Annex - The disputes resolution process

The disputes process was introduced in 1996 in response to the recommendations of the Richardson Committee. [55]

The objection procedures at that time were perceived to be deficient, in that they did not adequately support the early identification and prompt resolution of issues leading to tax disputes. The Richardson Review recommended that a comprehensive approach to tax disputes be developed with the following objectives:

- every practical effort be made to ensure that assessments are correct before they are issued;

- any dispute be identified at the earliest practical time;

- communication between the taxpayer and Inland Revenue be direct and open to ensure that all information relevant to the dispute is available as soon as possible; and

- appropriate independent advice within Inland Revenue be provided at the earliest practical time.

In response, a pre-assessment phase was introduced, comprising a set of prescribed steps to facilitate the “all cards on the table” approach to tax dispute resolution.

This annex describes in detail the legislative steps that make up the disputes resolution process.

How does a dispute arise?

A dispute may arise when a taxpayer and Inland Revenue have not reached agreement on a tax position taken in a taxpayer’s self-assessment, and often follows an audit of the taxpayer. If no agreement has been reached on some or all of the issues identified, Inland Revenue will begin the disputes process by issuing a notice of proposed adjustment (NOPA).

Alternatively, a taxpayer may dispute his or her own assessment or disputable decision made by the Commissioner by issuing a NOPA.

The time-bar

The TAA imposes time limits for increasing assessments. If a taxpayer has furnished a return and made an assessment, the Commissioner may not amend the assessment to increase the amount assessed if four years have passed from the end of the income year in which the taxpayer provided the return. [56] The Commissioner is prevented from refunding amounts of overpaid income tax after four years from the end of the year in which the original assessment was made. [57] The Commissioner cannot refund amounts of overpaid GST after four years from the end of the taxable period in which tax was assessed. [58]

The time-bar does not apply if the Commissioner is of the opinion that a return is fraudulent, wilfully misleading or does not mention gross income which is of a particular nature or was derived from a particular source. [59]

The disputes process

Once a dispute has begun, the issuing of a correct assessment is intended to be achieved through a series of steps prescribed in Part IVA.

Once an assessment is issued, the challenge process, involving litigation in the courts, as set out in the TAA begins.

The main legislative elements of the pre-assessment phase of the disputes resolution process are:

- Notice of Proposed Adjustment (NOPA);

- Notice of Response (NOR); and

- Disclosure notice and Statement of Position (SOP).

There are also two important administrative phases in the process – the conference and adjudication phases.

The current application of all these elements is explained in more detail below.

The Notice of Proposed Adjustment

The NOPA is the first formal step in the disputes process.

The content of a NOPA is prescribed. It must contain sufficient detail to reasonably inform the recipient of: [60]

- the adjustments or adjustments proposed to be made to the assessment;

- the tax laws on which the adjustments are based;

- a statement of the facts giving rise to the adjustments; and

- a statement of how the law applies to the facts.

The purpose of the NOPA is to ensure that the party receiving the notice is aware of the arguments on which the other party is relying. Reducing these points to writing emphasises the need to review the positions of Inland Revenue or the taxpayer and is intended to foster open and frank discussion early in the resolution process in terms of the “all cards on the table” objective. Providing adequate information also ensures that the NOPA can be responded to fully.

The taxpayer may dispute his or her own assessment by issuing a NOPA within two months after the date of the notice of assessment.

Acceptance of Notice of Proposed Adjustment

If the adjustment is accepted in writing, or the adjustment is deemed to have been accepted, because either Inland Revenue or the taxpayer has not responded in time, the disputes process ends and an amended assessment is issued or the assessment stands. [61] No further challenge may be made to that adjustment. [62]

A late response by a taxpayer is deemed to have been received within the response period if exceptional circumstances apply. Exceptional circumstances are discussed in detail in Chapter 7 of this document.

The Notice of Response

If the taxpayer or Inland Revenue disagrees with one or more of the proposed adjustment in a NOPA, the taxpayer must notify the other party by issuing a NOR within two months of the date of issue of the NOPA. [63] The NOR is the vehicle used by the recipient of the NOPA to formally reply to the proposed adjustment.

The content of the NOR must: [64]

- specify the facts or legal arguments in the NOPA that the recipient considers to be in error and why they are in error;

- specify the facts and tax laws that are relied on by the recipient and how the law applies to the facts; and

- state the adjustments to a figure referred to in the NOPA as a result of the above factors.

Small claims election

A taxpayer may indicate in his or her NOPA or NOR (in a dispute initiated by the Commissioner) that he or she wishes to be heard before the small claims jurisdiction of the Taxation Review Authority (TRA). [65] The TRA’s jurisdiction includes the determination of small claims where the facts are clear and not in dispute, the tax to pay or tax effect is below $30,000 and no significant legal issues or precedent are involved. The taxpayer is bound by the decision of the TRA.

Conference

Conferences between the Commissioner and the taxpayer were administratively prescribed following a recommendation by the Richardson Committee.

The purpose of the conference, of which there may be more than one, is to facilitate the resolution of any disputed facts and issues that have been raised in the NOPA and NOR.

Disclosure notice

If the dispute is not resolved because the NOR is not accepted, the Commissioner may issue a disclosure notice. For disputes initiated by the Commissioner, the disclosure notice must be accompanied by a SOP. The disclosure notice is an important document because it triggers the application of the evidence exclusion rule. The evidence exclusion rule is discussed in detail in Chapter 4.

The Statement of Position

Each party’s SOP must: [66]

- give an outline of the facts on which the party intends to rely;

- give an outline of the evidence on which the party intends to rely;

- give an outline of the issues that the party considers will arise; and

- specify the propositions of law on which the party intends to rely.

Statement of Position in Commissioner-initiated disputes

If the Commissioner initiates the dispute, then the Commissioner must issue a SOP at the same time that a disclosure notice is issued. [67] The taxpayer must file his or her own SOP within two months of the disclosure notice. [68] The taxpayer may apply to the High Court for further time to issue the SOP provided that the taxpayer applies within two months and it is unreasonable to reply because the issues in dispute had not previously been discussed. [69]

If the taxpayer fails to respond to the Commissioner’s SOP and the taxpayer has not applied to the High Court for more time in which to reply, the taxpayer will be considered to have accepted the proposed adjustment as detailed in the Commissioner’s SOP or NOPA. [70]

The Commissioner has a right of reply to the taxpayer’s SOP [71] but must exercise this right within two months of the date of issue of the taxpayer’s SOP. Any additional information in the reply then becomes part of the Commissioner’s SOP. [72]

The Commissioner may apply to the High Court for an extension of time to reply to the taxpayer’s SOP. [73] The extension may be granted if the Commissioner applies before the expiry of the two-month period in which to respond to the taxpayer’s SOP and it is unreasonable to reply within the period owing to the number, complexity or novelty of the matters raised in the taxpayer’s SOP. [74]

The need to apply to the High Court may arise when the taxpayer’s SOP refers to facts, issues, evidence or propositions of law that have not previously been disclosed and it is necessary for the Commissioner to obtain and consider these matters.

Statement of Position when the taxpayer initiates the dispute

If the taxpayer has initiated the dispute, the taxpayer may issue a statement of position within two months of the date that the Commissioner issues a disclosure notice. [75] It is standard practice for the Commissioner to issue a SOP in reply – generally within three months of receipt of the taxpayer’s SOP.

The taxpayer does not have a right to reply to the Commissioner’s SOP. However, the Commissioner and the taxpayer may agree to additional information being added, at any time, to their SOPs. [76]

Adjudication

A dispute that is not resolved by the end of the SOP phase is generally referred to the Inland Revenue’s Adjudication Unit. The function of this Unit is to consider the dispute impartially and independently of the audit function. The Adjudication Unit makes the assessment decision on behalf of the Commissioner. As a result, if the Unit finds in favour of the taxpayer, the dispute will conclude. On the other hand, if the Unit finds that an adjustment is necessary, an assessment consistent with that finding will be issued.

Assessment

An assessment as amended by the Commissioner is issued after completion of the disputes process, or the original assessment stands.

Post-assessment challenge

A taxpayer is entitled to challenge an assessment by beginning proceedings in a court within the two-month response period. [77]

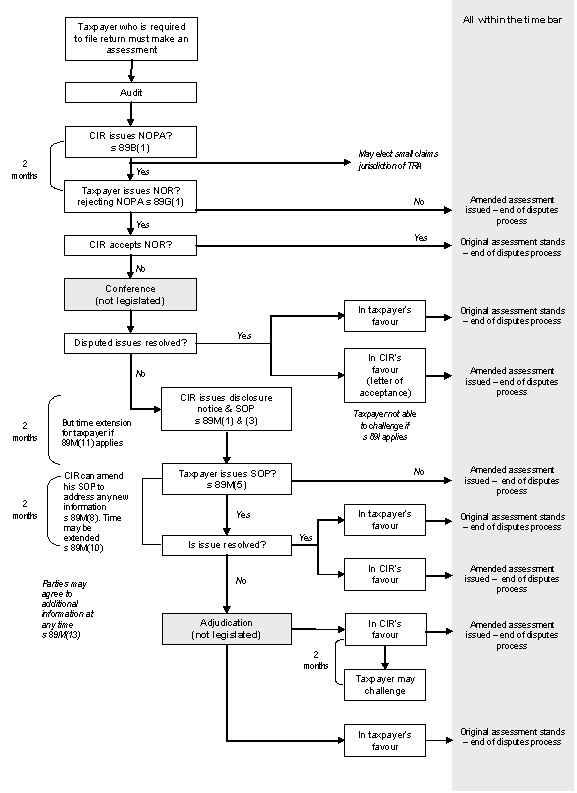

Figure 2: Process for a dispute initiated by the Commissioner of Inland Revenue

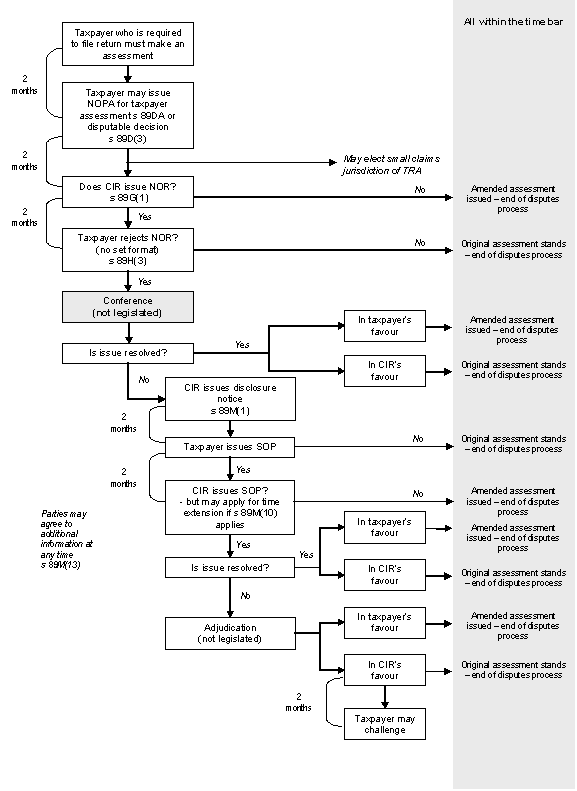

Figure 3: Process for a disputed initiated by a taxpayer

55 Organisational Review of the Inland Revenue Department, Report to the Minister of Revenue (and on tax policy, also to the Minister of Finance) from the Organisational Review Committee, April 1994.

56 See section 108 and for GST assessments, section 108A.

57See section RM, Income Tax Act 2007.

58 See section 45, GST Act 1985.

61 See sections 89H and also 89J.

63 Section 89AB defines “response period”. For these purposes, this is two months from the date of issue of the originating document.

66 See sections 89M(4) and 89M(6).