How tax pooling operates

Tax pooling generally involves a taxpayer depositing money with a tax pooling intermediary. The deposits earn interest. The intermediary deposits that money in its tax pooling account with IR. The taxpayer may use the funds (deposits) in the future to satisfy their outstanding tax liabilities or may sell the funds to another taxpayer who is also a client of that tax pooling intermediary. The funds remain in the tax pool until the taxpayer directs the intermediary to transfer the funds to the taxpayer’s own IR account or to another taxpayer’s IR account. The taxpayer may also request for the funds to be refunded. If the taxpayer sells the funds, the intermediary will facilitate the sale for a fee. On the payment of the fee, the intermediary transfers the funds to the other taxpayer’s IR account, as at the date the money was originally deposited with the intermediary.

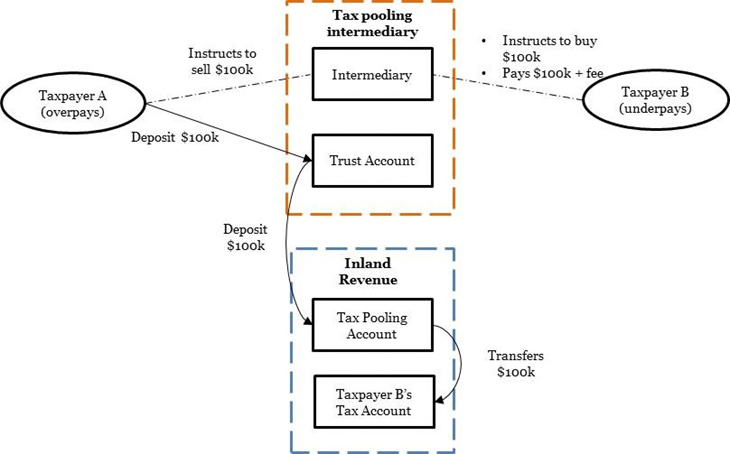

The diagram below provides a simplified view of the tax pooling regime:

In this example, Taxpayer A has deposited $100k into the tax pooling intermediary’s trust account. The intermediary (through the use of a trustee) deposits the money into the intermediary’s tax pooling account set up with IR. Taxpayer A then instructs the intermediary to sell its excess tax as it has overpaid.

Taxpayer B, who has underpaid its tax, instructs the intermediary to purchase tax in order to meet its obligation with IR. The intermediary facilitates the transaction. Once the transaction is completed (i.e. Taxpayer B pays the $100k and fee) the $100k in the tax pooling account is transferred to Taxpayer B’s IR account as at the date that Taxpayer A deposited the money with the intermediary.

There are a number of specific rules and provisions that limit the use of the tax pooling funds. One of the key restrictions is that taxpayers must access funds within 75 days of their terminal tax date in order to apply tax pooling funds against their provisional or income tax liabilities as at the effective date of the original deposit. The time limit is reduced to 60 days if the income tax liability relates to a reassessment. Note that there is no time restriction if the taxpayer is using their own deposited funds and they have filed a tax return.

How to become a tax pooling intermediary

A person that wants to act as a tax pooling intermediary must first get IR’s approval. The person may only apply to be a tax pooling intermediary if they are fit to apply. This means the person (or officer or principal) must not be a discharged or un-discharged bankrupt; nor have been convicted of an offence involving dishonesty; and must be eligible to be a company director.[5]

Although IR is required to approve tax pooling intermediaries, it is under no obligation to oversee or audit the operation of tax pooling accounts and is not liable for any loss suffered by the taxpayer if the account is not properly operated.[6]

In approving tax pooling intermediaries IR must be satisfied that the applicant can operate the tax pooling account correctly and will operate systems that will allow it to make payments and provide information in the format required by IR.[7] This means IR must be satisfied that the applicant has the requisite systems in place to protect personal information and payment details, which are obtained in the course of running the tax pooling account, and to keep a record of each taxpayer’s balance in the account.[8]

In their application the prospective intermediary must undertake to inform the taxpayer, before acting as intermediary for a taxpayer, of IR’s role in relation to tax pooling and that it is fit to operate the tax pooling account using the appropriate system, outlined above.[9]

The intermediary must also confirm to IR that it will establish a trust account into which it will pay the amounts received in its role as intermediary. The amounts paid by taxpayers are held on trust by the intermediary until they are transferred out of the pool, whether this is to another IR account or refunded to the taxpayer.

Ceasing to be a tax pooling intermediary

Although the intermediary may wind up the account at their discretion at any time, IR only has the power to require an intermediary to wind up their tax pooling account if the intermediary does not meet certain conditions.

IR may require the intermediary to wind up its tax pooling account if:

- The tax pooling account has gone into deficit

- The intermediary’s actions are preventing a taxpayer from effectively managing their liabilities to pay provisional tax and UOMI

- The intermediary has been put into liquidation or receivership

- Fewer than 100 taxpayers are using the pooling account or are likely to be using the pooling account

- The intermediary has breached any of their obligations to establish and maintain a tax pooling or no longer meet the requirements to be fit to operate a tax pooling account (as outlined above).

IR may require the pooling intermediary to be wound up immediately or may set a future date for the wind up.

On the winding up of a tax pooling account, IR may refund the balance of the account to the former holder of the account (i.e. the tax pooling intermediary) or apply to the courts for directions on the disposal of the balance of the account.[10]

5 Tax Administration Act 1994, section 15R.

6 Tax Administration Act 1994, section 15P.

7 Tax Administration Act 1994, section 15S(2).

8 Tax Administration Act 1994, section 15S(1)(b).