Chapter 6 - Administrative process

6.1 The R&D tax losses proposal has similar administrative implications to the now repealed R&D tax credit. In particular, implementation would require changes to the IR 4 company income tax return and a new statement of R&D activity and expenditure. Changes to the IR 4J imputation return would also be required.

6.2 Under the proposed new rules, when a company files its income tax return, it would request its tax losses to be refunded. This will be done through additional key points added to the IR 4 income tax return to show the amount of loss being cashed out and the actual value of the cashed-out amount (once the loss is converted using the company tax rate).

6.3 To determine if a company is eligible for a loss to be cashed out, Inland Revenue would need to know the nature of the R&D activity and the amount of expenditure. This would likely be done by the company filing a statement which details their R&D activity and expenditure within 30 days of the income tax return being filed.

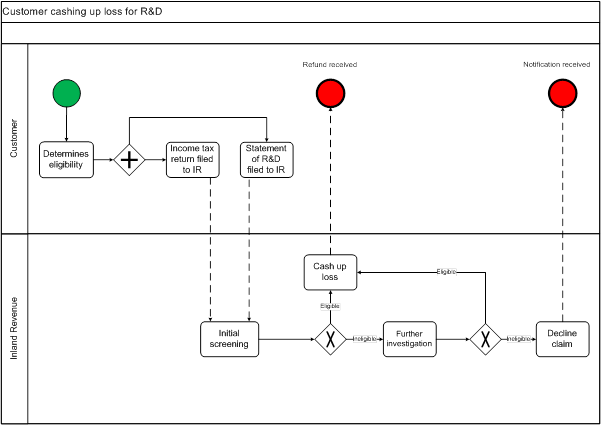

6.4 Once both the company income tax return and statement of R&D is received, both would be put through a comprehensive screening process. Once the initial screening process is complete, either a payment would be made, or the claim would be passed on for further investigation. Applications that are investigated further would either be approved and the appropriate payment made, or declined.

6.5 Inland Revenue would pay out these losses to the company, subject to the rules and criteria for the cashed out loss being met. Companies that do not meet eligibility would be notified and have the full loss carried forward. This process is shown in diagram 1.

Diagram 1

Screening returns

6.6 Companies wanting to cash out a loss will require a high level of scrutiny to discourage fraudulent claims. Practically, this requires an up-front screening process to counter the risk of cashing out ineligible tax losses (compared with carrying excess tax losses forward). Inland Revenue’s experience with the R&D tax credit proved that reclaiming money from taxpayers who had erroneously received R&D tax credits was very difficult. As accessing tax losses early may incentivise fraudulent activity, a cautious approach to screening applicants is favoured.

Statement of R&D activity and expenditure

6.7 The purpose of the statement of R&D is to establish eligibility by detailing the nature of R&D activity and the amount of qualifying expenditure. Companies will be required to provide information within the statement that confirms they are eligible for a cash-out. Information required will include:

- details of the R&D activity that show it meets the accounting definition of R&D;

- evidence that the R&D is being undertaken in New Zealand;

- salary and wage expenditure that relates to R&D activity; and

- details of the company grouping, ownership and shareholding.

6.8 Enough detail will need to be provided to allow checks to take place. The comprehensiveness of the screening process will need to be balanced against greater administration and compliance costs for companies.

6.9 In most instances, it will be possible to make a payment based on the information provided in the statement of R&D, along with other information already held by Inland Revenue (such as PAYE schedules). This will minimise the additional compliance burden placed on taxpayers. In some cases however, further screening and investigation may be needed.

Education

6.10 Given that the proposals set out in this paper are new, there is likely to be some uncertainty for taxpayers over how to apply some of the suggested rules above, particularly around the definition of R&D and eligible/excluded activities. Inland Revenue intends to produce guidance material for R&D companies and provide further education through community compliance officers. We want to hear from taxpayers how Inland Revenue can further help address possible uncertainties.

Changes to Financial Reporting Standards

6.11 Inland Revenue is aware that the simplification of financial reporting requirements for small and medium enterprises will mean that this policy proposal could impose an additional compliance burden on taxpayers. However, it is important that mechanisms that encourage compliance remain intact. It should be noted that this policy proposal is advantageous for taxpayers.

Imputation

6.12 New Zealand’s imputation system creates a design complication if tax losses are cashed out (rather than carried forward). Generally, when companies pay corporate income tax they receive imputation credits and when they receive a refund they get an imputation debit. This means any taxpayer that accesses a cashed-out tax loss would incur an equivalent amount of “imputation debits” (or “negative imputation credits”).

6.13 While imputation debits for refunds are a current feature of the imputation system, a company cannot have a net debit balance at the end of their income year without incurring a penalty. To provide for ongoing imputation debit balances arising from these proposals, Inland Revenue systems will be modified to allow for this.

Consultation questions for this section:

- What approaches would be helpful to reduce uncertainty about the application process for potential applicants?