2.3 However, under the NRWT rules, a higher tax is applied to related-party lending to reduce incentives for companies to use tax-deductible interest payments to shift New Zealand profits into related offshore companies and out of the New Zealand tax base.

2.4 In some countries, NRWT can be used to reduce home taxes on interest income received from New Zealand. However, it is common practice for the tax costs to be added to the standard interest rate. Often lenders will contractually require the borrower to bear the cost of the NRWT in the loan agreement. In these cases, the New Zealand borrower would be better off paying AIL at 2 percent, rather than grossing up the interest payment by 10 or 15 percent for NRWT.

Status quo and problem

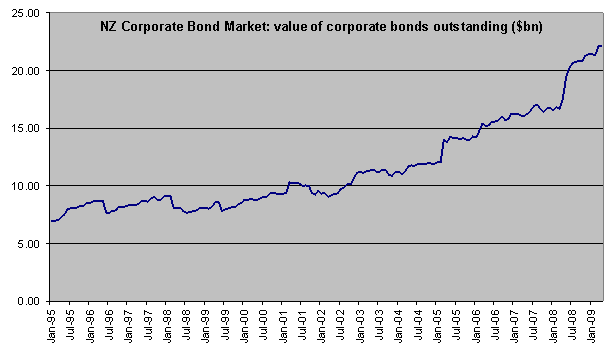

2.5 New Zealand’s corporate bond market is a minor part of our financial system, but has experienced strong recent growth. Since 2005 the total value of corporate bonds on issue has increased from $12 billion dollars to $23 billion dollars.[3] As at December 2008 the domestic bond market was the source of about 4 percent of all debt for non-financial businesses. The bulk of business debt was raised through domestic financial institutions (61 percent) and from offshore (26 percent from significant stakeholders and 9 percent from others).[4] The following graph illustrates this growth.

Source: RBNZ, Financial Stability Report, May 2009

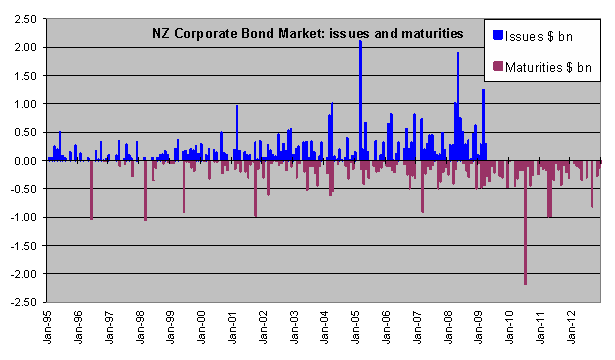

Source: RBNZ, Financial Stability Report, May 2009

2.6 A well-functioning bond market has a number of important signalling and support roles which affect the performance of the wider financial system. For example:

- Bond markets provide an observable benchmark for pricing derivatives and equities.

- Bond markets make financial investment more attractive by providing a broader range of options (and risk/return profiles) for savers. This may result in more savings becoming available to fund investment.

- Bonds can reduce the effective cost of funds and provide longer-term financing options for firms (especially those with long-term growth potential such as infrastructure firms).

- A strong bond market can make the economy less vulnerable to a banking crisis, through diversification of lending instruments.

2.7 Concerns have been raised that the current AIL/NRWT rules may be one factor hindering the further development of New Zealand’s corporate bond market. This is because AIL/NRWT increases the cost of issuing bonds to non-residents. For example, a non-resident investor who requires a 10 percent return to buy bonds from a New Zealand company would require the company to pay an interest rate of 10.2 percent to ensure that the investor gets the required return after AIL is deducted.

2.8 The impact of AIL on the domestic bond market could be exacerbated by the fact that it is possible for companies to establish foreign branches and borrow through these branches without paying AIL or (as an alternative) NRWT. On the other hand, interest payments on bonds issued in the domestic market are subject to either AIL or NRWT. This means that issuing bonds on the domestic market may be discouraged relative to issuing bonds through an offshore branch or borrowing directly through domestic banks.

Zero-rating AIL on bonds

2.9 The impediment could be removed by having AIL apply at a rate of zero (rather than the usual rate of 2 percent) on interest paid on corporate bonds, subject to certain criteria discussed below.

2.10 A zero rate of AIL on bonds would make it marginally cheaper to issue bonds to non-residents. This could lead to further growth in issuance and a better-functioning New Zealand bond market as it would reduce the cost of foreign funds and increase the pool of potential investors.

2.11 It is difficult to gauge the extent to which a zero rate on AIL would lead to increased bond issuance. Many factors influence bond issuing decisions besides interest costs. These include a desire to secure larger or longer-term finance, maintain a good credit rating, or gaining access to a larger pool or different set of investors.

2.12 Because of the fiscal costs and risks of removing NRWT and AIL on interest, it would be useful to receive submissions on the extent to which AIL affects bond issuance and the way that businesses raise funds, relative to other factors.

Maintaining the corporate tax base

2.13 As well as raising revenue directly, AIL/NRWT plays a critical role in supporting the domestic tax base. It does this in two ways. In related party debt transactions, it reduces the incentive for corporate groups to shift income offshore by paying interest to a related company in another country. In closely held debt arrangements, it can provide an incentive to maintain banking activity in New Zealand. If either tax base were compromised, New Zealand would lose significant amounts of revenue. The remainder of this paper will consider whether it is possible to develop rules and criteria that would allow AIL and NRWT to be relieved on widely held bonds, while ensuring that related party transactions and closely held debt arrangements are still subject to the existing rates of AIL or NRWT.

Related party debt

2.14 The risk from related party debt transactions could be managed through the existing AIL/NRWT settings. These settings ensure that NRWT only applies at a zero rate if the following conditions are satisfied:

- the interest payer (borrower) must register as an approved issuer and pay the approved issuer levy (approved issuer status can be revoked if taxpayers fail to meet their tax obligations);

- the interest must be paid to a non-resident who is not associated with the approved issuer; and

- the interest payment cannot be jointly derived with a New Zealand resident.

2.15 A zero rate of AIL for qualifying bonds would not alter these requirements. This means that NRWT would continue to apply at 10 percent or 15 percent for any interest paid to a non-resident who was associated with the interest payer, regardless of whether the interest was paid on qualifying bonds. Likewise, a 2 percent rate of AIL would continue to apply to unrelated debt that did not meet the requirements of a qualifying bond issue.

Closely held debt

2.16 If the government were to introduce a zero rate of AIL on bonds, it would have to be confident that it could not be used to remove NRWT and AIL on interest paid on closely held debt. Otherwise, there could be an increased incentive for loans to be made directly from offshore (for example, by a foreign bank). In such cases, the margin earned on the loan would no longer be subject to New Zealand tax. This could pose a significant fiscal risk to New Zealand because of the importance of the banking sector to our corporate tax base.

| Closely held debt | Bonds |

|---|---|

| Not typically bought and sold (unless securitised). | Usually bought and sold on financial markets. |

| Typically a single lender or a small number of syndicated banks. | Can be widely held by a large number of retail investors or by a smaller (or larger) number of professional investors. |

| Range of different loan sizes and maturities. | Typically used for larger, multi-million dollar deals with longer-term debt available in sophisticated markets. |

| Not generally registered on an exchange. | Retail bonds more often registered on exchanges in regulated markets such as NYSE or LSE. |

2.17 It may be possible to manage this risk by developing some specific criteria that could be used to exclude closely held debt. Under this approach, AIL would apply at a zero rate on interest paid on a qualifying bond that satisfied the criteria. AIL would continue to apply at the usual rate of 2 percent on debt which did not qualify.

2.18 Suggested criteria for a zero rate of AIL on bonds are discussed below.

Australia’s public offer test

2.19 Australia’s “public offer test” exemption provides some examples of the types of criteria that could be applied.

2.20 Australia provides an exemption from withholding tax on interest paid on bonds (or syndicated loans) issued by an Australian company (or an intermediary that issues the bonds on an Australian company’s behalf) which satisfies one of the four public offer tests. The test is satisfied if the bonds are offered to 10 financiers (who are unrelated to the Australian company and each other) or 100 other potential investors, or are listed on a stock exchange or are quoted in a published source that is monitored by investors. However, if the bonds are issued to an associated person, the interest payments remain subject to withholding tax. (See appendix I for a more detailed description of Australia’s public offer tests.)

2.21 Australia’s public offer test exemption can apply to syndicated loans[5] and closely held bonds. New Zealand would require tighter criteria, given our objective for AIL to continue to apply at a rate of 2 percent on closely held debt.

2.22 We suggest that a zero rate of AIL would typically apply if either of two tests were satisfied:

- the widely held test; or

- the stock exchange test.

The widely held test

2.23 The widely held test would require:

- the bonds to be held by at least 100 investors (who are not associated or who could not reasonably be expected by the issuer to be associated); and

- no person (or group of persons that the issuer could reasonably expect to be associated with each other) holds more than 10 percent of the bonds.

2.24 The issuer would be required to apply the test annually to check that the thresholds were still satisfied.

2.25 One drawback with the 10 percent limit is that it could deny the zero rate if an underwriter is required to purchase a significant proportion of the remaining bonds that it had failed to sell during the initial offering. For this reason it would make sense to disregard bonds initially held by an underwriter for the purposes of the maximum number of bonds test so long as the bonds were subsequently sold to third parties within one year after the initial issue date.

The stock exchange test

2.26 Another way in which bonds differ from closely held debt is that they can be publicly traded. One of Australia’s public offer tests is that bonds which are “listed on a stock exchange” qualify for the exemption.

2.27 We suggest that New Zealand could adopt a similar stock exchange qualification. In many cases a stock exchange’s listing requirements could help ensure that the bonds were publicly traded and priced at an arm’s-length rate.

2.28 As a stand-alone qualification, a stock exchange test would be easier to verify than a widely held test, but may not offer as much protection. This is because a company could emulate a closely held loan by listing bonds on a stock exchange but then issue them to just one or a few parties. For this reason bonds issued through a private placement would need to be specifically excluded from the concessionary rate of AIL.

Safeguards

2.29 As a further safeguard, the widely held, and stock exchange tests would need to be supported by specific exclusions to make it more difficult to reclassify closely held debt in order to qualify for the exemption. The zero rate of AIL would be denied if:

- The bonds are issued through a private placement that is limited to a select group of investors as opposed to a public offering that is open to all investors. The concern is that such bonds could be used in place of a loan or a syndicated loan.

- The bonds are not openly advertised to the target market during the book-build process.

- The bonds are an “asset-backed” security – that is, any security where the interest payments are financed by cashflows from a pool of financial assets, such as mortgages. The concern with these securities is that they can be used to package together a group of closely held loans and effectively shift the margin earned on these outside the New Zealand tax base. Note that this measure is not intended to exclude bonds that are simply “secured” against a collateral asset which the bond holder can claim in the case of default.

Questions for submissions

We would be interested to receive feedback on questions such as:

- Should AIL apply at a rate of zero on qualifying bonds?

- To what extent would this affect bond issuance and the way that businesses raise funds?

- Would this affect the decision to issue bonds offshore (as opposed to in New Zealand)?

- Which companies would make use of a zero rate of AIL for qualifying bonds?

- How can the proposed tests and safeguards be improved?

1 If New Zealand has a tax treaty with the non-resident’s country.

2 If a non-treaty country or Japan.

3 Reserve Bank of New Zealand, Financial Stability Report, May 2009.

4 Reserve Bank of New Zealand, Financial Stability Report, May 2009.

5 A syndicated loan is a loan offered by a group of lenders (called a syndicate) who work together to provide funds for a single borrower.