Chapter 2 - Rationale for extending the active income exemption

The current problem

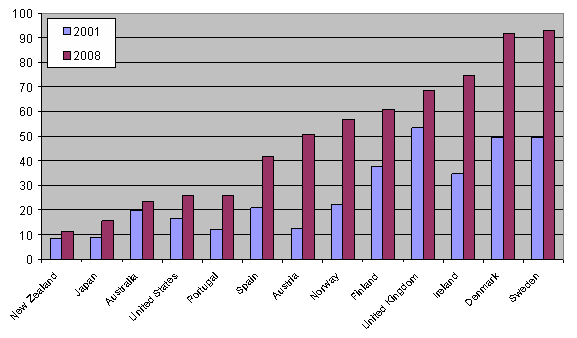

2.1 Compared with other developed economies, New Zealand businesses are less engaged in operating outside of their home country. This is illustrated by figure 1, which shows the stock of outbound foreign direct investment (FDI) product as a proportion of gross domestic product (GDP). [1], [2]

Figure 1: Outbound FDI as a percent of GDP

2.2 This is a concern as it suggests that New Zealand may be missing out on the economic benefits associated with businesses expanding their activities through the use of subsidiaries, joint ventures and other substantial investments in foreign markets. These benefits can include improved market knowledge, skills transfer and access to customers and suppliers. This may facilitate export growth or an increase in high-value research, design and management activities in New Zealand.

2.3 A range of possible factors could contribute to New Zealand’s relatively poor outbound FDI performance. For example, some of the difference could be due to industrial structure. Tapping into offshore markets and access to offshore distribution channels may be of varying importance for firms in different industries. Distance from markets may also be important as this could make it more difficult to invest offshore.

2.4 It is important that New Zealand businesses can compete on an even footing with foreign competitors operating in the same country. New Zealand-based businesses have previously raised concerns that New Zealand’s international tax rules could impose higher tax or compliance costs on offshore operations than those faced by competing businesses operating in the same country. This was because a New Zealand business that operated in a foreign country had to comply with the tax rules of that country and also attribute income (and potentially pay further tax in New Zealand) using New Zealand tax concepts. In contrast, many other countries reduce or eliminate the additional tax or compliance burden created by a second layer of tax by exempting offshore income that is earned by active businesses. This created an incentive for New Zealand companies undertaking or considering active business ventures outside New Zealand to relocate their headquarters to countries with more favourable tax rules.

2.5 In response to these concerns, the Government introduced an exemption for active income earned by foreign companies that are controlled by New Zealand investors (CFCs). This means that a shareholder with a 10 percent or greater interest in a CFC is taxed only on their share of any passive income earned by that CFC. In very broad terms, passive income consists of “moveable” income such as rent, royalties, certain dividends and interest. Taxing such income on accrual protects the domestic tax base against income being shifted offshore to reduce tax.

2.6 Before this reform, New Zealand shareholders in CFCs were generally subject to tax on their share of all of the CFC’s income (active and passive) as it accrued, with a credit provided for tax paid by the CFC in its home country. This “full accrual” approach continues to apply to most investments in foreign companies not controlled by New Zealanders (FIFs). The main exceptions are an exemption for interests of 10 percent or greater in FIFs located in one of eight grey list countries and an exemption for less than 10 percent interests in Australian companies listed on the Australian stock exchange.

Extending the active income exemption to other types of offshore investment

2.7 CFCs are a key vehicle for expanding New Zealand businesses beyond the domestic market. However, businesses access new markets and opportunities through a variety of structures, and New Zealand companies wanting to expand overseas may have good commercial reasons for not operating through a wholly or majority-owned subsidiary.

2.8 For example, firms wanting to expand abroad may establish links with a local partner and establish a joint venture, meaning that the New Zealand company has a substantial but non-controlling, interest in an overseas entity. Typically, the New Zealand partner will provide significant input, through management expertise, technical or specialist input and funding. The host country partner may provide raw materials and a manufacturing base or labour force, as well as an established set of business relationships and an understanding of the market. Although the entity is not controlled by the New Zealand partner, the New Zealand firm will have a major say in the entity’s operations.

2.9 In some countries joint ventures may be the only option for New Zealand businesses. This is because some countries do not allow the entry of companies that are wholly or mainly foreign owned into particular markets.

2.10 As with the former CFC rules, the existing FIF rules can impose additional tax and compliance costs on New Zealand businesses that operate in offshore markets through non-controlling stakes in FIFs. This may create an incentive for these companies to relocate their headquarters to countries with more favourable tax rules as a number of other countries have an active income exemption for FIFs as well as for CFCs.

2.11 One way to reduce tax and compliance costs would be to exempt all types of income derived from a non-portfolio interest in a FIF. However this would create opportunities and incentives for taxpayers to shift moveable (passive) income into low-tax jurisdictions to minimise their tax liabilities. This type of offshore investment is unlikely to enhance New Zealand’s economic potential or wellbeing and could result in a large loss of tax revenue.

2.12 For this reason the CFC rules make a distinction between active and passive income. Restricting the exemption to active income (or active businesses) can be an effective way to reduce tax and compliance costs in cases where the economic benefits are highest and the risks to the tax base are low.

2.13 The remainder of this paper is concerned with developing a similar active income exemption for non-portfolio interests in FIFs. The following design issues are discussed:

- Should the active income exemption for FIFs be the same as the active income exemption applying to CFCs? (chapter 3)

- Which FIF interests should be eligible for the active income exemption? (chapter 4)

- How should the active income exemption rules be applied to FIFs? (chapter 5)

- What alternative methods should be available for holders of FIF interests that are eligible for the active income exemption but are unable to comply with it? (chapter 6)

Questions for submitters

What types of entities and structures are most commonly used by New Zealand businesses to expand their activities offshore?

When investing and competing in foreign markets, how important are tax and compliance costs? Do New Zealand’s existing FIF rules create a significant disadvantage?

Is an active income exemption for non-portfolio interests in FIFs an effective way to reduce this disadvantage? Are there other ways to reduce tax and compliance costs?

1 FDI is debt and equity holdings of greater than 10 percent in a foreign company.