Chapter 1 - Why focus on tax administration?

BACKGROUND

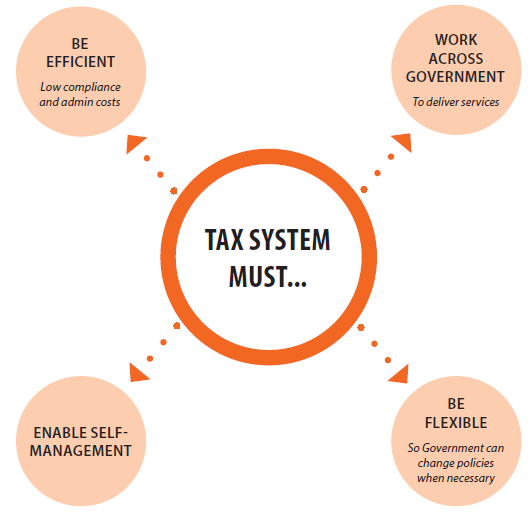

A priority of the Government is an efficient public service. This includes a responsibility to all New Zealanders to be efficient in collecting taxes and paying entitlements. Inland Revenue must deliver on government priorities. It should be a world-class revenue organisation, recognised for service and excellence. This means it must:

- be agile, effective and efficient (for example, by reducing compliance and administration costs);

- enable taxpayers, wherever possible, to self-manage with speed and certainty; [1]

- enable the Government to make timely and cost-effective policy changes; and

- work with other government agencies to more efficiently deliver services.

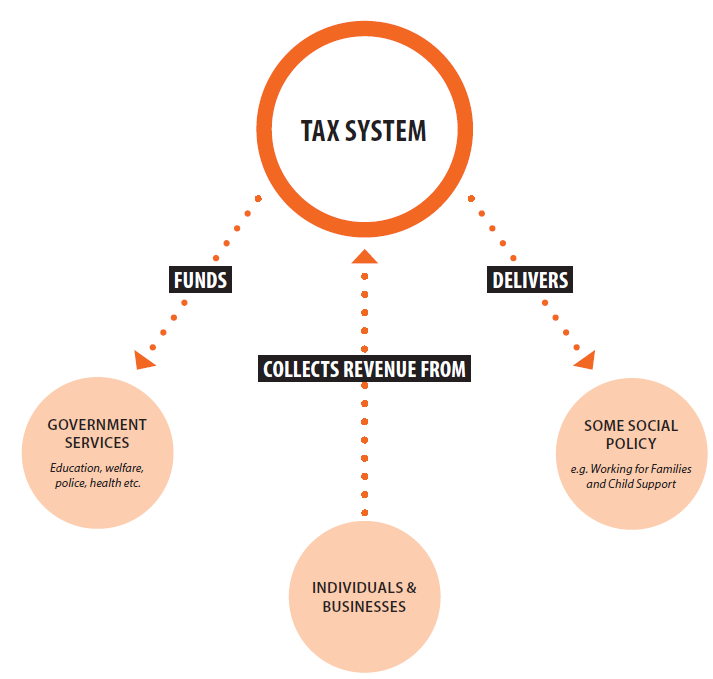

New Zealand’s tax system

Having a good overall tax system means having both good tax policies and good administrative systems. These elements need to go hand in hand. The tax system includes social policies administered by Inland Revenue; Working for Families, Child Support, Student Loan repayments, KiwiSaver and Paid Parental Leave.

The tax system should ensure that it is easy for customers to comply with their obligations. The ease with which customers can comply has an effect on overall compliance and, together with the perception of fairness, is a crucial factor in assessing the overall effectiveness of a tax system.

New Zealand’s tax policies

The aim of New Zealand’s tax policies is to tax as broad a range of income and expenditure as practicable at rates that are as low as possible.

Known as the broad-base, low-rate (BBLR) approach, this provides stable revenue and promotes efficiency, equity and fairness. It helps support economic efficiency and growth.

It also helps keep administration and compliance costs low. It is a much more coherent way of levying tax than in most OECD countries.

WHAT THE TAX SYSTEM DOES

GOALS OF THE TAX SYSTEM

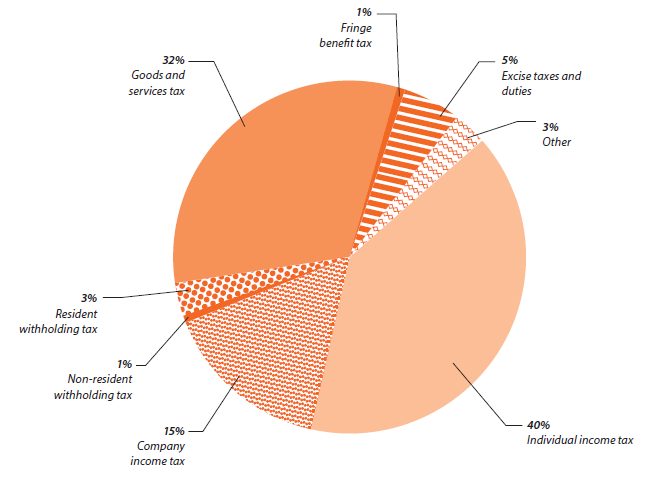

COMPOSITION OF TAX REVENUE YEAR ENDED JUNE 2014

New Zealand’s main tax bases

The chart on page 14 shows the composition of tax revenues in New Zealand. It highlights New Zealand’s focus on just three main tax bases (personal income tax, company tax and GST).

All of these have broad coverage, allowing substantial amounts of tax to be collected at relatively modest tax rates, while avoiding the inefficient taxes found in many other countries.

Endorsement of New Zealand’s tax policies

New Zealand’s tax policies work well and are held in high regard internationally.[2] A number of independent domestic reviews of the tax system have also been undertaken in recent years, and have fundamentally supported New Zealand's underlying tax system and BBLR framework.[3] A high burden of proof is needed for any reforms which move away from BBLR principles.

Future challenges

There are long-term future fiscal pressures that future Governments will need to consider. An ageing population coupled with the increasing demand for world class healthcare and other services, will contribute to these pressures.

We should do everything possible to ensure high levels of compliance to manage these fiscal pressures.

Boosting levels of compliance is an important part of modernising the tax administration.

MODERNISING OUR TAX ADMINISTRATION

The way our tax administration currently runs reflects a series of changes that have been made over the years. Each change has been sensible but not necessarily in relation to the overall coherence of the system.

The Government has not, until now, stood back and had a fundamental look at how tax might best be administered if it were starting from scratch.

Problems with the current system include:

- Compliance and administration costs are too high.

- Some people find it difficult to fully comply.

- There is a lack of flexibility in accommodating future policy changes.

- Stakeholders have commented on a lack of speed and certainty (for example, taxpayer rulings and rectifying defects in legislation).

- There are difficulties for customers and advisors in accessing the right information at the right time.

- There are concerns about customers falling into debt and the difficulties they face in emerging from debt.

- The Government wants to see Inland Revenue providing better value for money. This is not just a matter of reducing administration costs but also ensuring that resources are focused on the highest value tasks.

- Information is often not provided in a way that represents value for money. This makes it difficult to identify key policy concerns and audit risks.

- While most customers voluntarily comply with the tax system, there are some that do not and it is important to continue to improve levels of overall compliance.

- Those who knowingly or unknowingly fail to comply or who otherwise “game the tax system” because of the ability to claim refunds without always paying outstanding tax, can create an unfairness in the tax system.

The Government's proposed modernisation and simplification of tax administration is far more than just updating a computer system. Rather, it is a chance to have a fundamental look at tax administration in New Zealand and see what changes need to be undertaken to meet the challenges of the 21st century.

This includes re-shaping the way Inland Revenue works with customers, and looking at possible changes to legislation including the Tax Administration Act 1994.

This has wider implications beyond Inland Revenue. The information Inland Revenue collects is already critical to the delivery of services by other agencies such as ACC. Consistent with Government’s drive for better public services, information sharing between government agencies is expected to increase to deliver more efficient outcomes for New Zealanders.[4]

It is therefore vital to establish the sort of tax administration services that promote high levels of compliance and deliver the benefits that taxpayers, their advisors, and users of social policy services actually want and need.

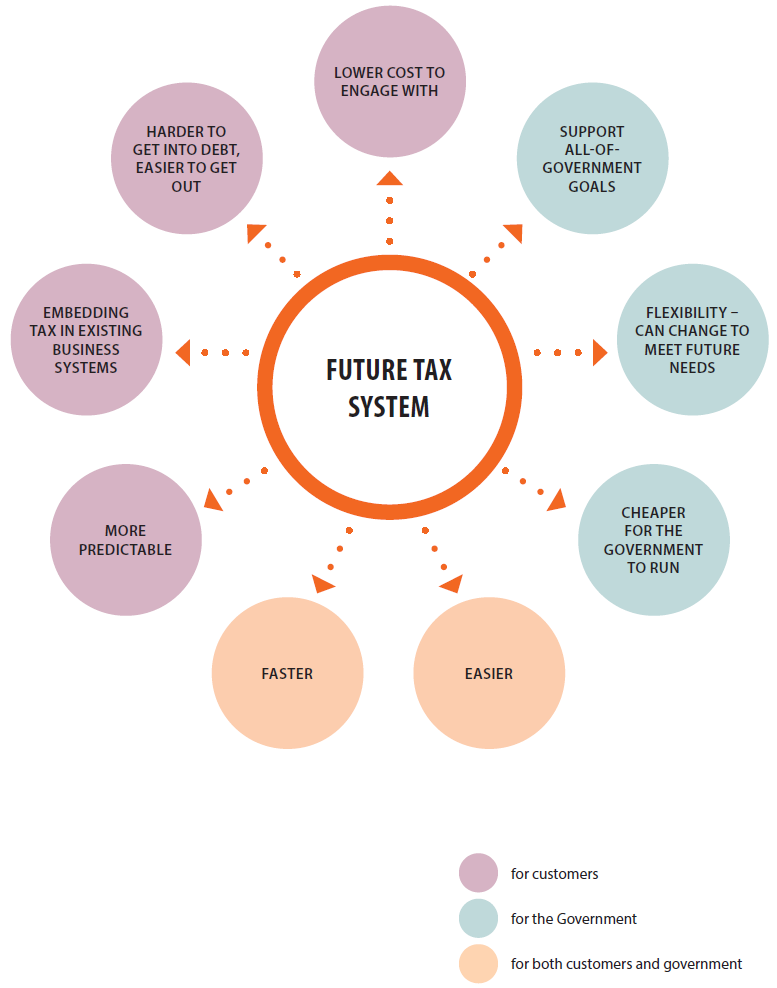

Key benefits

The potential changes discussed in this Green paper, when taken as a whole, should help to make the tax administration more customer-focussed.

It should be easier for people to see their overall position, and to meet their tax and social policy obligations with greater speed and accuracy.

Predictability for customers should be increased by:

- providing easy digital access to customers’ accounts (and alternatives for those without such access);

- providing earlier and simpler transactions and responding to customers’ issues quickly and effectively;

- using a business’s normal business processes and systems to meet tax obligations; and

- improving the collection, accuracy and timeliness of information to simplify and better tailor interactions.

It should be easier and less expensive for people to get it right and meet their obligations (and harder for them to get it wrong).

It should be harder for people to fall into debt in the first place, and also easier for them to correct if they do.

Compliance and administration costs should be reduced.

It should help ensure the on-going surety and integrity of the tax and social policy system.

A more effective tax administration would support broader 'all-of-government' goals and provide value for money for the Government.

It would provide sufficient information so that key policy concerns and audit risks can be identified easily.

A more effective tax administration would also provide flexibility to cater for future policy changes.

In short, Inland Revenue’s processes and systems should be simple, and make it easy to get things right and hard to get things wrong, be quick and low-effort to use, provide more certainty, and should not require duplication of effort by customers or associated third parties. They should also be flexible enough to move with technology developments.

This will not be an easy shift to make, or a quick one, but it is absolutely necessary.

If you would like to read more about policy considerations that frame New Zealand's tax administration, go to Appendix 1.

BENEFITS OF A FUTURE TAX SYSTEM

WE NEED YOUR FEEDBACK

The Government recognises that many of the opportunities for improvement will be best known by customers, third parties, advisors and the wider business community.

To that end, issuing this Green paper formally establishes the start of the consultation process on how to undertake the process of transforming New Zealand’s tax administration services.

The Government invites submissions on whether the potential changes discussed in this Green paper would likely achieve the intended benefits for businesses and other customers.

The ideas in this Green paper are in the early stages of development, and will be subject to their own consultation processes over the coming years. However, even at this early stage, the Government is keen to get your feedback to test whether the general direction and indicative timing of any potential changes outlined in this Green paper are valid or not, and to identify any errors or omissions

of scope.

The Government recognises the cumulative impact on business and other customers resulting from possible changes discussed in this Green paper. This process will need to be managed to ensure businesses and other customers are not faced with multiple changes occurring throughout the implementation of different streams of work. This is to minimise the one-off compliance cost impact of changing business systems to accommodate changes.

KEY QUESTIONS FOR READERS

- Would the potential changes discussed in this Green paper be broad enough to deliver significant improvements to New Zealand’s tax administration systems?

- Are the potential changes heading in the right direction, and have we focused on the right issues?

- Are there any errors or key omissions? If so, what are they?

- Is the proposed sequencing and order of the work sensible?

- Does the current sequencing and order of work ensure the compliance costs associated with implementing change are minimised for business and other customers?

1 Certainty is defined in the Oxford English Dictionary as “the quality of being reliably true” or “a general air of confidence”. In the context of this Green paper, the use of the word ‘certainty’ is not intended to convey any reference to legislative certainty in the context of the statutory time bar, rather it is to be used in its more general meaning.

2 See, for example:

- Deloitte’s 2014 Asia Pacific Tax Complexity Survey Report (http://www2.deloitte.com/content/dam/Deloitte/global/Documents/Tax/dttl-tax-ap-2014-tax-complexity-survey.pdf)

- Washington DC Tax Foundation’s 2014 international tax competitiveness index (see http://taxfoundation.org/article/2014-international-tax-competitiveness-index)

3 For example the McLeod Review in 2001 and, more recently, the Tax Working Group in 2010

4 Such as through Result Area 9; New Zealand businesses have a one stop online shop for all government advice and support to run and grow their business. The Better Business Programme is a recognition that the public sector needs to take a more joined-up approach to achieve better outcomes for business customers and individuals.