Chapter 2 - Background

2.1 The Government’s Business Growth Agenda emphasises the importance of building innovation to help grow New Zealand’s economy. Innovation creates new sources of economic growth by delivering new products and processes, as well as generating improvements in the quality and cost of existing products and processes. “Encouraging business innovation” is one of the seven key initiatives of the Building Innovation work-stream, which recognises that enabling R&D is a key element in the innovation process.

2.2 The Government wishes to gauge the extent to which the potential for R&D expenditure to receive “black hole” tax treatment is discouraging businesses’ R&D investment.

Black hole expenditure

2.3 “Black hole” expenditure is business expenditure that is not immediately deductible for tax purposes and also does not form part of the cost of a depreciable asset for tax purposes, and therefore cannot be deducted over time as depreciation.

2.4 When R&D expenditure that has been capitalised has given rise to an asset that is depreciable for tax purposes, the appropriate tax treatment is to allow that expenditure to be depreciated over the life of the asset. When R&D expenditure that has been capitalised fails to give rise to a valuable asset, the appropriate tax treatment, at least in some circumstances, is to allow tax deductions for that expenditure. However, the current tax treatment of capitalised development expenditure leaves the potential for this expenditure to be rendered neither deductible nor depreciable for tax purposes.

2.5 The potential for R&D expenditure to be treated as black hole expenditure results in economic distortions. It can cause a risk-neutral (or risk-averse) investor deciding between two alternative investments offering the same expected pre-tax rate of return, but when one of the investment options carries a risk of black hole expenditure occurring, to prefer the other investment option. Furthermore, businesses may be incentivised to complete projects that (ignoring tax) have been discovered to be inefficient, simply to avoid black hole treatment of sunk capital expenditure.

Current tax settings for R&D

2.6 As stated in the Government’s Revenue Strategy, the Government supports a broad-base, low-rate tax system that minimises economic distortions. Under such a tax system, the tax treatment of alternative forms of income and expenditure is as even as possible. This ensures that overall tax rates can be kept low, while also minimising the biases that taxation can introduce into economic decisions. In line with this strategy, the current tax treatment of R&D expenditure in New Zealand is largely consistent with the tax treatment of other forms of business expenditure.

Tax deductibility of R&D expenditure

2.7 Expenditure on R&D that is regarded as a revenue expense for accounting purposes is generally deductible for tax purposes. Section DB 34 of the Income Tax Act 2007 allows a person a deduction for expenditure they have incurred on research or development when the expenditure is expensed under paragraph 68(a) of the New Zealand Equivalent to International Accounting Standard 38 (NZ IAS 38 Intangible Assets). For the purposes of paragraph 68(a), paragraphs 54 to 67 of NZ IAS 38 are applied.

2.8 A taxpayer who is allowed a deduction under section DB 34 of the Income Tax Act 2007 is entitled to the deduction in the income year in which they incurred the expenditure (that is, immediate deductibility). Alternatively, in certain circumstances, they may choose to allocate all or part of the deduction (for expenditure that is not interest) to later income years. Although a taxpayer may have a choice over the timing of the deduction, R&D expenditure that is deductible under section DB 34 of the Income Tax Act 2007 is generally referred to in this document as being immediately deductible.

2.9 Under NZ IAS 38, expenditure on an intangible item is expensed up until the asset recognition criteria are met. The intangible asset recognition criteria require an entity to demonstrate all of the following:

(a) The technical feasibility of completing the intangible asset so that it will be available for use or sale.

(b) Its intention to complete the intangible asset and use or sell it.

(c) Its ability to use or sell the intangible asset.

(d) How the intangible asset will generate probable future economic benefits. Among other things, the entity can demonstrate the existence of a market for the output of the intangible asset or the intangible asset itself or, if it is to be used internally, the usefulness of the intangible asset.

(e) The availability of adequate technical, financial and other resources to complete the development and to use or sell the intangible asset.

(f) Its ability to measure reliably the expenditure attributable to the intangible asset during its development.

2.10 Once all of these asset recognition criteria are satisfied, the immediate deductibility of R&D expenditure ceases and all further development expenditure is capitalised.

2.11 This capitalised development expenditure can only be depreciated (that is, deducted over the life of an asset) for tax purposes once there is “depreciable property” under the Income Tax Act 2007. Expenditure on intangible property may only be depreciated if the intangible property is listed in schedule 14 of the Income Tax Act 2007, which lists items of “depreciable intangible property”. For an item of property to be listed in schedule 14, it must be intangible and have a finite useful life that can be estimated with a reasonable degree of certainty on the date of its creation or acquisition.

2.12 In the event that the project does not create a depreciable asset for tax purposes, the development expenditure that has been capitalised will be rendered non-deductible, either immediately or over a period of time.

2.13 Moreover, even if the project does create an asset that is listed in schedule 14, capitalised development expenditure incurred in creating the asset may still be rendered non-deductible, either immediately or over a period of time. As explained below, this may occur because, although the expenditure has given rise to an asset that is depreciable for tax purposes, the depreciable costs of the asset have been interpreted to exclude development expenditure.

Depreciable patent costs

2.14 An interpretation statement issued by the Commissioner of Inland Revenue takes the view that the depreciable patent costs (for a taxpayer who has lodged a patent application with a complete specification or had a patent for an invention granted) are limited to the administrative and legal fees incurred in the patent process.[1] According to the Commissioner’s view of the law, capitalised development expenditure relating to the invention that is the subject of the patent (or patent application) is potentially neither deductible nor depreciable for tax purposes.

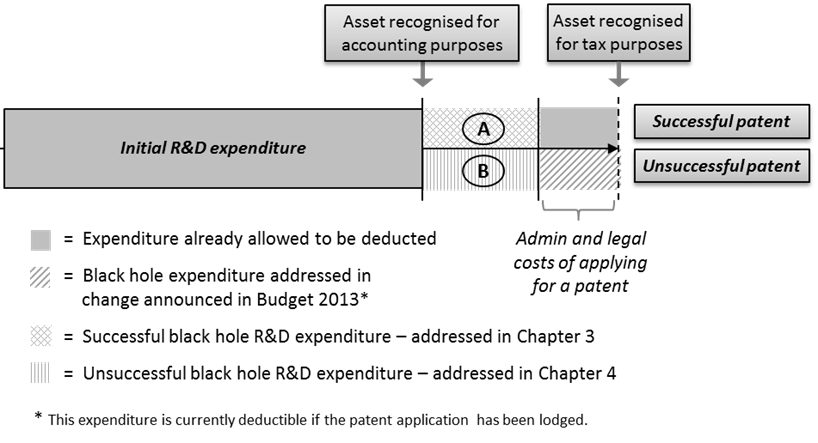

2.15 Figure 1 illustrates the tax treatment of expenditure incurred both successfully and unsuccessfully in attempting to create a patent. The area marked “A” represents the capitalised development expenditure relating to a patented invention which is currently black hole expenditure. A proposal to make this expenditure depreciable is discussed in Chapter 3. The area marked “B” represents the capitalised development expenditure relating to an invention for which a patent is not obtained which is currently black hole expenditure. A proposal to make this expenditure deductible is discussed in Chapter 4.

Figure 1: Patent

Depreciable plant variety rights costs

2.16 Although the Commissioner’s interpretation statement referred to previously is confined to patents, it is likely that the depreciable costs of plant variety rights would be interpreted in the same way, given that they are both types of intellectual property rights obtained by registration following an R&D process.

Depreciable costs of software development for use in own business

2.17 The Commissioner’s views on the income tax treatment of computer software are contained in a 1993 policy statement.[2] The statement applies to expenditure incurred on or after 1 July 1993.

2.18 In outlining the tax treatment of expenditure incurred on in-house software development, the statement says that “when the development is completed capitalised costs will be deductible under the depreciation regime”. This indicates that the policy intent was that capitalised expenditure incurred in the development of software by a business for its own use should be depreciable.

2.19 The Government’s understanding is that taxpayers who have developed software for use in their own business, based on the 1993 policy statement, have been depreciating all of the capitalised development costs. Although this is in accord with the policy intent, some doubt has been expressed about whether this approach is correct under current law.

2.20 “The copyright in software, the right to use the copyright in software, or the right to use software” is listed as an item of “depreciable intangible property” in schedule 14 of the Income Tax Act 2007. The rights to use listed in schedule 14 relate to licensees.[3] It is only “the copyright in software” that will be relevant to a taxpayer who has self-developed software.

2.21 A taxpayer who develops their own software will own the copyright for that software. The copyright arises by operation of law. It comes into existence automatically when an original work is created. There is no registration process and no fee to be paid to obtain the copyright.

2.22 The question then arises: what are the depreciable costs of “the copyright in software” for a taxpayer who has self-developed software? Arguably, when a business develops software for its own use, there will not be a cost associated with the copyright. There is support in case law for the view that “software” can exist independently from the depreciable software rights set out in schedule 14.[4] Therefore, it is possible to have software that is not depreciable under schedule 14.

Other schedule 14 assets

2.23 Note that some of the assets listed in schedule 14 are not created from capitalised development expenditure and are therefore not relevant for the purposes of this discussion document, as it is concerned only with black hole R&D expenditure. This includes the various “rights to use” listed in schedule 14, which are only relevant to licensees. The depreciable cost of these assets for the licensee will be based on the price paid by the licensee to obtain the right to use.

Further comment

2.24 The Government is aware that the possibility of development expenditure being treated as black hole expenditure exists. However, the intangible asset recognition criteria seem quite a high bar to satisfy, which suggests that the vast majority of R&D expenditure is already immediately deductible. A taxpayer knows in advance that once they recognise an intangible asset for accounting purposes, concessionary tax treatment under section DB 34 will cease, and that any further development expenditure on the asset will be capitalised. On this basis, it is difficult to envisage that taxpayers would “prematurely” incur substantial capitalised R&D expenditure under current tax settings.

2.25 That said, the inability of a business to depreciate part of its development expenditure could act as a barrier to investment in innovation. The Government is therefore seeking greater understanding of the extent to which black hole development expenditure is a problem in practice by undertaking this consultation.

Consultation questions

|

Sale of successful output from R&D

2.26 Under current tax settings, profits from the sale of assets created from R&D are not always taxed. When the sale of outputs from R&D is untaxed, the seller is deriving black hole income (the opposite of black hole expenditure). Under current tax settings, a large part of the R&D cost of developing such assets is deductible. This, combined with the large scope for deriving untaxed income from the sale of the output from the R&D, means that there is:

(i) an existing inconsistency between R&D outputs that are taxed upon sale and those that are not; and

(ii) an existing asymmetry when R&D expenditure is deductible but the sale of the resulting R&D outputs is not taxed.

2.27 Allowing even more R&D expenditure to be deductible will exacerbate these inconsistencies/asymmetries. This is perhaps the strongest argument against allowing additional deductions for R&D expenditure.

2.28 Tax does apply when income arises from royalties or from the sale of patent rights or patent applications.

1 Interpretation statement “Income tax treatment of New Zealand patents”, Tax Information Bulletin Vol 18, No 7 (August 2006), p 51.

2 Appendix to Tax Information Bulletin Vol 4, No 10 (May 1993).