Appendix 2 - Examples of different interaction and transaction rules in the Inland Revenue Acts

Example of silent legislation as to form of interaction and transaction with Inland Revenue

Section 15I of TAA states: [Procedure for revocation of listing]

(1) The Commissioner must notify a listed PAYE intermediary of an intended revocation under section 15H, and must provide reasons for the intended revocation.

(2) If the listed PAYE intermediary who is notified by the Commissioner under subsection (1) does not resolve the matters set out in the notice to the satisfaction of the Commissioner within 30 days of the date on which they are notified, the Commissioner may give 14 days’ notice of revocation.

(3) At the end of the 14-day notice period under subsection (2), the listing of the listed PAYE intermediary is revoked.

(4) A decision by the Commissioner under this section is not open to challenge under Part 8A.

Example of Commissioner having discretion as to form of interaction and transaction

Section 34B of TAA states: [Commissioner to list tax agents]

A person who is not a tax agent and who is eligible to be a tax agent may give a notice (the application) to the Commissioner in a form approved by the Commissioner—

(a) stating that the person wishes to be listed as a tax agent; and

(b) providing the information required by subsection (11), if the person is not a natural person; and

(c) providing any other information required by the Commissioner.

Example of where the specific form of interaction and transaction is prescribed in legislation

Section 14B of TAA states: [Giving of notices to Commissioner]

(1) This section applies when this Act or any other Act requires a person to give a notice to the Commissioner.

(2) The person must give the notice in writing.

(3) The person may give the notice to any office of the department.

(4) The person may use the methods set out in subsections (5) to (7) to give the notice, subject to any conditions described in the subsection.

(5) The person may give the notice by personal delivery, if the personal delivery is made during working hours.

(6) The person may give the notice by an electronic means of communication, if the person complies with the Electronic Transactions Act 2002.

(7) The person may give the notice by post—

(a) to the street address; or

(b) to the post office box number.

(8) A notice given by post is treated as having been given at the time the notice would have been delivered in the ordinary course of the post.

(9) The following provisions apply if there is a conflict between this section and a provision in this or any other enactment:

(a) if the conflict is between either of subsections (2) and (6) and another provision, subsection (2) or (6) prevails; and

(b) if the conflict is between any of subsections (3) to (5), (7), and (8) and another provision, the other provision prevails.

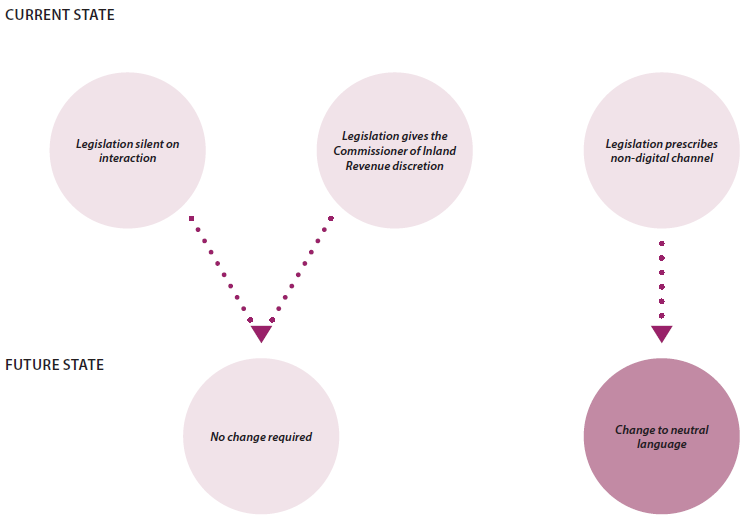

LEGISLATION ON INTERACTION