Supplies to New Zealand GST-registered businesses

(Clauses 47(2), 47(5), 47(6), 47(7), 49(1,), 49(2), 50, 52(2), 53(2), 53(3), 55(4), 55(5), 56, 57(1), 57(2), 59(1), 59(2), 60(1,) 60(2) and 64)

Summary of proposed amendment

The bill proposes that supplies to New Zealand-registered businesses (business-to-business supplies) will not be subject to GST unless the supplier and recipient agree to zero-rate the supply. Zero-rating the supply would allow the offshore suppliers to deduct any New Zealand GST costs incurred (in the same way as resident suppliers).

There will be special rules when GST is inadvertently charged to a New Zealand GST-registered person and when a GST-registered person receives a remote service from a non-resident supplier and uses it, or intends to use it, for non-taxable purposes.

Key features

Currently, section 8(4) treats supplies of goods and services by a non-resident person to a GST-registered person, as being made outside New Zealand (and so not subject to GST) unless the suppler and recipient agree that the supply is treated as being made in New Zealand (subject to GST). Under the proposed rules, this section will also apply to remote services supplied to persons resident in New Zealand to which proposed section 8(3)(c) applies.

This means that remote services provided by a non-resident to a GST-registered person will be considered to be supplied outside New Zealand, unless the supplier and recipient agree that the supply be treated as being supplied in New Zealand.

If the supplier and recipient come to an agreement, proposed section 11A (1)(x) will apply to zero-rate the supply. This allows the supplier to deduct any New Zealand GST costs incurred in relation to the supply.

As a consequence of these rules, non-resident suppliers may be required to identify whether a New Zealand-resident recipient of the supply is GST-registered. Proposed section 8B(4) and (5) require the supplier to treat the recipient as not being a registered person unless the recipient:

- notifies the supplier that they are a registered person; or

- provides the supplier with their registration number or New Zealand business number.

GST-registered recipients of remote services should not identify themselves as a GST-registered person, or provide their GST registration number or a New Zealand business number, if they intend to use the service for 100 percent non-taxable purposes.

The Commissioner will be able to agree with a supplier on the use of another method to determine whether the supply is made to a registered person (see proposed section 8B(6)).

Invoices

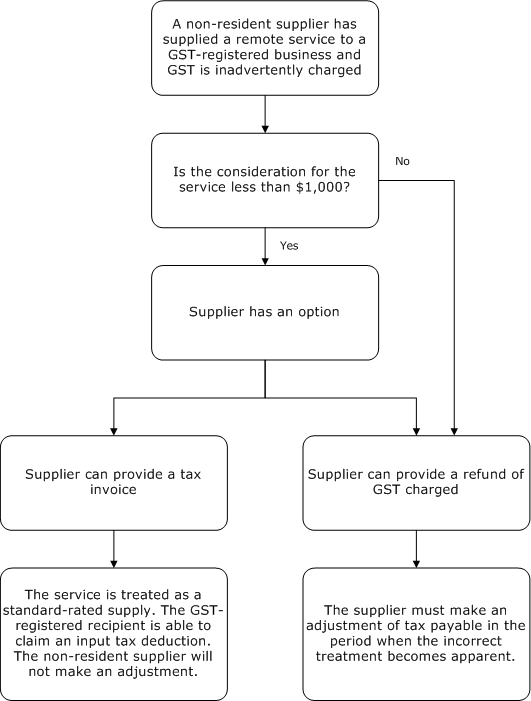

A non-resident supplier will not need to provide a tax invoice in relation to supplies of remote services under section 8(3)(c) (see proposed amendments to section 24(5)). However, under proposed section 24(5B), a non-resident supplier can choose to provide a full tax invoice if the recipient has been inadvertently charged GST and the payment for the supply is NZ$1,000 or less (inclusive of GST).

Input tax deductions

Under proposed section 20(4C), a recipient will not be able to claim an input tax deduction for a supply of remote services, unless the recipient has obtained a tax invoice under section 24(5B), resulting from the recipient being inadvertently charged GST and the consideration for the supply is NZ$1,000 or less.

The recipient will not be denied an input tax deduction when the supply is treated as made in New Zealand by the recipient of the supply (under section 5B) and the recipient has applied the reverse charge under section 8(4B).

Incorrect GST treatment

When a GST-registered recipient is inadvertently charged GST, a non-resident supplier may make an output tax adjustment in the return when it is apparent that a mistake has been made, under amendments proposed to section 25(1)). These amendments apply when:

- the supply was standard-rated when it should not have been treated as a taxable supply (see proposed subsection 25(1)(aab)); or

- the supply was standard-rated when it should have been zero-rated (see proposed subsection 25(1)(abb)).

A non-resident supplier will have the option to issue a tax invoice when the recipient has been inadvertently charged GST at the standard-rate when it should not have been taxed or should have been taxed at zero percent (see proposed section 24(5B)(a)(i) and (ii)). However, the non-resident supplier may only provide a tax invoice when the consideration for the supply is NZ$1,000 or less, and the recipient notifies the supplier that he or she is a registered person (see proposed section 24(5B)(b) and (c)).

When the remote supply has been incorrectly taxed, and the supplier opts to issue an invoice, the invoice must contain all the details in existing section 24(3) (see proposed section 24(4)). The provision of a tax invoice allows the GST-registered recipient to claim the inadvertently charged GST to the extent to which the recipient uses the services, or the services are available for use in, making taxable supplies.

The option to provide a tax invoice is not available to the supply of a contract of insurance (see proposed section 24(5C)).

When a non-resident supplier opts to provide a tax invoice under section 24(5B):

- the supplier must not make an adjustment under section 25 to correct the amount of GST shown on the invoice (see section 25(1)(aab)(ii) and exception to section 25(1)(abb));

- the supplier and recipient are deemed to have agreed that the supply is made in New Zealand (and so is subject to GST) under section 8(4) (see proposed section 24(5D)); and

- the proposed zero-rating provision under section 11A(1)(x) does not apply (see proposed exception to the zero-rating provision under section 11A(7)).

Reverse charge

A proposed amendment to section 8(4B) extends the existing reverse charge to supplies of remote services that are not treated as being made in New Zealand under section 8(3)(c) and (4). The reverse charge applies if the percentage intended or actual use of the services is less than 95 percent of the total use. The reverse charge treats the services as being made in New Zealand by the recipient in the course and furtherance of a taxable activity carried on by the recipient (see section 5B).

A new reverse charge is also proposed in relation to zero-rated supplies received by a registered person. Proposed section 20(3JC) will require the recipient of a remote service under new section 8(3)(c), that is zero-rated under 11A(1)(x), to return output tax on the nominal GST component for any non-taxable use of the services. Consistent with section 8(4B), this proposed section will only apply when at the time of acquisition, or at the end of an adjustment period, the taxable use of the service is less than 95 percent.

Background

A feature of the proposals is the fact that business-to-business supplies are excluded (unless the parties agree to zero-rate the supply). From a revenue perspective, there is little value in applying GST to business-to-business supplies as the GST-registered recipient would, in most cases, be able to claim back the GST in their normal GST return, resulting in no net GST liability. Other advantages of excluding business-to-business supplies include:

- Tax invoice requirements can be relaxed because no New Zealand consumers charged with GST would be in a position to claim back the GST.

- There are some fiscal risks associated with applying GST to business-to-business supplies, which would arise if any offshore supplier purported to charge GST but did not return the GST. Registered New Zealand businesses would then seek to claim the GST back in the normal manner.

- Excluding business-to-business supplies is consistent with how similar rules have been applied in other countries.

Because business-to-business supplies are proposed to be excluded, special rules are required when a GST-registered recipient acquires or uses the services they receive from a non-resident supplier for non-taxable purposes (such as private purposes or for making exempt supplies). In these situations, a GST-registered recipient should be treated in a similar way to a final consumer, otherwise the services may be under-taxed. It is therefore proposed that the existing reverse charge (section 8(4B)) and a proposed reverse charge for the receipt of zero-rated supplies (section 20(3JC)) will apply to ensure GST is returned by the GST-registered recipient on the portion of non-taxable of the service.

This would ensure that businesses receiving services and intangibles from an offshore supplier, other than for making taxable supplies, are treated in the same way as individual consumers.

Detailed analysis

Section 8(4) will apply to supplies made under proposed section 8(3)(c), so that remote services that are supplied to GST-registered businesses will be treated as being supplied outside New Zealand, unless the supplier and the GST-registered recipient agree that the supply is a taxable supply. Where the parties have agreed, these supplies will be zero-rated under proposed section 11A(1)(x).

Example

Accommodation Co. is a non-resident company that provides facilitation services, in that it matches customers who are looking for accommodation in a particular location with local providers of these services.

The facilitation services provided by Accommodation Co. to the local accommodation providers are remote services, as there is no necessary connection between the location of the recipients and the place where the facilitation services are performed.

If the local providers are not registered for GST, these supplies will be subject to GST under section 8(3)(c), as the facilitation services are remote services that are supplied to a New Zealand resident who is not a GST-registered business.

If the local providers are registered for GST, then under section 8(4) the facilitation services will be treated as being supplied outside New Zealand, unless Accommodation Co. and the local accommodation providers agree that these supplies are zero-rated. If Accommodation Co. incurs New Zealand GST costs, it may wish to agree with the local providers of accommodation to make these supplies zero-rated, as this would allow them to deduct these costs incurred in New Zealand in making the supplies.

As a result of these rules for business-to-business supplies, non-resident suppliers will need to differentiate between individual consumers and GST-registered businesses. When similar rules have been applied in other countries, GST or Value Added Tax (VAT) numbers are used to identify a business customer. Similarly, the proposed rules require the supplier to treat the supply as being to a consumer, unless the recipient notifies the supplier that they are registered or provides their GST registration number or a New Zealand business number. Note that GST-registered recipients of remote services should not identify themselves as a GST-registered person, or provide their GST registration number or a New Zealand business number, if they intend to use the service for 100 percent non-taxable purposes.

Non-resident suppliers with services targeted at individual consumers can assume those recipients are not GST-registered and apply GST at the 15% rate. Suppliers may collect further information if it is likely that the services they provide may be purchased by GST-registered businesses.

It is recognised that it may not be practical for all suppliers to ask for evidence that a customer is GST-registered. Therefore, to provide additional flexibility, the proposed rules allow the Commissioner to agree an alternative method to determine whether the supply is made to a GST-registered person. The Commissioner’s discretion is expected to apply in situations when a supplier distinguishes between businesses and individual consumers due to the nature of the services they supply and can provide evidence that the services targeted at businesses are supplied to GST-registered businesses.

Example

Software Co. is a non-resident that provides software to New Zealand businesses and individual consumers. Factors such as price, and licensing terms and conditions mean that there is a clear division between the software purchased by businesses and individual consumers. Businesses that purchase the software are likely to be GST-registered persons.

Software Co. has a large number of customers and it is impractical to ask for evidence to identify their customers as GST-registered. Software Co. is able to apply to the Commissioner to use an alternative method for identifying whether their customers are GST-registered persons.

Evidence such as the nature of the products, pricing, licensing terms and other conditions could be used, as well as a sample of their customer base that supports the notion that future customers will be GST-registered.

GST inadvertently charged to a GST-registered recipient

There may be instances when a non-resident supplier accidently treats a GST-registered business as an individual consumer and therefore charges the business GST. In this situation, the GST-registered recipient should seek a refund from the non-resident supplier and not claim an input tax deduction for the inadvertently charged GST (see proposed deduction prohibition under section 20(4C)). There is, however, a proposed exception to the deduction prohibition for supplies under NZ$1,000 (see commentary below).

Proposed amendments to section 25(1) will allow a supplier to make adjustments to the payment of output tax in the return in which it is apparent that the mistake has been made. This will apply when the supply was standard-rated when it should not have been treated as a taxable supply (see proposed subsection 25(1)(aab)), or the supply was standard-rated when it should have been zero-rated (see proposed subsection 25(1)(abb)).

Note that an adjustment will only be required if the non-resident supplier has already furnished a return and has accounted for an incorrect amount of output tax as a result of the mistake (see existing section 25(1)(e)). If the mistake becomes apparent before the relevant return has been furnished, the mistake will be able to be rectified before the return is filed.

Since non-resident suppliers are not required to provide a tax invoice under the amendment to section 24(5), they will not be required to issue a credit note under section 25(4).

Supplies of $1,000 or less

An exception to the above rules applies when the payment for the supply (including GST) is NZ$1,000 or less. In this situation, when the supplier inadvertently charges a GST-registered recipient GST, the supplier can choose to provide a full tax invoice to the GST-registered recipient. This option is intended to be a compliance-saving measure for non-resident suppliers in relation to low-value supplies, when the cost of issuing a refund may exceed the cost of issuing a tax invoice. Note that if the supplier chooses to provide a tax invoice, the supplier must provide a full tax invoice, even if the payment for the supply (including GST) is less than $50 (see amendments to section 24(5)).

The tax invoice must be a full invoice as set out in section 24(3), and therefore must contain the following particulars:

- the words “tax invoice” in a prominent place;

- the name and registration number of the supplier;

- the name and address of the recipient;

- the date upon which the tax invoice is issued;

- a description of the services supplied;

- the quantity of the services supplied;

and either—

- the total amount of the tax charged, the consideration, excluding tax, and the consideration, inclusive of tax for the supply; or

- where the amount of tax charged is the tax fraction of the consideration, the consideration for the supply and a statement that it includes a charge in respect of the tax.

An exception to the deduction prohibition (discussed above, under section 20(4C)) allows the GST-registered recipient to claim an input tax deduction under the normal deduction provisions to the extent to which the services are used for, or available for use, in making taxable supplies.

If the supplier chooses to provide a tax invoice;

- the supplier is not required to make an adjustment under section 25 to correct the amount of GST shown on the invoice (see section 25(1)(aab)(ii) and exception to section 25(1)(abb));

- the supplier and recipient are treated as having agreed that the supply is made in New Zealand (and therefore subject to GST) under section 8(4); and

- the proposed zero-rating provision under section 11A(1)(x) does not apply (see proposed exception to the zero-rating provision under section 11A(7)).

These provisions are intended to turn a supply that should not have been taxed or was taxed at zero percent, into a supply that is taxed at the standard rate of 15%. In this situation, the correct amount of GST is returned by the supplier and therefore an adjustment to the supplier’s GST return, under section 25, is not required.

The diagram below summarises how these rules will apply.

The option to provide a tax invoice is not available for the supply of a contract of insurance (see section 24(5C) and the commentary on the special provisions that apply to contracts of insurance).

Reverse charge (GST-registered recipient of remote services)

An amendment to the existing reverse charge under section 8(4B) will require recipients of a remote service under new section 8(3)(c), that are not treated as being supplied in New Zealand, to return output tax on the supply if the percentage intended or actual use of the services is less than 95 percent of the total use.

An exception (proposed section 20(4D)) to the prohibition on input tax deductions (proposed section 20(4C)) allows a recipient of remote services, that is required to return output tax under the reverse charge, to claim an input tax deduction to the extent to which the services are used for, or available for use, in making taxable supplies.

Example 1

Melissa is a self-employed project manager who is registered for GST. She purchases a software package from an offshore supplier for $400 and identifies herself as a GST-registered person and therefore is not charged GST. She uses the software 50 percent for her taxable project management services and 50 percent for home/recreational use.

Under the reverse charge, Melissa is treated as making a supply to herself of $400 at the 15% rate. She must return output tax of $60 ($400 x 15%). However, Melissa can claim an input deduction for the portion of the value of the software package (50 percent) that is attributed to her taxable use. This input tax deduction is $30 ($60 x 50 percent). Her net position in the relevant return (assuming no other supplies) is therefore an output tax liability of $30 ($60 output tax minus $30 input tax).

If Melissa’s taxable use of the software package had been 95 percent or more, she would not have been required to apply the reverse charge.

The existing reverse charge only applies when the supply of services is not treated as a supply being made in New Zealand. Therefore, the reverse charge under section 8(4B) will not apply when the non-resident supplier and the recipient agree to treat the service as being made in New Zealand under section 8(4) as the service will be zero-rated under section 11A(1)(x).

In this situation, proposed section 20(3JC) requires the recipient of a remote service under section 8(3)(c), that is zero-rated under proposed section 11A(1)(x), to return output tax on the nominal GST component for any non-taxable use of the services. The nominal GST component is the tax that would be chargeable on the value of the supply, as if the value were equal to the consideration charged on the supply.

This proposed section will only apply when at the time of acquisition, or at the end of an adjustment period, the taxable use of the service is less than 95 percent. This is consistent with the application of the reverse charge under section 8(4B). This provision is also similar to the existing reverse charge applied to recipients of zero-rated supplies of land under section 20(3J).

Example 2

Consider the same example as above (example 1), however, this time Melissa agrees with the supplier to treat the service as a supply in New Zealand, in which case the service is zero-rated under section 11A(1)(x). Because the supply is zero-rated, Melissa will be required to return output tax on the nominal GST component for any non-taxable use of the services under section 20(3JC).

Since the value of the software is $400, the nominal GST component is $60 ($400 x 15%). The amount of output tax Melissa is required to return is $30; this is calculated by multiplying the nominal GST component ($60) by the non-taxable use of the service (50 percent).

Note that an equivalent amount of tax is paid on the services as with the application of section 8(4B).

Amendments are also proposed to existing sections 10(15C) (reduction of value of related party internal charges), 24B (records to be kept by recipient of imported services), and 56B (branches and divisions in relation to certain imported services) to ensure these provisions apply when the recipient is required to apply the proposed reverse charge under section 20(3JC).

Reverse charge for supplies of $1,000 or less

There may be instances when a GST-registered recipient applies the reverse charge and the non-resident supplier also inadvertently charges the GST-registered recipient GST. In this situation, GST may be returned twice on a single supply (by the non-resident supplier and the GST-registered recipient). This issue will likely be resolved if the non-resident supplier subsequently returns the GST to the GST-registered recipient and makes an adjustment under section 25 as described previously (note that an adjustment may still be necessary under section 25AA(1)(a)(iii) to ensure the correct amount of tax is accounted for under the section 8(4B) reverse charge).

To ensure the correct amount of tax is paid in a situation when the supplier provides a tax invoice under section 24(5B), an addition to section 25AA will allow the GST-registered recipient to correct the amount of output tax paid and deductions claimed as a result of the application of the reverse charge under section 8(4B). The recipient will then be able to claim, in the normal manner, the portion of the GST charged by the non-resident supplier to the extent to which the services are used for, or available for use, in making taxable supplies.

Example 3

Consider example 1 again, where Melissa has applied the reverse charge under section 8(4B). However, she subsequently finds out that the price for the software included GST at the standard 15% rate (3/23 x $400 = $52.17).

Melissa contacts the non-resident supplier and seeks a refund for the incorrectly charged GST. Instead of providing a refund, since the consideration for the supply is $1,000 or less, the supplier issues Melissa with a full tax invoice.

The tax invoice enables Melissa to claim an input tax deduction to the extent the services are used for, or available for use, in making taxable supplies, which means she can deduct $30. The non-resident supplier is also not required to make any adjustments under section 25.

Under proposed section 25AA(1)(a)(v), Melissa makes an adjustment in the return during which it is apparent that a mistake has been made to the amount of output tax and deductions claimed as a result of the application of section 8(4B). Melissa can claim a deduction under section 20(3) for the output tax actually accounted for ($60 – section 25AA(2)) and return output tax for the deduction actually claimed ($30 – section 25AA(3)).