Appendix 5 - Individuals

5.1 In terms of sequencing, there is a heavy interdependency on improving and enhancing the withholding tax mechanisms noted in Appendices 2 and 4. Changes to the way these operate are necessary to achieve a critical mass of accurate information that covers the majority of individuals taxed in New Zealand.

5.2 The current New Zealand tax administration system generally works well for individual customers whose income is derived solely from salary and wages which are subject to tax withholding regimes. It works less well where tax on investment income is either not withheld or withheld at an incorrect rate.

5.3 The current filing obligations on individual customers vary, based on historic and sometimes apparently arbitrary distinctions. This can result in customers being genuinely unaware they even have an obligation. There is a tension inherent in the tax administration system between customers who are not required to file, those who are, and those that choose to do so.

5.4 This adds complexity in meeting obligations and creates fairness and equity concerns for some individuals. A customer who is required to file a tax return might have an underpayment in one year and receive a refund in another year. For customers who are not required to file, however, there is no incentive to square-up in years of underpayments, but they can easily claim any available refunds.

5.5 Policy makers have attempted to minimise incentives for these customers to 'cherry pick' and file only when they have overpaid tax. Customers have, in effect, been forced into a gamble – if they enquire about their tax affairs by requesting a Personal Tax Summary (PTS), they are treated as filing even if this leads to a tax liability. This system, however, has led to firms offering a service to determine details of an individual’s tax affairs before requesting a PTS to remove this gamble.

5.6 This compares with those who have other forms of business income (for example, rental income) or overseas income who are required to file. These taxpayers do not get the opportunity to 'cherry pick'.

5.7 There are now growing numbers of customers who are filing returns, or otherwise interacting with Inland Revenue. Examples include individuals filing a donations rebate form or those that have in excess of $200 of interest or dividends. Likewise, Inland Revenue’s growing involvement in the delivery of social policies, such as Working for Families tax credits, has also substantially increased the number of customers who file or interact with the Department.

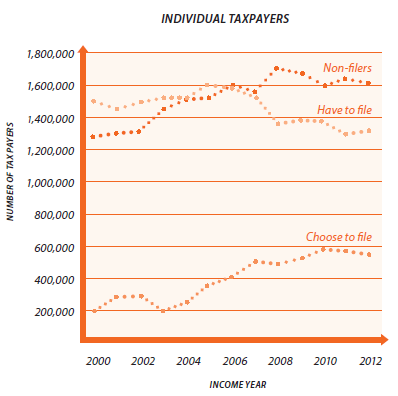

5.8 The following graph, which shows the increasing number of individuals filing income tax returns or PTSs from the years 2000 to 2012, illustrates this point. In the year 2000, 50% of individual taxpayers were either required to or chose to file an income tax return. By 2012 this number had increased to 62% of individuals, an increase

of 12%.

CURRENT PROBLEMS

5.9 The objective of keeping people away from filing returns has also resulted in the creation of complex and inaccurate rules in some areas of the tax system. For example, the income earned from investments in portfolio investments entities (PIEs) is taxed at the PIE rate rather than in the hands of the PIE investors. The rules are very complex because of the need to ensure that investors are taxed on their portion of the PIE income at a rate that approximates their own personal tax rate. Similar policy compromises arise when individuals earn superannuation which is subject to ESCT.

5.10 Such complexities can make it difficult for customers to understand what rates should apply to their circumstances, making it difficult for them to accurately comply with their requirements.

5.11 As highlighted above, all of this has led to significant numbers of people being required to file. As well as those who know they have to file tax returns – for example, those earning foreign income, rental income or business income, or who are receiving Working for Families tax credits – there are others who may not know they have to. This includes people who have interest or dividend income, or an extra pay or secondary earnings on which tax has been withheld at the wrong rate.

5.12 The current problems with individuals’ current filing requirements include:

- policies that can sometimes create artificial and unclear boundaries;

- the fact that the system works well for individuals with one source of income, but less so if there are multiple sources of income;

- customers 'cherry picking' refunds, without the requirement to always pay outstanding tax, leading to fairness and equity concerns;

- the fact that the current system is not efficient in managing small debts;

- high administration and compliance costs for Inland Revenue, customers and third-parties; and

- Inland Revenue pre-populating some, but not all, information for individuals (for example salary and wages information, but not interest). In addition to inefficiencies, lack of visibility of information means customers can be unaware of mistakes or evasion occurring (for example, by their employer).

5.13 As previously noted, increasing numbers of customers are now interacting with Inland Revenue. Common areas where multiple interactions are occurring between Inland Revenue and customers include filing income tax returns, requesting personal tax summaries and donation rebates, Working for Families tax credits, Student Loans repayments, and Child Support issues. Customers currently can have these multiple interactions with Inland Revenue for various products dealt with separately – there is scope to have at least some of these issues considered together.

POTENTIAL CHANGES

Objectives

5.14 The direction outlined in this Green paper for individuals is premised on the following framework – it should:

- reduce effort and provide a high level of uniform outcome for customers;

- provide for a low cost of contact for all parties, including Inland Revenue, individuals and third parties (for example, employers);

- be designed for a digital world;

- realise the full potential of all information sources, whether these are generated internally (for example, cross-referencing information from other related tax returns) or externally (for example, from information arising in the future from automatic exchange of information agreements);

- provide for one process that applies for all individual taxpayers, regardless of different information requirements;

- be flexible to allow for future changes (for example, the introduction of new tax bases or new forms of technology);

- pre-populate as much information as possible (in a timely manner), and prompt for information which cannot be pre-populated;

- efficiently allow for the recovery of underpayments through the use of variable withholding rates; and

- make effective use of on-going analytics and risk assessment tools to deliver a better service to customers.

Initial option for consultation

5.15 One option for consideration could be for all customers to interact at some level with Inland Revenue, albeit in a much easier form than currently.

5.16 The potential changes discussed in this Green paper envisage an electronic filing system that is pre-populated by timely and accurate withholding systems. The majority of customers would then, as a maximum, only be required to check and confirm their details and, where applicable, report unlisted income such as overseas income or income where there is no deduction at source (for example, rental income). In most cases, square-up amounts of tax would be dealt with by either refunds being automatically released or debts paid by automatically adjusting withholding rates on future income sources.

5.17 In short, the focus would be on making “filing” simpler and less onerous for individuals’ tax obligations using pre-population and better technology to automatically adjust withholding rates to collect prior underpayments of tax.

5.18 This could be facilitated, in part, by a personalised web page showing:

- known income;

- other sources of taxable income, such as PIE income;

- prompts based on third-party data and/or previously provided information;

- a tax liability calculated by Inland Revenue and confirmed by the taxpayer; and

- a digital notification of the resulting tax position.

5.19 The key benefits potentially arising would include:

- greater fairness and transparency;

- potential simplification of regimes such as the PIE rules;

- improved automation of debt collection;

- flexibility for dealing with future policy changes, and future opportunities to support all-of-government outcomes;

- administration efficiencies (for example, less 'exception' processing) and lower compliance burden for taxpayers over time; and

- better use of information and data across government (both internationally and domestically).

5.20 The change in focus towards providing data also allows a move away from concepts like 'filing' and 'returns', and enables associated information to be consolidated (for example, charitable rebates can be dealt together with income tax rather than as a separate form). From a customer perspective, it would also allow individuals to understand what their obligations are and how the wider tax system works, which would support compliance over time.