Technical analysis

Introduction

In February 2015, public consultation was held seeking feedback on policy proposals to address the tax consequences of related parties debt remission issues when the debtor and the creditor are either in the same wholly owned group of companies, or, in certain circumstances, when the owner, or owners, of a company or a partnership remit debt. Cabinet has now agreed to the proposals.

The Minister of Revenue intends to introduce amending legislation into Parliament early next year. To provide certainty, this note provides early detail of the proposals to be included in that draft legislation. The proposals outlined here still remain subject to parliamentary process.

The current asymmetric debt remission result

Debt remission is the extinguishing of a liability of a debtor by operation of law or forgiveness by the creditor. The reduction of the liability is currently treated as taxable income because, like other forms of income, it increases the wealth of the debtor. This is the right tax outcome for the remission of most loans.

This issue concerns remission (or cancellation) of a loan (a debt remission) in situations when there is no change in ownership of the debtor or net wealth of the “owner”. A debt remission within a wholly-owned group of companies is a good example of this. One company (who advanced the loan – the creditor) suffers a loss, and the other company (who borrowed the money – the debtor) has a corresponding gain but overall there is no change in the ownership of the companies or in the wealth of the owner (that is, the owner of the wholly owned group of companies, or indeed, the parent company). See example 1 in the appendix.

Under present tax law, this type of remission produces taxable income to the debtor, but no tax deduction for the creditor. This asymmetric tax result overtaxes the corporate group. This outcome was commonly “managed” by issuing equity to pay the debt – the debt is capitalised instead of it being remitted or forgiven.

However, a recent interpretation by Inland Revenue has indicated that debt capitalisation may sometimes be considered tax avoidance and so taxed like debt remission. This interpretation has created uncertainty among taxpayers and their advisors and has prompted officials to review the appropriate taxation of debt remission.

As well as the group company scenario, other common scenarios which raise the same scenarios include:

- debt remission between an overseas parent and its New Zealand subsidiary; and

- shareholder or partner debt advanced to a company or partnership (including look-through companies (LTCs) and limited partnerships), is remitted or capitalised pro-rata to ownership. See example 2 in the appendix.

Collectively the “related parties” or “economic group” referred to in this analysis are the parties discussed immediately above.

If a capitalisation of a debt advanced by a related party would not change the overall wealth of the “economic group” or the ownership of the debtor, the core policy recommendation is that, if instead the debt is remitted, the tax result should be symmetric and this should be achieved by not imposing debt remission income on the debtor.

Therefore Cabinet has agreed that there should be no debt remission income for the debtor when the debtor and creditor are in the New Zealand tax base, which includes controlled foreign companies, and:

- they are members of the same wholly owned group of companies; or

- the debtor is a company or partnership and:

- all of the relevant debt is owed to shareholders or partners in the debtor; and

- if we presume that the debt remitted was instead capitalised, there would be no dilution of ownership of the debtor following the remission and all owners’ proportionate ownership of the debtor is unchanged.

Inbound investment

The taxation treatment when the owner/creditor is a non-resident and the debtor is New Zealand-resident was discussed but not concluded in the February 2015 issues paper. The core proposal extends to inbound debt as any alternative produces arbitrary results.

Fiscal

There should be no fiscal implications to agreeing to the “core proposal”. Until recently taxpayers have commonly “managed” recognising debt remission taxable income on related-party debt by using debt capitalisation instead. The proposal will allow such treatment to continue.

Supporting technical issues

That the “core proposals” extend to relatives of the owner

The “core proposal” as above applies where the owner is the person who has advanced the debt (group companies scenarios excepted). However, in a number of situations the debt could be advanced by a relative of the owner. For example a person could advance a loan to their spouse’s company or LTC. There is no certainty of taxation outcome if that debt is later capitalised – the capitalisation could, depending on the circumstances, be tax avoidance, and be reconstructed as a debt remission.

This will be explicitly clarified and the “core proposals” will apply in situations when the loan is advanced by a relative of the owner.

That nominal shareholdings be ignored in applying the “core proposals”

Frequently nominal holdings in a family company are held by individuals whereas the company is effectively owned by the family trust, which is also the entity that has advanced the debt that is being remitted or capitalised. The nominal holding might be to give the individuals access to the shareholder/employee salary tax rules (salary not taxed at company level, but at shareholder level).

Given the legal uncertainty that would arise if the debt is capitalised, to provide certainty these nominal shareholdings will be ignored when measuring ownership for the purpose of applying the “core proposals”.

The Income Tax Act 2007 financial arrangement debt remission mechanism

To date there has been little discussion on the detailed mechanics of how to give effect to the “core proposals” in the taxation legislation. There is a need to provide complete certainty of outcome, and, of course, protect the tax base, by specifying the amount of the loan that is deemed to be paid on remission or capitalisation.

On a very similar point, the Income Tax Act provides a useful precedent for addressing satisfactorily the mechanics to satisfy the financial arrangement rules. Where debt is forgiven (remitted) for natural love and affection the debt is deemed to have been repaid in full (including any unpaid interest). This deeming for the debt remittances and capitalisations would ensure that the correct amount of tax is charged over the life of the loan (including upon a base price adjustment).

The natural love and affection debt remission mechanism will be used.

Other Tax Act mechanisms

Debt remission will be deemed to cause “available subscribed capital” for a corporate debtor (so that it can later be returned tax free to the shareholders if appropriate). Debt capitalisation already explicitly causes this outcome, and the economics are the same.

Debt remission will be deemed to increase the cost of the creditor’s investment in the debtor (with adjustments to make it work where the creditor is not also the owner (e.g. group companies)). Again debt capitalisation already explicitly causes this outcome, and again the economics are the same.

Application dates

There are two ways by which the “core proposals” retrospective application date (the commencement of the 2006–07 year) can be effected:

- backdate the detailed proposals; or

- grandparent past returns (to the end of the 2013–14 year) and apply the detailed proposals going forwards.

There are arguments both ways. However, certainty and simplicity would suggest the grandparenting approach. This will also drive the application date of the technical issues.

Media queries

T. 04 890 1698

Appendix

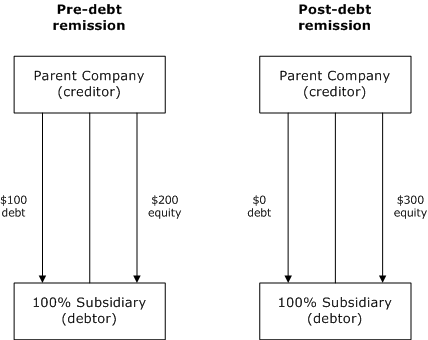

Example 1: Simple debt remission

Result: under current tax law Subsidiary has $100 debt remission taxable income and Parent has no corresponding tax deduction.

However, the net combined wealth of Parent Company and Subsidiary has not changed.

The proposed amendment will remove this taxation impost.

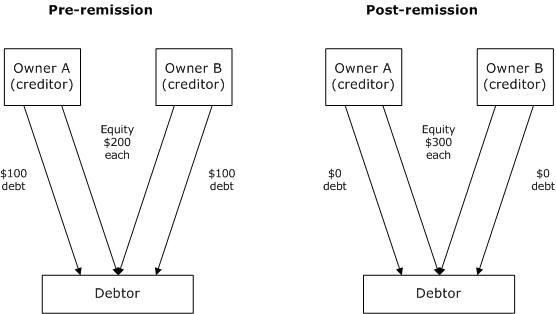

Example 2: Multiple owner pro-rata debt remission

Debtor could be a partnership, an LTC or a company.

Result: under current tax law there is $200 debt remission income and no corresponding tax deductions.

However, the net wealth of Owners and the Debtor has not changed.

The proposed amendment will remove this taxation impost.