Tax treatment of foreign superannuation

(Clauses 6–9, 17, 18, 25, 40–43, 75, 103(9) –(11), 106, 115–117)

Summary of proposed amendment

The bill proposes new rules for taxing interests of New Zealand residents in foreign superannuation schemes. Under the proposed changes, interests will no longer be taxed on accrual under the foreign investment fund (FIF) rules or on distribution from a company or a trust. Instead, distributions will be taxed under a new set of rules specific to foreign superannuation.

Lump-sum amounts from foreign superannuation schemes will be partially or wholly taxed when received. The new rules will apply to cash withdrawals and to amounts transferred into New Zealand or Australian superannuation schemes. Transfers between foreign schemes will generally not be taxable. Withdrawals in the first four years after a person becomes resident will not be taxable.

After the four-year exemption period, a person’s tax liability on a withdrawal will generally be calculated using a new “schedule method”. Proposed new schedule 33 provides a particular fraction based on how long the person has been a New Zealand resident before making the withdrawal. This fraction will be applied to the withdrawal to determine the person’s taxable income. This method will approximate the tax that would otherwise have been paid on accrual while the person is resident in New Zealand.

An alternative method of calculating actual gains derived while the person is New Zealand-resident – the “formula method” – will also be available for amounts received from foreign “defined contribution schemes”. An interest factor will be applied to the value of the gains to compensate for the use-of-money (deferral) benefit.

The proposed new rules will mainly apply to people who contribute to a foreign superannuation scheme through an employer while working overseas. They will also cover non-employment-related schemes which fall within the tax definition of a “foreign superannuation scheme”. The proposed rules will not apply to periodic pensions or foreign social security, which will continue to be taxed as they are currently − that is, taxed on receipt at the person’s marginal tax rate. The proposed rules will not be expected to apply to withdrawals from Australian superannuation funds, which are generally exempt under the New Zealand-Australia double tax agreement.

Under the proposed changes, people who have transferred their superannuation savings from a foreign superannuation scheme to a KiwiSaver scheme will be able to withdraw funds from the transferred amount to pay the tax liability.

Application date

The amendments will apply from 1 April 2014.

A person may continue to apply the FIF rules to an interest in a foreign superannuation scheme if they returned FIF income or a loss in respect of that interest before the date this legislation was introduced.

As a concessionary measure, people who have made a lump sum withdrawal or transfer before 1 April 2014 will have the option to pay tax on only 15 percent of the lump-sum amount. People using this option will need to include 15 percent of the lump-sum amount as income in their 2013–14 or 2014–15 tax return. This option will satisfy the tax liability for past withdrawals in relation to which a person did not properly return income.

Background

An officials’ issues paper released in July 2012[1] proposed to replace the current rules for taxing foreign superannuation with a new set of rules that would be fairer and simpler for taxpayers to understand and comply with. Further analysis of the rationale of this proposal may be found in the Regulatory Impact Statement to this bill, published on Inland Revenue’s tax policy website, www.taxpolicy.ird.govt.nz.

The issues paper proposed that:

- foreign superannuation interests would be taxed on receipt rather than under the FIF rules;

- lump sums would be partially taxed based on the person’s length of residence (previously called the “inclusion rate” method but under the changes proposed in the bill, this is referred to as the “schedule method”); and

- periodic pensions would continue to be taxed on receipt at a person’s marginal tax rate, which is the current tax treatment.

While generally supportive of taxing foreign superannuation on receipt, submitters suggested a number of changes. The proposed changes in the bill take into account submitters’ views.

In particular, an alternative method is being introduced to tax actual investment gains derived while the taxpayer is a New Zealand resident (the “formula method”). This will be available in respect of interests in foreign “defined contribution schemes” if the person has access to sufficient information.

The issues paper proposed that the new rules would apply to transfers from the 2011–12 tax year (generally from 1 April 2011). However, most submissions favoured a prospective application date. Accordingly, the new rules will generally apply from 1 April 2014. A concessionary measure allowing people to pay tax on 15 percent of their lump-sum transfer will be available, in addition to existing law, for transfers made before 1 April 2014.

In some cases, foreign superannuation is transferred to a locked-in New Zealand scheme. A person may be unable to access the transferred amount in order to pay the tax liability, which can result in cashflow difficulties. The issues paper invited comment on whether a mechanism for allowing tax to be paid directly from a New Zealand fund would be useful. As a practical solution, an amendment to the KiwiSaver rules will therefore permit withdrawals from KiwiSaver schemes to pay the tax liability.

Detailed analysis

New rules for interests in foreign superannuation schemes

The bill proposes new rules for all interests in foreign superannuation schemes from 1 April 2014. The new rules will apply to interests in a “foreign superannuation scheme” as defined in section YA 1 of the Income Tax Act 2007.

A new definition of “FIF superannuation interest” is included in section YA 1, which specifies the requirements by which a person may continue to use the FIF rules from 1 April 2014. The FIF rules will apply only to these interests. The qualifying criteria are discussed in more detail below.

Interests in foreign superannuation schemes which are not FIF superannuation interests will be excluded from the FIF rules through amendments to section EX 29 and a broad new FIF exemption in section EX 42B. Proposed new section EX 42B provides that interests in or rights to benefit from a foreign superannuation scheme will not be subject to the FIF rules for income years beginning on or after 1 April 2014.

Accordingly, sections CQ 5, DN 6, EX 29, EX 33 and EX 42 are being amended or repealed to remove references to the FIF rules that will no longer be required.

Proposed new section CD 36B clarifies that foreign superannuation withdrawals will not be taxed as dividends under the company tax rules. Similarly, amendments to sections HC 15 and HC 27 provide that foreign superannuation withdrawals are not subject to the trust tax rules.

Instead, all amounts from foreign superannuation schemes – whether in the form of lump sums or pensions − will be taxed on receipt.

Proposed new section CF 3 introduces new rules for taxing lump sums received from foreign superannuation schemes. Lump sums will be taxed either under the schedule approach or the formula approach.

As with other forms of income, it should be noted that the portion of the lump sum that is assessable income may impact a person’s entitlements and obligations for that tax year, such as child support, Working for Families, and student loans.

When will lump-sum withdrawals and transfers be taxed?

A lump sum withdrawal will be taxable under the proposed new rules if it is a “foreign superannuation withdrawal” and if it is received during the person’s “assessable period”. The rules for calculating when a person’s assessable period begins and ends are discussed below.

Proposed new section CF 3(1) defines a “foreign superannuation withdrawal” as an amount received from a foreign superannuation scheme that is not a pension. It includes:

- a cash withdrawal;

- a transfer from a foreign superannuation scheme into a New Zealand superannuation scheme;

- a transfer from a foreign superannuation scheme outside Australia into an Australian superannuation scheme; and

- a disposal of the superannuation interest to another person − for example, as part of a relationship property agreement or if the interest is sold to another person.

Example

James worked in the United Kingdom and has an interest in a UK scheme. He moves to New Zealand and transfers part of his interest into a KiwiSaver scheme under the UK’s QROPS legislation. The amount that is transferred will come within the definition of a foreign superannuation withdrawal and so James must calculate his tax liability on the transfer under the new rules.

When will lump sum withdrawals and transfers not be taxed?

Withdrawals and transfers from Australian superannuation schemes

Withdrawals from Australian schemes, and transfers from Australian schemes to New Zealand schemes, are generally not taxed under the Australia-New Zealand double tax agreement or under the forthcoming trans-Tasman superannuation portability agreement (which will take effect from 1 July 2013). This treatment will continue under the new rules.

Transfers between two foreign schemes (rollover relief)

A transfer between two foreign superannuation schemes typically gives rise to a taxable event under current law, being a disposal of rights in the first scheme and an acquisition of rights in the new scheme.

Proposed new section CF 3(1) provides that a transfer from one foreign superannuation scheme to another foreign superannuation scheme will not be taxable. This may occur, for example, when a person disposes of their interest to purchase an annuity with a different provider, or if a person transfers from one foreign scheme to another foreign superannuation scheme in order to obtain better returns. Instead, the person will be taxed on the eventual withdrawal or payment (or transfer to an Australian or New Zealand scheme) based on the length of their New Zealand residence from when they initially acquired the interest (in the first scheme).

As transfers from Australian schemes are typically exempt, as noted above, transfers from a foreign scheme to an Australian scheme will be taxable as if the transfer was made to a New Zealand scheme.

Example

Sarah, a New Zealand resident, has an Individual Retirement Account in the United States. She wants to purchase an annuity with a different scheme provider. Under normal circumstances this would be taxable as it is a disposal and reacquisition. However, under the proposed new rules Sarah will get rollover relief so does not need to pay tax on the amount she withdraws to purchase the annuity. Any pension received while resident will be taxable under the current law.

Transfers upon death

Rollover relief will also be provided when a deceased person’s interest in a foreign superannuation scheme is transferred directly to a New Zealand resident. The transfer will not be taxed. Instead, the recipient will be taxed on the eventual withdrawal or transfer (subject to the rollover relief discussed above), based on the duration of New Zealand residence of both the recipient and the deceased.

Example

Matthew moved to New Zealand in 2016 to be closer to his New Zealand-based daughter Jenny. Matthew died in 2023, seven years after migration. Matthew had an interest in a foreign superannuation fund which was acquired while non-resident. His foreign superannuation was transferred to Jenny under his will, and was not taxed at that time. Jenny withdraws the foreign superannuation in 2026, after her father’s death. She is treated as having acquired the foreign superannuation interest in 2016, which is when Matthew first became resident after acquiring the interest.

No tax if lump sum is withdrawn during first four years of residence

Under the current rules, people who are transitional residents are generally not subject to tax on foreign income during the first four years of residence. The FIF rules do not apply and any withdrawals are not taxable.

Under the proposed new rules, new sections CF 3(2)(b), CW 28B and CF 3(3) provide for a four-year grace period (exemption period) during which certain people who do not meet the criteria for the transitional residents’ exemption may also make a withdrawal or transfer with no New Zealand tax consequences. The exemption period will operate in a similar way to the transitional residents’ exemption, to ensure consistency of treatment between all new migrants. A person may only receive the exemption period once.

The exemption period will apply for the 48-month period starting at the end of the month in which they become resident (and are not non-resident under a double tax agreement). It will apply for persons who acquired an interest in a foreign superannuation scheme while non-resident under either section YD 1 or an applicable double tax agreement. The exemption period will not be available for interests that were acquired while the person was resident in New Zealand.

Proposed new section CF 3(2)(a) confirms the current position where there is no tax on foreign superannuation withdrawals for transitional residents. The transitional residents’ exemption in section CW 27 is also being retained in its current form.

Example

Amanda is deemed to have acquired a permanent place of abode in New Zealand on 16 June 2015. She is eligible for an exemption period which begins on the date she acquired her permanent place of abode. Her exemption period ends on 30 June 2019. Her assessable period begins on 1 July 2019.

Methods for taxing lump sums

Lump sums received will be taxable if they are received during the person’s assessable period. How to calculate the assessable period is described below.

A lump sum will be partially taxed under one of the two following methods:

- the “schedule method” (the default method) in proposed new section CF 3(6)(a); or

- the “formula method” in new section CF 3(6)(b).

Proposed new section CW 28C provides that the part of the lump sum that is not treated as a gain under the schedule method or formula method is exempt income.

A person who satisfies the criteria to use the formula may choose to apply either that method or the schedule method in relation to withdrawals from a particular interest in a foreign superannuation scheme.

The criteria for using the formula method are listed in section CF 3(6)(b). The foreign superannuation scheme must be a defined contribution scheme for which a person has sufficient information about the value of the scheme and contributions made. A person must not have used the schedule method for a past withdrawal in respect of that particular interest, and must not have made a withdrawal or transfer before 1 April 2014.

Calculating the assessable period

As noted above, a person who receives a foreign superannuation withdrawal during their assessable period will be taxed under either the schedule or formula method.

If the person acquired the interest while they were non-resident, the assessable period will start when their exemption period ends.

If the person acquired the interest while they were resident, they are not eligible for an exemption period. Their assessable period will start when they acquire the interest.

The assessable period ends when a person becomes non-resident.

The tax liability arising under the schedule method will depend to a large extent on how long the person has been a New Zealand tax resident. This is based on the number of income years beginning in the person’s assessable period. The interest factor in the formula method is also a function of years of residence. Sections CF 3(8)(c) and CF 3(15)(c) provide that a person’s years of residence is calculated as the greater of 1 and the number of income years which begin in the assessable period before a person makes a withdrawal.

Example

Ben’s exemption period ends on 30 September 2015. His assessable period begins on 1 October 2015. The first income year beginning in his assessable period starts on 1 April 2016. Ben leaves New Zealand and his last day as a New Zealand tax resident is 27 March 2030. His assessable period is from 1 October 2016 until 27 March 2030.

As noted above, section CF 3(1) provides that transfers between two foreign schemes will generally not be taxed. Instead, the amount will be taxed under the schedule or formula method either when it is finally withdrawn or when it is transferred to a New Zealand or Australian superannuation scheme. The schedule and formula methods are based on the duration of residence since the interest in the first scheme was acquired, so the assessable period will begin on the date the interest in the first scheme was acquired.

When an interest in a foreign superannuation scheme is transferred to another person, the transfer will be taxable to the transferor based on their years of residence, if the transferor is a New Zealand resident. The recipient’s assessable period will begin when they first acquire the interest from the transferor, if they are a New Zealand resident. This will apply in situations such as a relationship split, where a relationship property agreement may transfer all or part of an interest in a foreign superannuation scheme from one party to the other.

For someone who loses residency and then becomes resident again, it is possible to have more than one assessable period. In this situation, the applicable assessable periods will be aggregated.

The assessable period will be determined for each specific foreign superannuation interest, based on the number of years of residence since the interest in that particular interest was acquired.

It is possible that a person might have different assessable periods for different interests. For example, a person migrates to New Zealand with an interest in a foreign superannuation scheme and they acquire an interest in another scheme while they are New Zealand-resident. The assessable period for the first interest will begin when their four-year exemption period ends and for the second interest it will begin when the second interest is acquired.

This will ensure that the new rules will still work as intended if an individual has interests in multiple schemes and transfers amounts at different points in time.

Schedule method

Proposed new sections CF 3(6)(a), CF 3(7), (8) and (16) provide for the schedule method. The schedule method is the default method for taxing foreign superannuation withdrawals.

The schedule method deems a certain amount of the lump-sum receipt to be investment gains, based on the person’s years of residence. The approach uses fractions that represent the proportion of the lump-sum receipt to be included in assessable income. The schedule year fractions increase with years of residence. The remainder of the lump-sum receipt is not assessable.

The fractions in proposed schedule 33 are set at the rate necessary to put a person who leaves their foreign superannuation overseas in the same position as if they had instead transferred their superannuation to New Zealand and paid tax on investment gains as they accrued. Given the assumptions (including a 5% post-tax interest rate in the foreign scheme), a person should conceptually be indifferent between keeping their superannuation overseas and transferring it to New Zealand. Further discussion of the policy rationale behind the schedule method can be found in the annex to the issues paper.

A person’s assessable income will be calculated as follows:

Assessable income = (super withdrawal – contributions left) x schedule year fraction

The term “super withdrawal” is the amount of the transfer or withdrawal made by the person.

The appropriate “schedule year fraction” to use is identified by calculating the number of income years beginning in the assessable period, before the person receives the lump sum. In short, this is the number of income years which begin after the person is a New Zealand resident and after their four-year “exemption period” ends. The effect of counting a person’s years of residence from the end of the exemption period is to treat them as being non-resident during the exemption period. Gains which accrue during those four years will not be clawed back and taxed on receipt.

Example

Lucy's assessable period begins on 1 August 2020. She withdraws a lump sum of $50,000 on 27 January 2024. There are three income years beginning in Lucy’s assessable period, so Lucy is required to use the schedule year fraction for year three. The corresponding schedule fraction is 14.06%, so her assessable income will be $7,030 (being $50,000 x 14.06%). Assuming Lucy’s tax rate is 33%, she will be liable to pay $2,319.90 of tax on her $50,000 lump-sum withdrawal.If the number of income years beginning in their assessable period is zero (that is, in the part-year in which their exemption period ended but before the start of the next income year), the person should use the schedule year fraction associated with year one.

If the number of income years beginning in their assessable period is zero (that is, in the part-year in which their exemption period ended but before the start of the next income year), the person should use the schedule year fraction associated with year one.

Example

Karen’s assessable period begins on 1 October 2020. She withdraws a lump sum of $50,000 on 5 February 2021, which means that an income year has not yet started during her assessable period. Karen is required to use the schedule year fraction for year one because the withdrawal was made between 1 October 2020 and 31 March 2022. The corresponding schedule fraction is 4.76%, so her assessable income will be $2,380 (being $50,000 x 4.76%). Assuming Karen’s tax rate is 33%, she will be liable to pay $785.40 of tax on her $50,000 lump-sum withdrawal.Proposed new schedule 33 provides the full schedule of rates per year of residence as follows:

Proposed new schedule 33 provides the full schedule of rates per year of residence as follows:

| Schedule year | Schedule year fraction |

|---|---|

| 1 | 4.76% |

| 2 | 9.45% |

| 3 | 14.06% |

| 4 | 18.60% |

| 5 | 23.07% |

| 6 | 27.47% |

| 7 | 31.80% |

| 8 | 36.06% |

| 9 | 40.26% |

| 10 | 44.39% |

| 11 | 48.45% |

| 12 | 52.45% |

| 13 | 56.39% |

| 14 | 60.27% |

| 15 | 64.08% |

| 16 | 67.84% |

| 17 | 71.53% |

| 18 | 75.17% |

| 19 | 78.75% |

| 20 | 82.28% |

| 21 | 85.74% |

| 22 | 89.16% |

| 23 | 92.58% |

| 24 | 95.58% |

| 25 | 99.08% |

| 26+ | 100% |

The “contributions left” item in the formula is effectively a deduction for contributions made for or on behalf of a person while the person is a New Zealand resident, if the contributions satisfy certain conditions. The schedule method may otherwise treat some of the New Zealand contributions as gains and would result in over-taxation.

Proposed new section CF 3(16) sets out these conditions:

- at the time the contribution is made, the person must be a New Zealand resident under section YD 1 and not non-resident under a double tax agreement;

- the contribution must be required under the rules of the foreign superannuation scheme (that is, voluntary contributions will not be eligible);

- the contribution has been subject to New Zealand tax, such as being paid out of after-tax income or subject to employer superannuation contribution tax or fringe benefit tax (for an employer contribution); and

- the contribution must not have previously been deducted under the schedule method.

The contributions that are able to be deducted are restricted in this manner because the schedule rates already include an implicit allowance for contributions. For example, for the year one schedule rate, 4.76% of the withdrawal is treated as taxable New Zealand-sourced gains and the remainder is treated as non-taxable amounts (that is, contributions as well as gains derived while non-resident).

A number of submitters on the issues paper argued that there should be no restrictions on the types of contributions that are deductible. This would not be appropriate, as it could lead to contributions being effectively deducted more than once − first, by being deducted as “contributions left” in the formula and, secondly, by then being allocated out using the schedule rates.

Formula method

The formula method is an alternative to the schedule method for people with a foreign defined contribution scheme if they have sufficient information. This method will tax actual investment gains derived while a person is a New Zealand resident (after the end of their exemption period). It was introduced following submissions on the issues paper.

Proposed new sections CF 3(6)(b), CF 3(9), (10), (11), (12), (13), (14), (15) and (16), and section YA 1 “foreign defined contribution scheme” provide for the formula method.

To use this approach, a person is required to obtain the market value of the foreign superannuation interest at the time the exemption period ends, as well as information about contributions made and other necessary information. Requirements relating to the quality of information will apply.

The formula in section CF 3(9) is:

Distributed gain = (super withdrawal x calculated gains fraction) – gains out

“Super withdrawal” is the amount of the foreign superannuation withdrawal and “gains out” is the total amount of distributed gains previously calculated under this formula for previous withdrawals in the assessable period.

The “calculated gains fraction” is given by the formula in section CF 3(11):

Predistribution + withdrawals – transit – contributions

predistribution

“Predistribution” is the value of the person’s interest in the scheme immediately before they made their foreign superannuation withdrawal. “Withdrawals” is the total amount of previous foreign superannuation withdrawals made in the assessable period. “Transit” is the opening value of the person’s interest in the scheme at the beginning of their assessable period. “Contributions” is the total amount of recognised contributions under section CF 3(16), as described above.

Interest will be charged on the amount of taxable New Zealand gains to account for the deferral benefit that the person obtains by not paying tax on accrual (similar to the use-of-money interest rules). The interest will be payable at the same rate as the average growth of the person’s superannuation interest over the number of years of residence. The interest component is contained in section CF 3(13) to (15).

Taxpayers will not be able to switch from the schedule method to the formula method.

Example

Thomas migrates to New Zealand with a foreign superannuation scheme worth NZ$100,000. Ten years after Thomas’ assessable period begins, his scheme is worth $180,000 and he withdraws a lump-sum amount of $60,000. Five years after this, his scheme is worth $150,000 and he withdraws the full amount. Thomas has made no contributions to the scheme while he has been New Zealand-resident.

First withdrawal

The transit value is $100,000 and the predistribution value is $180,000. Since Thomas has made no contributions or taken any withdrawals, contributions and withdrawals are $0.

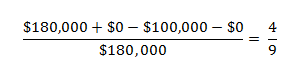

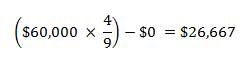

His “calculated gains fraction” under section CF 3(11) is:

Thomas’ “distributed gain” under section CF 3(9) is:

The formula in section CF 3(13) is applied to this amount to calculate what Thomas should include as income in his IR 3. This formula requires calculating the “grow rate” which is given by section CF 3(14).

Second withdrawal

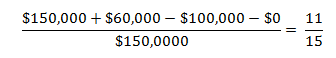

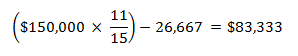

As before, the transit value is $100,000 but the predistribution value is now $150,000. Thomas’ “calculated gains fraction” is calculated as follows:

Thomas’ “distributed gain” under section CF 3(9) is:

Thomas is then required calculate his assessable income from this amount using the formula in section CF 3(13).

Transfers to KiwiSaver schemes

In some cases, foreign superannuation may be transferred into a locked-in superannuation scheme, such as KiwiSaver. This may lead to cashflow difficulties for the person as they cannot access any of the transferred amount to pay the resulting tax liability. To address this, new clause 14A will be inserted into schedule 1 of the KiwiSaver Act 2006. This will allow a person to withdraw an amount up to the value of the tax due from their KiwiSaver scheme.

If a taxpayer wishes to use this facility, they will be required to provide a statutory declaration to their KiwiSaver provider. The manager of the KiwiSaver scheme must be sufficiently satisfied that the requested amount does not exceed what a hypothetical tax liability could be for that person in relation to that interest. The money will be paid to the individual rather than directly to Inland Revenue, so the individual will be responsible for ensuring that their tax liability is paid.

Example

Hannah transfers her interest worth $100,000 in a UK scheme into a KiwiSaver scheme on 1 July 2014. She makes an application to the manager of her KiwiSaver scheme on 6 October 2015 to withdraw the amount of her tax liability arising from the transfer. She provides a signed statutory declaration and the documents required by the manager. The KiwiSaver manager approves the withdrawal and Hannah uses the funds to pay her tax liability.

Transitional measures: FIF rules can continue to apply for certain interests (grandparenting)

A new definition of a “FIF superannuation scheme” has been inserted in section YA 1 to enable the FIF rules to continue to apply to interests when the person has complied with the FIF rules by the introduction date of the new legislation.

These people will have the option to either continue to return income under the FIF rules (that is, they will be grandparented), or to apply the new rules instead.

If a person continues to apply the FIF rules, any withdrawals or transfers in relation to that foreign superannuation interest will not be taxed under the proposed new rules.

There are certain requirements that must be satisfied in order for a person to use the FIF rules in relation to a particular foreign superannuation interest. Some will be determined based on past behaviour. These criteria must be met each time a person seeks to apply the FIF rules (that is every income year from 1 April 2014):

- the person must have had an attributing interest in a FIF under section EX 29 for an income year up to and including the 2014 income year (the qualifying year);

- for the relevant income year, the FIF must have been a foreign superannuation scheme;

- the person must have calculated their FIF income or loss resulting from that attributing interest under one of the methods specified in section EX 44; and

- the FIF income or loss must have been included in a tax return filed with Inland Revenue by the date of introduction of this bill.

A person who does not meet these criteria by 1 April 2014 may not continue to use the FIF rules for the 2015 income year (commencing 1 April 2014) or subsequent years.

The effect of these criteria is straightforward. A person who complied with the FIF rules for a prior year, and filed that return before the introduction of this bill, may be grandparented under the FIF rules. If a person has two or more interests in foreign superannuation schemes, the criteria are assessed per interest (not just once for that person).

That person must then continue to return FIF income or losses in relation to that grandparented interest for all income years after 1 April 2014. If FIF income or loss is not returned in a year (in which the person still holds the interest), the interest will cease to be grandparented. The person must pay tax under either the schedule method or the formula method on any subsequent withdrawal.

A person whose foreign superannuation assets are valued at less than the $50,000 minimum threshold in section CQ 5(1)(d) may choose to apply the FIF rules in this manner, as long as the above criteria are satisfied.

Example

Aaron is a migrant to New Zealand and acquired a permanent place of abode in May 2006. He was a transitional resident until the end of May 2010. For the 2011 income year, Aaron complied with the FIF rules in relation to his foreign superannuation interest, and included the FIF income in his tax return before the filing date. He does not return FIF income in relation to this interest in the 2012 to 2014 income years because the interest qualified for a FIF exemption following a change in the foreign superannuation scheme’s rules which made it locked-in. As at 1 April 2014, the criteria are still satisfied as Aaron correctly returned FIF income in the 2011 income year. Despite the exemption, Aaron will have to return FIF income in relation to his interest for the 2015 income year in order for it to remain grandparented.

Transition – low cost option for withdrawals from 1 January 2000 to 31 March 2014

Proposed new sections CZ 21B of the Income Tax Act 2007, CF 3 of the Income Tax Act 2004, and CC 4 of the Income Tax Act 1994 allow an optional method in addition to the current provisions for lump-sum transfers and withdrawals up to 31 March 2014, including past transfers that have not complied with the current law.

The alternative to using the current provisions is the option to pay tax on only 15 percent of the lump-sum amount. The remainder of the lump sum will not be assessable. This is a simple option which is intended to encourage compliance before the introduction of the new rules.

People who have complied with the existing law and paid the associated tax will not be able to reassess their position using the 15 percent option.

To use the option, a person will need to return 15 percent of the lump-sum amount in their 2013−14 or 2014−15 tax returns. Penalties and interest will not apply from the tax year in which the withdrawal or transfer was made. The 15 percent option will continue to be available in later years, but the legislation proposes that penalties and use-of-money interest will be calculated from the 2014−15 tax year. The proposed legislation will be changed to clarify that this will be done by amending the person’s 2014−15 income tax return.

As with other forms of income, it should be noted that the portion of the lump sum that is assessable income may impact a person’s entitlements and obligations for that tax year, such as child support, Working for Families, and student loans.

If the person does not use the option to pay tax on 15 percent of the amount, then they must apply the law as it was at the time that they made the withdrawal. The original due date for payment of tax would still apply if there is a positive amount of income under reassessment. This means that any relevant penalties and use-of-money interest will apply from the income year in which the transfer or withdrawal occurred.

1 Taxation of foreign superannuation, released on 24 July 2012.

2 Qualifying recognised overseas pension scheme.

3 Taxation of foreign superannuation, released on 24 July 2012.