Chapter 10 - Imported mismatches

10.1 Recommendation 8 in the Final Report relates to imported mismatches. It requires a country to deny a payer a deduction for a payment (an imported mismatch payment) which meets all of the following requirements:

- is made to a payee in a country that does not have hybrid mismatch rules;

- does not itself give rise to a hybrid mismatch;

- which the payee sets off against a hybrid deduction, that is, a deduction for a payment that gives rise to a hybrid mismatch, or a deduction for a payment made to a third person which is offset by that third person against a payment giving rise to a hybrid mismatch.

10.2 The rule only applies if the payer is in the same control group as the parties to the hybrid mismatch, or the arrangement is a structured arrangement to which the payer is a party.

10.3 The rule is not limited to payments in relation to financial instruments. There is no defensive rule requiring inclusion by payees.

10.4 The objective of the rule is to increase the effectiveness of the hybrid rules. Importantly, the rule will not apply to a payment to a person in a country that has implemented hybrid rules.

10.5 The imported mismatch rule is potentially complex to apply. It will require knowledge of the tax consequences of a wide range of transactions within a group. On the other hand, if a group is structured in a straightforward way, and monitors the existence of hybrid mismatches in intra-group transactions, it is likely that the necessary information will be readily available.

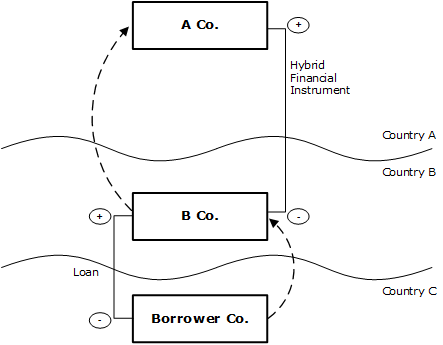

10.6 Figure 2.6 (in Chapter 2 of this document) contains a simple example of an imported hybrid mismatch in a structured arrangement, and is reproduced again here.

Figure 10.1: Imported mismatch from hybrid financial instrument (repeated Figure 2.6)

10.7 The arrangement involves A Co providing financing to B Co by way of a hybrid financial instrument, with B Co then lending that money to Borrower Co in Country C. Suppose that Country C is the only one with hybrid rules. Leaving aside the imported mismatch rule, the result of the arrangement is:

- a deduction for Borrower Co;

- no net income to B Co (because its income from the loan equals its deduction on the hybrid instrument); and

- no income to A Co (because Country A treats the financing as equity and does not tax the dividend).

The overall outcome is double non-taxation.

10.8 Accordingly, under the imported hybrid mismatch rule, Borrower Co would be denied a deduction for the lesser of its interest payment and the interest payment by B Co.

Non-structured imported mismatches

10.9 Final Report Examples 8.3 to 8.9 in particular demonstrate the application of the direct and indirect imported mismatch rule. These rules apply to payments within a control group. They apply when a payment is made by a payer in a country with hybrid rules to a payee in a country without hybrid rules, to the extent that payee is:

- a payer under a hybrid mismatch (in which case there is a direct imported mismatch); or

- a payer to a payee who is in turn a payer under a hybrid mismatch (in which case there is an indirect imported mismatch).

Application to New Zealand

10.10 As it is part of the OECD recommendations, it is proposed that New Zealand should introduce an imported hybrid rule. Multinational groups with Australian or UK members will already need to be keeping track of uncorrected hybrid mismatches for the purpose of compliance with the rules in those countries, so the imposition of such a rule by New Zealand should not involve significant additional costs. This may require the New Zealand members of the group to have access to information held within the group but outside New Zealand. This should not be problematic, in a control group context.

10.11 Accordingly, an imported mismatch rule that is introduced in New Zealand should, so far as possible, be consistent with the rules adopted by the UK and Australia. For instance, the Australian Board of Taxation has noted that a de minimis/safe harbour test may be appropriate for the imported mismatch rule in Australia.

Submission point 10

Submissions are sought on whether New Zealand should adopt an imported mismatch rule as recommended by the OECD, and what matters may need to be considered in order to ensure that the rule works as intended, with compliance costs reduced so far as possible.