Chapter 1 - Overview

- Investment income and how it is taxed

- The investment income types are taxed in different ways

- Getting better information

- Summary of proposals

- How to make a submission

The purpose of this discussion document is to seek your views on proposed changes to the way that tax on investment income is administered and in particular to the way investment income information is collected.

The amount of income New Zealanders earn from savings and investments is likely to grow over the coming years, as our population ages and more capital is accumulated.

The way people invest is also changing. The sharing economy, where consumers interact with each other, bypassing the traditional third-party suppliers[1], is growing rapidly worldwide, with PWC projecting growth in the global sharing economy from USD15 billion in 2013 to USD335 billion by 2023[2]. Peer-to-peer lending platforms are now established in New Zealand, and overseas experience suggests that this type of lending will continue to expand here.

Our tax system needs to be flexible enough to cope with growing levels of investment income, changing sources of investment income and new types of investment products.

For these reasons, it is important to review how this type of income is administered. The Government wants to ensure that it has an accurate understanding of peoples’ income. It also wants to ensure that people and organisations pay the right amount of tax and receive the right amount of social policy assistance, and wants to enable them to do that easily. This discussion document is part of the Making Tax Simpler series, which began in March 2015. Ultimately, the Making Tax Simpler proposals are about making it easier for people to get their tax right. These are the main underlying principles:

- Improve information flows to Inland Revenue and use the information received to pre-populate information for taxpayers to simplify the requirements for those taxpayers that have to, or choose to, file a tax return.

- Increase the use of digital services to bring that information together.

- Use the information to help ensure that people are on an appropriate tax rate.

The Making Tax Simpler proposals are seeking to cumulatively make it easier for people to comply with their tax and social policy obligations, and to ensure they are receiving any tax and social policy entitlements that they are due to receive.

This discussion document looks at how these goals could be achieved in relation to investment income. In addition, the changes proposed in this document will support a number of future initiatives and are designed to gather enough information to give the Government flexibility in areas that will be consulted on in future such as the taxation of individuals and social policy (including Working For Families tax credits and Child Support).

Investment income and how it is taxed

Investment income is income earned from the investment of capital. It can include:

- interest;

- dividends;

- portfolio investment entity (PIE) income; and

- royalties.

Income distributed by Māori authorities to their members is not strictly investment income but can be subject to resident withholding tax (RWT), and is covered in this document.

Withholding taxes are an efficient means of taxing investment income because they:

- reduce the cost of tax collection by shifting the obligation from many people to one person – i.e. one withholder deducts and pays the tax for all the taxpayers it pays income to;

- support compliance with tax laws as:

- the investment income payer is reporting the recipients’ income to Inland Revenue which reduces the non-declaration of investment income; and

- people who don’t declare their income still have tax withheld;

- ensure taxpayers do not have to pay tax on investment income as one lump sum at the end of the tax year.

Some investment income can have credits attached, as well as the tax withheld. Dividends can have imputation credits, and Māori authority distributions can have Māori authority credits. These credits represent tax paid by the company or the Māori authority. They are also a credit against the income tax owed by the recipient and Māori authority credits are refundable if they exceed the recipient’s income tax liability.

RWT deducted (withheld) from the income before it is paid to the recipient is allowed as a credit against the recipient’s total income tax for the year, in the same way as PAYE on salary and wages. PIE tax is usually a final tax but in situations where a recipient’s PIE income does become part of their taxable income the PIE tax is also allowed as a credit against their total income tax for the year.

Royalties and dividends paid to non-residents have been included within the scope of this document as they are subject to the NRWT regime. There are, however, no changes to the administration of the taxation of royalties or dividends paid to non-residents proposed in this document.

The Appendix explains how the rules and processes for tax on investment income currently work. It will help put the proposed changes into context.

The investment income types are taxed in different ways

Dividends

Dividends on shares (or other equity instruments) paid to New Zealand residents have RWT deducted and may also have imputation credits attached. The total RWT and imputation credits will be 33% of the dividend.[3] Dividends paid to a non-resident are subject to non-resident withholding tax (NRWT) of up to 30% depending on their country of residence.

Interest

When New Zealand residents invest in debt instruments (for example, bonds or bank deposits) they can provide their IRD number and select a tax rate: 0%, 10.5%, 17.5%, 28%, 30% or 33% (ideally they will match it to their own marginal tax rate in other words the correct rate for their last dollar of income)[4]. If the investor doesn’t provide their IRD number or doesn’t choose a rate, the 33% rate will apply. Interest paid to a non-resident is subject to NRWT at 10% or 15% depending on their country of residence, or the approved issuer levy (AIL) at 2% if elected by the non-resident.

PIE income

If a person invests through a PIE they can provide their IRD number and select their appropriate prescribed investor rate (PIR) based on their income in the last two years[5]. The possible PIRs are 10.5%, 17.5% and 28%. If the investor doesn’t provide their IRD number, the 28% rate will apply. The tax on their PIE income is then calculated based on the applicable PIR.

Māori authority taxable distributions

Taxable distributions from a Māori authority will have credits attached at a maximum of 17.5% of the total of the net distribution and the credit. If the Māori authority decides not to attach credits, or if the credits are less than 17.5%, they can deduct RWT to provide the same amount of tax credits to the member. If the distribution is over $200 and the member has not provided their IRD number, the Māori authority must deduct RWT at 33%, reduced by any credits attached, up to a maximum rate of 17.5%.

Royalties

Royalities with a New Zealand source paid to a non-resident are subject to NRWT at 10% or 15% depending on the recipient’s country of residence. International tax agreements between New Zealand and some countries may allow for lower rates of tax.

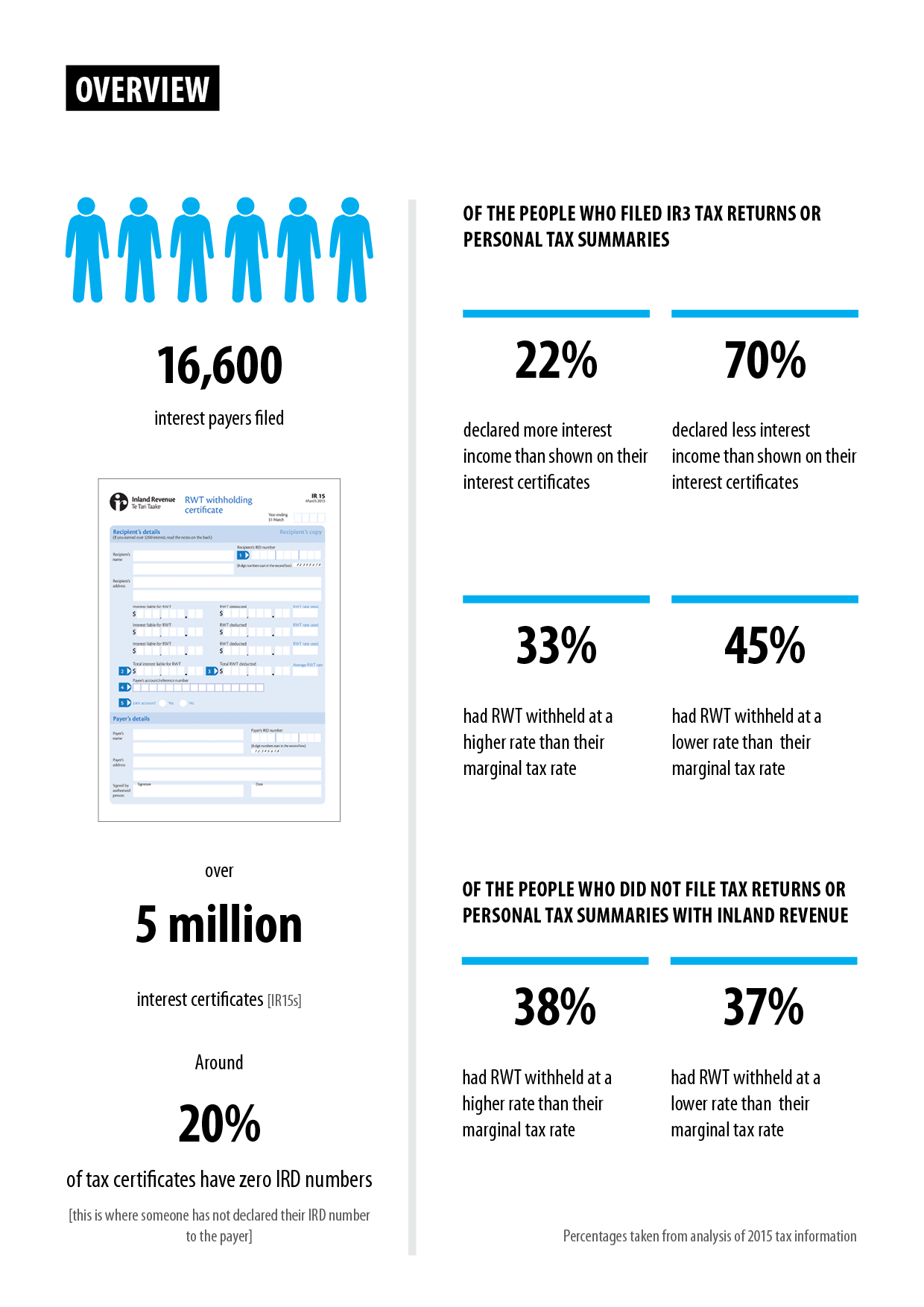

Getting better information

Improving the collection of information about investment income and taxes would give Inland Revenue a more accurate picture of an individual’s income during the year, allowing people's tax records to be pre-populated with more information. This in turn should increase voluntary compliance by making it easier for people to get their tax right.

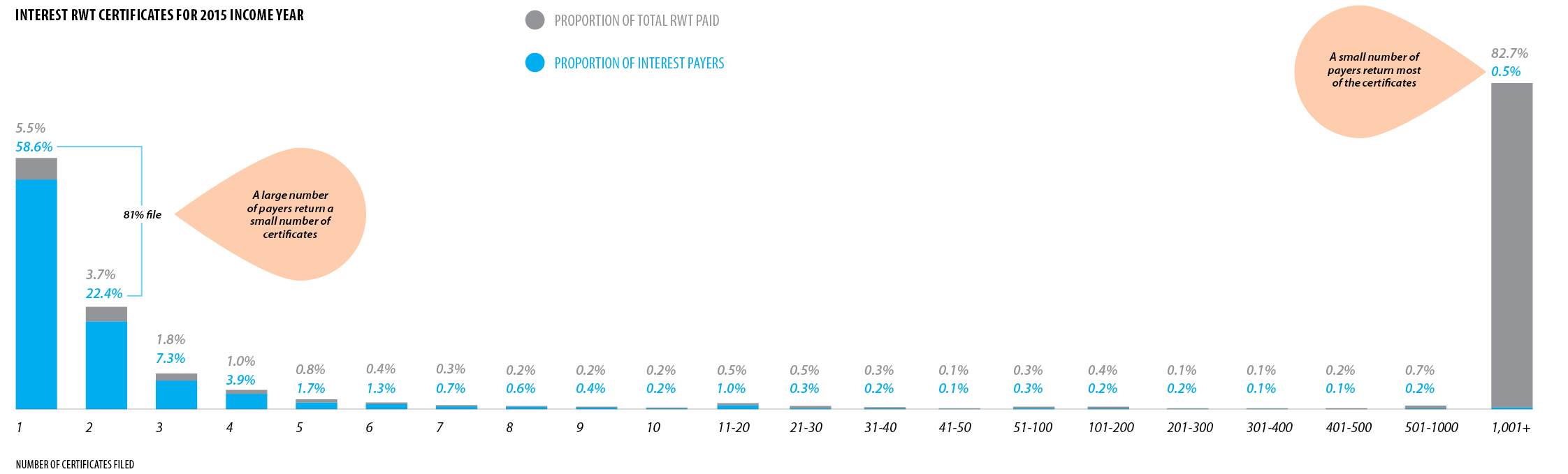

Collecting information from the payers of investment income is significantly more efficient and reliable than collecting the same information from each of the recipients of the income. The most significant efficiency gains would be driven by the collection of information from investment income payers with large numbers of customers as shown in the diagram below.

Summary of proposals

The main proposals set out in this document are:

- requiring payers of investment income to provide Inland Revenue with taxpayer specific withholding information on a monthly basis (or for the month of the business process of paying the income if that occurs less often than monthly);

- taxpayer specific information would include:

- the amount of income paid to the customer;

- the amount of tax withheld (if any), or imputation or Māori authority tax credits attached;

- the customer’s IRD number (if held);

- the customer’s name;

- the customer’s address;

- the customer’s date of birth (if held);

- if the investment is a joint investment, information on each owner of the investment;

- if the payer is paying approved issuer levy, details of the relevant customers;

- if the payer is paying interest that is exempt from withholding tax, details of the relevant customers;

- removing the need for payers of withholding tax to provide end of year tax certificates to their customers who have provided their IRD number;

- increasing the “non-declaration rate”[6] for RWT on interest and PIE tax to 45%;

- creating a database of taxpayers holding certificates of exemption from withholding tax; and

- requiring all taxpayers seeking to receive their investment income not subject to withholding tax to obtain a certificate of exemption.

Proposals that the Government decides to proceed with would be expected to be included in legislation to be introduced in 2017. The application date of the legislation would follow a period of time sufficient to allow for system changes.

How to make a submission

This discussion document seeks feedback from both payers and recipients of investment income. The Government invites submissions on the proposals raised. Submissions should include a brief summary of major points and recommendations. They should also indicate whether the authors are happy to be contacted by officials to discuss the points raised, if required.

You can make a submission:

- online at makingtaxsimpler.ird.govt.nz

- by email to [email protected], with “Investment Income Information” in the subject line;

- by post, to:

Investment Income Information

C/- Deputy Commissioner,

Policy and Strategy

Inland Revenue Department

PO Box 2198

Wellington 6140

The closing date for submissions is 19 August 2016.

Submissions may be the subject of a request under the Official Information Act 1982, which may result in their release. The withholding of particular submissions, or parts thereof, on the grounds of privacy, or commercial sensitivity, or for any other reason, will be determined in accordance with that Act. Those making a submission who consider that there is any part of it that should properly be withheld under the Act should clearly indicate this.

|

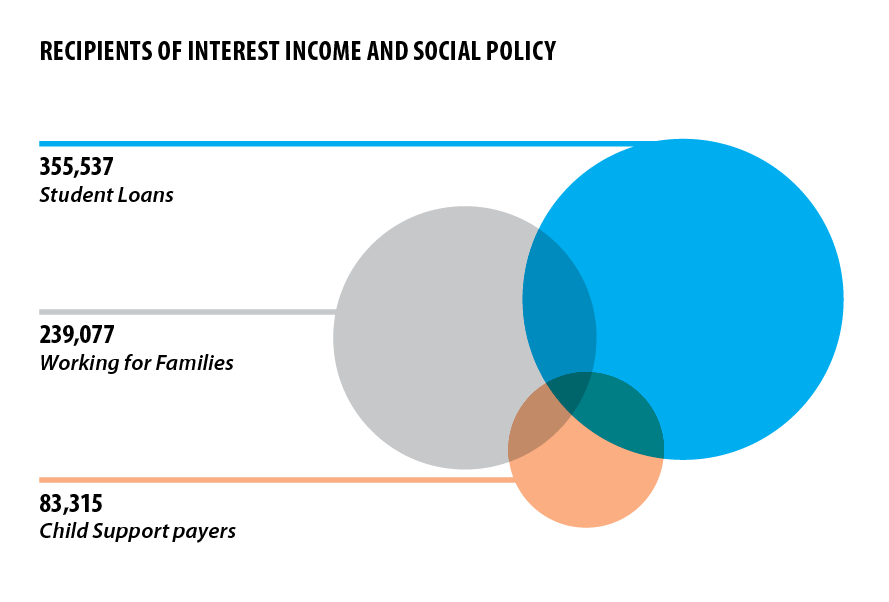

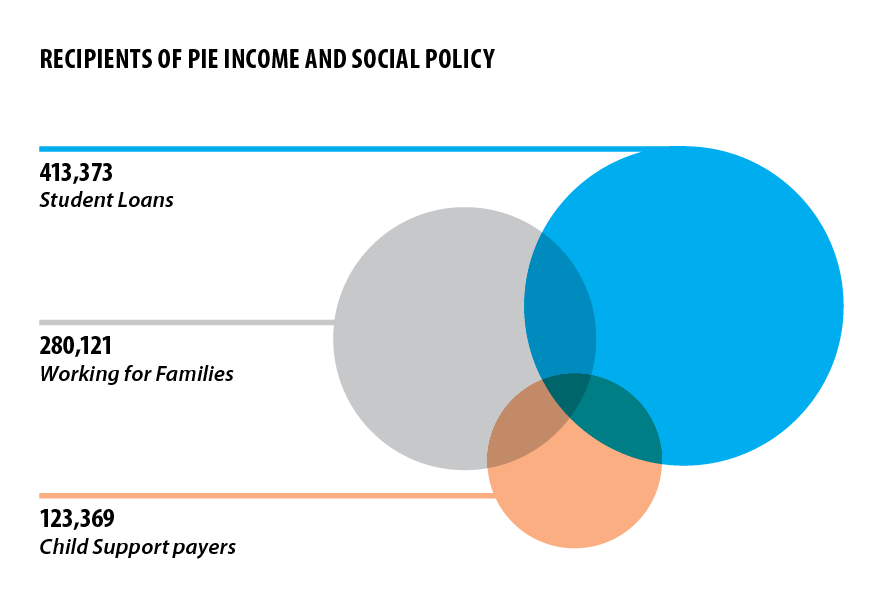

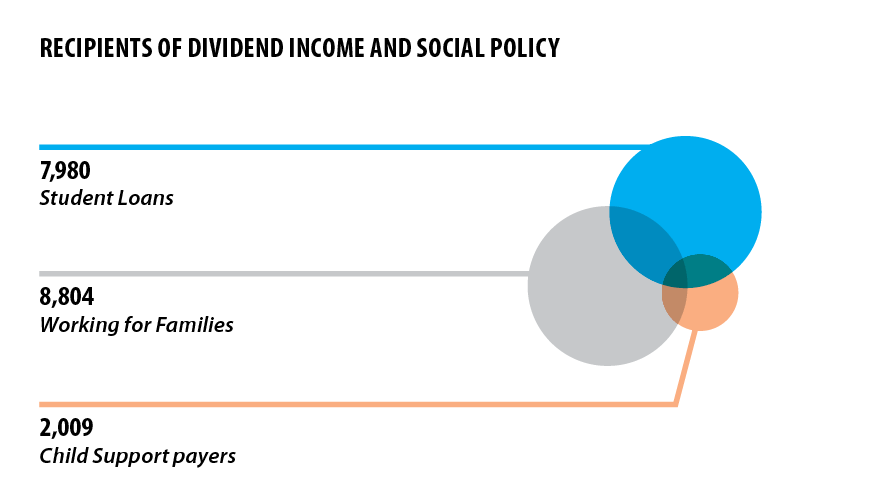

A significant number of recipients of investment income also receive Working for Families tax credits or have student loan and child support payment obligations. The calculation of these entitlements and obligations is based around the taxpayer’s total income which includes interest income, dividends and some types of PIE income. By getting details about the recipients of investment income more regularly Inland Revenue will be able to have a more accurate understanding of the total income earned. |

|

The numbers of recipients of interest and PIE income shown only takes into account those recipients who have provided their IRD numbers to their investment providers or who have returned the interest income in their tax return or Personal Tax Summary (PTS). |

|

The dividend income information shown is limited to those dividend recipients who returned the dividend income in a tax return or PTS.

Some recipients of investment income are likely to have more than one of the three types of entitlements or obligations shown and as such the diagrams show overlapping fields. The extent of any overlap has not been quantified at this stage. |

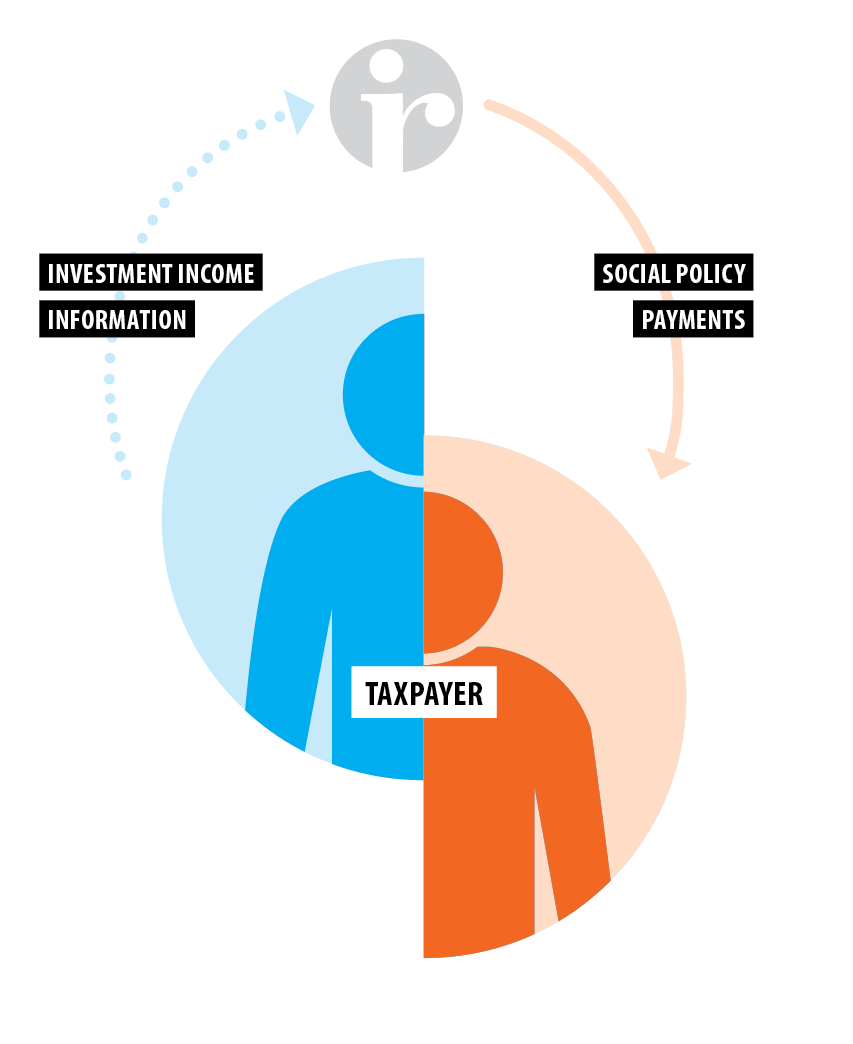

WHAT CURRENTLY HAPPENS It can be difficult for individual taxpayers to keep track of their overall tax position based on the statements and certificates that they have received, as well as any other income they earned. This can make it harder for them to know whether they are fully complying with their tax and social policy obligations or receiving the correct level of social policy entitlement. |

|

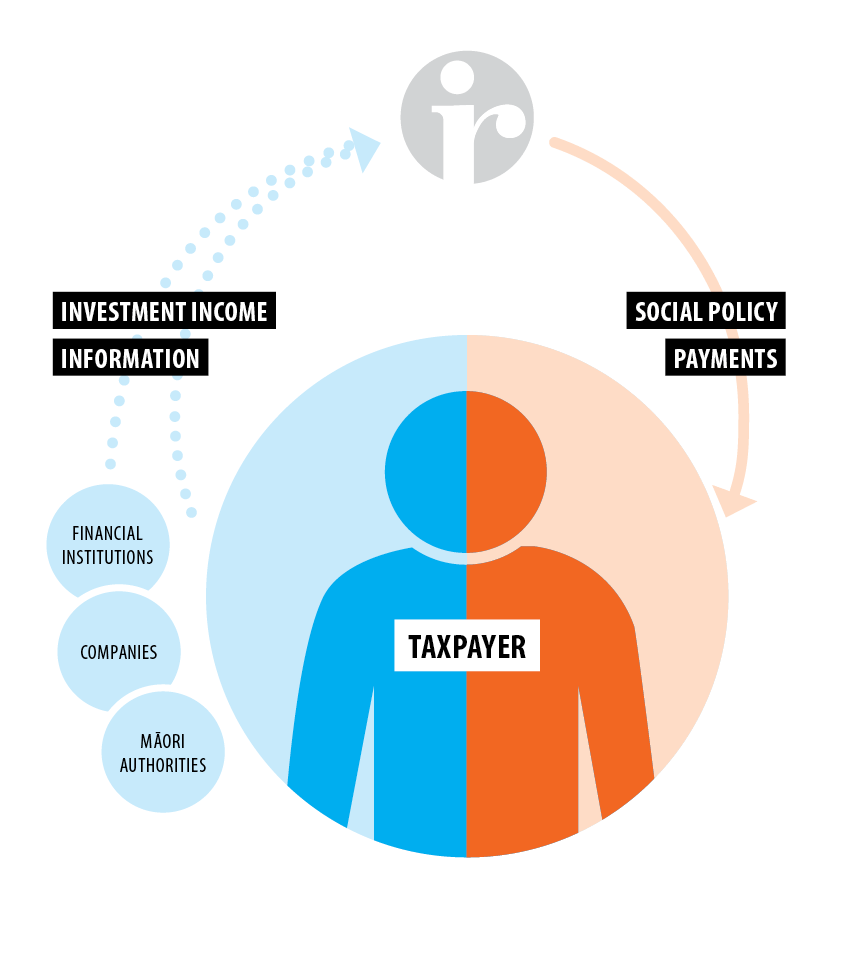

THE PROPOSED FUTURE Obtaining detailed withholding information regularly throughout the year would give Inland Revenue a better understanding of taxpayers’ income positions and the time at which the income was earned. This would enable Inland Revenue to more accurately determine the amount of social policy payments a taxpayer is entitled to receive or the amount of child support or student loan a taxpayer is liable to pay during the income year. |

|

[1] The most relevant part of the sharing economy for this document is peer-to-peer lending.

[2] http://www.pwc.co.uk/issues/megatrends/collisions/sharingeconomy.html

[3] The Taxation (Annual rates for 2016-17 Closely held Companies and Remedial Matters) Bill proposes allowing companies paying dividends to companies to elect not to deduct RWT from fully imputed dividends.

[4] The 0% and 10.5% rates are only available when taxpayers meet specific requirements.

[5] Income for these purposes includes PIE income.

[6] The “non-declaration rate” is applied when a customer does not provide the payer with their IRD number.