Briefing to Incoming Minister – June 2013

As Minister of Revenue you are accountable for the overall working of New Zealand’s tax system and for the Inland Revenue Department. In addition, tax policy decisions are made jointly by yourself and the Minister of Finance.

This briefing provides you with some initial information relevant to your role, a summary of current issues and some details on suggested administrative arrangements.

OVERVIEW

1. New Zealand’s tax system

New Zealand’s tax system is robust and provides reliable sources of revenue to fund Government programmes. Our tax system is perceived as being among the most coherent in the OECD. The different pieces of the tax system fit together well and the tax bases are broad, with few exemptions. These broad bases in turn allow sufficient revenue to be collected with relatively low tax rates (as such, our tax system has been characterised as a “broad-based, low-rate” system).

As well as having a coherent tax policy, the tax administration functions well; this is critical as a good tax system is not just about good policy. Both tax policy and tax administration must be working well for the tax system to be effective.

The tax system was comprehensively reviewed by the Victoria University of Wellington Tax Working Group in 2009/10. That review considered that the foundation of the tax system, of broad tax bases with low tax rates, is sound. The review did express concerns about some tax settings – in particular, the difference between the company, trust and top personal tax rates – and these issues were largely addressed in Budget 2010 by reducing the top personal rate to align with the trust rate.

In its Budget 2013 Fiscal Strategy the Government stated it is comfortable with the broad structure of the tax system and that it has no plans for further major reforms in the near term. That statement mentioned that the Government has considered, and rejected, potential tax changes such as moving away from the broad-based, low-rate structure, a land tax or a capital gains tax.

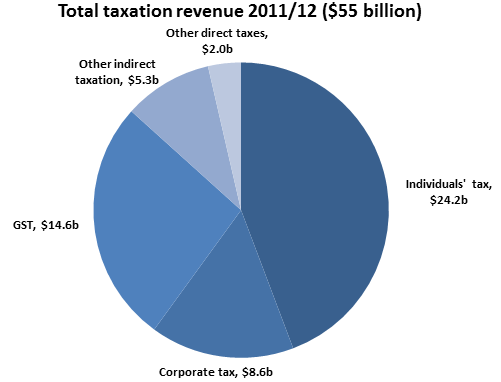

The Government collects approximately 65 percent of its revenue – around $55 billion per year – through taxes.[1] The two largest sources of tax revenue are PAYE (withholding tax on salary and wages) and GST. These two sources alone amount to 66 percent of tax collections.

2. Inland Revenue

Inland Revenue is charged by Parliament to levy tax in accordance with the law to the best of its ability. Inland Revenue must also maintain the integrity of the tax system and confidentiality of people’s tax affairs. To ensure these duties are met, the Commissioner of Inland Revenue has statutory independence from Ministers.

From time to time the Commissioner must exercise a statutory judgement to determine where resources should be focused. This statutory independence means Ministers cannot direct the Commissioner in how her duties should be carried out.

This is a somewhat different arrangement from other Government departments, where Ministers have more ability to influence how a department should act. Inland Revenue is bound to independently assess and collect tax according to the law; it cannot be influenced in this by Ministers.

Inland Revenue employs around 5,300 people in 17 offices across the country. Its largest office is in Wellington, but it also has a large presence in Auckland, Hamilton, Christchurch and Dunedin.

The areas of Inland Revenue include:

- Service delivery (processing and assisting with returns)

- Investigations (auditing taxpayers)

- Office of the Chief Tax Counsel (providing rulings on tax law and issuing interpretation statements)

- Business transformation (working with the rest of the department to implement Inland Revenue’s change programme)

- Policy and Strategy (advising Ministers on policy matters, drafting certain revenue legislation, forecasting tax revenue and providing strategic direction for the department).

Inland Revenue is responsible for more than the tax system. It administers several social policy and other programmes; including child support, repayments of student loans, Working for Families, paid parental leave and KiwiSaver.

At present, the main challenges facing Inland Revenue are:

Doing more with less: Along with other Government departments, Inland Revenue is facing a slowly reducing funding baseline. At the same time, Government expectations of the department’s performance have not changed.

Peak season: Inland Revenue has very high contact volumes in the months surrounding June, when numerous taxpayers are required to file tax returns. Many of these calls are from people who are seeking advice on how certain tax rules work and apply to them. These high volumes can translate into very long wait times. This is managed in a number of ways including by increasing call centre resources. This often creates some media interest.

Business transformation: Inland Revenue’s computer systems and processes are becoming increasingly out-of-date, increasing the risk of operational failure and making it difficult to implement new policies to meet Government or customer expectations. Part of the department’s business transformation process involves re-engineering its key computer systems. This also presents an opportunity to update Inland Revenue’s business processes and how we interact with taxpayers at the same time. This is a very large and on-going process of change, which we expect to take around 10 years. Cabinet agreed in April to the overall business transformation direction that Inland Revenue wishes to pursue.

3. Tax policy development

The Treasury and Inland Revenue jointly develop tax policy. The specific changes that are worked on are based on the Government’s tax policy work programme. This is updated regularly, with the next update scheduled for later this year.

Tax changes are developed in accordance with the Generic Tax Policy Process (GTPP). This is a very open and interactive process which helps ensure that tax policy changes are well thought through and workable in practice. The key element of this process is consultation. This works especially well as New Zealand has a private sector that is particularly well informed on tax policy issues. We believe this is in large part a legacy of the open and constructive policy debates that have flowed from the GTPP.

A consequence of the GTPP is that it increases the time it takes to develop and implement tax policy. However, we believe the GTPP to be a valuable and essential part of building and maintaining a good tax system. On occasion, there will be some changes that require immediate action to protect the revenue base. It is not possible to respond quickly and, at the same time, engage in wide consultation. In these instances it is accepted that public consultation cannot occur.

CURRENT ISSUES

There are a number of current issues that will require your immediate attention including:

| Date | Item | Comments |

|---|---|---|

| 11 June | Sign Parliamentary Questions from Hon Phil Goff regarding IR call times/peak season | [Information withheld] |

| 12 June | First reading of Foreign Superannuation Bill | We have provided your office with a first reading speech. |

| [Information withheld] | [Information withheld] | [Information withheld] |

| 13 June | Papua New Guinea double tax agreement (DTA) considered by LEG Cabinet Committee | You will need to attend this LEG meeting. We will provide you with speaking notes. |

| 14 June | Sign Parliamentary Questions from Hon David Cunliffe requesting a list of all Cabinet Papers submitted by the Minister of Revenue in April/May 2013 | The issues covered in relevant papers are already in the public arena. |

| [Information withheld] | [Information withheld] | [Information withheld] |

| 18 June | Department scheduled to release interpretation paper on section BG 1 (the general tax anti-avoidance provision) | Paper has been long-awaited and has been extensively consulted. Will be of media interest. |

| 20 June | Open IR office in Christchurch CBD | This will be the first public sector-tenanted building within CBD since the earthquake. |

| [Information withheld] | [Information withheld] | [Information withheld] |

| 27 June | Livestock Bill second reading scheduled. We have two supplementary order papers (SOPs) planned for the Committee of the Whole House stage of this Bill. | Your office will need to liaise with the Leader of the House’s office to ensure the second reading is scheduled for around this date given application dates in the Bill. We will provide your office with a draft second reading speech. The SOPs will be tabled in advance of the Committee of the Whole House stage. |

| 27 June | Scheduled release of R&D cashing out losses issues paper | Release date must align with the release of R&D funding proposals by MBIE. |

| 4 July | Discuss IR business transformation with Information and Communication Technology (ICT) Ministers |

Recommended other briefings

There are several medium-term projects and issues that you should be aware of. These are summarised in the table on the next page. We recommend that officials provide you with more detailed briefings (written and oral) on these issues in the near future.

In addition to these priorities, there are other issues such as those listed below you may want a briefing on in the coming months. We are happy to work with your office to schedule briefings on these issues and provide advice on sensible sequencing.

- Peak season: how it is managed, Inland Revenue’s performance and likely media interest

- Child support: background, the proposed changes and key issues

- GST and online shopping: background and current process

- Employee allowances, including accommodation

- [Information withheld]

- Mutual recognition of imputation credits with Australia

- Options to reform the tax treatment of portfolio investment entities (PIEs)

- Tax treatment of charities and charitable donations

- The Foreign Account Tax Compliance Act (FATCA) – US legislation.

Medium-term priorities

| POLICY | What | When |

|---|---|---|

| Budget 2013 |

|

Issues paper to be released 27 June |

|

October tax bill | |

|

October tax bill | |

|

Student Loan Scheme Amendment bill (introduction late July) | |

| Legislation programme |

|

First reading and referral to FEC 12 June |

|

Draft SOP – referred to FEC in June | |

|

FEC has reported the Bill back to the House . Aim is for second reading on 27 June | |

|

Report and discuss with Ministers – June | |

| New work programme |

|

Report and discuss with Ministers – June |

| Taxation of multinationals |

|

|

| IR FOR THE FUTURE | What | When |

|---|---|---|

| Business transformation |

|

|

| Better public services (BPS) |

|

|

| Information sharing |

|

We will report soon on submissions on information sharing with the Police. [Information withheld] |

| Baseline profile |

|

ADMINISTRATIVE ARRANGEMENTS AND STAKEHOLDERS

Key contacts

| Naomi Ferguson Commissioner of Inland Revenue |

[Information withheld] |

| Struan Little Deputy Commissioner, Policy and Strategy |

[Information withheld] |

| Emma Grigg Policy Director, Policy and Strategy |

[Information withheld] |

Reports and communications

Every week you will receive reports on both policy and Inland Revenue operational issues. The policy reports will be predominantly on tax, but may also cover other policies Inland Revenue is involved with (for example, student loans, child support, KiwiSaver and Working for Families).

Some of these reports will be sent jointly to you and other Ministers. For example, reports on key tax policy issues will be put to you and the Minister of Finance. Reports on student loans will generally be addressed to you and the Minister for Tertiary Education, Skills and Employment.

The Minister of Revenue’s office regularly gets calls and letters from concerned parties, both individuals and corporates, on a range of issues – for example, student loans, employee allowances, child support and secondary tax codes.

Administrative support

To assist with the reports and communications that the Minister of Revenue receives, Inland Revenue has previously provided, via its Ministerial Services team, two secondees to your office. The secondees have acted as advisors on tax and social policy matters, assisted in handling media enquiries, helped liaise with the department and dealt with incoming communications.

The secondees to the previous Minister of Revenue were [Information withheld] and [Information withheld].

Inland Revenue staff also assist in providing draft replies to Ministerial correspondence on tax and social policy issues, and in the collation of information for Official Information Act requests and Parliamentary Questions.

From time to time, you will be required to give speeches (for example, for a reading of a tax bill before the House). You will also be invited to give speeches for various tax events from time to time. Previous practice was for Policy and Strategy to provide draft speeches for these events to your office. Policy and Strategy has also drafted any media statements on tax policy matters for your office, and provided technical checks on any policy statements as required. We recommend this practice continue.

Regular meetings

The table below sets out the regular meetings that we have previously had with the Minister of Revenue. We suggest that these meetings continue.

| Meeting | Frequency |

|---|---|

| Meeting with Commissioner to discuss current issues in portfolio | Weekly |

| Meeting with you and Minister of Finance to discuss key decisions and issues in the portfolio (Minister of Revenue chairs this meeting) | Fortnightly |

| Meeting with the Minister of Tertiary Education, Skills and Employment to discuss student loans issues | Monthly |

| Quarterly policy meeting involving a detailed discussion on a topical tax policy issue | Quarterly |

Stakeholders

Your office will also frequently be contacted by various industry bodies and groups, who have certain areas of interest. They include:

| Stakeholder | Areas of concern | |

|---|---|---|

| New Zealand Institute of Chartered Accountants (NZICA) | Representative body for accountants | Broad range of tax policy issues. |

| Corporate Taxpayers Group (CTG) | Representative body for large corporates | At present: depreciation on buildings, employee allowances, blackhole expenditure. |

| New Zealand Bankers’ Association (NZBA) | Banks | FATCA, tax effects of Basel 3 requirements. |

| Financial Services Council (FSC) | Financial service providers | PIE issues, insurance, FATCA. |

| IT providers and payroll software developers | Tax administration, withholding taxes, offers to sell IT software to IR. | |

| Charitable organisations, including ANGOA | Allowances, charities, charitable giving. | |

| New Zealand Law Society | Representative body for lawyers | Broad range of tax policy issues. |

| Business New Zealand | Representative body for New Zealand companies | Tax treatment of employees and their allowances. |

| Accounting, law firms and large corporates | Broad range of tax policy issues. | |

| New Zealand Property Council | Commercial building investment firms | Tax deductibility of seismic strengthening. |

| Rewrite Advisory Panel | Panel established by the Government to advise on issues associated with the rewrite of the Income Tax Act | Unintended legislative changes. |