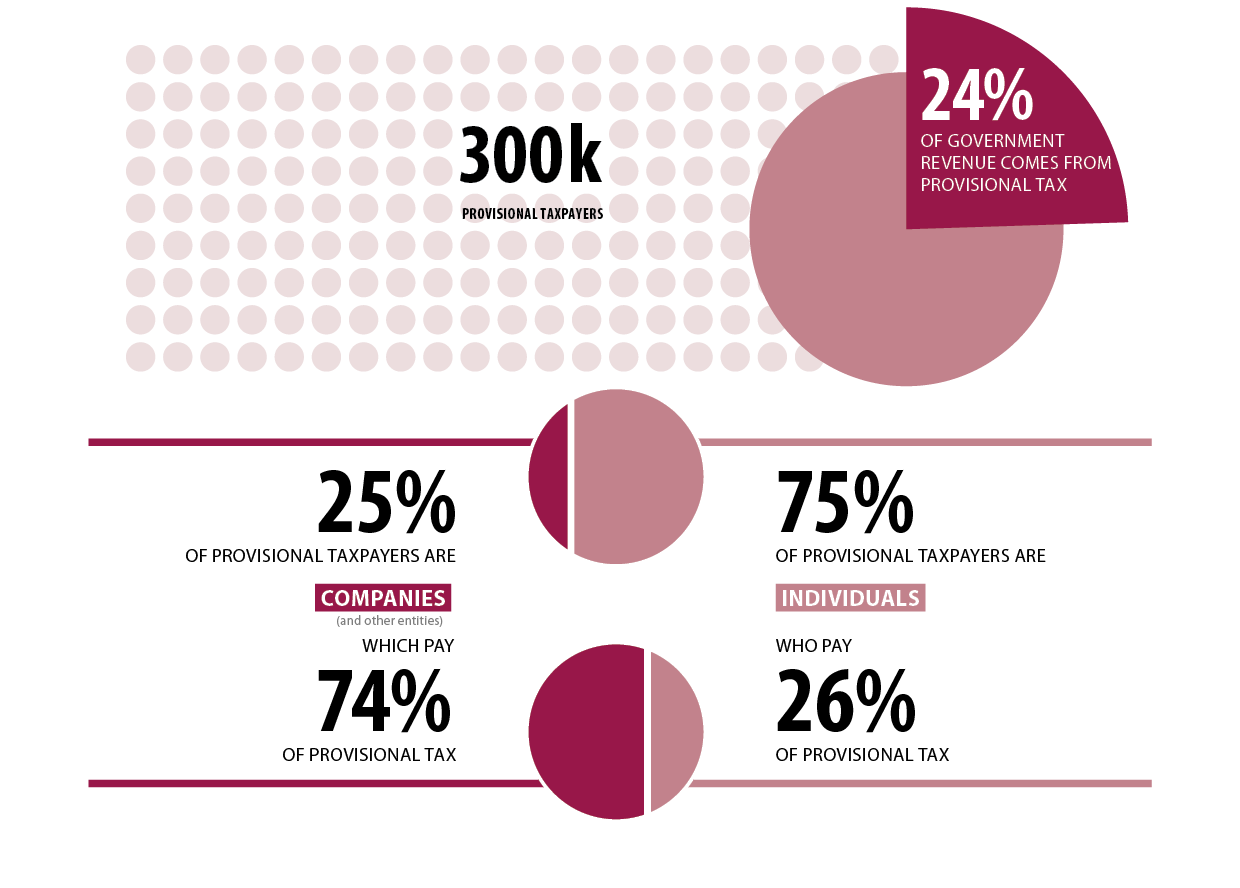

A significant proportion of Government revenue is collected through provisional tax, making up almost a quarter of collections.

There are approximately 300,000 provisional taxpayers, three quarters of whom are individuals. However, when considering the tax collected, three quarters of provisional tax revenue is collected from companies. The top 5% of companies represent approximately 43% of the total provisional tax collected.

Previous feedback indicates that, while provisional tax works well for some taxpayers, for others, small businesses in particular, provisional tax is a source of stress. This is chiefly because of the uncertainty or unpredictability of income.

Use of money interest has been effective at encouraging accurate payment of provisional tax, and has allowed removal of other measures that would otherwise be necessary, such as underestimation penalties. However, submissions on the Green Paper make it clear that the interest and penalty rules also impose costs and stress on many taxpayers. Further, the assumptions that underlie the interest rules, such as income being evenly earned throughout the year, are often incorrect and seen as unfair.

Example 1: Mustang Limited (Mustang) is a bloodstock auction house that has one major sales event each year. Over the course of this three day sale, held in February, Mustang makes 95% of its annual taxable income. Mustang has a March balance date.

In the 2018 income year Mustang makes $1.5 million taxable income. It had estimated this exact amount for provisional tax purposes and paid $420,000 in three equal instalments of $140,000 in August, January and May. Two of these instalments were paid before Mustang had actually earned any income for the year.

While the use of money interest rules are intended to act as compensation for over or underpayments, rather than act as a penalty, they can be seen as having a penal effect. In particular, where a taxpayer has not paid sufficient tax for the year due to an unexpected or unpredictable event.

Example 1B: As in Example 1, Mustang estimated their provisional tax at $1.5 million and paid the three instalments as outlined above. However, due to an unexpectedly large price obtained for a standout colt at the sales, Mustang’s taxable income was in fact $2 million for the year. Therefore instead of three instalments of $140,000, Mustang should have paid three instalments of $186,666.

While Mustang can correct its position from the third instalment, it has underpaid the first two instalments by $46,666 each. Mustang will be charged interest on these amounts until the outstanding amounts and interest have been paid. At the point that the first two instalments were required, Mustang had not yet earned any income for the year. Mustang also had no idea at that time that they would obtain such a high price for one colt at the sales.

While the Mustang example is somewhat extreme, similar issues exist for many businesses with seasonal or volatile income-earning patterns. These issues can especially impact smaller businesses that do not necessarily have the means to fund tax payments prior to earning their income.

The Government has therefore announced measures to change some of the aspects of provisional tax that cause particular stress, while maintaining the underlying principle that tax is paid as income is earned. The measures are:

- Increasing the current residual income tax limit of $50,000 before use of money interest is imposed (commonly known as the “safe harbour”) to $60,000 and extending this safe harbour rule to non-individual taxpayers;

- Removing use of money interest for the first two provisional tax instalments for all taxpayers who use the standard method to calculate and pay provisional tax (commonly referred to as the “uplift method”);

- Introducing an accounting income method for smaller taxpayers which uses accounting results to determine provisional tax payments; and

- Allowing a closely held company to pay provisional tax as agent of its shareholder-employees in order to remove them from the provisional tax rules.

The remainder of this chapter discusses the first two measures. The accounting income method and paying tax as agent measures are discussed in Chapter 3.

Extending and increasing the current safe harbour

By far the most popular method for calculating provisional tax is the standard method, which is used by approximately 92% of provisional taxpayers. It is the most straightforward method, however, it can result in outcomes that can be seen as adverse. The most obvious is where the method underestimates the final liability and the taxpayer is subject to use of money interest. It can also result in taxpayers paying too much or having to pay before they have earned any income (the seasonal fluctuations as in examples 1 and 1B).

Use of money interest applies to both the standard and estimation methods. It applies from the first instalment date where the payments made do not equal those that should have been made based on the taxpayer’s total liability for the year.

Example 2: Viper Limited (Viper) has residual income tax for the 2016 year of $200,000. Viper bases its 2017 provisional tax payments on 105% of the 2016 liability ($210,000) and makes three payments of $70,000 during the 2017 year.

On completing its 2017 tax return, Viper calculates its actual liability at $300,000 and as a consequence should have made three payments of $100,000. Viper will be liable for use of money interest on the shortfall of $30,000 from each provisional tax payment date until the tax and use of money interest is paid.

A key simplification measure, that has previously been introduced to the provisional tax rules, is the inclusion of a safe harbour rule to remove smaller taxpayers from the application of use of money interest, provided they use the standard method to calculate their payments. This safe harbour rule[3] provides that where a taxpayer:

- Is a natural person, other than in their capacity as a trustee;

- Has residual income tax of less than $50,000 for the tax year;[4]

- Has not estimated their residual income tax for the tax year;

- Has not used the GST ratio method for the tax year; and

- Has not held, at any time during the tax year, a RWT certificate of exemption;

their provisional tax is deemed to be due and payable in one instalment, on their terminal tax date.

Therefore use of money interest will not apply to that taxpayer, unless they do not pay by the terminal tax date, in which case use of money interest will apply from that date.

The safe harbour was restricted to individuals, due to concern about taxpayers switching income between related parties to eliminate paying use of money interest and provisional tax altogether.

Example 3: Challenger Limited (Challenger) is a consulting firm owned by Reginald Dodge. Reginald undertakes all the work for Challenger as a shareholder-employee and payments from Challenger to him are not subject to PAYE. In the 2016 year Challenger has residual income tax (RIT) of $45,000 as all the income was held in the company that year. Reginald had no residual income tax.

Over the next two years, assuming the same income level, but shifting it between Challenger and Reginald, and alternating provisional tax calculation methods, no provisional tax is paid by either party, and there is no exposure to use of money interest:

| Year | 2017 | 2018 | ||||

|---|---|---|---|---|---|---|

| Method | Provisional amount | RIT | Method | Provisional amount | RIT | |

| Challenger | Estimate | Nil | Nil | Standard | Nil | $45,000 |

| Reginald Dodge | Not liable | Nil | $45,000 | Estimate | Nil | Nil |

Therefore any extension of the safe harbour rule to include non-individuals will require some safeguards [see pages 17 to 20].

The Government will extend the safe harbour rule by:

- Increasing the threshold from $50,000 to $60,000; and

- Allowing non-individuals to use it.

This will mean that all taxpayers, whether they are an individual, company, trust, or other entity, who calculate and pay provisional tax using the standard method, will not be subject to use of money interest, provided they have residual income tax below $60,000 and meet the other criteria listed [see page 15]. For these taxpayers, any use of money interest will apply from their terminal tax date. This change is expected to remove approximately 67,000 taxpayers from the use of money interest rules, at least 63,000 of which are non-individuals.

Safe harbour for all taxpayers using the standard method

Currently taxpayers who use the standard method but exceed the safe harbour threshold are liable to comprehensive use of money interest applied to any over or underpayments. This applies from the first instalment date where the amount paid differs from the amount of residual income tax subsequently calculated.

The Government considers that this may not provide taxpayers with certainty. A taxpayer who bases their current year provisional tax payments on the previous year’s tax amount for simplicity, should not be subject to use of money interest when, by chance, that turns out to have resulted in an underpayment of tax.

Taxpayers who fall outside the safe harbour are generally larger and more sophisticated, and therefore have a better understanding of their tax position at any point in time. It is highly likely that by the date of the last provisional tax instalment, which is after their balance date, these taxpayers will be well placed to more accurately work out their total tax payable for the year. This should allow them to compare the actual liability to the provisional payments already made and make up any shortfall to avoid any use of money interest.

The Government has therefore announced that it will introduce legislation to apply use of money interest only from the last instalment date for taxpayers using the standard method and falling outside the new $60,000 safe harbour.

Taxpayers using the standard method are committing to making a minimum level of provisional tax payments during the year. It may be that these payments are ultimately more or less than their actual final liability, but this will depend on factors that may be outside the taxpayer’s control. The standard method is designed to approximate a taxpayer’s current liability using the best information available (other than a comprehensive estimate by the taxpayer). A taxpayer who wishes to, can use the estimation method where they consider the standard method does not produce a reasonable approximation of their liability for the year.

Applying use of money interest only from the final instalment date will allow a taxpayer to pay all their tax without use of money interest being imposed.

Example 4: Thunderbolt Limited (Thunderbolt) a manufacturer of clapping devices for sports fans, has residual income tax of $250,000 in the 2016 year. Thunderbolt has trouble estimating its provisional tax due to volatility in its income. Sales volumes are highly dependent on the success of local sports teams – the more successful the teams, the more clapping devices are sold. Therefore Thunderbolt decides to use the standard method to calculate its provisional tax payments, reducing the risk of use of money interest applying if it estimates and the estimate is incorrect.

For the 2017 year Thunderbolt makes two provisional tax payments of $87,500 per payment. At the third instalment date Thunderbolt has calculated that its actual annual liability is $300,000, due to the success of the local football team, the Fords.

Thunderbolt could now either pay a third instalment of $87,500 or pay the full year balance of $125,000. If Thunderbolt pays the full $125,000 it will have satisfied its income tax obligation for the year and will not be subject to any use of money interest. If Thunderbolt pays $87,500, it will incur use of money interest on the shortfall of $37,500 from the third instalment date until the outstanding tax and interest is paid.

When a taxpayer has overpaid their liability using the standard method, use of money interest will apply to any overpaid balance at the third instalment date until that tax is refunded or otherwise applied.

Example 4B: Returning to the Thunderbolt example, but assuming the Fords have a poor season, resulting in Thunderbolt’s residual income tax for the 2017 year being $230,000. Thunderbolt could pay the final instalment of $87,500 and be paid use of money interest from the third instalment date until the amount was refunded, or it could make a final payment of $55,000 with no use of money implications.

Consistency requirements

The measures announced by the Government are intended to reduce the potential negative impacts of the current provisional tax and use of money interest rules. However, in attempting to address these issues and provide taxpayers with greater certainty there is the potential for people to take advantage of the rules.

As detailed in example 3, extending the safe harbour to non-individuals could lead to some undesirable practices such as switching income between parties and switching between the estimation and standard methods. This could result in no provisional tax payments being made by these taxpayers. In addition, it will be important to ensure that taxpayers pay the instalments required under the standard method.

Officials consider rules to reduce the ability of taxpayers to switch between methods could address the first issue. Taxpayers would still be permitted to switch methods during and between years, but some restrictions will apply.

Switching income between parties

Related parties would be required to use the same method of calculating provisional tax within an income year (with the exception of taxpayers using the GST ratio method). This will apply to companies in a group of companies[5] and to companies and shareholder-employees who do not have PAYE deducted from payments of salary.

Example 5: Charger Limited (Charger) is owned equally and run by its two shareholders Macintyre and Alistair Craig. Both draw shareholder-employee salaries from the company from which no PAYE is deducted. Charger chooses to use the standard method to calculate provisional tax.

Macintyre and Alistair will be required to use the same provisional tax calculation method as Charger for that income year

Example 6: Coronet Super Bee Limited (CSBL) produces honey from a special breed of bee. It has two subsidiary companies, Hummer Limited (Hummer) that operates the hives and Bel Air Limited (Bel Air) that bottles the honey. Hummer is 100% owned by CSBL but Bel Air is only 50% owned by CSBL with the other 50% owned by Pacer Limited, another honey producer who is unrelated to CSBL.

CSBL and Hummer would be required to use the same provisional tax calculation method during a year.

The requirement for related parties to use the same method to calculate provisional tax should largely prevent switching income between parties. However, it is proposed that a specific anti-avoidance provision be included within the rules to ensure that taxpayers cannot manipulate incomes to avoid being subject to the provisional tax rules.

The result of such an anti-avoidance provision being applied will be that the taxpayers will be deemed to be estimated taxpayers and subject to full use of money interest for the period of the manipulation. In addition, officials envisage that the general anti-avoidance provision will also apply to any manipulation of income to avoid the application of the provisional tax rules.

Switching between methods

A taxpayer who has chosen the standard method could subsequently switch to the estimation method within an income year. However, any related parties would also be deemed to have switched. A taxpayer choosing to switch will be subject to use of money interest from the first instalment – the same treatment as under the current rules.

If a taxpayer selects the standard method but does not make the minimum payments, use of money interest will apply to the lower of the difference between the amount paid and the required standard method instalment or one third of the taxpayer’s RIT for the year. They will also be liable for late payment penalties on the same basis. This rule will also apply to taxpayers falling within the expanded $60,000 safe harbour.

Example 7: Camaro Limited (Camaro) elects to use the standard method for its 2017 provisional tax calculation. Camaro’s residual income tax for the 2016 year was $450,000 and therefore its 2017 liability will be three instalments of $157,500. On each instalment date Camaro only pays $100,000.

If Camaro’s RIT for the 2017 year was $330,000, three provisional tax instalments of $110,000 should have been paid. Camaro will be liable for use of money interest and late payment penalties on $10,000 for each instalment (the difference between Camaro’s RIT “instalments” and the payment made).

If Camaro’s RIT for the 2017 year was $600,000, then three instalments of $200,000 should have been paid. Camaro will be liable for use of money interest and late payment penalties on $57,500 for each instalment (the difference between the required standard instalment and the payment made).

Another issue that could arise is switching between methods, to extend the period use of money interest is payable to the taxpayer when an overpayment has been made. Under the current rules, interest is payable from the first instalment date under either method. However, under the new rules a taxpayer who subsequently discovers they have overpaid using the standard method might seek to switch to the estimation method to maximise the use of money interest payable.

Example 8: Caballero Limited (Caballero) manufactures staple removers. In the 2016 income year its residual income tax was $350,000. Caballero decides to pay its 2017 provisional tax using the standard method. Under this method it is required to pay three instalments of $122,500.

After paying the first two instalments, and due to a downturn in people using paper, Caballero now believes it will only have a total tax liability of $100,000 for 2017. This is less than the provisional tax instalments already paid.

Caballero’s accountant, Mr Edsel, suggests that Caballero switch to the estimation method to calculate provisional tax. This would enable them to earn use of money interest on the overpaid amount back to the first instalment date, instead of only from the third instalment date under the standard method.

This defeats the intention of simplifying and reducing the application of the use of money interest rules. Therefore a restriction to prevent this form of switching is required.

Officials suggest that taxpayers can only switch from the standard method to the estimation method prior to the payment of the second provisional tax instalment.

Reassessments

From time to time it is necessary for reassessments of a particular year or years to be made. Under the current rules, use of money interest would apply back to the first instalment of provisional tax for the year subject to the reassessment. Removing use of money interest for those who use the standard provisional tax calculation method raises a question about how to apply interest to reassessments.

There are two options:

- Continue to apply use of money interest to reassessments as is currently the case (i.e. from the first instalment date); or

- Apply use of money interest on the basis it would have been applied had the reassessed amount been correctly accounted for in the year concerned.

The first option, applying use of money interest in full, recognises that there is a cost to the government in not having the right amount of tax in the right period.

The second option would mean that if a taxpayer had calculated and paid their provisional tax using the standard method, use of money interest (if any) would only have applied from the final instalment date for the year in question. If a taxpayer had used the estimation method, use of money interest would apply from the first instalment date.

It is proposed that the second option is adopted. This recognises that taxpayers have still, during the relevant year, made the provisional tax payments they were required to under the standard method. If anything, the only provisional tax amount that would have been underpaid was the final instalment which should have captured the amount of the reassessment. Therefore use of money interest should only apply from that date.

Example 9: Escalade Limited (Escalade) is a furniture retailer. Escalade calculated and paid its 2017 provisional tax using the standard method. In November 2017 Escalade discovered that it had omitted to include, in its closing stock, some stand up desks with built in treadmills that were being stored offsite. This resulted in a tax shortfall for the 31 March 2017 year of $30,000.

Escalade makes a voluntary disclosure and is reassessed for the 2017 year. Escalade will be subject to use of money interest on the $30,000 shortfall from the last instalment date of the 2017 income year (7 May 2017) until November 2017 when they pay the shortfall (plus interest and any shortfall penalties).

For taxpayers who fall within the new “under $60,000 safe harbour” rule and who receive a reassessment, officials consider that use of money interest should apply in the same way as it would have had the reassessment been dealt with in the year in question. If a reassessment places a taxpayer above the safe harbour limit of $60,000, the interest position will default to the standard safe harbour rule. That is, use of money interest will apply from the third instalment rather than the terminal tax date.

Example 10: Caprice Limited (Caprice) is a small business that advises corporate clients on integrating pets within the workplace. They have used the standard method and have residual income tax of $50,000 for the 2017 year. Caprice met all the other requirements to qualify for the under $60,000 safe harbour, therefore use of money interest, should it apply, will not apply until the terminal tax date.

In 2019 Inland Revenue audits Caprice and finds that they did not declare income of $50,000 from a client who was invoiced in the 2017 year but did not pay until the 2018 year. Inland Revenue reassess Caprice for an additional $14,000 tax in the 2017 year. Caprice’s residual income tax now exceeds the $60,000 limit for the safe harbour to apply. However, because Caprice used the standard method to calculate and pay its provisional tax, it would have been eligible for the standard method safe harbour. Therefore use of money interest will only apply from the third instalment date for the 2017 year.

Tax pooling

Currently many taxpayers use tax pooling intermediaries as a way to reduce their exposure to use of money interest. Tax pooling intermediaries are able to reduce the amount of use of money interest incurred by taxpayers by offsetting these tax shortfalls with surplus payments by other taxpayers within the “pool”.

Taxpayers who have surplus payments can also derive higher credit interest where that surplus can be “sold” to another member of the pool.

The new safe harbour rule will reduce the impact of use of money interest on taxpayers. However, taxpayers may wish to continue using pooling intermediaries to make tax payments.

Tax pooling will continue to be available for taxpayers who wish to use the new safe harbour option.

Tax payments within group companies

It is common in a group of companies for one entity to make all the tax payments for all members of the group, and then transfer those payments once the group’s tax returns are completed.

One issue that arises with the proposed safe harbour rule is that, although in total the group may have paid provisional tax instalments based on the standard method, individual entities may have short paid as they make no provisional tax payments during the year.

It is proposed that group companies continue to be able to make tax payments in one entity within the group and be able to make transfers to other group members at the end of the year.

1 For a taxpayer to be subject to provisional tax they must have had a residual income tax (RIT) liability of greater than $2,500. RIT is calculated by subtracting any tax credits and PAYE which have been deducted during the year from the total tax liability.

2 A taxpayer is able to re-estimate during an income year and alter their instalments as required.

3 Section 120 KE of the Tax Administration Act 1994.

4 The safe harbour rule was increased from $35,000 to $50,000 with effect from 1 April 2009, for the 2009-10 income year. When the safe harbour was reconsidered in 2007, lifting the threshold to $50,000, meant about 243,000, or 97% of all individual provisional taxpayers, could potentially rely on the use of money interest safe harbour threshold. See Reducing tax compliance costs for small and medium-sized enterprises: a Government discussion document (2007) at paragraph 2.33.