Annex - Background on methodology used for inclusion rate

Below is background information about the basis on which the inclusion rate approach was calculated.

Policy rationale

An individual with an interest in a foreign superannuation scheme may be able to withdraw an amount from that scheme as a lump sum.

If an individual transfers their superannuation to New Zealand at the time that they first become a New Zealand tax-resident, the amount transferred would be in the New Zealand tax base. In general, this amount can be expected to generate a taxable return (such as interest). If an individual does not transfer their savings immediately on migration but instead transfers their savings at a later date, New Zealand foregoes tax on the interest income that the savings would otherwise have accrued.

Under the inclusion approach, the lump sum would be taxed to an extent that would roughly equal the amount of tax otherwise payable on New Zealand interest income, after taking into account the benefits of deferral of not having paid that tax on accrual. After paying tax on the lump sum, the individual would be in approximately the same position they would have been in if they instead transferred the amount on migration and derived interest income.

The portion of the lump sum to be taxed would primarily depend on the length of time that elapses between the individual’s migration to New Zealand and the date on which they transfer their savings. This is relevant because the longer the delay between migration and transfer, the more tax is foregone on interest income that would otherwise have accrued.

Formulae

As explained, the desired policy is to tax the lump sum withdrawal or transfer so that the post-tax amount of the lump sum is equal to the amount that an individual would have had if they instead derived interest income in New Zealand and paid tax on accrual.

The variables in the following formulae are:

- “x” = value of the superannuation interest at the date of migration

- “i” = interest rate, which is set at 5%

- “t” = tax rate, which is set at 33%

- “n” = number of years between migration and the withdrawal or transfer

- “b” = necessary inclusion rate to achieve policy intent

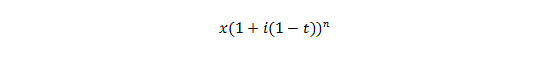

The value of the amount that would otherwise have been taxed on accrual in New Zealand can be written as:

This is the value of the superannuation on the date of migration after accumulating gains for n years at a post-tax interest rate.

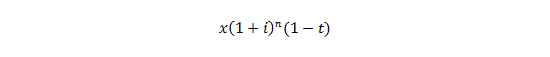

The value of the amount transferred in a lump sum to New Zealand and taxed on receipt is:

In other words, this amount represents the value of the savings at the time of migration, after being left in the foreign scheme to earn i interest for n years. It is then taxed on withdrawal at the end of the nth year.

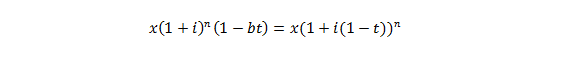

The policy intent is for the value of the first amount to equal the second amount, in order to put the individual in the same position. This gives the following formula:

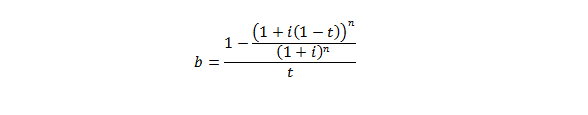

This can be rewritten to find the inclusion rate, as follows:

The inclusion rates depend on three factors:

- the interest rate (to which the inclusion rate is sensitive);

- the average tax rate (to which the inclusion rate is insensitive); and

- the number of years before the withdrawal or transfer that the individual was a New Zealand-resident (to which the inclusion rate is sensitive).

The inclusion rates do not depend on the amount of income transferred, or on the value of the foreign superannuation interest at the time of migration (the cost base). The cost base is simply assumed on the basis of the applicable interest rate.