CFC remedials

FAIR DIVIDEND RATE METHODS

(Clauses 137, 138 and 139)

Summary of proposed amendment

The bill proposes changes so that taxpayers can change between fair dividend rate (FDR) methods in calculating income from offshore investments no more than once every four years for each foreign investment fund (FIF) interest.

Application date

The amendment will apply from the 1 April 2016 tax year.

Key features

Proposed section EX 51B of the Income Tax Act 2007 sets out when a person, other than a unit valuing trust, can use the FDR periodic method, and when they must use the FDR annual method. The proposed section allows a change in method no more than once every four years on a per fund basis.

Proposed section EX 53 sets out when a unit valuing trust or other persons who choose to do so can use the FDR periodic method. The proposed section allows a change in method no more than once every four years on a per fund basis.

Background

Under the FDR method of calculating their taxable income from offshore investments, taxpayers are considered to have income from their FIF interests equal to 5 percent of the opening value of each investment. This is referred to as the “usual method” of calculation. Most taxpayers use this method but they also have the option to use a more complex FDR method known as the “unit-valuing funds” method. Taxpayers must use the same FDR method for all of their FIF interests.

This second method was introduced for certain investment funds, for whom the calculation method is mandatory. It was also extended to all taxpayers who were willing to incur the additional compliance costs of basing the FDR calculation on the value of the investment on each day of the year – that is, they must make 365 calculations rather than just one.

The unit-valuing method provides a more accurate result as it takes into account changes in value throughout the year.

If a FIF loses value over the course of a year, the unit-valuing method will calculate a lower amount of income than the usual method because the latter method will base the entire year’s income on the (higher) opening value. Conversely, if the FIF gains value over the year, the unit-valuing method will result in more taxable income than the usual method.

As the choice of method is made retrospectively – that is, after the taxpayer has observed if the FIF has gained or lost value, they are able to pick the method which produces the least income. This was not an intended feature of the rules as it was expected that taxpayers would choose one or the other method and use that consistently. The change proposed in this bill is intended to restore the original policy intention.

PREPAID EXPENDITURE

(Clause 126)

Summary of proposed amendment

The bill proposes amending the controlled foreign company (CFC) rules so that they mirror the effect of the prepayment rules in section EA 3 of the Income Tax Act 2007 and prevent taxpayers from claiming an immediate deduction for an amount that should be spread over several years.

Application date

The amendment will apply from the 1 April 2016 tax year.

Key features

Section EX 20C(13)(a)(iii) corrects an anomaly in the rules which allowed immediate deductions for amounts that should be spread over several years. This is achieved through direct reference to the adjustments provided in sections CH 2 and DB 50.

Background

The tax rules allow taxpayers to claim deductions for expenses incurred in generating taxable income. If a taxpayer incurs an expense in one year for something that will last more than one year, adjustments are made so that the deductions are spread over the relevant years. These rules, known as the prepayment rules, are separate from the depreciation rules but serve similar purposes.

Currently, the CFC rules do not include such adjustments and taxpayers can make a full claim in the year payment was made for expenses that may relate to goods or services that will be used over many years. This is an omission.

PART-YEAR EXEMPTIONS FOR AUSTRALIAN FIFS

(Clause 134)

Summary of proposed amendment

The bill proposes to limit the test for the Australian FIF exemption so that it only applies to the period of the year that the taxpayer holds an interest in the FIF.

Application date

The amendment will apply to income years starting on or after 1 July 2011.

Background

Taxpayers with a 10 percent or more interest in a FIF that is resident in Australia generally qualify for the Australian FIF exemption and do not have to declare income from that investment. One of the criteria for the exemption is that the taxpayer must have a 10 percent or more income interest in the FIF at all times in the income year.

Income interests are calculated by averaging out the taxpayer’s interests in the FIF across the income year. This means that a taxpayer who has a 40 percent income interest in a FIF for six months of the year and a 20 percent income interest in the FIF for the remaining six months will be considered to have a 30 percent income interest in the FIF for the whole year.

This averaging out is done across the whole income year irrespective of whether the taxpayer had an interest in the FIF at all times or not. Therefore, if a taxpayer acquires a 15 percent holding halfway through a year, their income interest is calculated as a 7.5 percent income interest for the year.

In that scenario the taxpayer would not qualify for the Australia exemption in the year they acquired the interest in the FIF. In the next year they would qualify, if they continued to hold the interest and, if they dispose of the interest halfway through the following year, they would again fail to qualify for the Australian exemption as their FIF income interest would be less than 10 percent.

This is not the correct outcome as the taxpayer has held the same interest in the FIF across the three years, but is not taxed consistently. The proposed amendment is intended to correct this anomaly.

ANTI-AVOIDANCE RULE FOR THE TEST GROUPING CONCESSION

(Clause 165)

Summary of proposed amendment

The bill introduces an anti-avoidance rule to prevent taxpayers from using the test grouping rules, which were introduced as a compliance concession, to gain an unintended tax advantage.

Application date

The amendment will come into force on 1 April 2016.

Key features

Proposed section GB 15BA will provide that the Commissioner may treat an election to include or not to include a particular CFC in a test group as reversed if the person has entered into an arrangement to reduce the amount of net attributable CFC income or increased the amount of net attributable CFC losses.

Background

The CFC rules allow taxpayers to consolidate same-jurisdiction CFCs into a test group when applying the active income exemption test. This means that operational CFCs, who earn active income, can shelter the passive income of holding CFCs. While some criteria have to be met (for example, each CFC must have a taxed CFC connection with the same jurisdiction) the taxpayer otherwise has complete discretion over whether they include a CFC in a test group.

The rules were introduced to allow taxpayers to take full advantage of the active income exemption, irrespective of their business structures.

Because taxpayers have discretion in applying the test group rules it is possible for them to arrange matters so that they pay no tax when they have income but still accumulate losses when they do not.

This means that when there is an operating (active) CFC and a holding (passive) CFC the taxpayer can choose to group the CFCs when the holding CFC has passive income but not when it makes a loss. When grouped, the active income of the operating CFC will grant the group the active income exemption. When not grouped, the loss of the passive CFC will be carried forward to be used against any future attributable income within that jurisdiction. In this way taxpayers may be able to accumulate losses without having to pay tax on their income.

TEST GROUPS FOR GROUPS OF COMPANIES ACQUIRED OR DISPOSED OF DURING THE YEAR

(Clauses 128 and 129)

Summary of proposed amendment

The bill proposes to allow taxpayers who acquire or dispose of groups of foreign companies during the year to access the test grouping concession in that year, for those companies.

Application date

The amendment will apply for income years starting on or after 1 July 2009.

Key features

Proposed sections EX 21D and EX 21E are being amended so that taxpayers using either the default or accounting standard tests can form test groups comprising newly acquired or disposed CFCs.

Background

Taxpayers have the option of grouping multiple CFCs together into a test group and working out the ratio of active to passive income based on the consolidated accounts when applying the active business test. The CFCs must be resident in the same country and the taxpayer must hold an income interest of more than 50 percent in each CFC. The latter rule prevents a single CFC from being used by more than one taxpayer.

This rule produces counter-intuitive results when a taxpayer acquired or disposed of a group of foreign companies part-way through a year.

For example, NZ Co A sells a group of two Australian companies to NZ Co B on 1 October. As neither NZ Co A or NZ Co B will have more than a 50 percent interest in the Australian companies, as the interests are calculated by taking an average holding over the whole income year, they will be unable to access the test group concessions. This may mean that the passive income earned by one of the Australian companies will now have to be attributed back to both New Zealand taxpayers as it will no longer be sheltered by the active income of the other company.

In this scenario the intent of the more than 50 percent interest income requirement is to prevent NZ Co B from grouping the newly acquired companies with the existing CFCs that it already owns. There is no need for the rules to also prevent the two Australian companies from being grouped together by the New Zealand taxpayers for the periods that they hold the interests.

ATTRIBUTION OF INCOME FOR PERSONAL SERVICES

(Clause 166)

Summary of proposed amendment

The bill proposes to allow taxpayers to choose between the standard attribution of personal services rules or the CFC rules if they provide personal services through a foreign company.

Application date

The amendment will come into force on the date of enactment.

Key features

Proposed section GB 27 is being amended to exclude from the exemption from attribution, income from personal services derived through a CFC, if the amount is less than $5,000. This means that a person who derives income from personal services through a CFC has to attribute that income irrespective of the amount.

Proposed section GB 27 is also amended so that the exemption from attribution under section GB 27 only applies in relation to income derived from a CFC if the person has filed a tax return attributing income to the person under the CFC rules.

Background

The attribution rule for income from personal services applies when a taxpayer has interposed an entity (commonly a company) between themselves and the person they are providing services to. For example, Dr Paul could provide medical services to his patients but incorporate a company to be the contractual provider of those services. The company would then employ Dr Paul, who would see the patients and carry out the services. The attribution rule looks through the interposed entity and in certain circumstances attributes the income earned by the company for services provided by the taxpayer, back to the taxpayer.

These rules are duplicated and have the same effect under the CFC rules. Income earned by a taxpayer providing services through a foreign company is considered passive income and is attributed back to the taxpayer.

While the tax effect of the two sets of rules is the same, taxpayers who fall under the CFC personal services attribution rules face a more complex undertaking as they must comply with both the personal services attribution rules and the CFC rules.

This additional compliance burden is not felt by taxpayers who derive both personal services income and other forms of passive income from their CFC interests. These taxpayers would have to comply with the CFC rules regardless of how their personal services income was calculated due to the other passive income. However, taxpayers who only derive personal services income from their CFC interests face additional costs compared with taxpayers who fall under the standard rules. The proposed new rule corrects this.

ATTRIBUTABLE FIF INCOME METHOD FOR INDIRECTLY HELD INVESTMENTS

(Clause 136)

Summary of proposed amendment

This bill proposes to align the tax rules for taxpayers who hold FIF interests indirectly with those applying to taxpayers who directly hold FIF interests. The amendments are intended to ensure that income does not arise from a FIF interest if the taxpayer does not hold an interest in the FIF during that FIF’s relevant accounting period.

Application date

The amendment applies to income years starting on or after 1 July 2011.

Background

Taxpayers who hold a 10 percent or more interest in a FIF have the option of using the attributable FIF income method to calculate their FIF income. This method provides a more accurate result but at a higher compliance cost and largely mirrors the CFC rules.

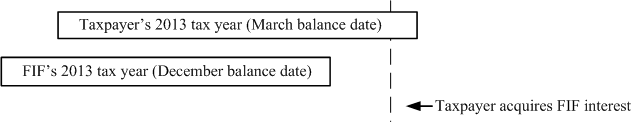

Under the attributable FIF income method a taxpayer who acquires an interest in a FIF after the end of that FIF’s income year will not have attributable income. For example, a taxpayer with a 31 March balance date acquires an interest in FIF Co on 1 March 2013. FIF Co’s balance date is 31 December.

The taxpayer will not have to include any income from FIF Co’s 2013 tax year (1 January 2012 to 31 December 2012) as they did not acquire the FIF interest until after the end of that year.

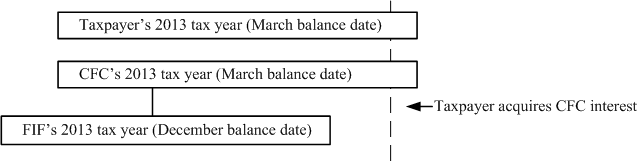

If, instead of directly acquiring the FIF, the taxpayer acquires a CFC that holds the same FIF investment, the treatment is different even if the taxpayer is using the attributable FIF income method for that interest.

In this scenario, the taxpayer is attributed income from the FIF for the 2013 tax year even though they did not hold an interest in the FIF during the FIF’s 2013 income year.

MINOR TECHNICAL REMEDIALS

The following changes are proposed to correct or update terminology used in the CFC rules to make them easier for readers to understand.

| Section | Change proposed |

|---|---|

| Section CD 18(3)(a) | Refers to income tax paid “in the country”. Expands to “in the country or territory” in line with changes made to section LJ 3 in the Taxation (Annual Rates, Employee Allowances, and Remedial Matters) Act 2014. |

| Section CQ 2(2) | Renames section title “Special rule: Taxable distributions under the attributable FIF income method”. Current title uses out-of-date terminology. |

| Section CQ 5(3) | Clarifies that income from a FIF held by a non-attributing active CFC can be attributed by inserting “or a non-attributing acting CFC under section EX 21B (Non-attributing active CFCs)” at the end of the subsection. |

| Section CQ 5(1)(c)(xiv) | Deletes the word “non-resident’s” to match section DN 6(1)(c)((xiv). |

| Section DN 6(1)(c)(iv) | Replaces the word “regime” with “rules” to match section CQ 5(1)(c)(iv). |

| Section DN 6(3) | Clarifies that losses from a FIF held by a non-attributing active CFC can be attributed by inserting “or a non-attributing acting CFC under section EX 21B (Non-attributing active CFCs)” at the end of the subsection. |

| Section EX 58(6) | Clarifies that the section, which applies to CFCs that hold interests in FIFs, applies to both non-attributing active CFCs and non-attributing Australian CFCs by inserting “or a non-attributing active CFC under section EX 21B (Non-attributing active CFCs)” at the end of the subsection. |

| Section EX 24(3) + (4) | Replaces references to “branch equivalent income or loss” with “CFC attributable income or loss” to reflect current terminology. |

| Section EX 31(2)(c)(ii) | Clarifies how the rules apply when a taxpayer acquires separate share packages on different days by amending the subsection to read along the lines of “At the earliest date in the income year when the person acquires shares in the company, if the person does not own shares in the company at the beginning of the income year”. |

| Section EX 44(1) | Clarifies that this provision applies on an interest-by-interest basis rather than to all interests. |

| Section EX 62(2)(a) | Repeals section containing transitional rules relating to the 2011 FIF rule changes. These rules are no longer needed. |

| Section EX 62(6) | Removes references to “branch equivalent method” as this method is no longer available. |

| Section YA 1 | Introduces a definition of an “indirect attributing interest” to clarify the changes made to section EX 58 in the Taxation (Annual Rates, Employee Allowances, and Remedial Matters) Act 2014. |