Financial arrangements

Electing to treat excepted financial arrangements as financial arrangements

Agency Disclosure Statement

This Regulatory Impact Statement has been prepared by Inland Revenue.

The problem addressed is how to prevent taxpayers from obtaining a deduction under the financial arrangement rules for an in-substance capital sum.

Limited consultation only has been undertaken due to the high sensitivity of the issue and the consequent significant risk to the tax base, which requires an immediate response. Officials have undertaken this limited consultation with a private sector tax advisory firm who support the approach outlined in the RIS.

Officials consider (and have been strongly advised through limited consultation) that the problem gives rise to a serious fiscal risk. This is because there are a number of opportunities for taxpayers within the services sector to structure to achieve a favourable tax outcome, e.g. it may be achieved through a third party transaction or an internal reorganisation. Contracts for the provision of services are particularly open to these opportunities. Given the size of the services sector of the economy, this has the potential to cause a significant fiscal cost in a short period of time. The size of this fiscal cost is difficult to quantify given that the problem is prospective and relates to tax returns that have not yet been filed. However, it is estimated that the revenue cost could be as much as $100 million per annum.

The proposed solution will mean that taxpayers will not be able to structure to take advantage of an opportunity to achieve a favourable tax outcome. However, there will be a savings provision for taxpayers who have filed a tax return or obtained a binding ruling (including a determination) before the date that the amendment is announced by Ministers.

There are no other significant constraints, caveats and uncertainties concerning the regulatory analysis undertaken, other than as set out above. The recommended approaches to the various issues raised do not impose additional costs on businesses, impair private property rights, restrict market competition, reduce the incentives on businesses to innovate and invest, or override fundamental common law principles, even though they are retrospective.

Dr Craig Latham

Group Manager, Policy

Inland Revenue

10 September 2012

STATUS QUO AND PROBLEM DEFINITION

1. The problem addressed by this RIS is how to prevent taxpayers from obtaining a deduction under the financial arrangement rules for an in-substance capital sum.

2. The problem has been brought to light as a result of an application for a private ruling regarding the tax treatment of certain service contracts under the financial arrangements rules. The tax treatment of such service contracts is outlined in Special Determination S21: “Spreading of acquisition cost of agreements for the sale and purchase of services”, which was issued to the taxpayer. This determination, which is now publicly available, also outlines details of the taxpayer’s arrangements and how a deduction could be obtained for the goodwill component of certain service contracts under the financial arrangements rules.

3. The scenario outlined in Special Determination S21 is one where two companies providing services under long-term profitable contracts decided to merge. The newly merged company elected to treat the contracts (ordinarily, excepted financial arrangements) as financial arrangements. The outcome available under the determination is that the company obtains a deduction for the purchase price of the contracts. This is contrary to policy intent because it allows a deduction (i.e. revenue account treatment) for an in-substance capital amount.

Background to the financial arrangements rules

4. The financial arrangements rules are intended to tax the return on a financial arrangement (the interest component) over the term of the arrangement. The capital/revenue boundary is generally disregarded to ensure that all returns on financial arrangements are taxable. For example, suppose a debt instrument is issued at a discount under a financial arrangement. The discount is simply a component of the transaction that is inside the tax base (prior to the financial arrangements rules the discount may have been regarded as capital).

5. Certain arrangements are carved out of the financial arrangements rules by treating them as “excepted financial arrangements”. In broad terms, these are either carved out on the basis that they are more characteristic of equity rather than debt (e.g. shares), or they are carved out to minimise compliance costs. However, taxpayers have an unfettered ability to elect to treat some of these excepted financial arrangements as financial arrangements. These are:

- certain agreements for the sale and purchase of property or services;

- short-term agreements for sale and purchase;

- short-term options;

- travellers’ cheques; and

- certain variable principal debt instruments.

6. The ability to elect to treat certain excepted financial arrangements as financial arrangements was introduced to reduce compliance costs. Electing to treat these arrangements as financial arrangements meant that taxpayers did not have to separate these out from other arrangements that were subject to the financial arrangements rules, in their accounting systems.

Effect of retention of the status quo

7. If the status quo is retained, taxpayers will continue to be able to deduct the goodwill component of a contract, an outcome which was not contemplated at the time the election rule was introduced. Not only is the result incorrect from a policy perspective but it also creates a fiscal risk.

8. This fiscal risk arises because, while taxpayers are unlikely to deliberately complete a transaction to obtain this favourable tax outcome for its own sake, there are a number of opportunities to obtain it as a by-product of other transactions (such as, a third party transaction or even an internal reorganisation). Further, it seems that it might be possible to undertake a transaction and subsequently, but before the tax return is filed, achieve the favourable tax outcome.

9. Contracts for the provision of services are particularly open to these opportunities. Given the size of the services sector of the economy, this has the potential to cause a significant fiscal cost in a short period of time. The size of this fiscal cost is difficult to quantify given that the problem is prospective and relates to tax returns that have not yet been filed. However, it is estimated that the revenue cost could be as much as $100 million per annum (based on advice from limited consultation).

Root cause of problem

10. The root cause of the problem is that the current rules allow taxpayers to elect to treat short-term agreements and certain agreements for the sale and purchase of property or services as financial arrangements, thereby permitting the cost price of those agreements to be spread over the life of the agreement as a deductible sum. A key issue is the degree to which more transactions may occur or have occurred following the public release of Special Determination S21 in May this year.

OBJECTIVES

11. The objectives are to:

a) prevent a potentially significant risk to the tax base; and

b) ensure that the legislation aligns more closely with the policy underlying the financial arrangements rules, namely to tax the return on a financial arrangement (the interest component) over the term of the arrangement and prevent deductions for in substance capital sums.

REGULATORY IMPACT ANALYSIS

12. There are two options that may deal with the problem and achieve the objectives:

a) a limited change to prevent a financial arrangements election for short-term agreements and agreements for the sale and purchase of property or services only (preferred option); or

b) remove the ability to elect for the full range of excepted financial arrangements that can currently be elected to be treated as financial arrangements.

13. We have discounted other options such as introducing a rule preventing a taxpayer from electing to treat an excepted financial arrangement as a financial arrangement within a certain time period before the sale or after the purchase of the arrangement. This is because options like this would address the issue by introducing an arbitrary distinction. As a result, they may be easy for taxpayers to circumvent, e.g. taxpayers could elect financial arrangement treatment just outside the specified time limits.

Option one (preferred option): Prevent financial arrangements election for short-term agreements and agreements for the sale and purchase of property or services

14. Option one involves preventing the financial arrangements election of two categories of excepted financial arrangements (short-term agreements and agreements for the sale and purchase of property or services). Officials consider that this option will achieve the objective of preventing the use of the election rule under the financial arrangements rules to obtain a tax deduction for an amount that is in substance a capital sum. It will also align with the original policy intent of minimising compliance costs to taxpayers by allowing amounts owing under the agreements to be spread under the financial arrangements rules. This option also removes the fiscal risk.

15. There are limited fiscal implications arising from this option. The option will prevent a decrease in the future baselines for those taxpayers who have not filed a tax return or received a binding ruling (including a determination) on the issue. However, the grandparenting of certain transactions (discussed below under “Implementation”) means that there will be a reduction in the baselines of $1.4 million in the near future.

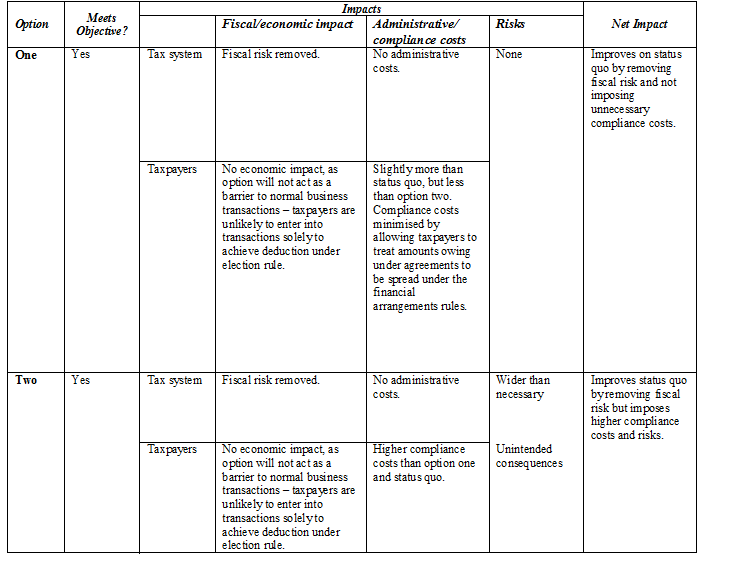

16. The impacts of this option are summarised in the table below.

Option two: Remove ability to elect for full range of excepted financial arrangements

17. Option two involves preventing the election of any of the five excepted financial arrangements that can currently be elected to be treated as financial arrangements. This option also achieves the objective of preventing the use of the election rule under the financial arrangements rules to obtain a tax deduction for an amount that is in substance a capital sum.

18. However, this option is wider than necessary to deal with the problem and may consequently have a broader impact. This is because it would remove the ability to elect for all of the excepted financial arrangements that can currently be treated as financial arrangements, whereas the issue that is the subject of this RIS relates to only two of these excepted financial arrangements. Consequently, this option would have greater compliance costs than option one and may have other unintended impacts.

19. This option also removes the risk to the tax base.

20. The impacts of this option are summarised in the table below.

Summary of impacts of options one and two

Social, environment or cultural impacts of both options

21. There are no social, environment or cultural impacts to the options. The groups affected by the amendments proposed are taxpayers that have excepted financial arrangements and may be contemplating such an election. Taxpayers who have already filed or obtained a ruling are not affected.

Net impact of both options

22. The net impact of both options is to remove a significant fiscal risk to the tax base, without causing a negative economic impact for taxpayers.

CONSULTATION

23. No public consultation has been undertaken due to the high sensitivity of the issue and the consequent significant degree of fiscal risk, which requires an immediate response. The Generic Tax Policy Process is designed to allow for limited consultation in specific cases involving base maintenance issues where there is a high degree of fiscal risk.

24. Limited consultation only has been undertaken with a private sector tax advisory firm. The feedback that it provided is that the issue is significant, as there is the potential for structuring to occur on a wide scale in the services sector of the economy. The consultation provides that there is a significant fiscal risk and supports the preferred option. Consultation also supported a retrospective application date with a savings provision for taxpayers who have filed or obtained a binding ruling on the basis of current law.

25. The Treasury was also consulted and agrees with the preferred option.

CONCLUSIONS AND RECOMMENDATIONS

26. Option one is the preferred option because it prevents a significant fiscal risk and achieves the objective of preventing the use of the election rule under the financial arrangements rules to obtain a tax deduction for an amount that is in substance a capital sum, contrary to the policy intent. Any disadvantage caused by the change in treatment of the contracts in relation to existing taxpayers is managed by having a savings provision for these taxpayers.

27. Option two is not favoured because, while it also achieves the objective, it is likely to be broader than necessary.

IMPLEMENTATION

28. Legislation would be implemented through the next available tax bill. The legislation would apply for the 2008-09 and later income years. This is to reduce the fiscal risk created by the existing rules and is consistent with the date that the current income tax legislation came into force (1 April 2008).

29. It is proposed that there would be a savings provision for taxpayers who have filed a tax return on the basis of electing to treat an excepted financial arrangement as a financial arrangement before the date of the announcement. The savings provision would also cover taxpayers who have obtained a binding ruling (including a determination) on the tax treatment of a financial arrangement under the election rule prior to the amendment being announced by Ministers. This treatment would apply until the relevant financial arrangement is disposed of or matures.

30. Consideration was also given to whether the change could instead commence from the start of the 2011–12 income year. However, this option was rejected as it increased the risk where tax returns were overdue, and could potentially allow taxpayers to revisit older transactions (although this is unlikely to be successful). Given the size of the potential fiscal risk, this option was not favoured.

31. The new rules would be administered by Inland Revenue through existing channels and there should be no other significant administrative issues.

32. Compliance costs for taxpayers would be minimised through grandparenting for taxpayers who have already filed or obtained a ruling (including a determination) under the existing election rule. Compliance costs would also be minimised by allowing taxpayers to treat debts outstanding under short-term agreements and agreements for the sale and purchase of property or services as amounts that can be taken into account under the financial arrangements rules.

MONITORING, EVALUATION AND REVIEW

33. There are no specific plans to monitor, evaluate and review the changes under the Income Tax Act 2007 following the changes, given that this is an isolated base maintenance issue.

34. If any detailed concerns are raised, officials will determine whether there are substantive grounds for review under the Generic Tax Policy Process (GTPP).

35. In general, Inland Revenue monitoring, evaluation and review of new legislation takes place under the GTPP. The GTPP is a multi-stage tax policy process that has been used to design tax policy in New Zealand since 1995. The final stage in the GTPP is the implementation and review stage, which involves post-implementation review of the legislation, and the identification of any remedial issues. Opportunities for external consultation are also built into this stage. In practice, changes identified as necessary for the new legislation to have its intended effect would generally be added to the tax policy work programme, and proposals would go through the GTPP.