Changes to the taxation of foreign superannuation

A special report from

Policy and Strategy, Inland Revenue

Taxation of foreign superannuation

This special report provides early information on changes to the tax rules that deal with interests in foreign superannuation schemes held by New Zealand tax residents. The changes were introduced in the Taxation (Annual Rates, Foreign Superannuation, and Remedial Matters) Bill enacted on 27 February. Information in this special report precedes full coverage of the new legislation that will be published in the May edition of the Tax Information Bulletin.

Sections CD 36B, CF 3, CQ 5, CW 28B, CW 28C, CZ 21B, DN 6, EX 29, EX 42B, HC 15, HC 27, YA 1 and schedule 33 of the Income Tax Act 2007, section CF 3 of the Income Tax Act 2004, section CC 4 of the Income Tax Act 1994 and clause 14C of the KiwiSaver Act 2006

Changes to the Income Tax Act 2007 have been made in relation to the taxation of interests in foreign superannuation schemes held by New Zealand residents.

From 1 April 2014, a new set of rules replaces the previous rules applying to interests in, and amounts derived from, foreign superannuation schemes.

The new rules are intended to bring greater clarity and cohesion to the rules, making it easier for taxpayers to understand and comply with their obligations.

Key features

From 1 April 2014, the foreign investment fund (FIF) rules generally cease to apply to interests in foreign superannuation schemes unless the interest was first acquired while the individual was a New Zealand tax resident or if it is grandparented.

Instead, from 1 April 2014, interests in foreign superannuation schemes are taxed only when:

- an amount has actually been received by the individual (either as a pension or as a cash lump sum);

- a transfer has been made into a New Zealand or an Australian superannuation scheme; or

- a transfer of an interest is made to another person (unless rollover relief is available).

Lump sums received or transferred in the first four years of New Zealand tax residence are generally exempt from tax.

Lump sums are taxed using one of two methods:

- The schedule method is the default method. It is designed to approximate the tax that would have been paid on accrual while the person was a New Zealand tax resident, in conjunction with an interest charge that recognises that the payment of tax has been deferred until receipt.

- The formula method taxes the person based on the actual gains that have been earned by their scheme while they were a New Zealand tax resident, again in conjunction with an interest charge that recognises that the payment of tax has been deferred until receipt. This is subject to certain criteria.

The new rules do not generally affect the taxation of foreign pensions received by New Zealand tax residents which continue to be taxed as most were before 1 April 2014 – that is, in full on receipt.

A low-compliance option is available to individuals who received (or applied to receive) a lump sum from their foreign superannuation scheme (either as a cash withdrawal or a transfer to another scheme) between 1 January 2000 and 31 March 2014 but did not comply with their tax obligations relating to the interest in their scheme. To remedy their non-compliance, an individual has the option of including 15 percent of the lump sum in their 2013–14 or

2014–15 income tax return and paying tax on that amount.

A new type of permitted withdrawal has been introduced into the KiwiSaver Act 2006 to allow individuals who have transferred their foreign superannuation into a KiwiSaver scheme to pay their tax liability resulting from the transfer. The individual may also use the withdrawal mechanism to pay their student loan repayment obligation, to the extent that it arises from the transfer being assessed as income.

Circumstances when the FIF rules continue to apply from 1 April 2014

A person who has already met their tax obligations in relation to their foreign superannuation interest under the FIF rules before the introduction of the Taxation (Annual Rates, Foreign Superannuation, and Remedial Matters) Bill on 20 May 2013 has the option to continue using the FIF rules after 1 April 2014. This is known as “grandparenting”. To remain grandparented, they must treat their interest as an attributing interest in a FIF in all subsequent returns of income following the return filed before 20 May 2013. If they miss one year, they are no longer grandparented and are subject to taxation on receipt under the new rules. Credit will not be available for previous tax paid on income arising under the FIF rules.

A person who first acquired their interest in a foreign superannuation scheme while they were a New Zealand tax resident must generally use the FIF rules in relation to their interest. This is irrespective of whether the interest was acquired before or after 1 April 2014.

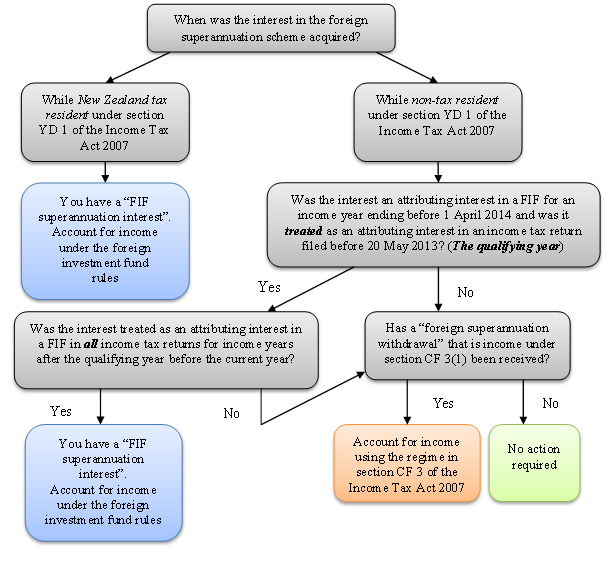

The following flow charts show how the rules apply.

Diagram 1: What is the tax treatment of a foreign superannuation interest in a given income year from 1 April 2014?

The following diagram provides information about which rules apply to a foreign superannuation interest held in a given income year by a New Zealand resident beginning on or after 1 April 2014.

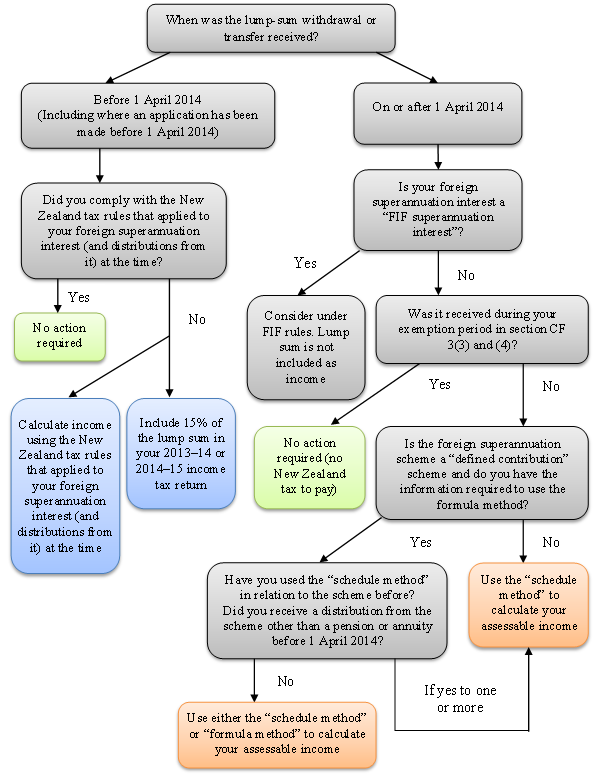

Diagram 2: What is the tax treatment of a lump sum received or transferred from a foreign superannuation scheme by a New Zealand resident?

Note that if the interest in the foreign superannuation scheme was acquired in a transaction described in section CF 3(18)(b) or (d) from a person who acquired the interest while non-resident, there may be other considerations to take into account.

Background

New Zealand residents are taxable on their worldwide income, including income from interests in foreign superannuation schemes. The previous rules for taxing New Zealand residents on their foreign superannuation were complex and difficult for taxpayers to understand. In some cases, superannuation interests were subject to tax on accrual under the foreign investment fund (FIF) rules. In other cases, a person was taxed on receipt of their superannuation interest depending on the legal structure of the foreign scheme (such as whether the scheme is structured as a company or a trust). The tax treatment differed according to which set of rules applied. As a result, it was not always clear that the rules resulted in a fair outcome, particularly for lump-sum amounts.

A review of the taxation of foreign superannuation was announced in November 2011.

The policy review focused on the application of the foreign investment fund (FIF) rules to foreign superannuation, and the taxation of lump sums received from foreign schemes, including both transfers and withdrawals. As there were no concerns about the current tax treatment of pensions, no changes to pensions were proposed, except insofar as those interests were taxed under the FIF rules.

As a result of this review, an officials’ issues paper, Taxation of foreign superannuation, was released in July 2012.

The issues paper proposed that the FIF rules would no longer apply to interests in foreign superannuation schemes. Instead, all foreign superannuation interests would be taxed on receipt, either as a periodic pension under the existing rules, or as a lump sum using a specific method proposed in the issues paper referred to as the “inclusion-rate approach”. The inclusion-rate approach proposed in the issues paper is the predecessor to what is now known as the “schedule method”.

The intention was to ensure that New Zealand-resident taxpayers pay a reasonable amount on their foreign superannuation, while also ensuring that the rules were relatively simple to apply. The solution also needed to take into account that individuals generally cannot access their superannuation scheme until retirement age.

The solution proposed in the issues paper had two key elements. First, payment of tax would be deferred until the person receives a distribution from their scheme or transfers it to a New Zealand or Australian superannuation scheme. The reason for taxing upon receipt rather than upon accrual was based on the fact that most foreign schemes are locked in to some extent. Further, because many other countries tax foreign superannuation when an amount is distributed to an individual (rather than taxing contributions to a fund and earnings derived by the fund), aligning the point at which tax is paid also reduces the likelihood of being effectively overtaxed in both tax jurisdictions.

Secondly, the issues paper provided for a special rule for taxing lump-sum transfers and withdrawals made from a foreign superannuation scheme – the inclusion-rate approach (now known as the schedule method).

The rationale behind the inclusion-rate approach (and now the schedule method) is that from a New Zealand tax perspective, the tax outcome for a person who migrates to New Zealand with a foreign superannuation should be broadly the same irrespective of whether the person transferred their funds to a New Zealand superannuation scheme on day one, or left it with the foreign scheme provider. This reflects the principle that tax should not distort a person’s economic decision-making.

If a person transferred their funds into a New Zealand bank account or KiwiSaver scheme, for example, they would be paying tax on the interest that the bank account earns or on the gains made by the KiwiSaver scheme (that is, they would be paying tax on accrual). This is because New Zealand has a taxed tax-exempt (TTE) system, whereby contributions are generally made from post-tax income, gains that accrue are also taxed, but any payments made from the scheme or account are exempt from tax.

In designing New Zealand’s tax rules, an important aim is to ensure that, where possible, taxpayers’ decisions about their affairs – such as when to draw down on their superannuation – are not driven by tax considerations. Therefore, the amount of tax that a person pays on their foreign superannuation interest should mirror what would have been paid on accrual, to ensure that people do not transfer their funds solely because of any tax advantage. The rates under the schedule method/inclusion-rate approach were calculated to do this, based on how long the person was a New Zealand tax resident before bringing their funds to New Zealand. These rates tell a person how much of their lump sum they should include as income in their tax return, and increase with the number of years of residence. Funds that accumulated before the person migrated to New Zealand (both contributions and gains) are not taxed.

The issues paper also proposed a simple option for individuals who had already received a lump-sum withdrawal or transfer between 1 January 2000 and 31 March 2011, but did not comply with their tax obligations in relation to the lump sum. It proposed that these individuals would have the option to pay tax on only 15 percent of the lump sum.

It was proposed that the FIF rules would remain available in very limited circumstances to those who had returned FIF income in relation to their foreign superannuation interest in their 2011–12 income tax return filed by 31 March 2012. This is known as “grandparenting”.

The issues paper received 59 submissions from a variety of interested parties, including legal and accounting firms, pension transfer agents, and individuals.

In response to these submissions, a number of modifications were made to the proposals in the issues paper, which were then introduced in the Taxation (Annual Rates, Foreign Superannuation, and Remedial Matters) Bill on 20 May 2013. The inclusion-rate approach was renamed the “schedule method” in the bill. The main modifications to the proposals in the issues paper were to:

- defer the application date from 1 April 2011 to 1 April 2014;

- extend the availability of the 15 percent option to lump sums derived by 31 March 2014;

- extend the filing date required for grandparenting under the FIF rules to 20 May 2013;

- extend a tax-free window during which a person may receive a lump with no New Zealand tax to pay from two years to four years, and make it available to returning residents, as well as new migrants;

- change the timing of the schedule method so that income earned by the scheme during the four-year window would not be taxed if a person receives their lump sum after the four-year tax-free window;

- provide separate rates for each year of residence under the schedule method, rather than one rate for a band of several years;

- introduce a method that allows individuals to calculate the actual gains derived by their scheme while they have been New Zealand tax resident, if they have the information available (known as the formula method); and

- introduce a KiwiSaver withdrawal mechanism to allow those who transfer their foreign superannuation interest into KiwiSaver to withdraw funds to pay their tax liability arising from the transfer.

Further refinements to the proposals were recommended by the Finance and Expenditure Committee in response to submissions made at the select committee stage of the bill. The Committee’s report was published in November 2013. The main recommendations were to:

- restrict the availability of the new regime (the schedule method and formula method) to when the interest in the foreign superannuation scheme is acquired while the person was non-tax resident;

- extend the KiwiSaver withdrawal mechanism to allow a person a withdrawal to pay their student loan repayment obligation, to the extent it arises from the transfer into KiwiSaver being assessed as income;

- provide rollover relief to transfers made from one person to another upon death of a spouse or relationship split; and

- use a lower tax rate when calculating the deferral benefit under the formula method.

Supplementary order paper 413 was introduced at the committee of the whole House stage. Supplementary order paper 413 proposed that the 15 percent option should be available to individuals who have applied to their foreign superannuation scheme provider to withdraw or transfer their funds by 31 March 2014, even if they have not actually received the funds by 31 March 2014.

The new legislation received Royal assent on 27 February 2014.

Application date

The new rules generally apply from 1 April 2014.

A minor change to the definition of superannuation scheme that corrects an unintended change that occurred during the rewrite of the Income Tax Act in 2004 applies from 1 April 2005.

Detailed analysis

New rules for interests in foreign superannuation schemes

New rules apply to interests in foreign superannuation schemes from 1 April 2014. The new rules apply to interests in a “foreign superannuation scheme” which is already defined in section YA 1 of the Income Tax Act 2007.

A new definition of “FIF superannuation interest” is included in section YA 1. This does two things.

First, it specifies when a person may use the FIF rules in relation to a foreign superannuation interest from 1 April 2014. Individuals who have complied with the FIF rules and treated their foreign superannuation interest as an attributing interest in a FIF in a return of income filed before 20 May 2013 have the option to continue using the FIF rules (known as grandparenting). To be grandparented, an individual must treat their interest as an attributing interest in a FIF in all returns of income following that return filed before 20 May 2013. Any distributions from the scheme are not treated as income of the individual at the time they are derived as the income has been taken into account under the FIF rules.

Secondly, the definition of “FIF superannuation interests” also specifies that individuals who acquire an interest in a foreign superannuation scheme while already tax-resident in New Zealand are required to use the FIF rules and are not permitted to use the new rules. This applies to interests first acquired both before and after 1 April 2014.

The FIF rules are not available to foreign superannuation interests that do not meet the definition of “FIF superannuation interest”. Interests in foreign superannuation schemes which are not FIF superannuation interests are excluded from the FIF rules through amendments to section EX 29 and a broad new FIF exemption in section EX 42B. New section EX 42B provides that interests in or rights to benefit from a foreign superannuation scheme are not subject to the FIF rules for income years beginning on or after 1 April 2014, unless it is a FIF superannuation interest.

Accordingly, sections CQ 5, DN 6, EX 29, EX 33, and EX 42 have been amended or repealed to remove references to the FIF rules that are no longer required.

New section CD 36B clarifies that foreign superannuation withdrawals and pensions are not taxed as dividends under the company tax rules. Similarly, amendments to sections HC 15 and HC 27 provide that foreign superannuation withdrawals and pensions are not subject to the trust tax rules.

Instead, all amounts received from interests in foreign superannuation schemes that were acquired while the holder was non-tax resident – whether in the form of lump sums or pensions − are taxed on receipt.

The tax treatment of periodic pensions has not been altered. Periodic pensions continue to be taxed as most currently are – that is, in full at a person’s marginal tax rate.

New section CF 3 introduces new rules for taxing “foreign superannuation withdrawals” – or lump sums – received from foreign superannuation schemes on or after 1 April 2014. A “foreign superannuation withdrawal” is defined as being a benefit other than a pension or annuity, and is income of the person, if it is a lump-sum withdrawal, a transfer from a foreign superannuation scheme into a New Zealand or Australian superannuation scheme, or a transfer of a foreign superannuation interest to another person. Lump sums received on or after 1 April 2014 are taxed either under the “schedule method” or the “formula method”.

Any reference to a “lump sum” throughout this special report generally means a “foreign superannuation withdrawal” that is income of a person, as defined in the new legislation.

The new regime in section CF 3 is available only to taxpayers who acquired their interest in a foreign superannuation scheme while non-resident under section YD 1 of the Income Tax Act 2007. As long as this requirement has been met and the interest is not a FIF superannuation interest, the regime in section CF 3 is available irrespective of whether the person became a New Zealand tax resident before or after 1 April 2014.

New section CF 3(22) ensures that an individual who was non-compliant with the FIF rules before 1 April 2014 and receives a lump sum after 1 April 2014 that is taxed under the schedule or formula approach, is not assessed for that previously un-assessed FIF income. This to ensure that these people are not double taxed as both the schedule and formula methods take account of income earned by the scheme during the period that the scheme should have been treated as an attributing interest in a FIF.

However, as section CF 3 only applies to people who first acquired their interest in a foreign superannuation scheme while non-resident, section CF 3(22) does not apply to those who were already New Zealand tax-resident when they first acquired the rights in their foreign superannuation scheme. These people would be assessed for any previously unpaid tax on FIF income and are also required to account for FIF income in relation to their interest for all income years after 1 April 2014.

As with other forms of income, the portion of the lump sum that is assessable income may affect a person’s entitlements and obligations for that tax year, such as child support, Working for Families tax credits, and student loan repayment obligations. Schedule 1 of the KiwiSaver Act 2006 has been amended to provide that where a transfer is made to a KiwiSaver scheme, the individual can withdraw an amount that represents the tax liability that arises in relation to the transfer.

What is a foreign superannuation scheme?

For the tax treatment of the new rules in section CF 3 to apply, section CF 3(1)(b) provides that a lump sum must arise from an interest in a foreign superannuation scheme.

A “foreign superannuation scheme” is defined in section YA 1 as a superannuation scheme constituted outside New Zealand. A superannuation scheme is a trust, company, or legislative arrangement established mainly for the purposes of providing retirement benefits to natural persons.

Most foreign employment-related retirement schemes that individuals contribute to while working overseas satisfy the definition of a “foreign superannuation scheme”. This is because these schemes usually will have been established by an individual’s employer to be used by the employer’s eligible employees. Investments in these schemes are usually held by trustees for the benefit of the participating employees.

Similarly, retirement entitlements originating from arrangements made under foreign legislation also usually satisfy the definition of a foreign superannuation scheme.

A retirement scheme will satisfy the definition of a foreign superannuation scheme so long as the scheme is either a trust, company, or arrangement established under the other country’s legislation, and is established mainly for the purpose of providing retirement benefits.

Sometimes savings in an individual’s retirement scheme can be used for purposes unrelated to retirement. For example, in the United States, individuals are able to establish a retirement savings account known as an Individual Retirement Account (IRA). An IRA is a savings account set up for the exclusive benefit of the individual or the individual’s beneficiaries. To discourage the use of IRAs for purposes other than retirement, a 10% penalty tax is imposed on any withdrawals made from the account before retirement. Some withdrawals can be made without penalty – for example, when withdrawals are made to meet higher education expenses, first home purchases or medical expenses, no penalty tax is imposed.

Nevertheless, IRAs are established mainly for the purpose of providing retirement benefits and therefore on the face of it, such accounts are likely to be “foreign superannuation schemes” for New Zealand tax purposes.

Where a retirement scheme is merely a “bare trustee” or similar arrangement for an individual, the scheme is unlikely to meet the definition for being a foreign superannuation scheme. If retirement savings are held by a bare trustee, section YB 21 provides that the underlying savings are deemed to be held by the individual personally. In those circumstances, New Zealand would generally tax the individual as if the individual is holding the underlying investments of the “scheme” directly.

The Taxation (Annual Rates, Foreign Superannuation, and Remedial Matters) Act 2014 also makes a minor change to the definition of “superannuation scheme” that corrects an unintended change that occurred during the rewrite of the Income Tax Act in 2004. This correction clarifies that the definition of superannuation scheme does not include schemes that pay a foreign social security pension that resembles New Zealand Superannuation and applies from 1 April 2005. This amendment ensures that the current rules for taxing such payments continue.

Tax treatment of foreign pensions and annuities

The tax treatment provided by section CF 3 does not apply to pensions and annuities paid from foreign superannuation schemes to New Zealand residents. Section CF 3(1)(a) provides this by defining a “foreign superannuation withdrawal” as a benefit that is not a pension or an annuity.

The tax treatment of pensions and annuities has not changed. Section CC 5 provides for the taxation of annuities, section CF 1(1)(g) provides for the taxation of pensions. Most pensions and annuities are taxable unless there is a specific exemption.

“A pension” is not defined in the Income Tax Act 2007. However, case law suggests that a payment from a superannuation scheme is generally a pension where:

- the payments are periodic;

- the amounts of the payments are fixed or ascertainable in advance; or

- the entitlement to the payments is for life or a fixed term.

New section CD 36B clarifies that pensions are not taxed as dividends under the company tax rules. Similarly, amendments to sections HC 15 and HC 27 provide that pensions are not taxed under the trust tax rules.

Example 1

Lisa worked for a few years in Hong Kong and has an interest in her employer’s private superannuation scheme. She moves to New Zealand and, upon her retirement, begins to receive a monthly pension payment of NZ$500 ($6,000 per year) from the scheme. These payments continue at the same amount (with an increase to account for inflation each year) until her death, at which point they will stop. From these facts, it appears that her monthly payments are a pension. She needs to include $6,000 in her New Zealand tax return each year and pay tax on that amount. If her marginal tax rate is 33%, she will pay tax of $1,980 each year.

Taxable lump-sum withdrawals or transfers

The rules set out in new section CF 3 apply to “foreign superannuation withdrawals” received from 1 April 2014 onwards, where the interest in the foreign superannuation scheme was first acquired at a time when the person was not a New Zealand tax resident. Providing that this condition has been met, it does not matter whether the person first became a New Zealand tax resident while holding the interest before or after 1 April 2014.

When is a person not a New Zealand tax resident?

New Zealand tax residence is determined by section YD 1 of the Income Tax Act 2007, which states that a person is a New Zealand tax resident if they have a permanent place of abode in New Zealand. If a person does not have a permanent place of abode in New Zealand, they are considered to be a New Zealand tax resident if they are personally present in New Zealand for more than 183 days in a 12-month period.

It is possible for a person to be a tax resident of more than one country. New Zealand has a number of special agreements with other countries called “double tax agreements”, or DTAs. These agreements allocate taxing rights to ensure that a person is not double-taxed when an item of income is sourced in one country and the person deriving it is a tax resident of the other, and also when a person is a tax resident in both countries. When a person is a tax resident of both countries, DTAs contain what is known as a “tie-breaker test” to determine where the person is tax-resident for the purposes of that DTA.

Consider a person who is a tax resident under domestic law of both country X and New Zealand. If the person tie-breaks to country X in the DTA, they are not considered to be a resident of New Zealand for the purposes of allocating taxing rights over certain income under that DTA. However, they are still considered to be a tax resident of New Zealand under section YD 1 of the Income Tax Act 2007.

When is a lump sum taxable?

A lump sum is taxable if it meets the definition of a “foreign superannuation withdrawal” and if it is received during the person’s “assessable period”. The rules for calculating when a person’s assessable period begins and ends are discussed below.

New section CF 3(2) states that a “foreign superannuation withdrawal” is income of the person when the amount is in the form of one of the following:

- a cash withdrawal (section CF 3(2)(a));

- a transfer from a foreign superannuation scheme into a New Zealand superannuation scheme (section CF 3(2)(b));

- a transfer from a foreign superannuation scheme outside Australia into an Australian superannuation scheme (section CF 3(2)(c)); or

- a transfer of a superannuation interest to another person (section CF 3(2)(d)).

Example 2

James worked in the United Kingdom and has an interest in a UK pension scheme. He moves to New Zealand and transfers part of his interest into a KiwiSaver scheme under the UK’s QROPS[1} legislation. The amount that is transferred comes within the definition of a foreign superannuation withdrawal, so James must calculate his tax liability on the transfer under the new rules.

A foreign superannuation withdrawal received during the person’s assessable period is taxable under one of two methods – the schedule method or the formula method. These methods are discussed below.

Non-taxable lump-sum withdrawals and transfers

In certain circumstances, transfers or withdrawals will not be taxable. These are described below.

Withdrawals and transfers from Australian superannuation schemes

Withdrawals from Australian schemes, and transfers from Australian schemes to New Zealand schemes, are generally not taxed in New Zealand under the Australia-New Zealand double tax agreement or under the trans-Tasman superannuation portability agreement (which took effect from 1 July 2013). This treatment continues under the new rules.

As withdrawals and transfers from Australian superannuation schemes are not taxable, transfers from a foreign (non-Australian) scheme into an Australian scheme are taxable under the new rules.

Transfers between two non-Australian foreign schemes (rollover relief)

A transfer between two foreign superannuation schemes could give rise to a taxable event under the old rules, being a disposal of rights in the first scheme and an acquisition of rights in the new scheme.

New section CF 3(2) lists the types of lump sums that are taxable. Through its omission in CF 3(2), a transfer from one foreign superannuation scheme to another non-Australian foreign superannuation scheme is not a taxable event. It does not matter whether the transfer is to a scheme in the same foreign country or a different foreign country, as long as the scheme to which it is transferred is not New Zealand or Australian.

This may occur, for example, when a person disposes of their interest to purchase an annuity with a different provider, or if a person transfers from one foreign scheme to another foreign superannuation scheme in order to obtain better returns.

Instead, the person is taxed on the eventual withdrawal or payment (or transfer to an Australian or New Zealand scheme). New section CF 3(21)(b) provides that the amount of tax payable is calculated from when they became New Zealand-resident while holding the interest in the first scheme.

Transfers from a foreign scheme to an Australian scheme are taxable under section CF 3(2)(c).The reason for taxing at this point is because transfers from Australian schemes are typically exempt, as noted above.

Example 3

Kimberley, a New Zealand tax resident, has an interest in a foreign superannuation scheme in Spain that she acquired before migrating to New Zealand. She wants to change providers to get a better investment return, and decides to transfer her funds into another foreign superannuation scheme in France that offers better returns.

Under the new rules, Kimberley does not need to pay New Zealand tax on the amount she transfers to the French scheme. Instead, she is taxed when she transfers the interest in the French superannuation scheme to a New Zealand superannuation scheme. Her tax liability on the transfer of the French interest into New Zealand takes into account the period of time she held the interest in the Spanish scheme while she was New Zealand-resident, as well as the period she held the French interest before transferring.

Certain transfers following the death of a spouse or a relationship split

Under new section CF 3(2)(d), the transfer of an interest in a foreign superannuation scheme to another person is generally a taxable event to the transferor.

New section CF 3(3) provides an exception to this rule if all of the following conditions are met:

- the transferor’s interest in a foreign superannuation scheme is partly or wholly transferred into a non-Australian foreign superannuation scheme in the name of the transferee;

- the transfer occurs upon the death of the transferor or under a relationship agreement that arises as a result of the dissolution of the transferor and transferee’s marriage, civil union partnership, or de facto relationship (“relationship cessation”);

- the transferee was the spouse, civil union partner, or de factor partner immediately before the death of the transferor or the relationship cessation; and

- the transferee is a New Zealand tax resident at the time of transfer.

This means when an interest is cashed out and merely distributed to another person, the conditions for rollover relief are not met. A cash distribution is a taxable event to the transferor under section CF 3(2)(a).

The condition that the transferee must be a New Zealand tax resident is a base protection measure as New Zealand does not tax foreign-sourced income derived by non-residents.

Where rollover relief is granted under section CF 3(3) to the transferor, section CF 3(1)(b)(ii) ensures that the transferee is ultimately taxable under the rules in section CF 3 rather than under the FIF rules.

Section CF 3(21)(d) provides that the transferee is taxed for the period they have held the interest in the superannuation scheme, as well as the period that the transferor held the interest in the foreign superannuation scheme while New Zealand tax-resident before the transfer. This is to ensure that all gains that accrued to the scheme while the transferor was a New Zealand tax resident while holding the interest are eventually taxed.

Example 4

Mary, her husband Martin, and their son Simon are all New Zealand tax residents. Mary first acquired an interest in a United Kingdom superannuation scheme while she was non-resident.

Mary dies unexpectedly. In her will, Mary transfers half of her interest in the UK superannuation scheme to Martin and the other half to Simon, rather than cashing out the interest and distributing the proceeds.

As Martin is a New Zealand tax resident and Mary’s surviving spouse, the transfer to him is not a taxable event as it meets the requirements for rollover relief under new section CF 3(3).

Ten years later, Martin decides that he wants to transfer the interest to a New Zealand scheme. This is a taxable event for Martin under section CF 3(2)(b). Under section CF 3(21)(d), the amount of the transfer that is deemed to be assessable income will take into account how long Mary was New Zealand-resident while owning the interest before she died and it was transferred to Martin, as well as how long Martin has owned the interest.

In contrast, Simon is not provided rollover relief under section CF 3(3) as he is Mary’s son and not a surviving spouse. This means that when the executor of Mary’s estate transfers half of Mary’s interest in the superannuation scheme to Simon, the transfer is a taxable event under section CF 3(2)(d) and the amount of the transfer that is deemed to be assessable income will depend on how long Mary was New Zealand-resident while owning the interest before she died and transferred it to Simon.

From the time that Simon acquires the interest, Simon has a FIF superannuation interest as Simon was already New Zealand-resident when it was transferred to him. This means that Simon needs to account for income on an annual basis under the FIF rules. Five years after he acquires the interest, Simon decides to transfer the interest into a New Zealand scheme. Because Simon’s superannuation interest has been taxed under the FIF rules, he does not pay any tax on the transfer to the New Zealand scheme.

Four-year exemption period

New sections CF 3(4)(a), CF 3(5), CF 3(6) and CW 28B provide that a lump sum that is received during a person’s exemption period is exempt from New Zealand tax.

The exemption period is similar to the four-year tax-free window provided by the pre-existing “transitional resident rules” in section HR 8 of the Income Tax Act 2007. People who are transitional residents are generally not subject to tax on foreign income during the first four years of New Zealand tax residence.

Unlike the transitional resident rules, section CF 3(5) does not require a person to be non-tax resident for a minimum period in order to qualify for an exemption period. The exemption period is thus available to new migrants and returning New Zealanders alike (as long as they satisfy the overall requirement for section CF 3 that the interest in the foreign superannuation was first acquired while non-tax resident).

Also, unlike the transitional resident rules, it is not possible to opt out of the exemption period.

In addition, a person who receives Working for Families tax credits still receives a full exemption period in relation to their foreign superannuation interest.

To be eligible for an exemption period in relation to a foreign superannuation interest, new section CF 3(5) provides that a person must have first acquired the interest while non-tax resident and has not had an exemption period under section CF 3(5) before they acquired that interest. This means a person may only have one exemption period under section CF 3 during their lifetime, but it may apply to several interests simultaneously, provided that the interests were acquired while non-tax resident.

The wording provided in section CF 3(6) to determine the timing and length of the exemption period mirrors the transitional residence period provided in section HR 8(3). This provides consistency for individuals with foreign superannuation interests who are also transitional residents. This is reinforced by an amendment to section HR 8(1), which states that a lump sum derived under section CF 3 during a person’s transitional residence period is not taxable in New Zealand.

The exemption period begins on the date a person becomes a New Zealand tax resident under section YD 1 of the Income Tax Act 2007 (either by acquiring a permanent place of abode or meeting the requirements of the 183-day rule). The exemption period ends at the end of the 48-month period beginning after the month in which the person meets the requirements of section YD 1(2) or YD 1(3), ignoring the rule in section YD 1(4).

If a person becomes a tax resident under section YD 1 part-way through a calendar month, their exemption period applies for that partial month as well as the subsequent 48-month period.

If a person becomes a New Zealand resident as a result of meeting the 183-day rule in section YD 1(3), the exemption period starts on the first day they are New Zealand-resident (under section YD 1(4)), but does not end until 48 months after they actually triggered the 183-day rule in section YD 1(3) (that is, on their 184th day in New Zealand).

Note that tax residence in this context means tax residence as provided in section YD 1 of the Income Tax Act 2007. As discussed in the section on “Taxable lump-sum withdrawals or transfers”, a person could be considered to be a tax resident of New Zealand and another country under the domestic laws of each country. If the person “tie-breaks” to the other country under the DTA and is treated as not being a New Zealand resident for the purposes of the DTA, they are still considered to be a New Zealand tax resident under section YD 1 of the Income Tax Act 2007, which is relevant for the purposes of calculating the exemption period. (It should be noted that when the individual tie-breaks to the other country for the purposes of a DTA, in general New Zealand cannot tax lump sums originating from that other country and paid to the individual during the period that they tie-break to the other country).

Example 5

Jordan migrates to New Zealand with an interest in a foreign superannuation scheme. She is deemed to have acquired a permanent place of abode in New Zealand on 16 June 2015. Jordan is eligible for an exemption period which begins on the date she acquired her permanent place of abode. Her exemption period lasts for the remainder of June 2015, plus the 48 full calendar months following that. This means her exemption period ends on 30 June 2019 and her assessable period begins on 1 July 2019.

Methods for taxing lump sums

Lump sums are taxable if they are received during the person’s assessable period.

A lump sum is taxed under one of two methods:

- the “schedule method” (the default method) in new section CF 3(9)(a), (10), (11), and (19); or

- the “formula method” in new section CF 3(9)(b), (12)–(19).

These two methods determine how much of a lump sum should be included as assessable income in an individual’s income tax return (the assessable withdrawal amount).

New sections CF 3(4)(b) and CW 28C provide that the part of the lump sum that is not treated as assessable income under the schedule method or formula method is exempt income. The exempt income is not taken into account for student loan or Working for Families tax credit purposes.

The schedule method is the default method for calculating a person’s assessable income in relation to a foreign superannuation withdrawal.

A person who satisfies the criteria in section CF 3(9)(b) is eligible to use the formula method in relation to a lump sum received from their foreign superannuation scheme, if they choose to do so. If they choose not to use the formula method, they must use the schedule method.

To be eligible to use the formula method the individual must meet several criteria in relation to the interest.

First, the foreign superannuation scheme must be a foreign defined contribution scheme for which a person has sufficient information about the value of the scheme and contributions made. A foreign defined contribution scheme is defined in section YA 1 as a foreign superannuation scheme that operates on the principle of allocating contributions to the scheme on a defined basis to individual members.

In addition, a person must not have used the schedule method for a past lump sum received from that particular interest, and must not have received a withdrawal (other than a pension or an annuity) before 1 April 2014. If the person received their interest from a spouse, civil union partner, or de facto partner, in a transaction referred to in section CF 3(21)(d), another condition is that the person who originally held the interest did not use the schedule method in relation to the interest.

Calculating the assessable period

As noted above, a person who receives a lump sum during their “assessable period” is required to calculate their assessable income in relation to that lump sum by using either the schedule or the formula method (the assessable withdrawal amount).

Generally speaking, the assessable period is the period during which a person is a New Zealand tax resident while holding an interest in a foreign superannuation scheme. The assessable period is calculated on an interest-by-interest basis. This ensures that the rules still work as intended if an individual has interests in multiple schemes acquired at different points in time (because, for example, they worked for different employers).

Determining the duration of a person’s assessable period is necessary to calculate the assessable withdrawal amount under both the schedule method and formula method. New section CF 3(7) reinforces this.

The tax liability arising under the schedule method essentially depends on how long the person has been a New Zealand tax resident. It is calculated using the number of income years beginning in the person’s assessable period.

The interest factor in the formula method is calculated using a person’s years of tax residence.

Sections CF 3(11)(c) and CF 3(18)(c) provide that a person’s years of residence is calculated as the greater of 1 and the number of income years which begin in the assessable period before a person receives a lump sum.

New section CF 3(8) provides how a person’s assessable period for a foreign superannuation interest is calculated.

If the person has a four-year exemption period in relation to their foreign superannuation interest (as described above), their assessable period for that foreign superannuation interest begins as soon as the exemption period ends. This is provided for in new section CF 3(8)(a)(ii).

If the person does not have an exemption period in relation to their foreign superannuation interest (this will generally occur if the person has already had an exemption period before they acquired the foreign superannuation interest in question), their assessable period for that foreign superannuation interest begins when they become a New Zealand tax resident for the first time while owning that interest. This is given by section CF 3(8)(a)(i).

It is possible that a person could migrate to New Zealand with a foreign superannuation interest, lose their New Zealand tax residence, and then become tax resident again. New Zealand does not generally aim to tax foreign-sourced income derived by non-tax residents. To ensure that the schedule and formula methods do not contradict this principle, new section CF 3(8)(c) provides that the assessable period excludes periods of non-tax residence.

New section CF 3(8)(b) provides that a person’s assessable period for an interest in a foreign superannuation scheme ends when the person derives a lump sum (the distribution time). This means when a person receives multiple lumps from a given foreign superannuation interest, their assessable period for that interest is extended with each lump sum they receive.

Example 6

Brian’s exemption period ends on 30 September 2015. His assessable period begins on 1 October 2015. Brian leaves New Zealand and his last day as a New Zealand tax resident is 27 March 2022. He becomes a New Zealand tax resident again on 1 August 2027. Brian receives a lump sum from his foreign superannuation scheme on 5 February 2029.

Brian’s assessable period is from 1 October 2015 until 5 February 2029, but excludes the period 28 March 2022 to 31 July 2027 (which is when he was non-resident).

As noted above, section CF 3(2) provides that transfers between two non-Australian foreign superannuation schemes are generally not taxed. Instead, the holder of the interest is taxed when it is finally withdrawn or transferred to a New Zealand or Australian superannuation scheme. New section CF 3(21)(b) provides that in such a case, the assessable period begins when the person first became New Zealand tax-resident while owning the interest in the original foreign superannuation scheme or when their exemption period for that original interest ended.

Example 7

Matilda migrated to New Zealand with an interest in an employment-related German superannuation scheme and became tax-resident on 8 August 2012. Her exemption period is 8 August 2012 to 30 August 2016. Her assessable period for that superannuation interest begins on 1 September 2016.

On 7 July 2017 she transfers her interest into a different German superannuation scheme. This transfer is not a taxable event. On 21 March 2020, Matilda transfers that German superannuation interest to a New Zealand superannuation scheme, which is a taxable event.

Matilda’s assessable period in relation to the transfer starts on 1 September 2016 and ends on 21 March 2020.

When an interest in a foreign superannuation scheme is transferred to another person, the transfer is generally taxable under new section CF 3(2)(d) to the transferor based on their assessable period, if the transferor is a New Zealand tax resident.

If the transferee is a New Zealand tax resident when they receive the interest from the transferor, the transferee generally does not qualify for the tax treatment provided in section CF 3 in relation to their acquired interest for subsequent lump sums received from the interest. In this case, the transferee has a FIF superannuation interest and is required to account for tax on an annual basis under the FIF rules.

The exception to this is where the transfer meets the conditions listed in section CF 3(3) for rollover relief following the death of the transferor or a relationship split involving the transferor and transferee. In this case, the transfer is not a taxable event to the transferor, but section CF 3(21)(d) provides that the transferee’s assessable period begins when the transferor’s assessable period for that interest began.

This approach ensures that all gains that have accrued to the scheme while the transferor was New Zealand tax-resident while holding the interest are eventually taxed.

Further explanation of the conditions for rollover relief arising under section CF 3(3) and an example can be found in the section “Certain transfers following the death of a spouse or a relationship split” of this report.

Example 8

Rebecca and Stella are sisters who migrated to New Zealand. Rebecca acquired an interest in an Italian superannuation scheme while she was working in Italy. Rebecca’s exemption period ends on 30 November 2013 and her assessable period begins on 1 December 2013. On 16 October 2019, Rebecca decides to transfer her interest to Stella.

The transfer does not met the requirements for rollover relief under section CF 3(3) as Rebecca and Stella are not married, in a civil union, or in a de facto relationship.

Rebecca must account for the transfer using the rules in section CF 3. Rebecca’s assessable period for calculating her assessable withdrawal amount arising from the transfer is 1 December 2013 to 16 October 2019. Rebecca must calculate her tax liability under either the schedule or formula method.

As Stella is a New Zealand tax resident when she acquires the interest from Rebecca, and does not qualify for rollover relief under section CF 3(3), Stella needs to account for income on the foreign superannuation interest using the FIF rules.

Schedule method

New sections CF 3(9)(a), CF 3(10), (11), and (19) provide for the schedule method. The schedule method is the default method for taxing foreign superannuation withdrawals received by individuals who first acquired their foreign superannuation interest while they were non-tax resident.

The schedule method deems a certain amount of the lump-sum transfer or withdrawal to be investment gains, based on the person’s years of tax residence. The approach uses fractions that represent the proportion of the lump sum to be included in a person’s assessable income – the assessable withdrawal amount. The schedule year fractions increase with years of residence. New sections CF 3(4)(b) and CW 28C provide that the remainder of the lump sum that is not deemed to be the assessable withdrawal amount is exempt from tax.

The fractions in new schedule 33 are set at the rate necessary to put a person who leaves their foreign superannuation overseas in the same position as if they had instead transferred their superannuation to New Zealand when they first became tax-resident and paid tax on investment gains as they accrued in a KiwiSaver or bank account, for example. This would also put them in a similar tax position to someone who pays tax on an annual basis under the FIF rules on an overseas-based financial asset. Given certain assumptions (including a 5% post-tax interest rate in the foreign scheme), the schedule method has been designed so that a person should conceptually be indifferent from a tax perspective between keeping their superannuation overseas and transferring it to New Zealand. Further discussion of the policy rationale behind the schedule method can be found in the annex to the issues paper.[2}

A person’s assessable income (or assessable withdrawal amount) under the schedule method is calculated using the following formula provided in new section CF 3(10):

(super withdrawal – contributions left) x schedule year fraction

The terms in the formula are defined in new section CF 3(11).

The term “super withdrawal” is the amount of the foreign superannuation withdrawal (the lump sum).

The “contributions left” item in the formula is a deduction for contributions made for or on behalf of a person while the person is a New Zealand tax resident, if the contributions satisfy certain conditions. The schedule method may otherwise treat some of the New Zealand contributions as gains would result in over-taxation.

New section CF 3(19) provides that all of the following conditions must be met:

- at the time the contribution is made, the person must be a New Zealand resident under section YD 1 and treated as a New Zealand resident under all applicable double tax agreements;

- the contribution is made by the person, or the person’s employer, or for the benefit of the person;

- the contribution must be required under the rules of the foreign superannuation scheme (that is, voluntary contributions cannot be deducted); and

- employer contributions must be subject to employer superannuation contribution tax or fringe benefit tax.

Additional conditions set out in section CF 3(11)(b) provide that a given contribution may only be deducted once under the schedule method, and for a given lump sum, the amount of contributions deducted may not exceed the value of the lump sum in calculating the assessable withdrawal amount. Section CF 3(11)(b) also provides that only recognised contributions made during the assessable period before the distribution time can be deducted.

Contributions that can be deducted are restricted in this manner because the schedule rates already include an implicit allowance for contributions. For example, for the year one schedule rate, 4.76% of the withdrawal is treated as taxable New Zealand-sourced gains and the remainder is treated as non-taxable. The non-taxable portion includes contributions as well as gains derived while non-resident.

The reason for having restrictions on the types of contributions that are deductible is to ensure that contributions are not effectively deducted more than once − first, by being deducted as “contributions left” in the formula and, secondly, by then being allocated out using the schedule year fractions.

The appropriate “schedule year fraction” to use is identified by calculating the number of income years that begin in the person’s assessable period, before the person receives the lump sum. This is the number of income years which begin after the person becomes a New Zealand tax resident and after their four-year exemption period ends. This means that when a person has an exemption period, the number of income years beginning in a person’s assessable period is less than the number of years that they have been New Zealand-resident.

The effect of counting a person’s years of residence from the end of the exemption period is to treat them as being non-resident during the exemption period. Gains which accrue during those four years are not clawed back and are therefore not taxed under the schedule method.

Example 9

After a period spent working overseas, Dan returned to New Zealand with an interest in a foreign superannuation scheme and acquired a permanent place of abode on 28 June 2012. Dan’s exemption period begins on 28 June 2012 and ends on 30 June 2016. Dan’s assessable period starts on 1 July 2016.

He withdraws a lump sum of $50,000 on 27 January 2020. There are three income years that begin in Dan’s assessable period: the years beginning 1 April 2017 (2018 income year), 1 April 2018 (2019 income year), and 1 April 2019 (2020 income year).

Dan is therefore required to use the schedule year fraction for year three. The corresponding schedule year fraction is 14.06%, so his assessable income is $7,030 (being $50,000 x 14.06%).

Dan includes $7,030 as income in his 2020 income tax return. His marginal tax rate is applied to this amount, rather than the full amount of the lump-sum withdrawal.

If the number of income years beginning in a person’s assessable period is zero when a person receives a lump sum (that is, they receive the lump sum during the part-year in which their assessable period starts but before the start of the next income year), the person should use the schedule year fraction associated with year one.

Example 10

Melanie’s assessable period begins on 1 October 2014. She withdraws a lump sum of $50,000 on 5 February 2015, which means that an income year has not yet started during her assessable period.

Melanie is required to use the schedule year fraction for year one because the withdrawal was made between 1 October 2014 and 31 March 2015. The corresponding schedule fraction is 4.76%, so her assessable income is $2,380 (being $50,000 x 4.76%). Assuming Melanie’s tax rate is 33% (which is the top personal marginal tax rate for the 2014–15 income year), she is liable to pay $785.40 of tax on her $50,000 lump-sum withdrawal.

Example 11

Ruby migrated to New Zealand with an interest in a foreign superannuation scheme and became a New Zealand tax resident on 25 November 2008 when she obtained a permanent place of abode. Her exemption period is 25 November 2008 to 30 November 2012 and her assessable period begins on 1 December 2012. On 6 May 2018, Ruby transfers her foreign superannuation scheme into a New Zealand scheme and the transfer equates to $100,000.

Ruby has been treated as New Zealand-resident under all applicable double tax agreements since early 2009.

The rules of Ruby’s foreign superannuation scheme require that she continues to contribute a certain amount to the scheme each year. The amount she is required to contribute during her exemption period amounts to $2,000. The amount she is required to contribute during her assessable period before the transfer is $3,000. Ruby decides to contribute an additional $500 to the scheme during her assessable period, which was not required by the scheme.

Ruby uses the schedule method to calculate how much of her transfer she needs to include in her 2019 income tax return.

Ruby’s assessable period in relation to the transfer is 1 December 2012 to 6 May 2018. The number of income years beginning in her assessable period is six, so Ruby must use the schedule year fraction of 27.47%.

The $2,000 of contributions made during her exemption period are not deductible as one of the requirements for a contribution to be deductible is that they are made during the assessable period before the distribution time. The $3,000 of contributions are deductible as they meet the requirements in sections CF 3(8)(b) and CF 3(19) that they were made during Ruby’s assessable period, they were required by the rules of the scheme, they were made by Ruby, and Ruby was treated as a New Zealand tax resident under all applicable double tax agreements when they were made. The additional $500 she contributed is not deductible as it was a voluntary contribution.

Ruby calculates her assessable withdrawal amount as follows:

($100,000 – $3,000) x 27.47% = $26,645.90

Ruby includes $26,645.90 as income in her 2019 income tax return and pays tax at her marginal tax rate on this amount.

New schedule 33 to the Income Tax Act 2007 provides the full schedule of rates per income year beginning in the person’s assessable period:

| Schedule year | Schedule year fraction |

|---|---|

| 1 | 4.76% |

| 2 | 9.45% |

| 3 | 14.06% |

| 4 | 18.60% |

| 5 | 23.07% |

| 6 | 27.47% |

| 7 | 31.80% |

| 8 | 36.06% |

| 9 | 40.26% |

| 10 | 44.39% |

| 11 | 48.45% |

| 12 | 52.45% |

| 13 | 56.39% |

| 14 | 60.27% |

| 15 | 64.08% |

| 16 | 67.84% |

| 17 | 71.53% |

| 18 | 75.17% |

| 19 | 78.75% |

| 20 | 82.28% |

| 21 | 85.74% |

| 22 | 89.16% |

| 23 | 92.58% |

| 24 | 95.83% |

| 25 | 99.08% |

| 26+ | 100% |

Formula method

New sections CF 3(9)(b), CF 3(12), (13), (14), (15), (16), (17), (18), (19) and a new definition for “foreign defined contribution scheme” inserted into section YA 1 provide for the formula method.

The formula method is an alternative to the schedule method for people with foreign defined contribution schemes, if they meet other certain requirements and choose to use the formula method. This method taxes the actual investment gains that have accrued to a person’s foreign superannuation scheme while the person has been a New Zealand tax resident (excluding the gains that accrued during the person’s four-year exemption period).

To use this approach, new section CF 3(9)(b) provides that in addition to the requirement that the scheme must be a foreign defined contribution scheme, all of the following conditions must be met:

- the person has the information required to use the formula method;

- the person must not have received a distribution from the scheme before 1 April 2014, other than a pension or an annuity;

- the person has not used the schedule method in relation to that scheme; and

- if the person has acquired the interest from another person in a transaction referred to in new section CF 3(21)(d), that other person did not use the schedule method.

As set out in section CF 3(9)(b), a person is not permitted to use the formula method for an interest in a foreign superannuation scheme if they have already used the schedule method for that interest. However, a person is able to use the schedule method, if they have previously used the formula method for a given interest.

To use the formula method, a person is required to obtain the market value of the foreign superannuation interest at the time the exemption period ends, as well as information about contributions made and other necessary information. Requirements relating to the quality of information also apply.

Detailed procedure

The necessary calculations for the formula method begin with new section CF 3(12):

Distributed gain = (super withdrawal x calculated gains fraction) – other gains

The definition of each of these terms is provided in section CF 3(13) and (14).

“Super withdrawal” is the amount of the foreign superannuation withdrawal for which the person is using the formula method to calculate their assessable income.

“Other gains” is the total amount of “distributed gain” calculated under this formula for previous foreign superannuation withdrawals received in the assessable period before this particular lump sum.

If this is the first lump sum for the person in relation to that foreign superannuation interest, then “other gains” is equal to zero. This is because no other lump sums have been received during the person’s assessable period before the time the current lump sum (for which the person is using the formula method) was distributed.

If, for example, a person is calculating the assessable withdrawal amount in relation to a third lump sum that the person has received from their foreign superannuation scheme, the “other gains” term consists of what they previously calculated for “distributed gain” in respect of the first and second lump sums.

The “other gains” term acts as a wash-up calculation to ensure that a person is not over- or under-taxed in relation to their foreign superannuation interest.

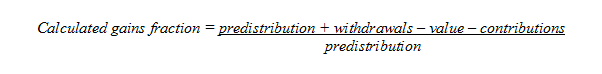

The “calculated gains fraction” is the greater of zero and the result given by the formula in section CF 3(14) as follows:

Where the formula for the “calculated gains fraction” provides a negative result, the person must enter zero for the “calculated gains fraction” term in the formula for the “distributed gain” in section CF 3(12). The result is that losses cannot be offset against other income in the person’s income tax return.

The terms in the “calculated gains fraction” formula are defined in new section CF 3(15).

“Predistribution” is the value of the person’s interest in the scheme immediately before they made their foreign superannuation withdrawal.

“Withdrawals” is the total amount of previous foreign superannuation withdrawals the person has received from their foreign superannuation scheme made during their assessable period before the time the current lump sum (for which the person is currently using the formula method to calculate their assessable withdrawal amount) was distributed. This term is zero if the person has received no other lump sums from the foreign superannuation scheme. If, for example, the person is calculating the “calculated gains fraction” in respect of their third lump sum, “withdrawals” would consist of the value of their first and second lump sums.

“Value” is the opening value of the person’s interest in the scheme at the beginning of their assessable period. If the person has an exemption period, “value” is the value of their foreign superannuation interest at the end of their four-year exemption period, not at the time of migration. This is to ensure that gains made by the scheme during the person’s exemption period and the pre-migration value are not taxed. If a person does not have an exemption period in relation to their foreign superannuation interest, “value” is the value of the person’s scheme at the time they first became a New Zealand tax resident while holding the interest.

“Contributions” is the total amount of recognised contributions under section CF 3(19) made to the scheme during the person’s assessable period before the distribution time. This term provides a deduction for contributions made for or on behalf of a person while the person is a New Zealand tax resident, if the contributions satisfy certain conditions. The formula method may otherwise treat some of the New Zealand contributions as gains and would result in over-taxation.

Section CF 3(19) provides that all of the following conditions must be met:

- at the time the contribution is made, the person must be a New Zealand resident under section YD 1 and is treated as a New Zealand resident under all applicable double tax agreements;

- the contribution is made by the person, or the person’s employer, or for the benefit of the person;

- the contribution must be required under the rules of the foreign superannuation scheme (that is, voluntary contributions cannot be deducted); and

- employer contributions must be subject to employer superannuation contribution tax or fringe benefit tax.

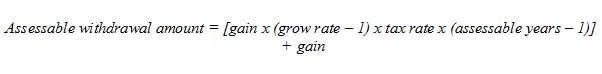

Once a person has calculated their “calculated gains fraction” and their “distributed gain” in relation to their lump sum, they are then required to calculate their assessable withdrawal amount by using the formulas in new section CF 3(16) to (18). These formulas are used to calculate the appropriate amount of “interest” to be charged on the amount of taxable New Zealand gains to account for the deferral benefit that the person obtains by not paying tax on accrual. This “interest” is calculated at the same rate as the average growth of the person’s superannuation interest over the number of years of New Zealand tax residence.

The terms in the formulas are defined in new section CF 3(18).

“Gain” is the amount of distributed gain that a person has calculated in section CF 3(12) in relation to the current lump sum for which they are using the formula method to calculate their assessable withdrawal amount.

“Tax rate” is the tax rate referred to in row 1 of table 1 in schedule 6 of the Income Tax Act 2007. This is the top prescribed investor rate (PIR) for taxing investments in multi-rate portfolio investment entities (PIEs).

The term “assessable years” refers to the number of tax years beginning in the person’s assessable period. Where a tax year has not yet begun during a person’s assessable period before the distribution time, the person must use “1” for this term.

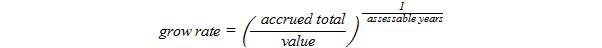

The term “grow rate” is given by the formula in new section CF 3(17):

The term “accrued total” means:

- the sum of:

– the value of the interest in the foreign superannuation scheme immediately before the distribution time; and

– the total amount of previous foreign superannuation withdrawals made during the assessable period from the scheme before the time that the current lump sum was distributed. This term is zero if the person has received no other lump sums during their assessable period from the scheme. This is the same as what is used for “withdrawals” in section CF 3 (14); - which is then reduced by:

– the value of recognised contributions under section CF 3(19) made to the interest in the scheme during the person’s assessable period before the distribution time.

The conditions that must be met in order for a contribution to be a recognised contribution are provided in new section CF 3(19) and have been discussed in further detail in reference to the formula for the “calculated gains fraction” in section CF 3(14).

“Value” is the value of the person’s interest in the scheme at the beginning of their assessable period. If the person has an exemption period, “value” is the value of their foreign superannuation interest immediately following the end of their four-year exemption period. This is to ensure that the pre-migration value and the gains made by the scheme during the person’s exemption period are not taxed. If a person does not have an exemption period in relation to their foreign superannuation interest, then “value” is the value of the person’s scheme at the time they first became New Zealand tax resident while holding the interest. This is the same as what is used for “value” in section CF 3(14).

The term “assessable years” refers to the number of tax years beginning in the person’s assessable period. Where a tax year has not yet begun during a person’s assessable period before the distribution time, the person must use “1” for this term. This is the same as the term “assessable years” in relation to section CF 3(16).

The final result given by section CF 3(16) is the person’s assessable withdrawal amount which is to be included as income in the person’s income tax return. The remainder of the lump sum that exceeds this amount is exempt income, as provided by new section CF 3(4)(b).

Summary of procedure

In addition to the detailed description of the procedure for the formula method, a summary of the procedure to calculate the assessable withdrawal amount under the formula method is shown below:

1. Calculate the “calculated gains fraction” in section CF 3(14) using:

- the value of the scheme immediately before the foreign superannuation withdrawal (“predistribution”);

- the total value of previous foreign superannuation withdrawals made during the assessable period before the distribution of the current foreign superannuation withdrawal (“withdrawals”);

- the value of the scheme at the beginning of the assessable period (“value”);

- the total value of recognised contributions made to the scheme in the assessable period before the distribution of the current foreign superannuation withdrawal (“contributions”).

2. Calculate the “distributed gain” in section CF 3(12) using:

- the result for “calculated gains fraction” as calculated in step 1;

- the amount of the foreign superannuation withdrawal (“super withdrawal”);

- the total value of distributed gains calculated in section CF 3(12) for previous foreign superannuation withdrawals from the scheme in the assessable period before the distribution of the current foreign superannuation withdrawal (“other gains”).

3. Calculate the “grow rate” in section CF 3(17) using:

- the value of the scheme at the beginning of the assessable period (“value”);

- the sum of the value of the scheme immediately before the foreign superannuation withdrawal and previous foreign superannuation withdrawals made during the assessable period before the distribution of the current foreign superannuation withdrawal, reduced by the total value of recognised contributions made to the scheme in the assessable period before the distribution of the current foreign superannuation withdrawal (“accrued total”);

- the number of tax years beginning in the assessable period and before the distribution time (or 1 if the result is zero) (“assessable years”).

4. Calculate the “assessable withdrawal amount” in section CF 3(16) using:

- the result for “distributed gain” as calculated in step 2 (“gain”);

- the result for “grow rate” as calculated in step 3;

- the number of tax years beginning in the assessable period and before the distribution time (or 1 if the result is zero) (“assessable years”);

- the tax rate referred to in schedule 6, table 1, row 1 (Prescribed rates: PIE investments and retirement scheme contributions) (“tax rate”).

Example 12

Graham migrates to New Zealand with an interest in a foreign superannuation scheme and becomes a New Zealand tax resident on 17 April 2011. His exemption period is 17 April 2011 to 30 April 2015.

During Graham’s exemption period, he withdraws a lump-sum amount of NZ$50,000 from his scheme on 20 November 2014.

Graham’s interest in his foreign superannuation scheme is worth NZ$100,000 when his assessable period begins on 1 May 2015.

Graham withdraws a lump-sum amount of NZ$60,000 from his scheme on 23 June 2025. His scheme is worth NZ$180,000 immediately before the lump-sum withdrawal.

On 9 November 2030, Graham’s foreign superannuation interest is worth NZ$150,000 and he transfers the full amount into a New Zealand superannuation scheme.

Graham has made no contributions to the scheme while he has been New Zealand-resident.

The withdrawal on 23 June 2025 and transfer on 9 November 2030 fall within the definition of “foreign superannuation withdrawal” and are received during Graham’s assessable period, so Graham must calculate his tax liability under section CF 3. However, the withdrawal on 20 November 2014 is exempt income as it is received during his exemption period.

23 June 2025 withdrawal

To calculate his “assessable withdrawal amount” in relation to his withdrawal made on 23 June 2025, Graham must first calculate his “distributed gain” and “calculated gains fraction”.

For the “calculated gains fraction”, Graham uses $180,000 for the “predistribution” term as this is what his interest in his foreign superannuation scheme was worth immediately before he made the withdrawal.

For the “value” term, he uses $100,000 as this was the value of Graham’s interest in the scheme at the beginning of his assessable period.

Graham has made no contributions and has not yet received any other foreign superannuation withdrawals during his assessable period, so both “contributions” and “withdrawals” are zero. Graham does not include the withdrawal he received during his exemption period on 20 November 2014 in “withdrawals”, because it was not received during his assessable period.

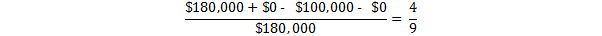

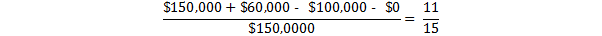

His “calculated gains fraction” under new section CF 3(14) is therefore:

Graham then uses this to calculate his “distributed gain” under section CF 3(12) in relation to the $60,000 lump sum:

The “other gains” term is zero because Graham has not received any other lump sums that were taxed under the formula method.

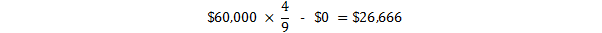

Now that Graham has his “distributed gain”, he uses this to calculate his “assessable withdrawal amount”.

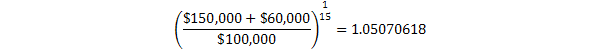

First, Graham calculates his “grow rate” under section CF 3(17).

To do this he must first identify his “accrued total”. His “accrued total” is $180,000 because his scheme was worth $180,000 immediately before the lump sum was withdrawn. He has not received any other foreign superannuation withdrawals during his assessable period, nor has he made any contributions to the scheme.

Graham uses $100,000 for the “value” term (the value of his interest at the beginning of his assessable period).

Ten tax years have begun in his assessable period so far, so the number of “assessable years” is ten.

Graham’s “grow rate” is:

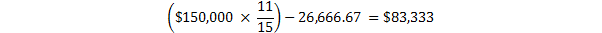

In calculating his “assessable withdrawal amount”, Graham is required to use the top prescribed investor rate[3} and makes use of the “distributed gain” amount he calculated earlier. As above, his number of “assessable years” is ten. Graham’s “assessable withdrawal amount” is:

Graham includes $30,734.99 as assessable income in his IR3 return for the 2025–26 tax year (the year in which he received the lump sum). The remaining $29,265.01 of the $60,000 withdrawal is exempt income.

Graham pays tax based on $30,734.99 of included income, rather than on the full amount of his foreign superannuation withdrawal of $60,000.

9 November 2030 transfer

Graham’s transfer of the remainder of his interest in his foreign superannuation scheme into a New Zealand scheme is a taxable event. Graham continues to use the formula method for this second foreign superannuation withdrawal.

As before, the “value” term is still $100,000 but “predistribution” is now $150,000. Graham has still not made any contributions to his foreign superannuation scheme, so “contributions” is still zero. Graham includes $60,000 in the “withdrawals” term to account for his lump-sum withdrawal made on 23 June 2025.

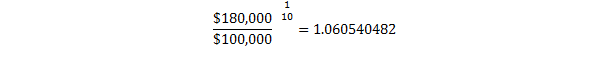

Graham’s “calculated gains fraction” under section CF 3(14) is therefore:

Graham uses this to calculate his “distributed gain” under section CF 3(12) as follows:

Graham then calculates his “assessable withdrawal amount” using the formulas in section CF 3(16) and (17).

Graham’s “accrued total” is the value of his fund immediately before the transfer plus the value of his first withdrawal ($150,000 + $60,000). Graham uses $100,000 for the term “value”. At the time of the transfer on 9 November 2030, 15 tax years have begun during Graham’s assessable period, so Graham uses 15 for the term “assessable years”.

Graham’s “grow rate” is:

Using the results for the “grow rate” and “distributed gain”, and assuming that the top prescribed investor rate is 28%3, Graham’s “assessable withdrawal amount” is:

Graham therefore includes $99,897.35 as assessable income in his IR3 return for the 2030–31 tax year. Graham pays tax on that amount, rather than on the full value of the transfer of $150,000.

Optional KiwiSaver withdrawal facility

Under section CF 3(2)(b), a transfer from a foreign superannuation scheme into a New Zealand superannuation scheme is a taxable event. In some cases, the transfer may be into a locked-in superannuation scheme, such as KiwiSaver. This could lead to cashflow difficulties for the person if they are unable to access any of the transferred amount to pay the resulting tax liability.