Chapter 4 - Moving to an electronic environment

4.1 Currently Inland Revenue sends out over 30 million envelopes and 76 million pages to be read, including nearly 9 million statements and notices annually. An electronic environment would:

- allow Inland Revenue to meet taxpayer’s expectations of good service levels;

- provide certainty with real time or near-real time electronic services that ensure taxpayers have instant confirmation of transactions by Inland Revenue;

- provide simplicity and flexibility for taxpayers so they can self-manage their obligations and reduce their compliance paperwork; and

- provide services that are available and responsive to taxpayers at any time.

4.2 Moving to a largely electronic environment would require a major shift in focus for taxpayers and their advisors.

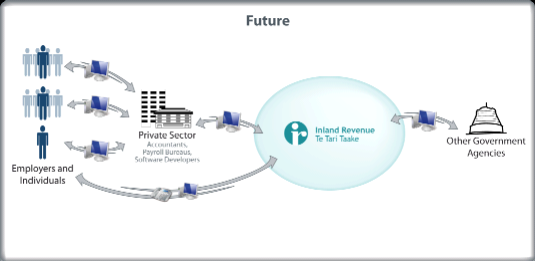

4.3 The role of Inland Revenue would change, and significant resources would be applied to further support the private sector in its role of helping taxpayers with their accounting, financial management and payroll support services. This is shown in the chart below. Taxpayers would, of course, continue be able to communicate with Inland Revenue directly.

Changing the way individuals, employers and businesses interact with Inland Revenue

4.4 Moving to an electronic environment would require significant changes for those who interact with Inland Revenue. For benefits to be fully realised the vast majority of interactions would have to be managed electronically.

| Old way | New way |

|---|---|

|

|

|

|

|

|

|

|

|

|

Proposals for individuals

4.5 Currently, taxpayers can log into a workspace hosted by Inland Revenue (similar to internet banking) where they provide details previously required by the paper personal tax summary (PTS) or IR 3 tax return. The workspace also gives individuals the opportunity to check their salary and wage income details, their PAYE deduction details and any child support and student loan obligations.

4.6 The Government proposes to increase efforts to move individual taxpayers from filing paper tax returns to providing information electronically. This is expected to take a number of years, but the expectation is of a future in which the majority of individuals will interact electronically with Inland Revenue

4.7 Change would not be limited to tax returns. The Government’s expectation is that payments and refunds would be made electronically in the near future and paper statements would not be issued by default.

4.8 It is recognised that many taxpayers would need to be supported in the move to an electronic environment. Businesses and Inland Revenue will need to work together to provide training in this new electronic environment.

4.9 Not all taxpayers will have access to the electronic facilities required in the proposed new environment, or have the capabilities to use them. Support may be required. The Government is interested in receiving comments on this.

4.10 Alternatives may include providing options for taxpayers rather than continuing current processes. For example, Inland Revenue may continue to provide a paper return for some taxpayers but the completed return would have to be provided to Inland Revenue electronically. That is, once an employer has completed an employer monthly schedule they would need to give it to a business services firm to file electronically with Inland Revenue. It is likely the business services firm would charge the employer for this service. For individuals, it could mean using a kiosk in the local Heartland (Ministry of Social Development) office to access a social policy entitlement.

Change may be compulsory for some

4.11 A recent study by McKinsey & Company, Global Survey of Tax Administration Best Practices in Management and Operations, indicates that the gain from an electronic environment starts once 60 percent of contact is through electronic channels, but becomes significant and organisationally transforming if over 90 percent of communication is through electronic channels. The move to an electronic environment of this scale would require an increased role for the private sector and a change to an electronic environment by most taxpayers.

4.12 While Inland Revenue would be improving its electronic services in a way that should be inherently appealing to taxpayers, some level of compulsion to use electronic services may be required to ensure that the Government’s value for money goals are achieved. The proposal is that Inland Revenue would have a general power to mandate the electronic filing of information, with penalties supporting that mandate.

Questions for submitters

Submissions on any of the issues outlined in this chapter are welcomed, including:

- Should the electronic provision of information to Inland Revenue be compulsory, by a date to be determined in the future, for some tax types.

- What do you think about Inland Revenue replacing paper guides and booklets with electronic information?

Businesses

- Would the ability to check your tax information online mean you would no longer need paper-based statements, or contact Inland Revenue?

- What do you think about your accounting software taking care of routine tax filing rather than doing it yourself?

Individuals

- What do you think about being able to access information, receive confirmation and view your Inland Revenue information online?

- What do you think about no longer receiving paper statements and notices from Inland Revenue?