Chapter 3 - Proposed approach for taxing foreign superannuation

3.1 This chapter outlines a proposal for reforming the tax treatment of foreign superannuation.

Guiding principles

3.2 Like most countries, New Zealand generally taxes all New Zealand residents on their worldwide income.[3]

3.3 This approach helps to ensure that decisions to invest in New Zealand or overseas are not driven by tax considerations. (If income from offshore investments was not taxed in New Zealand, it would create a bias in favour of foreign investment.) Under this approach, people who have migrated to New Zealand should have no preference between bringing their assets to New Zealand or leaving them offshore.

3.4 It is important that the rules are as easy to understand as possible. For many people, their foreign superannuation is their most significant financial asset. It is also likely to be their main or only foreign asset. It is important that the rules that they are required to comply with are not overly complex.

Key changes to the taxation of foreign superannuation

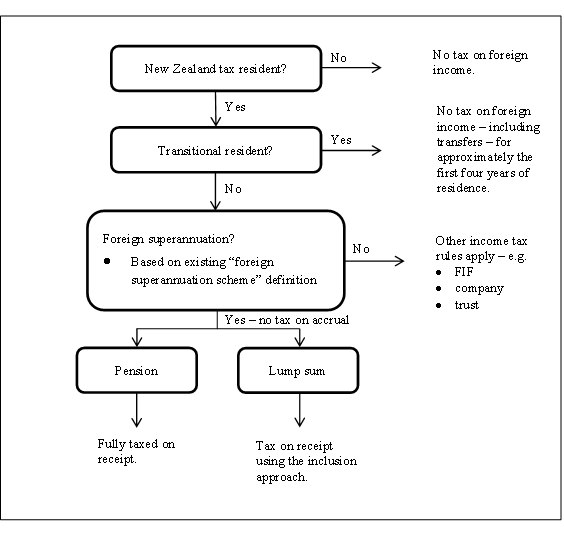

3.5 In light of these principles, the key changes to the taxation of foreign superannuation are proposed below.

One set of rules for all New Zealand-residents with foreign superannuation

3.6 As a starting point, people with interests in a foreign superannuation scheme would be taxed under one set of rules. This would avoid the complexity and uncertainty associated with determining whether the FIF rules apply or not. It would also help to ensure that there is equivalent tax treatment for all people with foreign superannuation.

3.7 The interests in foreign superannuation schemes to which these proposals apply would be based on the current definition of “foreign superannuation scheme” in the Income Tax Act 2007. This would include most defined contribution schemes and defined benefit schemes set up to provide retirement benefits.

3.8 The definition of a “foreign superannuation scheme” is a superannuation scheme constituted outside New Zealand. In this context, a “superannuation scheme” includes:

- A trust or unit trust established by its trust deed mainly for the purposes of providing retirement benefits to beneficiaries who are natural persons or paying benefits to superannuation schemes.

- A company that is not a unit trust and is established mainly for the purpose of providing retirement benefits to members or relatives of members who are natural persons.

- An arrangement constituted under the legislation of a country, territory, state, or local authority outside New Zealand mainly for the purpose of providing retirement benefits to natural persons.

Taxing foreign superannuation only on receipt

3.9 It is proposed that the FIF rules would no longer apply to any interests in foreign superannuation schemes. Instead, all income (pensions and lump sum payments) would be taxable only on distribution or receipt.

3.10 As previously noted, the FIF rules can be complex to apply. Retaining the FIF rules would mean the existing problems with the FIF rules would remain, particularly when there is:

- a restriction on rights being sold or assigned to another individual or otherwise “locked-in”, which presents cashflow difficulties as the funds cannot be accessed to pay the tax liability;

- difficulty in establishing a market value or cost of the superannuation interest, especially for defined benefit schemes; and/or

- a mismatch in the timing of taxation between New Zealand and the foreign country, which means that foreign tax is not able to be credited against the corresponding New Zealand tax liability.

3.11 Taxation on receipt would avoid these concerns, and may be generally more appropriate as foreign superannuation is often unable to be accessed until retirement age.

3.12 All amounts from these foreign superannuation interests would be taxable on receipt under the proposed new rules discussed below.

Taxation of pension payments on receipt

3.13 Under the proposed approach, foreign-sourced pensions would be taxed when they are received at an individual’s marginal tax rate. This is the way that foreign-sourced pensions from locked-in schemes are taxed currently. New Zealand-residents holding interests in foreign superannuation schemes would be taxed in a similar manner to residents who receive New Zealand Superannuation or foreign social security pensions. Taxation on receipt is simple for people to comply with.

3.14 Pensions would be taxed in this way regardless of whether the pension is paid directly by a past employer, or through an intermediary such as a trust, company or unit trust.[4]

3.15 The proposal would apply to amounts that would be treated as “pensions” under common law.

Taxation of lump sums on receipt based on an inclusion rate

3.16 It is proposed to tax lump sums in a way that broadly approximates the taxation on investment gains that would ordinarily arise had the original lump sum been invested in New Zealand during the period in which the individual was a New Zealand tax-resident. This approach would apply to lump sum withdrawals or transfers to other superannuation schemes.

3.17 Tax on lump sums would be calculated according to an “inclusion rate”. A portion of the lump sum would be included in an individual’s taxable income, according to the rates in paragraph 3.25. The excluded amount would not be taxable. The portion of the lump sum that is taxable would depend on the length of time that elapses between the individual’s migration to New Zealand and the date at which they withdraw or transfer their savings.

3.18 This approach overcomes the concerns and complexity relating to the taxation of lump sums under the “general” rules mentioned in the previous chapter. It also helps to ensures that tax does not create an incentive to leave superannuation in a foreign scheme as long as possible, rather than bringing it to New Zealand to invest or spend. On the contrary, a two-year grace period is proposed to give new migrants an incentive to transfer their funds as soon as possible post-migration.

Applying the inclusion rate to lump sums

3.19 The inclusion rate approach would tax the individual’s lump sum to largely the same extent that they would have paid tax on accrual in New Zealand (taking into account the benefit of deferral). After paying tax on the lump sum, the individual should be in approximately the same position as if they had instead transferred the amount on migration and derived taxable interest income in New Zealand.

3.20 This approach aims to ensure that an individual has no preference between bringing their foreign superannuation to New Zealand on the first day that they migrate to New Zealand and paying tax in the interim, or transferring at a later date. The inclusion approach would therefore focus on taxing an amount that takes into account taxable investment gains while the individual is New Zealand-resident and the time value of money (benefit of deferral). Background information about the methodology used to calculate the inclusion rate is included in the annex to this issues paper.

3.21 It should be noted that applying the inclusion rate to lump sum transfers would give a broadly similar tax result to accumulated FIF taxation under the FDR or cost methods.

3.22 The inclusion rate does not explicitly include a deduction for capital. This is because the basic framework for the proposal is to tax an amount that represents the accumulated New Zealand tax that would otherwise have been paid had it been invested in New Zealand.

3.23 These rules would apply regardless of the nature of the underlying legal structure of the superannuation scheme. The trust rules, company rules, and other general provisions in the Income Tax Act 2007 would no longer apply to distributions from foreign superannuation schemes.

3.24 To reduce complexity, officials consider that there is a strong case for providing for “brackets” of inclusion rates (rather than requiring people to apply a formula), and for capping the rates at 100%.

3.25 Under this approach, at the time an individual makes a lump sum withdrawal or transfer from a foreign superannuation scheme, they would apply the relevant inclusion rate based on the date they became a New Zealand-resident as follows:

| Years since migration | Inclusion rate |

|---|---|

| 0-2 | 0% |

| 3-4 | 15% |

| 5-8 | 30% |

| 9-12 | 45% |

| 13-16 | 60% |

| 17-20 | 75% |

| 21-24 | 90% |

| 25+ | 100% |

3.26 The inclusion rate during the first two years after migration should theoretically be 5%, and during years three and four it should be 15%. However, we propose a short grace period of two years so that migrants who are not transitional residents have a period of time in which they can bring their foreign superannuation to New Zealand with no New Zealand tax consequences.

3.27 When an individual makes a withdrawal or transfer partially in the form of a pension and partially in the form of a lump sum, the respective treatment would apply to each portion. That is, the portion taken as a pension would be taxed under the rules for pensions, and the portion taken as a lump sum would be taxed under the inclusion approach.

3.28 When a withdrawal or transfer is from a superannuation scheme in a foreign country that has a double tax agreement with New Zealand, that foreign country is not usually permitted to tax the lump sum. (There are some exceptions to this, such as the 2012 double tax agreement between New Zealand and Canada.) However, when the foreign country can tax the lump sum, New Zealand provides a tax credit for any foreign tax paid on the lump sum when it was distributed. When a New Zealand tax credit is provided, it is limited to the amount of New Zealand tax which is apportioned to the overseas income stream. This policy would remain unchanged under the proposed rules. This means that a tax credit would continue to be available, but only in proportion to the amount of New Zealand tax payable on the lump sum and subject to other relevant limitations.

Transitional resident rules and Australian superannuation schemes

Transitional resident rules

3.29 The transitional resident rules will be retained. These rules provide that new migrants and certain returning residents are temporarily exempt from New Zealand tax on most foreign income, including foreign superannuation.

3.30 Officials consider that retaining the transitional resident rules would be consistent with the proposed approach outlined above. Transitional residents will continue to be exempt from tax on their foreign pension or lump sum distributions from a foreign superannuation scheme, within approximately the first four years since becoming tax resident.

3.31 People who are not transitional residents would face an inclusion rate of 0% on lump sums withdrawn or transferred within the first two years of becoming a New Zealand tax-resident, and 15% (giving an effective tax rate of around 5%) on lump sums withdrawn or transferred in years three and four.

3.32 After the end of the fourth year and the transitional residents’ exemption, everyone would face the same inclusion rate (30% in years five to eight, which is an effective tax rate of up to 10%) regardless of whether they were previously a transitional resident.

Withdrawals and transfers from Australian superannuation schemes

3.33 Double tax agreements generally override domestic tax rules. Under the New Zealand-Australia 2010 double tax agreement, lump sums arising in Australia and paid to a New Zealand-resident under a retirement benefit scheme or in consequence of retirement are not taxable in New Zealand.

3.34 In June 2009, New Zealand and Australia signed a bilateral agreement to enable the trans-Tasman portability of retirement savings. Under this arrangement, people with savings in a qualifying Australian superannuation scheme will be able to transfer their savings to a New Zealand superannuation scheme. The new rules also provide that such transfers will be tax-free. In New Zealand, the rules were legislated for in the Taxation (Annual Rates, Trans-Tasman Savings Portability, KiwiSaver, and Remedial Matters) Act 2010. These rules will come into effect up to two months after New Zealand and Australia have exchanged notes informing each other that the necessary legislation has been enacted in both countries.

3.35 The rules described in paragraphs 3.33 and 3.34 would not be affected by the proposals in this issues paper.

Contributions made while New Zealand tax-resident

3.36 The proposed rules for taxing foreign superannuation are intended to apply when a New Zealand-resident had contributed to a foreign superannuation scheme prior to becoming a New Zealand-resident. In general, the rules are not intended to apply when the contributions are primarily made while the individual is New Zealand-resident. However, some people may continue contributing to an overseas scheme while in New Zealand because, for example, they are required to under the scheme’s rules.

3.37 The inclusion approach works backwards to presume, on the basis of the assumed interest rate, a particular value of the superannuation interest at the time of migration. Any difference between the transferred amount and the deemed original value are treated as gains. The inclusion approach assumes that contributions made while an individual is a New Zealand-resident are investment gains and effectively taxes them as such. As a result, the amount of the lump sum on which the inclusion rate is applied is too high. An individual’s lump sum withdrawal or transfer could be over-taxed.

3.38 In an extreme example, consider an individual who contributes $1,000 to a foreign superannuation scheme while non-resident, and $100,000 while New Zealand-resident. At the time of transfer some years later, he withdraws $150,000 (being $101,000 plus gains). The inclusion rate would apply to the $150,000. The inclusion approach assumes that the increase in value of $149,000 since becoming resident constitutes investment gains and taxes them accordingly. There is no allowance for the $100,000 of New Zealand contributions.

3.39 It is proposed to apply the inclusion rate to the amount of the lump sum after deducting the value of contributions made while New Zealand-resident, as long as those contributions have been subject to New Zealand tax. This would reduce the amount of the lump sum withdrawal on which the inclusion rate is applied by the value of the contributions, thereby reducing the individual’s taxable income.

3.40 A deduction would be allowed only to the extent that contributions are required to be made under the scheme’s rules. When an individual contributes amounts in excess of those required, those amounts would not be deductible from the lump sum withdrawal or transfer.

3.41 If no allowance is given for contributions made while New Zealand-resident, then the individual in the example in paragraph 3.38 would apply the inclusion rate to the full $150,000. If they withdraw the lump sum in year 10, then from paragraph 3.25 a 45% inclusion rate would apply to the lump sum. If the individual has a marginal tax rate of 33%, their tax liability would be $22,275 (being $150,000 x 45% inclusion rate x 33% tax rate).

3.42 Under the proposed approach, the individual would apply the inclusion rate to $50,000 (being $150,000 less the $100,000 of New Zealand contributions), rather than the full $150,000. Their tax liability would be $7,425 (being $50,000 x 45% inclusion rate x 33% tax rate) instead of $22,275.

Transfers to locked-in New Zealand superannuation schemes

3.43 Some people may wish, or are required, to transfer their foreign superannuation to a New Zealand scheme which has “lock-in” rules (as defined previously).

3.44 The inclusion approach would also apply at the point when retirement savings are transferred to a locked-in superannuation scheme. This means that an individual would have some tax to pay if they do not transfer within the concessionary two-year period or during the exempt period for transitional residents. Applying the inclusion rate to the amount when it is transferred to the superannuation scheme is consistent with the proposed policy outlined above.[5] However, an individual may face cashflow problems if they are unable to access their funds due to the lock-in restrictions.

3.45 Officials invite comment on whether there should be a mechanism that allows tax to be paid out of the transferred amount held in the New Zealand superannuation scheme and, if so, how this should operate.

Proposed rules for taxing foreign superannuation

Examples of the proposed approach for taxing lump sums

Example 1

Deirdre works in the United Kingdom for 20 years for the same employer. She starts on a salary of £40,000 which increases by 3% per year over that period. At the end of each year she contributes 9% of her gross salary to her defined contribution superannuation scheme, which accrues interest at an average interest rate of 4%. At the end of 20 years, her superannuation is worth £138,604.

She quits her job at the end of the 20th year and migrates to New Zealand. After the exchange rate conversion, the investment is worth $284,845. Of this amount, $198,732 constitutes contributions and the remainder ($86,113) is investment gains.

Deirdre decides not to become a transitional resident for the first four years in which she is a resident New Zealand-resident, as she elects to receive Working for Families tax credits.

After four years, Deirdre decides that it would be a good time to withdraw her superannuation savings. At an average interest rate of 4% in the foreign scheme over the four years, the amount has grown to $333,228. This is the value of the lump sum withdrawal to New Zealand.

Although Deirdre has made the withdrawal within four years of arriving in New Zealand she is not eligible for the transitional residents’ exemption. The relevant inclusion rate is 15%. For New Zealand tax purposes, $49,984 of the lump sum constitutes taxable income (being 15% of $333,228). Deirdre is currently studying and has no other taxable income. Under the current personal tax rate structure, the tax on her foreign superannuation withdrawal is $8,015. This represents an average tax rate of 2.4% on the $333,228 lump sum.

Example 2

Ken from the USA migrates to New Zealand at age 50 and begins work for a new employer. At the time, he has a 401k account worth US$250,000. At age 60 (10 years later) when he contemplates retirement, he decides to make a lump sum withdrawal rather than receive an annuity. The 401k is valued at $407,224 (at an average interest rate of 5% over 10 years). Ken has not been required to pay any tax on earnings on his superannuation interest during the 10 years that he has been resident in New Zealand.

After the exchange rate conversion, his superannuation is worth NZ$519,525.

The relevant inclusion rate for 10 years is 45%. This means that $233,786 (being 45% of $519,525) would be taxable income in the year of withdrawal. In the year that Ken withdraws his superannuation, he earns more than $70,000 from his employment income, which means that additional income he earns is taxed at the 33% marginal tax rate. His assessable income from his foreign superannuation is therefore taxed at 33%, resulting in a tax liability of $77,149 (being $519,525 x 45% inclusion rate x 33% tax rate). This represents an average tax rate of 14.8% on the $519,525 lump sum.

3It should be noted that New Zealand modifies this approach in certain cases for new migrants – for example, under the transitional resident rules. In those cases, the new migrants are generally not taxed on the transfer of assets they have built up in the country from which they emigrated.

4Currently, there may be some uncertainty about whether pensions paid by an intermediary such as a trust, company or unit trust would be subject to tax as a pension, or as a distribution under the trust rules or dividend under the company rules (as the case may be).

5Investment gains on amounts that have been transferred to a New Zealand superannuation scheme are taxed at the level of the scheme under the portfolio investment entity (PIE) tax rules. Once the entire amount (the transferred amount plus any subsequent investment earnings) is distributed from the scheme, it is exempt.