Provisional tax attribution

(Clauses 72, 73, 77, 78, 79, 82, 92(8)-(10), 96, 102 and 111)

Summary of proposed amendment

The bill proposes a new way of simplifying provisional tax liabilities on untaxed salaries received by shareholder-employees of close companies. Under this proposal, the shareholder-employee and the company can agree that the shareholder-employee’s provisional tax payment obligations on their shareholder salary are transferred to the company. At the end of the year, the company can transfer a tax credit, out of its provisional tax payments, to the shareholder-employee.

A shareholder-employee whose only income not subject to tax at source is their salary will be able to use these rules to completely remove themselves from provisional tax.

Application date

The amendments will apply from the beginning of the 2018–19 income year.

Key features

The proposed new rules will create a mechanism by which a shareholder-employee’s provisional tax payment obligations in relation to their salary can be transferred to a company which uses either the uplift or estimate method for provisional tax. (A different method is provided within the proposed AIM rules for AIM companies.) The company’s obligations to pay provisional tax on various instalment dates will be increased by the amount transferred from the employee.

At the end of the year, the company can choose to transfer some of the provisional tax it has paid to the shareholder-employee. The shareholder-employee will receive it as a tax credit. If insufficient tax has been paid by either the company or the shareholder-employee, use-of-money interest may be payable, depending on the size of the shortfall and the provisional tax method used.

The proposals will be the most useful in situations where there is a close relationship between the company and its shareholder-employees, and where one accountant prepares the tax returns for both at the end of the year.

Background

In a typical small company scenario, the company exists as a vehicle for the controlling shareholders to carry on their business activity with the protection of limited liability. The income the company derives will be split between being retained by the company and being distributed to the shareholders, with the final decision typically being made at the end of the year once the final results are known. While the shareholders and the company are legally separate, from an economic perspective the split is much less clear.

Current tax law follows the legal form. Salary amounts paid to shareholder-employees of close companies are typically not subject to PAYE. If the income tax on these salary amounts exceeds $2,500, the shareholder-employee will be required to pay provisional tax in the subsequent year. So, while there is one true stream of income (that which the company receives from external sources), and the decision about the allocation is made at the end of the year, during the course of the year, often two separate provisional taxpayers have calculated their provisional tax liabilities and are making payments to Inland Revenue.

Detailed analysis

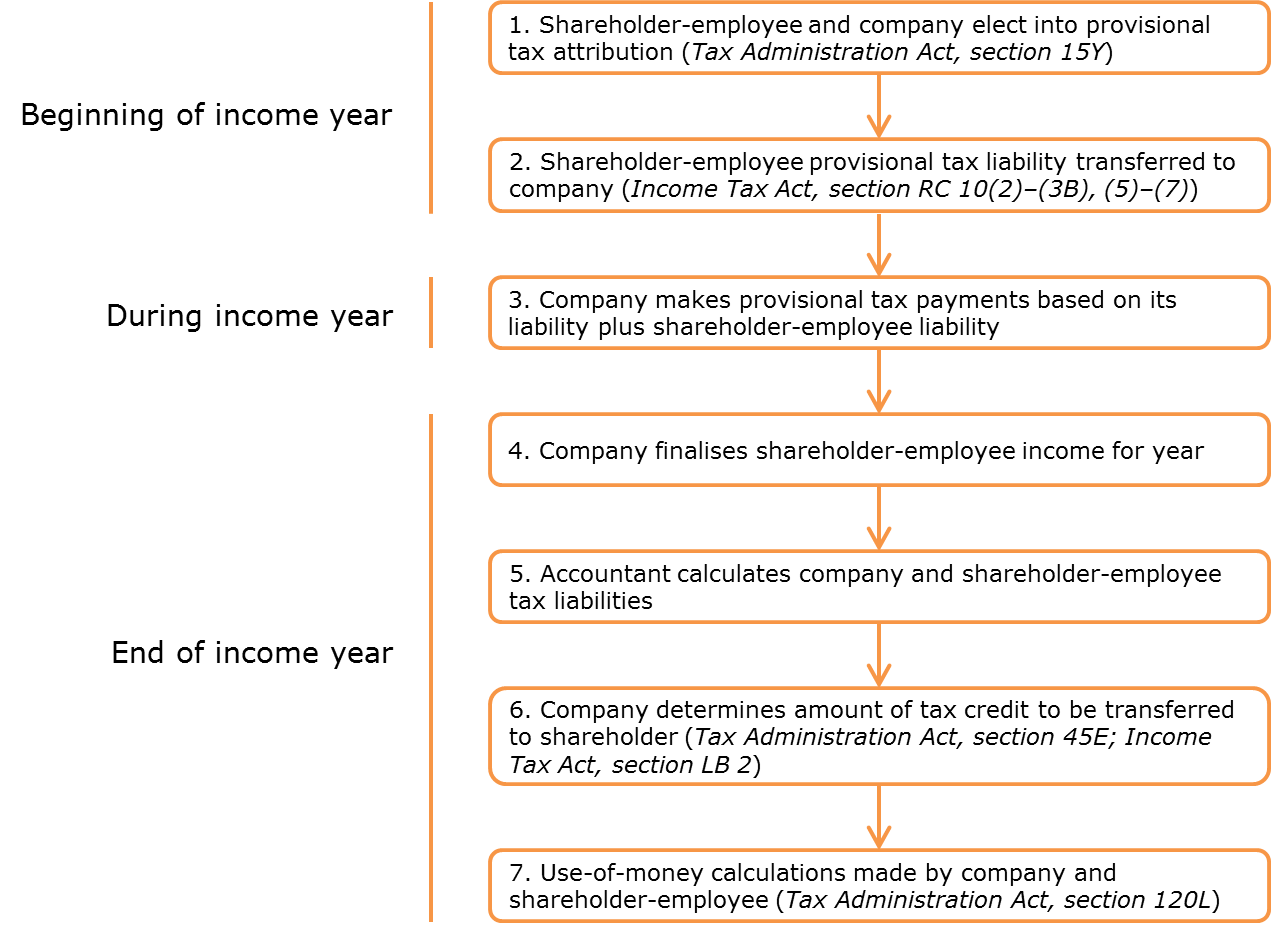

The following diagram illustrates how the proposed new rules would apply.

Beginning of the income year

Electing-in

When a company and a shareholder-employee want to use the provisional tax attribution (PTA) rules for the first time, they must elect to do so in accordance with proposed section 15Y of the Tax Administration Act 1994. The election must be made before the company’s first provisional tax instalment date.

The PTA rules can only be used if both the company and the shareholder-employee agree. A company can choose to use the PTA rules for some, but not all, of its shareholder-employees, and a person who is a shareholder-employee of more than one company can choose to elect in for some, but not all, of those companies.

Once a shareholder-employee and a company have elected into the PTA rules, they will remain in the rules in subsequent years, until they elect out in accordance with proposed section 15Y(2), again prior to the company’s first provisional tax instalment date. Inland Revenue will prescribe the methods for electing in and electing out closer to the beginning of the 2018–19 income year when the new rules are proposed to come into effect.

Adjustments to provisional tax liabilities

The key initial effect of electing into PTA is the adjustments made to both the shareholder-employee’s and the company’s provisional tax payment obligations in proposed section RC 10.

Under proposed subsection (2), the shareholder-employee’s provisional tax obligation will be reduced by the amount “shareholder attributed”, which is their “shareholder attributed tax” from earlier years uplifted by 5% or 10% as appropriate, or their estimate of their shareholder attributed tax. Shareholder attributed tax is defined in section RC 10(6) and (7) as either 28%, or the amount of tax paid, on their shareholder salary.

Under proposed section RC 3(4), where a shareholder-employee elects into the rules and their residual income tax for the previous year less the tax on the shareholder salary in the previous year is less than $2,500, the shareholder-employee has no obligation to pay provisional tax in the current year.

Under proposed section RC 10(2), the company’s payment obligations are increased by the amount “company attributed”. This is defined in proposed section RC 10(3)(c) as the total of the shareholder attributed tax amounts transferred by employees.

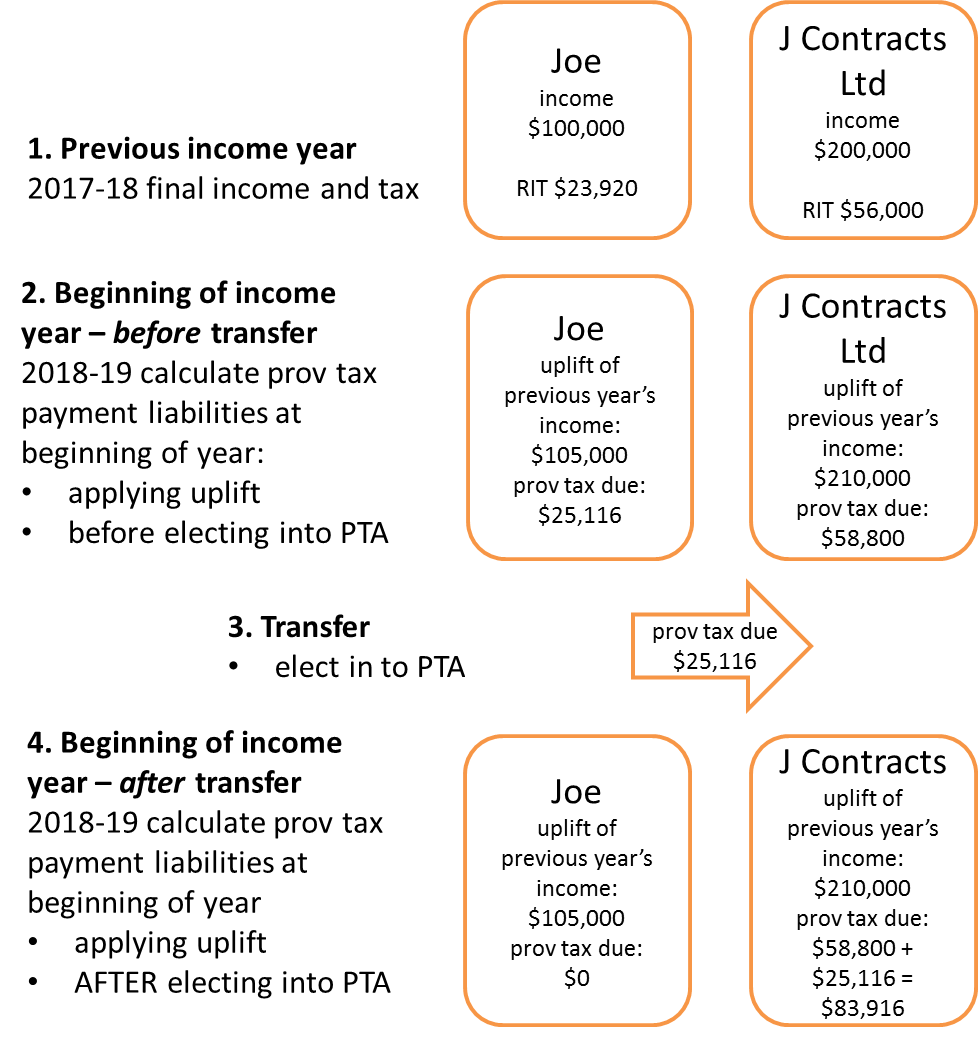

Example 1: Transfer of entire provisional tax payment obligation

Joe is the sole shareholder of J Contracts Ltd. In 2017–18, Joe received $100,000 in untaxed salary from the company, which is his sole income. The tax on this income is $23,920.

In that same year J Contracts Ltd had net income of $200,000, and the tax on that income was $56,000.

In the absence of using PTA, Joe would have a provisional tax liability for 2018–19 of 105% of $23,920, which is $25,116, and J Contracts Ltd would have a provisional tax liability of 105% of $56,000, which is $58,800, assuming both use the uplift method.

Joe and J Contracts Ltd agree to use the PTA method for 2018–19.

Joe’s shareholder attributed is $23,920 x 105%, which is $25,116. This is deducted from the payment liability he would otherwise have had, of $25,116, leaving a payment liability of nil. The residual income tax for the previous year of $23,920, less the tax on his salary for that year of $23,920, is nil. This means that Joe has no obligation to pay provisional tax in the 2018–19 income year.

The company’s liability to pay provisional tax in 2018–19 of $58,800 is increased by the amount transferred from Joe of $25,116, giving it a total liability to pay provisional tax of $83,916.

This is illustrated as:

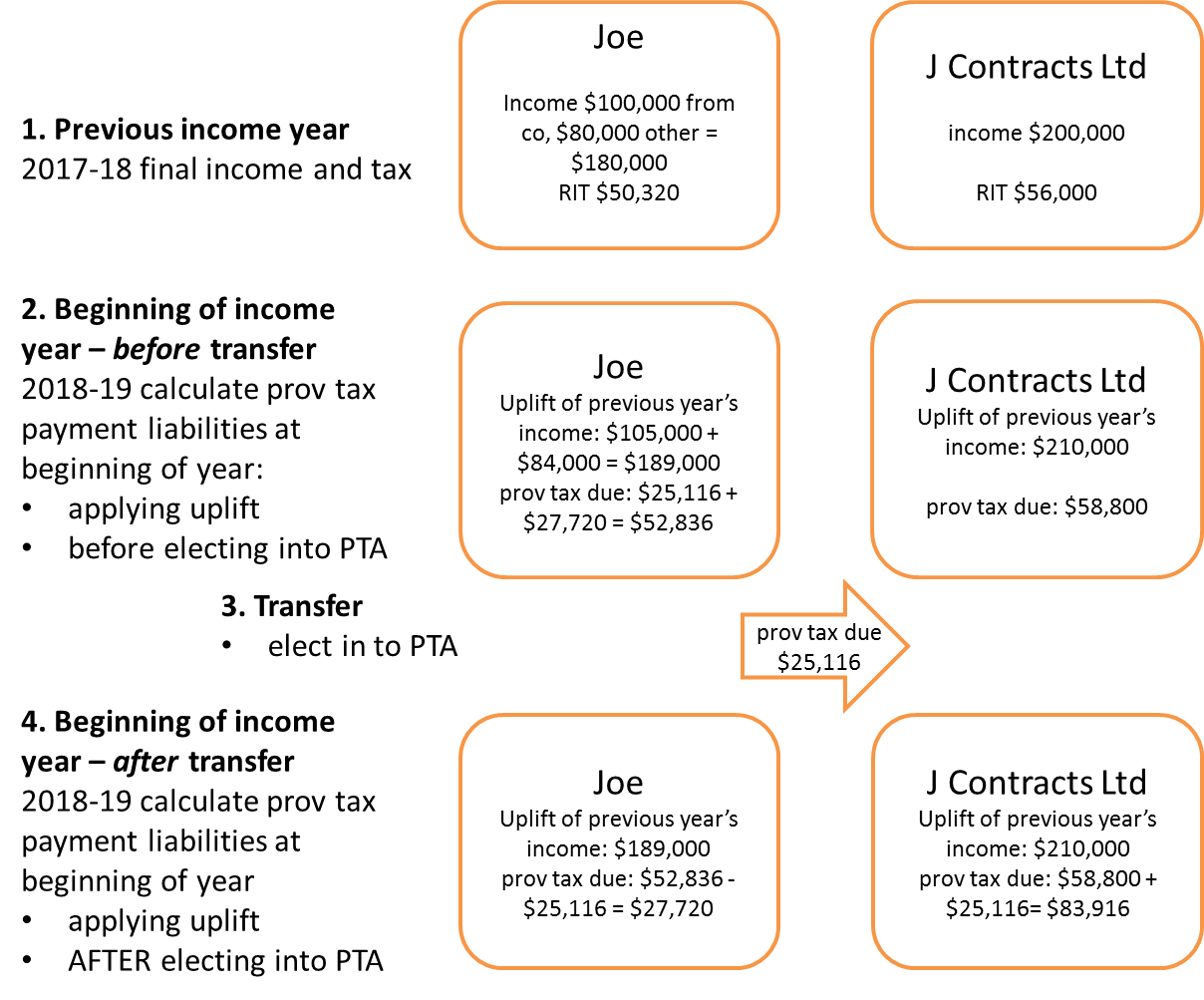

Example 2: Transfer of part of provisional tax payment obligation

The facts are the same as for Example 1, except that Joe also has other income in 2017–18 of $80,000. Total tax on his income of $180,000 is therefore $50,320. The definition of “shareholder attributed” treats Joe’s salary of $100,000 as the first part of his income, so tax on it is $23,920, and is uplifted in the following year to $25,116.

This is deducted from the payment liability he otherwise would have had, of 105% of $50,320, which is $52,836. $52,836 less $25,116 is $27,720. This is Joe’s provisional tax liability for the 2018–19 year. (He will not be a provisional taxpayer at all if his liability to make payments is less than $2,500, but here it clearly is.)

This is illustrated as:

During course of income year

The company will be required to pay provisional tax payments, under its chosen method, of the combined total of its own liability and the liability it has assumed on behalf of shareholder-employees. It will not be required to notify Inland Revenue of the make-up of each payment; the total payment amount constitutes provisional tax paid by the company.

End of income year

Allocation of tax credit to shareholder-employees

At the end of the income year, in the ordinary course of business, the company’s accountant will calculate the following amounts:

- the amount the company will pay to the shareholder-employee by way of salary;

- the shareholder-employee’s tax liability for the year; and

- the company’s tax liability for the year.

At that point, the company’s accountant can determine how the amount paid as provisional tax by the company will be allocated between the company and the shareholder-employees who elected into the provisional tax attribution rules.

The amount of tax credit the company can transfer to its shareholder-employees is not related to the amount the company paid on their behalf during the income year. The company can allocate to its elected-in shareholder-employees:

- all of the provisional tax it paid;

- some of the provisional tax it paid; or

- none of the provisional tax it paid,

except that a company cannot claim a refund unless it has first transferred to shareholder-employees an amount equal to their tax liability on their shareholder salaries (proposed section LA 6(2)(cb)).

The amount transferred by the company to its shareholder-employees will be treated as a tax credit by them under proposed amendments to section LB 2. This type of tax credit is applied after residual income tax is determined, in accordance with the existing definition in section YA 1. This is the same approach as that taken for provisional tax credits, and differs from the approach to other kinds of tax credits such as PAYE, RWT and tax paid by trustees on behalf of beneficiaries.

The amount transferred by the company will be deducted from the tax credits available to it, also under proposed amendments to section LB 2. Proposed section 45E of the Tax Administration Act sets out a process for the company providing information to Inland Revenue and to the shareholder-employee of the amount transferred by way of tax credit.

Example 3: Tax payments match total liability

In Example 1, at the beginning of the 2018–19 year Joe transferred his provisional tax payment liability of $25,116 to J Contracts Ltd.

J Contracts Ltd paid the new combined liability during the year of $83,916.

Both Joe and J Contracts Ltd had net income of exactly their uplift amounts – $105,000 for Joe and $210,000 for J Contracts Ltd, with a tax liability of $25,116 for Joe and $58,800 for J Contracts Ltd.

J Contracts Ltd has a tax liability of $58,800, but has paid provisional tax of $83,916. It therefore has excess tax credits of $25,116. It must transfer these excess tax credits to Joe. J Contracts Ltd could transfer more than $25,116 to Joe if it wished; it would then need to make up any shortfall as terminal tax.

UOMI adjustments

When a company and a shareholder-employee use the provisional tax attribution rules, use-of-money interest adjustments must be made at the end of the year. These adjustments reflect that, as a result of entering into the provisional tax attribution rules, the company accepted an obligation to meet the shareholder-employee’s provisional tax payment obligations.

For taxpayers outside the provisional tax attribution rules, use-of-money interest is payable on the difference between the amount of provisional tax paid and the taxpayer’s residual income tax. When provisional tax exceeds residual income tax, the excess is an overpayment (on which the taxpayer may be paid interest); when provisional tax is less than residual income tax, the shortfall is an underpayment (on which the taxpayer may be required to pay interest).

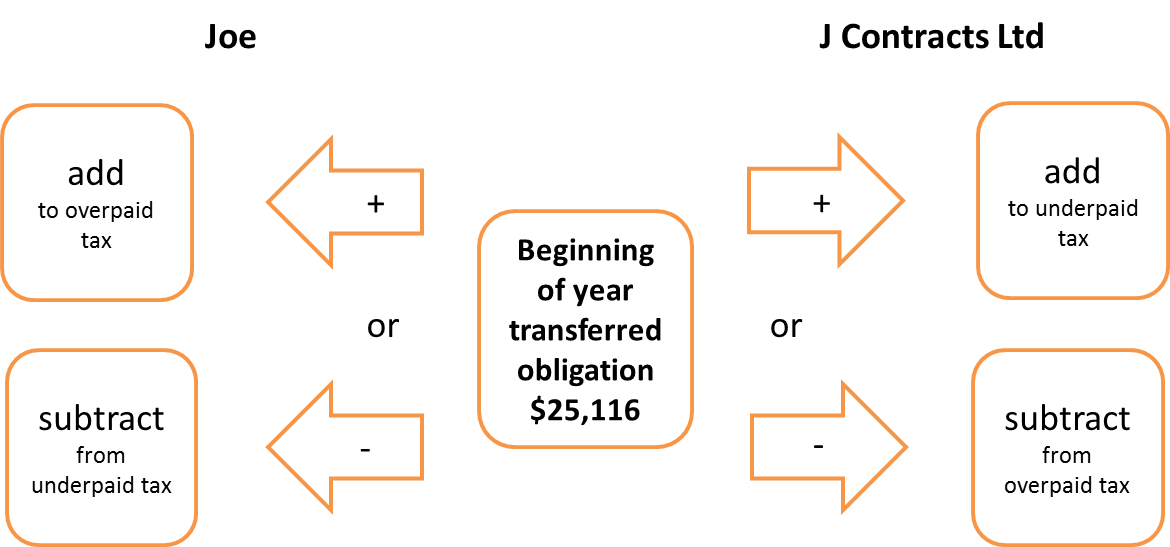

When shareholder-employees and companies have entered into the provisional tax attribution rules the payment liability transferred from the shareholder-employee to the company is added to the amount on which the company is potentially liable to pay UOMI, and deducted from the amount on which the shareholder-employee is potentially liable to pay UOMI. This is done by proposed section 120L(1B), which variously adds and subtracts the amount of liability transferred at the beginning of the year to the year-end underpaid and overpaid amounts. The following diagram sets out these adjustments in the context of the examples used above:

If the amount to be subtracted from underpaid tax is greater than the amount of underpaid tax, the difference is overpaid tax, and if the amount to be subtracted from overpaid tax is greater than the amount of overpaid tax, the difference is underpaid tax.

UOMI is calculated after the additions and subtractions described above have been made.

Example 4: UOMI calculations

In this example, both Joe and J Contracts Ltd are using the uplift method.

As in Example 2, at the beginning of the 2018–19 year Joe transferred his provisional tax payment liability in relation to his company salary of $25,116 to J Contracts Ltd, while remaining responsible for the provisional tax on his income from other sources (previously $80,000).

J Contracts Ltd paid the new combined liability during the year of $83,916.

At the end of the year, both Joe and J Contracts Ltd had net income significantly greater than their uplift amounts. Joe earns $84,000 from other sources, on which the tax is $27,720. During the year, Joe made his own provisional tax payments of $27,720, so he met the liability on his $84,000 of other income. But Joe’s income from the company has increased to $250,000, so Joe’s tax liability in relation to this amount is $73,420 giving him a total tax liability of $101,140.

J Contracts Ltd’s income was $500,000, so its liability is $140,000.

One option is for J Contracts Ltd and Joe to make an additional payment at P3 which meets their shortfalls. If this happens, then under the proposed changes to the uplift method made elsewhere in this bill, no use-of-money interest will be payable by either J Contracts Ltd or Joe.

The remainder of this example proceeds on the basis that any shortfalls are not paid until terminal tax date, which means that use-of-money interest calculation adjustments must be made.

J Contracts Ltd decides to transfer $10,000 of the provisional tax payments it made of $83,916 to Joe. This reduces Joe’s shortfall to $63,420, which Joe will need to pay. J Contracts Ltd will need to pay its tax shortfall which is now $140,000 – $73,916 = $66,084.

Use-of-money interest adjustments must be made.

Joe calculates his underpayment amount, which is his total tax liability less provisional tax payments made by him, so $101,140 – $27,720 = $73,420. (The amount transferred as credit to him is not relevant here.) But because he and J Contracts Ltd had agreed that the company would pay $25,116 on his behalf, this is deducted from his underpayment amount, reducing it to $48,304. This is the amount on which Joe must pay UOMI from P3.

J Contracts Ltd makes a similar underpayment calculation. Its total liability was $140,000, and it paid $83,916 during the year, so its underpayment amount is $140,000 – $83,916 = $56,084. But of the $83,916 it paid, it had agreed to pay $25,116 on behalf of Joe, so this is added to its underpayment amount. This makes its total underpayment amount $56,084 + $25,116 = $81,200. This is the amount on which J Contracts Ltd must pay UOMI, from P3.

The calculations can be checked as follows:

UOMI adjusted underpayment amounts above: Joe $48,304 + J Contracts Ltd $81,200 = $129,504

Total tax liabilities: Joe $101,140 + J Contracts Ltd $140,000 = $241,140

Total provisional tax paid to IR (before transfers): Joe $27,720, J Contracts Ltd $83,916 = $111,636.

Difference between total liabilities and total provisional tax paid to IR: $241,140 – $111,636 = $129,504.

Total shortfall amounts to pay: Joe $63,420, J Contracts Ltd $66,084 = $129,504.

These transactions can be summarised as follows:

Tax calculations:

| Joe | J Contracts Ltd | |

|---|---|---|

| 2017-18 tax return | ||

| 2017-18 income | $100,000 company $80,000 other $180,000 total |

$200,000 |

| 2017-18 tax liability | $50,320 | $56,000 |

| 2018-19 provisional tax | ||

| 2018-19 uplift amount | $52,836 | $58,800 |

| Transfer of prov tax on company income from Joe to J Contracts Ltd | -$25,116 | $25,116 |

| 2018-19 prov tax liability after transfer | $27,720 | $83,916 |

| 2018-19 prov tax paid | $27,720 | $83,916 |

| 2018-19 tax return | ||

| 2018-19 income | $250,000 company $84,000 other |

$500,000 |

| Tax on 2018-19 income | $101,140 | $140,000 |

| Tax shortfall | $73,420 | $56,084 |

| Transfer of prov tax previously paid by J Contracts Ltd to Joe | $10,000 | $10,000 |

| Terminal tax liability | $63,420 | $66,084 |

| 2018-19 UOMI calculations | ||

| Initial calculation of underpayment amounts | $73,420 | $56,084 |

| Deduct initial prov tax liability transfer from Joe | -$25,116 | |

| Add initial prov tax liability transfer to J Contracts Ltd | $25,116 | |

| Amount on which UOMI payable | $48,304 | $81,200 |

Additional rules in proposed sections 120L(1C) and (1D) apply when either the company or the shareholder-employee is using the uplift method, and is potentially only liable to UOMI from their third instalment date.

As noted above, where a shareholder-employee has elected into PTA and has no other income, the shareholder-employee will no longer be subject to provisional tax under proposed section RC 3(4). That person will also no longer be subject to use-of-money interest. Where the company was liable to use-of-money interest and its tax liability exceeded its tax payments, the non-application of use-of-money interest to the shareholder-employee might encourage the company to reduce its income and so its use-of-money interest liability by paying a larger salary to the shareholder-employee. Proposed section 120L(1E) and (1F) addresses this situation by adding the shareholder-employee’s residual income tax to the company’s residual income tax for use-of-money interest purposes, where the shareholder-employee’s residual income tax exceeds $60,000.