Special report

A special report from

Policy and Strategy, Inland Revenue

New information requirements to improve tax compliance in the property investment sector

Sections 2AA, 156A, 156B, 156C, 156D, 156E, 156F, 156FA, 156G, 156H, 156I, 164B, 236, and schedule 1AA of the Land Transfer Act 1952; section 23 of the Land Transfer (Computer Registers and Electronic Lodgement) Amendment Act 2002; sections 3, 24BA, and 81 of the Tax Administration Act 1994.

This special report provides information on changes contained in the Land Transfer Amendment Act 2015 and the Tax Administration Amendment Act 2015 enacted on 22 September 2015.

From 1 October 2015, the changes will require transferors and transferees of land to provide certain tax information, including a New Zealand IRD number, when land is transferred unless an exemption applies to them.

The changes will also require “offshore persons”, as defined, to provide a New Zealand bank account number when they apply for an IRD number.

Information in this special report precedes coverage of the new legislation that will be published in a future edition of the Tax Information Bulletin.

- Background

- Key features

- Application date

- Detailed analysis

- Supplying information when transferring land

- Requirement to provide a tax statement

- Information required for persons for whom transfer is non-notifiable

- Persons acting in different capacities

- Exemptions from requirement to provide information

- Main home information exemption

- Information exemptions (non-notifiable transfers) under regulations

- Offence to supply misleading or false tax information

- Correction of errors or omissions

- Information disclosure and retention

- Regulations providing for exemption from requirement to provide tax statement

- Regulations providing for other estates in land to be covered by the tax information requirement

- New Zealand bank account requirement

- Supplying information when transferring land

Background

The Income Tax Act 2007 contains provisions that impose income tax on certain property transactions, and also on rental or other income earned from property. Current tax rules include provisions which tax gains from property bought with the intention of disposal, and provisions which tax land acquired for the purposes of dealing in land. The Government is concerned that compliance with these provisions may be relatively low. It is recognised that enforcing tax rules on non-residents is very difficult, especially those with only limited engagement with New Zealand.

In order to investigate compliance with the income tax legislation relating to property transactions, Inland Revenue has the ability to access records of land transfers in New Zealand. But this process is historic, rather than in real-time. Information received might also not give a complete picture of the activities or identity of a particular taxpayer.

To address these concerns, the Government announced a package of measures as part of Budget 2015 aimed at providing clearer rules and providing more useful information to Inland Revenue to assist in its enforcement of the rules, including increased funding to Inland Revenue to investigate property compliance.

Three legislative measures, which are not aimed at a New Zealand person’s main home, will apply from 1 October 2015:

- Information will be required to be supplied to Land Information New Zealand (LINZ) upon transfer of property as part of the usual land transfer process. In particular, persons transferring any property (other than New Zealand individuals transferring their main home) must provide:

- their New Zealand IRD number; and

- their tax identification number from their home country if they are currently tax resident overseas.

- To ensure that New Zealand’s full anti-money laundering rules apply to non-residents before they buy a property, offshore persons must have a New Zealand bank account before they can get a New Zealand IRD number.

- A new “bright-line” test will be introduced for sales of residential property, to supplement Inland Revenue’s current “intentions” test. Under this new test, gains from residential property sold within two years of purchase will be taxed, unless the property is the seller’s main home, inherited from a deceased estate or transferred as part of a relationship property settlement.

The first two measures, which are discussed in this special report, were contained in the Taxation (Land Information and Offshore Persons Information) Bill, introduced on 22 June 2015. The bill was divided into two bills at the committee of the whole House stage. The resulting Land Transfer Amendment Act 2015 and the Tax Administration Amendment Act 2015 were enacted on 22 September 2015.

The bright-line test, which is not covered by this special report, was included in the Taxation (Bright-line Test for Residential Land) Bill which was introduced on 24 August 2015 and had its first reading on 9 September 2015.

To further ensure overseas property buyers meet both existing tax requirements and those of the new test, as part of Budget 2015, the Government also announced that it would investigate introducing a withholding tax for offshore persons selling residential property. An issues paper seeking feedback was released on 31 August 2015.

Key features

- Transferors and transferees of property will need to provide the following information:

- Whether the land has a home on it.

- Whether the person or a member of their immediate family is a New Zealand citizen or visa-holder.

- If the person is a transferee and they or their immediate family has a work or student visa, whether they intend living on the land.

- The following tax information must also be provided unless an exemption (such as the main home exemption) applies:

- The person’s IRD number.

- If the person is a tax resident in another jurisdiction at the time of transfer, the name of that jurisdiction and the equivalent of an IRD number (the “tax identification number”, or TIN) from that foreign jurisdiction.

- A person who is not an “offshore person” as defined and who is purchasing a property with the intention of that property becoming their main home, or selling a property that was their main home, will not have to supply the tax information. The main home information exemption is not available where the person is an “offshore person”, where the property is to be or was owned by a trust, or if the person is selling their main home for the third time in a two-year period.

- This information will be provided to LINZ as part of the transfer documentation and then passed on to Inland Revenue, to help compliance with New Zealand’s tax legislation. It could also be provided to overseas tax authorities by Inland Revenue in accordance with existing information-sharing legislation.

- Aggregate data that does not identify any person may also be used for the purposes of housing policy.

- Second, an “offshore person” (as defined) will be required to provide evidence of a fully functional New Zealand bank account as a prerequisite to obtaining an IRD number. This is to ensure that an offshore person seeking to obtain an IRD number has first been subjected to New Zealand’s anti-money laundering and Countering Financing of Terrorism rules.

- An individual is not an offshore person if:

- they are a NZ citizen and have been in New Zealand within the past 3 years; or

- they hold a NZ residency class visa and have been in New Zealand within the past 12 months.

All other individuals will be offshore persons.

- For a non-individual (such as a partnership, trust or company), in general an offshore person is an entity or arrangement which is:

- incorporated outside New Zealand; or

- 25 percent or more owned (legal or beneficial) or controlled by an offshore person.

Application date

The new rules apply from 1 October 2015.

However, the new information requirements for transfers of land do not apply for transfers where both the following two conditions are satisfied:

- the contract for the transfer is entered into before 1 October 2015; and

- the transfer is registered on or before 1 April 2016.

Detailed analysis

References are to the Land Transfer Act 1952 unless stated otherwise.

Supplying information when transferring land

Requirement to provide a tax statement

Section 156B provides that all transferors and transferees of real property who are transferring a “specified estate in land” must provide a “tax statement” before the transfer can be registered. The tax statement must be provided to LINZ, or to a certifier who will provide it to LINZ, in accordance with existing conveyancing processes as specified in section 156B(2) and (3).

The definition of a specified estate in land is contained in section 156A, and includes freehold estates, leasehold estates, and certain unit titles and licences to occupy, as well as any other estate in land that is declared to be a specified estate in regulations.

Section 156C states that a tax statement must contain the following:

- full name, date and signature of the transferor or transferee;

- whether the land has a home on it;

- whether the person or a member of their immediate family is a New Zealand citizen or visa-holder;

- if the person is a transferee and they or their immediate family has a work or student visa, whether they intend living on the land; and

- either:

- the category of exemption that applies (if the transfer is a “non-notifiable transfer” for the person as defined in section 156A(2) and therefore exempt from the requirement to provide tax information);

or - the tax information set out in section 156C(2) if the person’s transfer is not exempt from the requirement to provide tax information.

- the category of exemption that applies (if the transfer is a “non-notifiable transfer” for the person as defined in section 156A(2) and therefore exempt from the requirement to provide tax information);

Information required for persons for whom transfer is non-notifiable

Transferees and transferors must provide the information contained in section 156C(2) unless the transaction is a “non-notifiable transfer” as defined in section 156A(2) (and therefore exempt for the purposes of section 156(2)).

The exemptions would only apply to the party identified and not to the transfer as a whole. That means that the tax information will still be required by the other party to the transfer unless the transaction is a non-notifiable transfer for that person also.

In all cases, the non-exempt person must supply their IRD number. This applies regardless of whether they are tax resident in New Zealand or not. If the person does not currently have an IRD number, they must obtain one from Inland Revenue before they can complete the transfer.

If they are currently a tax resident of another jurisdiction, the person must state the name and country code of that jurisdiction. The list of country codes is available on Inland Revenue’s website.

The person must also provide the equivalent of their IRD number in that jurisdiction – that is, the unique identifier that they use in their dealings with the tax authority in that jurisdiction.

In some cases, where a person is a tax resident of more than one jurisdiction under the law of those jurisdictions (dual resident), a double tax treaty may provide that a person is a tax resident of only one jurisdiction for the purposes of the double tax treaty. In such cases the person would have to provide their tax identification numbers of both jurisdictions.

Persons acting in different capacities

Where a non-exempt person must supply information about their IRD numbers (and where applicable, their foreign equivalent of an IRD number and relevant country code), section 156C(3) provides that a person who is acting in a different capacity must provide the information as it relates to the capacity in which they are acting.

For example, where trustees of a trust are buying or selling trust property, they must provide the trust’s IRD number, not their own personal IRD numbers. Similarly, partners in a partnership who are buying or selling partnership property should provide the partnership’s IRD number, not their own IRD numbers. Nominees must provide the IRD number of the person for whom they are acting as nominee.

Exemptions from requirement to provide information

There are certain exemptions from the requirement to provide information. As noted above, these are “non-notifiable transfers” as defined in section 156A(2).

The first is for individuals who are not “offshore persons” who are transferring their main home.

The second is for particular transfers or parties to transfers that have been specified in regulations to the Act.

Having to supply an IRD number does not necessarily mean that tax must be paid on the sale of property. Conversely, while a person who does not have to provide their information will generally not have to pay New Zealand tax on their gain, in some circumstances this might not be the case.

Main home information exemption

This exemption is intended for New Zealand individuals who are transferring their main home. This is provided for by section 156A(2)(a)(i) and (ii).

The definition of “main home” contained in the Land Transfer Act 1952 is very similar to the definition of “main home” contained in the Taxation (Bright-line Test for Residential Land) Bill which was introduced on 24 August 2015. The policy intent was for the definitions to be broadly consistent with each other.

For the main home exemption to apply for a transferee, the land must be intended to be used predominantly for a dwelling that will be the transferee’s main home.

For the main home exemption to apply for a transferor, the land must have been used predominantly, for most of the time the transferor owned the land, as a dwelling that was the transferor’s main home.

The owner must intend to reside (or have resided) in the property as their main home. Accordingly, the exemption will not apply when only a family member will use or has used the property as their main home (and not the owner themselves).

Section 156A(2)(b) provides that the information exemption is not available where any one of the following applies:

- the person is an “offshore person”;

- where the property is to be owned via a trust (in the case of a transferee);

- where the property was owned via a trust (in the case of a transferor); or

- for the sale of a property where the main home exemption has been used twice or more in the past two years immediately preceding the date of transfer.

Transferor must have used the land for “most of the time” as their main home

In the case of a transferor, the land must have been used for most of the time that the person owns the land as their main home. This requires the property to have been used more than 50 percent of the time as their main home for the period the person owns the land.

The land does not need to have been used without interruption as their main home. For example, a main home can be rented out for short periods while the owner is on vacation or prior to settlement of the sale of the property, as long as the time is less than the private residential use.

Mixed use properties

Where a property is used as both a main home and for other commercial, investment, or farming purposes, the main home information exemption will be available where most of the land is used for the home. When less than 50 percent of the property is used for the main home of the person then the main home exception will not apply.

For example, where the person’s home is on a farm that is being run for profit, it is unlikely that the main home information exemption will apply because most of the land is used for commercial farming. However, if the home is on a small lifestyle block, it is likely that the main home information exemption will apply as the land is mostly used for the person’s home.

Where a property is used for commercial premises (for example, a shop above a house), the main home information exemption will apply if most of the premises are being used for the person’s home. If most of the property is being used for the shop, the main home information exemption will not apply.

In some circumstances this may require an estimation to determine the area of land used for their private residential purposes and the area of land used for other purposes. For example, when a single property has been used by the owner partly as a residential home and partly as a rental property, the relative areas will need to be determined. For transferors, a taxpayer will have determined the relative areas in working out the tax deductions (insurance and rates, for example) that can be claimed. The determination of the areas includes any land used for the relevant purposes (for example, a backyard for the home).

Another mixed-use situation can arise where a property is being used partly as a home for the transferor or transferee, and partly as rental accommodation for other people. For example, a person owning a two-bedroom house who has one flatmate could potentially use the main home exemption, as they are likely to be using the majority of the house as their main home. However, a person who owns and lives in a boarding house with eight rooms is not able to claim the main home exemption because the property is not used predominantly as their main home.

Multiple homes

Where a person resides in multiple homes, only one of those properties can be their main home.

Where a person has more than one place of residence, their “main home” would be determined according to which property a person has the greatest connection with. The factors that determine these connections would include:

- the time the person occupies the dwelling;

- where their immediate family (if any) live;

- where their social ties are strongest;

- the person’s use of the dwelling;

- the person’s employment, business interests and economic ties to the area where the dwelling is located; and

- whether the person’s personal property is in the dwelling.

The greatest connection factors are similar to those used to determine if a person has a permanent place of abode under current case law. Therefore, existing guidance on the “permanent place of abode” test should assist in determining which property the person has the greatest connection with.

Time at which test is applied

The time that the test should be applied is at the date of transfer. Occasionally this will mean that a person can use the main home information exemption for two properties sold at the same time.

An example is when a person purchases a house intending to live in it and then moves into a new home while trying to sell the original home.

The ownership overlap of the properties will not mean the original home fails to satisfy the requirements to be a main home for the previous period. If the two properties were sold at the same time, the owner will be able to use the main home exception for the purchase and sale of the original house, and also for the purchase and sale of the second property (if each transaction satisfied the requirements to be a main home at the date of transfer).

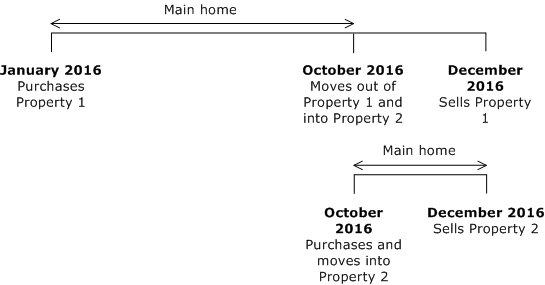

Example – Main home exception for multiple properties

The main home exception is available for both properties. Property 1 was the main home for the majority of the time that person owned Property 1 was owned. Property 2 was the main home for the entire time it was owned (October to December 2016).

Different co-owners can have different main homes

The test applies for each transferor or transferee. This means that different co-owners can have different main homes. For example, a person living in one city could potentially have a different main home from their spouse living in another city.

Offshore persons

Section 156A(2)(b)(iv) will provide that the main home exemption is not available to “offshore persons” (defined in section 3 of the Tax Administration Act 1994).

This means that the main home exemption will be available to a person only if one of the following applies:

- they are a New Zealand citizen or permanent visa holder who is currently present in New Zealand; or

- they are a New Zealand citizen who is not currently present in New Zealand but they have been away from New Zealand for less than three years; or

- they are a permanent resident visa holder who is not currently present in New Zealand but they have been away from New Zealand for less than one year.

All other persons who are transferring a property must supply their IRD number, and if they are a current tax resident of another country, their equivalent of an IRD number and the country code of the other country.

Trusts

Where the property being transferred was or will be trust property, section 156A(2)(b)(i) and (ii) provides that the main home information exception will not be able to be used. This means that the trustees of a trust will need to provide the trust’s IRD number (and foreign equivalent of an IRD number and country code, if applicable) when transferring trust property.

Persons selling their main home a third time within two years

Section 156A(2)(b)(iii) provides that a person who has transferred their main home at least twice in the past two years must provide their IRD number (and foreign equivalent of an IRD number and country code, if applicable) if they transfer their main home a third time within that two-year period. This is to address the situation where a person has a regular pattern of buying and selling a property in which they live, for profit. Such a person may be taxable under existing law on gains from the sale of these properties. Collecting information in relation to those who have sold their home for the third time within two years is intended to help Inland Revenue identify those situations.

Examples of main home information exemption

Example 1 – Main home

George buys his first home in Seymour Street in 2016. However, his neighbours complain about the noise when he plays his drum kit, so he decides to sell it and buy a new home with better soundproofing. When he puts his Seymour Street house on the market he is pleasantly surprised to discover that his house has risen in value. He has an offer accepted on a new house in Taradale Street. George does not need to provide his IRD number for the sale of the Seymour Street property, which he lived in as his main home, or the purchase of the Taradale Street property, which is to be his main home.

Example 2 – Holiday home

Lisa rents an apartment in Wellington, where she lives with her son. The apartment is close to her office from which she runs her consulting business fulltime. She is a member of a local tramping club and is on the Board of Trustees of her son’s school in central Wellington.

She owns a house on Lake Taupo with views over the lake. She does not let the Lake Taupo property out when she is not using it. She spends four weeks with her son in this property here over Christmas and New Year, and also uses the property for about five weekends during the ski season.

When Lisa sells the Lake Taupo property, she cannot use the main home exemption because it is not the property with which she has the greatest connection, taking into account the factors listed on pages 7–8.

Example 3 – Two properties

Mr and Mrs Brown and their children live in a house on a small lifestyle block in Oamaru. Mrs Brown works in Christchurch for three days a week, and works from the Oamaru house two days a week while her husband looks after the children fulltime. Mrs Brown plans to buy an apartment in Christchurch city. She will live in that apartment while she works in Christchurch.

Taking into account the fact that the majority of Mrs Brown’s time is spent at the Oamaru house, and her family is located at the Oamaru house, the main home information exemption will not apply in relation to Mrs Brown’s Christchurch apartment as it is not the home with which she has the greatest connection, and she will have to supply her IRD number in relation to the purchase of that property.

However, if Mr and Mrs Brown were to sell their Oamaru property, they would not need to provide their IRD numbers in relation to that sale because that property was their main home.

Example 4 – Offshore person

Sarah is a New Zealand citizen who has been living in the United Kingdom (UK) for the past 10 years. Prior to returning to New Zealand, she decides to buy a house in Te Awamutu to live in. As she is an “offshore person” at the time she purchases the house, she cannot use the main home information exemption for this property and she will need to supply her IRD number in relation to the purchase of that property. Because she is a tax resident of the UK at the time that she purchases the property, she will also need to supply her UK National Insurance number (which is the equivalent to a New Zealand IRD number), and the UK country code.

Example 5 – Investment property

Tom and Barbara are selling their property, which they used as their main home, to Jerry and Margo, who are buying it to use as an investment property.

The transfer is a non-notifiable transfer for Tom and Barbara. They are both New Zealand citizens and have been present in New Zealand within the last three years, and are selling their main home.

However, the transfer is not a non-notifiable transfer for Jerry and Margo. Jerry and Margo live in the UK but are New Zealand citizens, and have visited New Zealand within the last three years. However, they are not buying their main home. They must therefore supply the tax information required under section 156C(2).

Jerry and Margo must supply their New Zealand IRD numbers. Because they are both tax residents of the UK, they must also supply their UK National Insurance numbers.

Jerry is also a tax resident of France under France’s domestic tax laws because he owns a holiday home there. He therefore also needs to provide his French tax identification number. (Although there is a double tax treaty between France and the UK, and that double tax treaty provides that Jerry is a resident of the UK only, he still needs to provide both his French tax identification number and his UK National Insurance number).

Example 6 – Multiple dwellings

Tom buys an apartment block on a single title. He lives in one of the apartments as his main home and rents out the remaining six apartments. Tom sells the apartment block to a third party. Tom will have to provide his IRD number on the sale of the apartment block because the land (contained on the single title) was not used predominately as his main home. The majority of the land was used as rental property.

Example 7 – Lifestyle block

Paul purchases a two hectare block of former farmland and builds a house on it. Paul lives in the house as his main home with his family. The remaining land is used by the family to keep some family horses to ride and to run a handful of sheep to keep the grass down. The main home exception will apply and Paul will not need to supply his IRD number when he purchases or sells the land.

Example 8 – Mixed use: apartment attached to factory

Melissa intends to purchase a large factory with a small apartment attached. Melissa intends to live in the apartment as her main home. Melissa must supply her IRD number at the time she acquires the property because she does not intend to use the land predominately as her main home.

Example 9 – Mixed use: country store and house

Judy owns a country store that has living quarters attached. She lives in the living quarters and runs a retail business from the front half of the property. She estimates that the retail business uses 45 percent of the property and claims expenses (for example, insurance and rates) on that basis against the retail income. Judy sells the property. She does not need to provide her IRD number because she has used the property predominately (55 percent) as her main home during the time she has owned the property.

Example 10 – Mixed use: purchase of fish and chip shop

Brandon intends to buy a fish and chip shop with an attached dwelling. Brandon will need to determine the total area of the different parts of the property to determine whether he intends to use the property predominately for his main home, and so whether he needs to supply his IRD number as part of the purchase. (Brandon will need to make an estimation of the total area in the future in any event to determine the deductions that can be claimed against his retail income.) Brandon estimates that he will use the property (building and surrounding land) 60 percent for the fish and chip shop. He will, therefore, need to provide his IRD number on purchase of the property.

Example 11 – Purchase of lifestyle block (change in use)

Amy and Chris decide to move from the city to the country. They buy a 15 acre (six hectare) block. They intend to purchase some livestock to keep the grass down and the freezer full.

At the time of acquisition, they would not need to supply their IRD number as the main home exemption would apply.

After three years, the couple decide to supplement their income by leasing out all but one of the paddocks for horse grazing. As a result, the area that they use for their own purposes does not exceed the area of the leased paddocks. They continue to lease out most of the paddocks for horse grazing for the next five years, at which point they decide to sell the property.

When they sell the property, the main home exemption will not apply to them because the majority of the land was not used for their main home for the majority of the time that they owned it.

Information exemptions (non-notifiable transfers) under regulations

Sections 156A(2)(iii) and 236(l)(ha)(ii) provide that particular types of transfers or parties to transfers can be “non-notifiable” transfers under regulations to the Act. In these cases the IRD number, and where applicable, a tax identification number and country code are not required.

In order for a type of transfer, or party to a transfer, to be specified in regulations, section 236(4) provides that the Minister for Land Information must be satisfied that the type of transfer or party to a transfer meets the following criteria:

- collecting this information would be impractical or involve high compliance costs; or

- the transfer would represent a low tax avoidance risk.

The exemptions would only apply to the party identified and not to the transfer as a whole. That means that the tax information will still be required by the other party in the transfer unless the transaction is a non-notifiable transaction for them too.

Cabinet has approved regulations that will exempt transfers in the following situations.

Mortgagee sales

Where a transfer is the result of a mortgagee sale, a rating sale under the Local Government (Rating) Act 2002, a court-ordered or statute-ordered sale, the transferor does not need to provide an IRD number. This is because the transferor in this circumstance is the mortgagee or creditor and there is a low risk of tax avoidance in this context.

Transfers from executors

In the case of death, the executors of the person’s estate are exempted from the requirement to provide an IRD number. The rationale for this exemption is that estate sales will not be taxed under the proposed bright-line test, and requiring all executors to get an IRD number would also add compliance costs in a situation where there is no choice about the vehicle used for transferring property.

Public and local authorities

Tax-exempt public authorities and tax-exempt local authorities, as defined in the Income Tax Act 2007, would not need to provide an IRD number when transferring land. This definition includes departments and departmental agencies and local authorities but not wider Crown Entities or Council Controlled Organisations. It will include any land held by the Crown. As they are tax-exempt there is no need for tax information.

Offence to supply misleading or false tax information

Section 156E provides that a person who knowingly, or with intent to deceive, gives false or misleading tax information, commits an offence. A person who commits such an offence is liable to a fine of up to $25,000 if the conviction is a first time offence, and a fine of up to $50,000 for every subsequent offence.

A person who provides information that they genuinely believe to be true but which is not in fact correct will not be committing an offence.

Correction of errors or omissions

Section 156D provides a procedure for an omission or error that was contained in a tax statement provided to LINZ to be corrected. Such omissions or errors do not affect the validity of any registration of transfer instrument.

Information disclosure and retention

Section 156H provides that tax information must not be disclosed unless authorised or required by law.

Section 156F requires LINZ to supply Inland Revenue with the tax information and the details of the related property transaction that it collects. Section 156I of the Land Transfer Act and section 81 of the Tax Administration Act 1994 permit tax information to be disclosed between authorised persons in specified circumstances, which is intended to allow for information matching between Inland Revenue and LINZ in relation to the information collected by LINZ.

Section 156F also permits the chief executive of LINZ to release or to give tax information to any person who requests it, provided that the information is given in aggregate form only and in a manner that prevents any person, estate in land, or transaction from being identified.

Under section 156G, certifiers and LINZ must hold tax statements for 10 years. A copy of a statement must be provided to the Commissioner of Inland Revenue if requested in writing.

Regulations providing for exemption from requirement to provide tax statement

As noted above, section 156B provides that all transferors and transferees of real property must provide a tax statement before the transfer can be registered.

Section 236(1)(ha)(i) provides for regulations to be made to exempt certain types of transactions from the requirement to complete a tax statement if it would be impractical or involve high compliance costs, or where there is a low risk of tax avoidance.

Cabinet has approved regulations to exempt transfers of Māori Land as defined by Te Ture Whenua Māori Act 1993 (Māori customary land and Māori freehold land) for practicality reasons. There are often many owners and contacting them all is difficult, if not impossible. Cabinet has approved regulations to exempt transferees from the requirement to complete a tax statement where the transfer is a part of the Treaty settlement process. Again, in many cases it would be impractical to collect information from owners.

Except in the case of Māori land, the exemptions would only apply to the party identified and not to the transfer as a whole. That means that a tax statement will still be required by the other party in the transfer unless they too are exempted by regulation.

Regulations providing for other estates in land to be covered by the tax information requirement

Regulations will be able to be made to include transfers of other estates in land to be covered by the tax information requirement, where these are economically equivalent (see section 236(l)(hb)). No such regulations are currently under consideration.

New Zealand bank account requirement

Section 24BA(1) of the Tax Administration Act 1994 provides that the Commissioner must not allocate a tax file number (commonly known as an IRD number) to an offshore person unless she first receives a bank account number for that person.

The main features of the rule are:

- the definition of “offshore person”; and

- the definition of “bank account number”.

The amendments come into force on 1 October 2015.

Offshore person

The definition of “offshore person” applies both to individuals and non-individuals (for example, trusts and companies).

For individuals, a New Zealand citizen or person that holds a residence-class visa granted under the Immigration Act 2009 will generally not be classed as an offshore person unless:

- in the case of citizens, they have not been in New Zealand within the last three years; and

- in the case of residents, they have not been in New Zealand within past 12 months.

A non-individual will be an “offshore person” if they would be an overseas person under section 7(2)(b) to (e) of the Overseas Investment Act 2005 (modified to include the test for individuals described above). This test looks through structures that are New Zealand-tax resident and looks at their underlying ownership or control. The test is necessary to prevent offshore individuals avoiding the rule by interposing a New Zealand-resident structure.

Generally speaking this means a non-individual will be treated as being “offshore” if:

- It is a body corporate (such as a company) and:

- it is incorporated outside New Zealand; or

- 25 percent or more of its shares are owned by a body corporate incorporated outside New Zealand; or

- an offshore person has (or offshore persons have) 25 percent or more of:

- any class of securities;

- the power to control the composition of its governing body; or

- the right to exercise or control the voting power.

- It is a partnership or other unincorporated body of persons (other than a trust) and:

- 25 percent or more of its partners or members are offshore persons;

- an offshore person has (or offshore persons have) a beneficial interest in or entitlement to 25 percent or more of the profits or assets (including on winding up); or

- an offshore person has (or offshore persons have) has the right to exercise or control the exercise of 25 percent or more of the voting power at a meeting.

- It is a trust and an offshore person (or offshore persons)

- constitute 25 percent or more of its governing body; or

- has or have a beneficial interest in or entitlement to 25 percent or more of the trust property; or

- are 25 percent or more of those that have the right to amend or control the amendment of the trust deed; or

- are 25 percent or more of those having the right to control the composition of the trust’s governing body.

- It is a unit trust and an offshore person (or offshore persons) and:

- is or are the manager or trustee, or both; or

- has or have a beneficial interest in, or entitlement to, 25 percent or more of the trust property.

Bank account number

A “bank account number” is an identifying number of an account at either a “registered bank”, as defined in the Reserve Bank of New Zealand Act 1989,[1] or a “licenced non-bank deposit taker”, as defined in the Non-bank Deposit Takers Act 2013. The Reserve Bank publishes lists of both types of entity on its website.

The bank account must be one for which customer due diligence (under the AML rules) has been completed. This is to ensure that the relevant identity checks have actually been performed on the person applying for the IRD number. The account must be a current account (a person cannot use the details of a closed account).

The account number submitted to the Commissioner must be an account held by the IRD number applicant.

The bank account requirement applies only in instances where a person has applied for an IRD number. This is so that the current practice of the Commissioner allocating IRD numbers as an administrative matter in some cases will continue.

Becoming an offshore person

Section 24BA(2) of the Tax Administration Act 1994 is intended to prevent the bank account requirement being circumvented by, for example, a New Zealand company being established, obtaining an IRD number and then being sold to an offshore person. The proposed section requires a person to give their bank account number to the Commissioner immediately upon becoming an “offshore person”. However, this requirement to provide a bank account number at this later time applies only to non-individuals. This means that, for example, a New Zealand citizen who emigrates will not be obliged to provide a bank account number after being away for three years.

A person who has already provided a current bank account number to the Commissioner of Inland Revenue does not need to do so again if they become an offshore person.

Penalties for non-compliance

No new penalties are included as part of these amendments. If an offshore person does not provide a bank account number they will not be issued an IRD number. Existing penalties may apply in certain instances, such as for the requirement to provide a bank account number upon becoming an offshore person. In such cases, failing to provide information to the Commissioner of Inland Revenue when required to do so by a tax law is an offence under sections 143 and 143A of the Tax Administration Act 1994.

[1] This definition is already contained in section YA 1 of the Income Tax Act 2007, and so is incorporated in the Tax Administration Act through the operation of section 3(2) of that Act.