Chapter 5 - Economic framework for the suggested new rules

5.1 As discussed in chapter two, the Government’s objective is to, where possible, have a tax system that raises revenue in a fair and efficient manner. This is achieved by adopting a broad-base, low-rate tax policy framework that minimises economic distortions.

5.2 The suggested new rules governing the specified mineral mining are intended to reflect these objectives. This chapter outlines the economic policy behind the suggested new rules.

Economic background

5.3 For taxes to be neutral and therefore not distort investment decisions, expenditure incurred in acquiring future economic benefits should be amortised over the expected period of the future benefits. This principle applies equally to situations when expenditure is intended to produce future economic benefits but fails to do so.

5.4 A simple example demonstrates this principle in Table 1. Assume that there is an asset that is expected to produce a stream of income over five years and then expire. In years one to five it is estimated that the asset will produce the following series of cashflows: $300, $280, $260, $240 and $220.

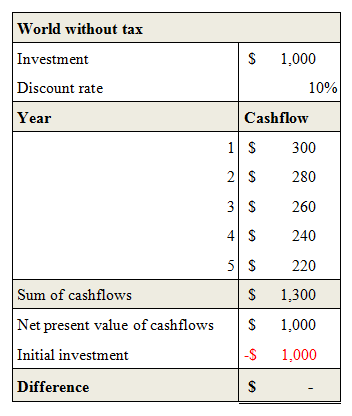

Table 1:

Marginal project, world without tax and no uncertainty

5.5 In a world without taxes and assuming a risk-free discount rate of 10 percent (10 percent is used to keep things simple), an investor would be indifferent between buying, for $1,000, the series of cashflows or placing $1,000 in the bank. The project can therefore be described as marginal.

5.6 For taxes to neither encourage nor discourage this investment, the $1,000 should be deductible over this five-year period. Moreover, the amount of the tax deduction in each year should mirror the asset’s expected decline in value. When the tax rules do this, an investor is still indifferent between buying for $1,000 the series of after-tax cashflows or placing $1,000 in the bank.

5.7 Table two demonstrates that when the tax rules allow a deduction for an asset’s actual decline in value, the project remains marginal despite the introduction of taxes. While the example is for a riskless investment, this analysis applies equally to risky investments.

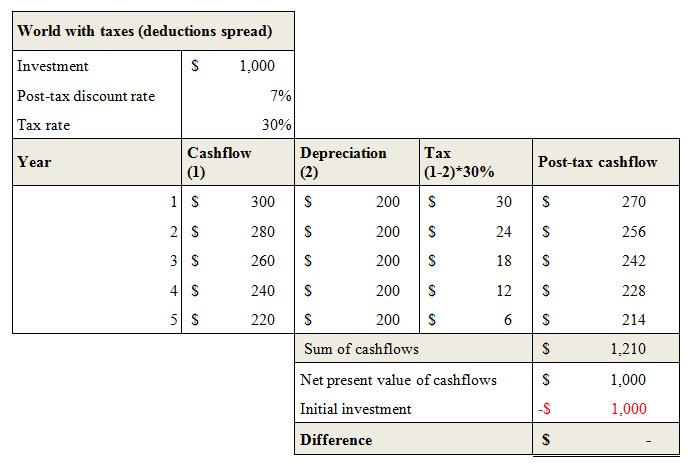

Table 2:

Marginal project, world with tax (deductions spread) and no uncertainty

5.8 In a world with a 30 percent tax rate, the post-tax discount rate is seven percent (.10 x (1 – .3), and the total amount of tax paid is $90. Allowing a tax deduction for the asset’s actual decline in value, in this case $200 per year, means that this project remains the marginal project in a world with taxes.

5.9 This can be contrasted with a scenario where an immediate deduction is allowed when the investment is made. This is illustrated in table three.

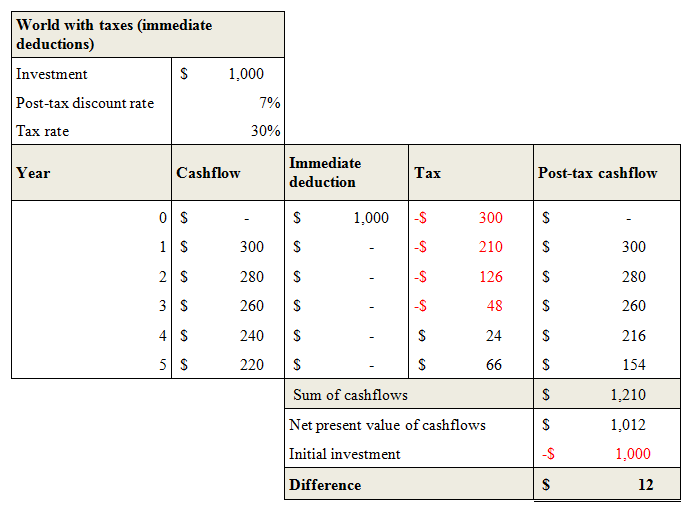

Table 3:

Marginal project, world with tax (immediate deduction) and no uncertainty

5.10 Although the investor pays the same amount of tax ($90) an immediate tax deduction means that the investor’s tax liability is deferred (until year four), as the first three years the investor has a tax loss. As a result, the post-tax cashflows are greater in the first few years, which in turn results in the cash flows having a higher net present value ($1,012). In this scenario, taxes are no longer neutral and the investor is incentivised to take up the series of cash flows instead of placing the $1,000 in the bank.

Fair return

5.11 As well as making the tax rules applying to specified mineral mining neutral, the Government is also concerned to ensure that New Zealand obtains an adequate return from the exploitation of its mineral reserves.

5.12 The current specified mining tax rules enable mining companies to defer the payment of income tax. This has a direct cost to the Crown. Assuming that the Government’s cost of capital is five percent, allowing mining companies to defer a $100 million tax liability for three years would cost the Crown approximately $15 million over the three years.