Chapter 6 - How branches interact with the NRWT rules

- Offshore branch exemption

- Application date

- Onshore branch exemption

- Cross-border related-party borrowing by banks

- Questions for submitters

6.1 The legislation currently has exemptions from NRPI for interest payments that are made by foreign branches of New Zealand companies or are made to foreign companies with New Zealand branches. Both exemptions are so wide in scope that they currently exempt certain interest payments that are not consistent with the policy intent for the taxation of New Zealand-sourced income earned by non-residents.

Offshore branch exemption

Issue

6.2 NRPI includes only income that has a New Zealand source. One of the exclusions from having a New Zealand source is the offshore branch exemption. This applies where the interest is derived from money lent outside New Zealand to a New Zealand resident that uses that money for the purposes of a business it carries on through a fixed establishment offshore.

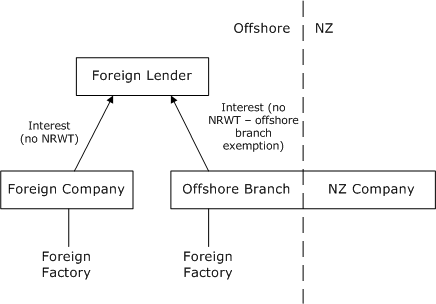

6.3 This exemption is intended to apply to a New Zealand resident operating an active business through a branch in another country. If that offshore branch borrows money to fund its offshore operations the interest on this funding should not be subject to NRWT. This treatment ensures that the offshore branch of a New Zealand company does not have to pay NRWT when a foreign incorporated subsidiary borrowing for an equivalent business would not have to. This is shown in figure 1.

Figure 1: Offshore branch exemption

6.4 However, this exemption also applies where a New Zealand company sets up an offshore branch which borrows money for the purpose of providing funding to New Zealand borrowers, who may be related or unrelated to the New Zealand company.

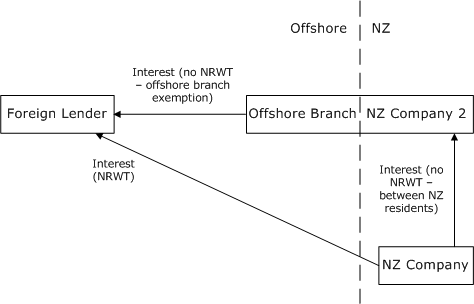

6.5 In this circumstance a New Zealand resident can borrow from a non-resident lender through an offshore branch of a second New Zealand resident without that borrowing incurring NRWT. If the first New Zealand resident had borrowed directly from the non-resident lender, the interest would be liable for NRWT (or AIL). As these are economically the same transaction they should have the same tax treatment. This is shown in figure 2.

Figure 2: Offshore branch lends to New Zealand

6.6 This structure has been adopted by a number of participants in the New Zealand financial sector as a means for funding their New Zealand operations. We are not aware of it currently being used by any non-financial sector entities.

6.7 Australia also has an offshore branch exemption from NRWT. However, section 128B(2A) of the Income Tax Assessment Act 1936 prevents this exemption being used in relation to money which is then on-lent to Australia. This is achieved by imposing NRWT on interest paid by an Australian resident (or a non-resident in connection with an Australian branch) to an offshore branch of an Australian resident.

Addressing the problem

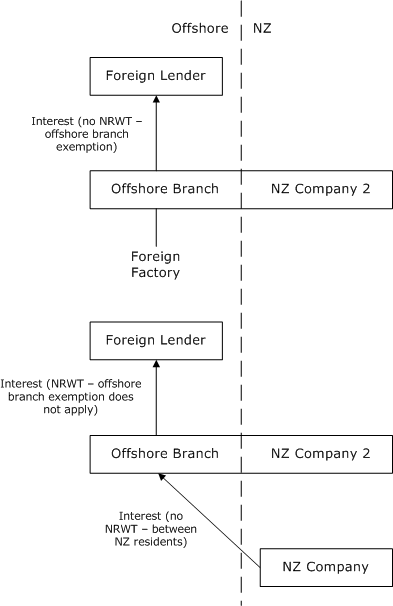

6.8 Officials wish to explore addressing this issue by defining interest paid by the offshore branch of a New Zealand resident as New Zealand-sourced income, except where that interest is paid on money borrowed for the purpose of a business outside New Zealand, which does not involve lending to New Zealand residents. This is shown in figure 3.

Figure 3: Proposal

6.9 This approach will remove the incentive to use an offshore branch for the purpose of removing AIL on international debt funding of New Zealand residents. This will create a consistent tax treatment for those who pay AIL on such funding because they do not have the scale, and/or other commercial reasons, to justify an offshore branch.

6.10 To ensure that such interest is appropriately subject to New Zealand tax, we intend also to require that if NRWT is not actually paid on such interest, payment of AIL will be mandatory.

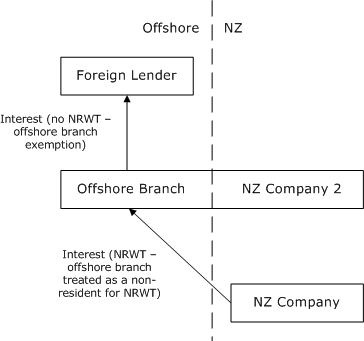

6.11 An alternative approach would be to impose NRWT (or AIL) on interest payments on amounts borrowed by a New Zealand resident from an offshore branch of another New Zealand resident. This is shown in figure 4. However, in this case it would seem difficult to also subject the interest earned by the second New Zealand resident to net income tax. Giving the second resident a tax exemption is not consistent with the taxation of New Zealand residents on their worldwide income. There might also be an argument that where the borrower and the branch are associated but the ultimate lender is not, AIL should be payable rather than NRWT. For these reasons we prefer the approach outlined above; we invite submissions on this point.

Figure 4: Alternative to proposal (not favoured)

Application date

6.12 Officials suggest that the reforms outlined in this chapter would apply to financial arrangements entered into on or after enactment of the legislation. This is expected to be in the second half of 2016.

Transitional

6.13 For financial arrangements entered into by offshore branches of New Zealand banking groups before enactment of the changes, we intend to impose AIL on interest payments made in income years beginning more than five years after enactment of the legislation. This provides an extended period of grandparenting, after which it is appropriate to apply the new rules to all arrangements. Consideration will also be given to whether a prepayment rule is required.

6.14 For any existing arrangements of offshore branches of non-bank groups, we suggest imposing NRWT or AIL (depending on whether or not the lender to the branch is associated with the borrower) on interest payments made in income years following enactment. There will also be a prepayment rule.

Onshore branch exemption

Issue

6.15 New Zealand-sourced interest income derived by a non-resident is not NRPI when the non-resident lender is engaged in business in New Zealand through a fixed establishment in New Zealand. This exemption from NRPI is known as the onshore branch exemption.

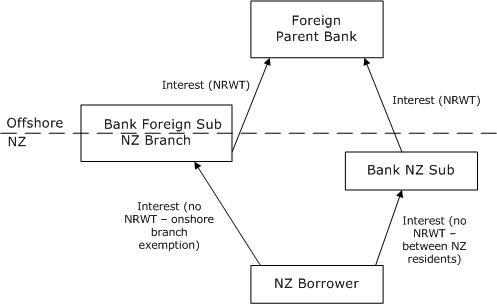

6.16 When NRWT, and this exemption, were introduced in 1964 many retail borrowers funded their home mortgages through banks and other institutions that operated in New Zealand as a branch of their overseas parent. These branches pay income tax on their branch income in a similar way to New Zealand residents. This exemption meant these retail borrowers did not have to deduct NRWT from interest paid to New Zealand based lenders. This is shown in figure 5.

Figure 5: Onshore branch exemption

In figure 5, both NZ Branch of Bank Foreign Sub and Bank NZ Sub are subject to New Zealand income tax on their New Zealand net income.

6.17 However, the exemption from NRWT also applies to lending by an entity with a New Zealand branch where the lending is not made through the New Zealand branch. As with the New Zealand branch income, this non-branch (but New Zealand-sourced) income is subject to New Zealand net income tax. This treatment of non-New Zealand branch income can be contrasted with the offshore branch exemption which does not apply to all interest paid by a resident company with an offshore branch, but only to interest on money borrowed which is “used by [the branch] for the purposes of a business they carry on outside New Zealand”.

6.18 There are at least two problems with this extension of the onshore branch exemption.

6.19 First, there is no NRWT (or AIL) on interest paid on money borrowed by the non-resident which is not for the purpose of its New Zealand branch, whereas there is NRWT (or AIL) on money borrowed for the purpose of the New Zealand branch. This means it is possible for a non-resident parent to lend money to its New Zealand subsidiary with no tax payable on the interest (other than income tax on a very slim margin). The parent can simply lend the money to the head office of a non-New Zealand group company which has a New Zealand branch. The head office of that company can then lend the money to a New Zealand group company.

6.20 Second, it is more difficult practically for New Zealand to audit the non-resident’s non-New Zealand activities, which is necessary to ensure that net income tax is being paid on its non-New Zealand branch but New Zealand-sourced income.

6.21 In practice, this exemption has been used by both financial sector and non-financial sector groups to fund New Zealand entities without paying NRWT or AIL.

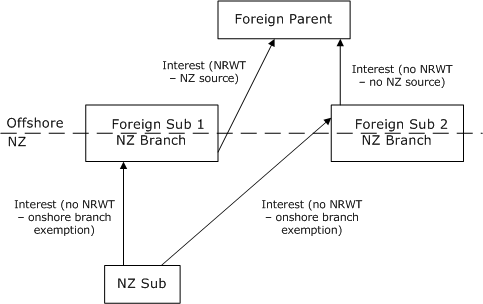

6.22 This structure is shown in figure 6.

Figure 6: Comparison of current onshore branch exemption

In figure 6 the net profit of Foreign Sub 1 NZ Branch and net profit from the New Zealand-sourced income of Foreign Sub 2 is subject to New Zealand income tax. However, unlike Foreign Sub 1, the interest payment by Foreign Sub 2 to Foreign Parent does not have a New Zealand source so is not subject to NRWT. Note that if NZ Sub borrowed directly from Foreign Parent, it would be required to withhold NRWT from the interest payments.

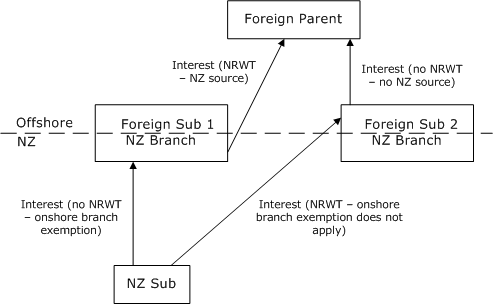

Addressing the problem

6.23 Accordingly, we suggest restricting the onshore branch exemption so that interest income of a non-resident with a New Zealand branch will only be exempted from being NRPI if the money lent is used by the non-resident for the purposes of a business it carries on through its New Zealand branch. This is shown in figure 7.

Figure 7: Proposal comparison for onshore branch exemption

Application date and transitional treatment

6.24 We suggest the same application date and transitional treatment for interest paid to a non-resident entity with a New Zealand branch[12] as we do for interest paid by a non-New Zealand branch of a New Zealand entity.

6.25 That is, NRWT (or AIL if the non-resident is not associated with the borrower) will apply to interest payments on all arrangements entered into after enactment of the legislation. Unless the non-resident operates in New Zealand as a registered bank, it will also apply to interest income on existing arrangements in income years following enactment. The prepayment rule, if introduced, would apply in this context. If the non-resident does operate in New Zealand as a registered bank, payments with respect to pre-enactment arrangements will be subject to NRWT/AIL if made on or after the fifth year following enactment of the legislation.

Cross-border related-party borrowing by banks

6.26 On first principles, whether NRWT or AIL applies to interest paid by a New Zealand resident to either:

- the offshore branch of a New Zealand resident; or

- a non-resident with a New Zealand branch, where the interest does not relate to the branch

will be determined by whether or not the borrower and lender are associated. However, this proposition requires further examination in the case of bank lending.

6.27 For a New Zealand bank that is part of a wider worldwide banking operation there are commercial reasons why the New Zealand bank may borrow from its parent or another associated entity. This can include the better credit rating held by the larger parent, economies of scale of a single funding operation and/or better name recognition of the parent, which allows funding to be raised more cheaply.

6.28 Unlike most other industries, even when the fungibility of money prevents it being traced through to the ultimate funding source, due to the structure of a bank as a margin lender it can reasonably be considered that funding on-lent to a New Zealand bank by its parent is largely ultimately borrowed from an unrelated third party and is largely not provided by the parent bank’s shareholders as a substitute for equity.

6.29 Interest on related-party funding to a New Zealand bank should be set according to transfer pricing principles such as the cost of funds to the parent bank, any difference in credit rating of the New Zealand bank, and different terms applied to the money lent to the New Zealand bank compared with its original borrowing. Accordingly the New Zealand bank has to accept (or not) the interest rate applied to that funding and has very little negotiating power over what that rate is.

6.30 If a foreign associate lends directly to a New Zealand-incorporated registered bank, the interest on this lending will be subject to NRWT. Whereas if that lending is channelled through an offshore branch of a New Zealand subsidiary or the head office of an offshore company with a New Zealand branch, this lending is not subject to NRWT.[13] As these arrangements have the same economic substance, the NRWT treatment should be the same.

6.31 By restricting the offshore and onshore branch exemptions, as covered above, New Zealand banks will no longer be able to rely on these structures to remove their NRWT liability. However, we recognise that, as covered above, banks are margin lenders, which means that:

- they do not make large profits on any particular dollar of lending; and

- their related party lending is indirectly sourced from third parties and is not a substitute for equity investment.

Also, applying NRWT to bank interest would be likely to increase the cost of capital for all borrowers in New Zealand significantly, should the banks increase their level of related party funding into New Zealand. For these reasons NRWT is likely to be inappropriate for this lending.

6.32 Officials therefore suggest that banks be allowed to pay AIL on interest paid to non-resident associated lenders. This would only apply when the borrower is a member of a New Zealand banking group (as already defined for thin capitalisation purposes).

6.33 For the same reasons, the suggestions in Chapter 3 would not apply to registered banks either.

6.34 We suggest that banks would be able to pay AIL on interest payments made after the enactment of the bill containing these proposals.

6.35 There is no suggestion to extend this approach to non-banks, including other businesses operating in the financial sector. This is because, unlike other industries, banks already have a clear definition which removes boundary issues and provides confidence that related-party funding is not an economic substitute for equity investment. This is consistent with the current legislation where New Zealand-registered banks are subject to more rigorous thin capitalisation requirements and greater regulatory oversight by the Reserve Bank of New Zealand, than other financial sector taxpayers.

Questions for submitters

6.1 Should the offshore branch exemption apply to borrowing used to make loans to New Zealand residents?

6.2 Are there any particular reasons to apply AIL/NRWT to interest paid to an offshore branch by a New Zealand-resident borrower, rather than applying it to the interest which the offshore branch pays on money it borrows in order to make the loan to the New Zealand-resident borrower?

6.2 Should the onshore branch exemption apply only to borrowing through the New Zealand branch of a foreign lender?

6.3 Should New Zealand-registered banks be able to pay AIL on related-party funding provided by a non-resident?

6.4 Should the suggested changes apply from the dates identified above?

12 Excluding interest paid to the New Zealand branch, which is not subject to any change.

13 Due to not having a New Zealand source or not being NRPI respectively.