Zero-rating transactions involving land

(Clauses 4, 6, 9, 10, 13(4), 17, 18, 19 and 20)

Summary of proposed amendments

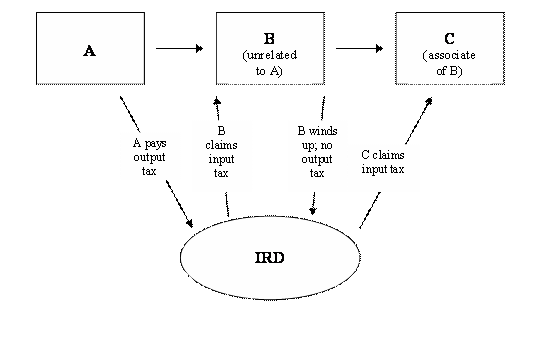

The GST legislation is being amended to require GST-registered vendors to charge, subject to certain conditions, GST at the rate of 0% on any supply to a registered person involving land or in which land is a component. This measure is intended to prevent “phoenix” fraud schemes that involve Inland Revenue refunding GST to the purchaser with no corresponding payment being made by the vendor because the supplying company deliberately winds up before making payment.

Application date

The amendments will apply from 1 April 2011.

Key features

Application

The Goods and Services Tax Act 1985 (GST Act) will be amended by new section 11(1)(mb) which will require a GST-registered vendor to charge GST at the rate of 0% on any supply involving land or in which land is a component to a registered person who acquires the goods with the intention of using them for making taxable supplies.

The new rules will not apply when the supply is a supply of land intended to be used as a principal place of residence of the purchaser or their relative (section 11(1)(mb)(ii)). This exclusion will prevent registered persons such as sole traders from using their GST-registered status to zero-rate the purchase of their family home. In circumstances when a principal place of residence forms part of a larger supply of land, the supply of the residence will be deemed to be a separate supply from the supply of the other land (section 5(15)).

A new definition of “land” will be added to section 2(1) of the GST Act to include an estate or interest in land, a right that gives rise to an interest in land, or an option to acquire land or an interest in land. The definition will not apply to mortgages or supplies of accommodation in a dwelling.

The new zero-rating rules will apply to any supply that involves land, irrespective of whether land is a predominant component of the supply. This will affect most supplies of “going concerns”, which often involve transfers of land, and in turn reduce the need to determine whether a going concern is being supplied.

New section 5(22) also extends the application of the zero-rating rules to certain supplies of land to which section 5(2) applies. For example, if a mortgagee sells a mortgaged property, subject to the obligation to account for GST under section 5(2), the mortgagee will be required to zero-rate the supply if the mortgagor would be required to zero-rate the transaction were they selling the property themselves.

Vendor’s obligations

Since the new rules apply to transactions between two registered persons, new section 78F(2) requires the vendor to obtain the purchaser’s registration details.

The proposed zero-rating rules will not apply if the registered purchaser does not intend to use the goods for making taxable supplies or if the property is being purchased as the principal place of residence of the purchaser or their relative. Vendors will therefore be required to confirm with the purchaser their intentions in relation to the supply.

If, in the circumstances relating to the supply, the vendor is unable to obtain the details described above, the vendor must make sufficient inquiries into the purchaser’s registration status and otherwise obtain all the information required (new section 78F(3)).

Having obtained the necessary information about the purchaser’s registration status or the purchaser’s intentions regarding the use of the land, the vendor will not be liable for tax on the supply in a case of mistake or misrepresentation by the purchaser (new section 78F(4)).

If the vendor fails to fully comply with their information-gathering obligations in section 78F(2) and (3), the vendor may be liable to account for tax even if it is also the case that the purchaser has provided incorrect information to them (new section 78F(5)).

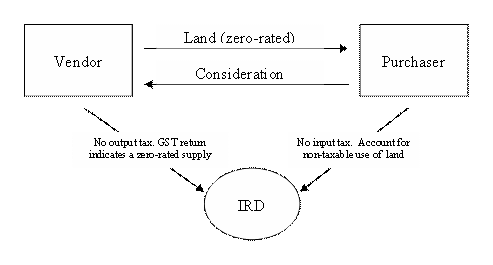

Although the vendor will not be required to account for any output tax for a zero-rated supply, they will need to disclose the zero-rated transaction on their GST return or an attachment to the GST return to be prescribed by Inland Revenue. This information will help Inland Revenue to identify the transaction and ensure that the purchaser complies with their apportionment obligations.

Purchaser’s obligations

New section 5(23) states that if an unregistered purchaser provides incorrect information to the vendor, the purchaser will be deemed to supply the goods and services to themselves and be liable to pay GST on the supply at the standard rate. For the purposes of this section, the unregistered purchaser will be required to register for GST (new section 51B(4)) and will not be able to claim a deduction in respect of the deemed supply (new section 20(4B)).

In circumstances when the purchaser fails to provide the correct information to the vendor, the purchaser may be liable to account for tax even if the vendor has failed to fully comply with their information-gathering requirements in section 78F(2) and (3) (new section 78F(5)).

This obligation on the purchaser to account for tax will only apply if the vendor has not accounted for the GST at the standard rate.

Under the rules for apportionment of input tax and change-in-use adjustments also proposed in this bill, any input tax deduction that can be claimed by a purchaser will be based on the GST paid by the purchaser and the intended taxable use of the goods and services. Since the amount of input tax in a zero-rated supply is zero, special rules will be required to ensure that any non-taxable use of acquired land is accounted for.

New section 20(3I) will require the purchaser to account for tax on the acquisition of a zero-rated asset when they do not intend to use the asset solely for the purpose of making taxable supplies – that is, the asset is also used privately or in making exempt supplies. This will be done by the purchaser having to calculate, on acquisition, the amount of GST that would have been paid by the vendor if the supply was subject to the standard rate of GST (the nominal GST component), and account to Inland Revenue for the proportion of the nominal GST component that relates to the non-taxable use of the acquired supply. The nominal GST component will also be used by the purchaser to make adjustments for any subsequent change in use.

Example of a zero-rated transaction

Nominations

Nominations are often used in transactions that involve transfers of land. For example, although a contract for a transfer of land may be between a vendor and a purchaser, the transaction may instead be settled and the title in land received by a third party nominated by the purchaser (the nominee).

The bill includes the introduction of new rules that would govern the GST treatment of transactions involving nominations. The purpose of the rules is to ensure that the GST treatment of a nominee transaction follows its economic substance. How the economic substance is determined depends on which party (the nominee or the purchaser) pays the consideration.

The new nomination rules will particularly affect land transactions when a contractual purchaser and a nominated person have a different GST registration status. For example, registered vendor A may agree to sell land to an unregistered purchaser B. Because of B’s unregistered status, A may have initially treated the transaction as subject to the standard GST rules. However, if purchaser B has nominated a registered person C to settle the transaction, the new nomination rules will treat the transaction as between A and C (new section 60B(5)). Therefore, the supply will need to be zero-rated by the vendor (and they will be able to claim back any output tax already paid in relation to the supply).

Conversely, registered vendor A may agree to sell land to a registered purchaser B. Because of B’s registered status, A may have initially treated the transaction as subject to the zero-rating rules. However, if B nominates an unregistered person C to settle the transaction, the new nomination rules will again treat the transaction as between A and C. As a result, A would be required to charge GST on the supply at the standard rate.

Background

In November 2009, the Government released the discussion document GST: Accounting for land and other high-value assets, which proposed a number of changes to the GST Act 1985 that would address certain GST base risks and improve the operation of the GST system more generally. The main risk to the tax base identified in the discussion document was “phoenix” fraud schemes that often occur between associated entities and involve Inland Revenue refunding GST to one party with no corresponding payment being made by the vendor because the vendor deliberately winds up the business before making payment.

Example of a phoenix fraud transaction

In considering this concern, the discussion document proposed a domestic reverse charge to transactions principally involving land, “going concerns” and assets with a value of $50 million or more. The zero-rating option was mentioned in the discussion document, but was not preferred. The preference for the domestic reverse charge largely resulted from concerns that zero-rating would not deal well with situations when an unregistered purchaser purports to be registered or when parties mistakenly zero-rate a transaction. However, most submitters expressed a preference for zero-rating as it would give rise to fewer compliance costs.

While both mechanisms would be effective, the domestic reverse-charge would introduce a new method of accounting for GST under which the obligations of parties to a transactions would significantly differ from those under the normal GST rules. Under the zero-rating mechanism, the accounting obligations of the parties would remain virtually unchanged. Accordingly, zero-rating the relevant transactions to the GST base risk is likely to be an easier mechanism for businesses to deal with.

Any remaining concerns regarding zero-rating are intended to be resolved by anti-avoidance provisions.

Submissions on the discussion document considered that for large-value non-land transactions, current Inland Revenue processes to allow an offset of the output and input tax between registered parties in order to avoid carrying costs and other risks are working effectively. The $50m threshold for zero-rating outlined in the discussion document was considered by most to be unnecessary and is not therefore included in this bill.