Chapter 5 - Main home exception

5.1 The suggested bright-line test is intended to apply to most disposals of residential land within two years of the acquisition of the property. However, there are three situations when the disposal of property is not intended to give rise to a tax liability under the suggested bright-line test for any gains from a disposal.

5.2 The first situation is when the property is the main home of the vendor. Excluding a person’s main home from the bright-line test is consistent with the current land sale rules, which generally exclude the sale of a person’s principal residence.

5.3 The main home exception should be tightly defined. Where a property is used mainly for investment purposes or where a person has multiple homes the main home exception should not apply (or should not apply more than once).

Suggested change

5.4 We suggest that the main home exception applies when:

- the land has a dwelling on it;

- the dwelling is occupied mainly as a residence by the owner; and

- the dwelling is the main home of the owner.

5.5 If the property is owned by a trust, we suggest that the main home exception apply when the dwelling is occupied mainly as a residence by a beneficiary of the trust, and is the main home of a beneficiary of the trust.

5.6 If the settlor of the trust has a main home that is not owned by the trust, then we propose the main home exception cannot apply to any property owned by the trust.

Mainly as a residence

5.7 We suggest that the main home exception apply when the dwelling is occupied mainly as a residence. This requirement is the key test for the residential exclusion within the current land sale rules and is intended to ensure that properties used mainly for investment or other purposes are not covered by the exception.

5.8 It is intended that this test is determined based on what a person’s actual use of the property is rather than what they intended the property to be used for.

Main home

5.9 A person should only be able to use the main home exception for one property at a time. To enable this, we suggest the exception applies to a property that is the “main home” of the owner and is used “mainly as a residence” by the owner.

5.10 Where a person has several residences, their “main home” is determined according to which property a person has the greatest connection. The factors that determine these connections would be similar to those used to determine whether a dwelling is a person’s “permanent place of abode” for residence rules and include:

- the time the person occupies the dwelling;

- where their immediate family (if any) live;

- where their social ties are strongest;

- the person’s use of the dwelling;

- the person’s employment, business interests and economic ties to the area where the dwelling is located; and

- whether the person’s personal property is in the dwelling.

Example: Multiple homes

Bob has two homes.

One home is a small apartment in Christchurch, which Bob lives in five days a week because he works in Christchurch.

The other home is in Wellington where his family lives. Bob lives in his Wellington home during weekends and holidays. His Wellington home is also where most of his personal possessions are located.

The Wellington home is Bob’s main home as it is the place he has the greatest connection with.

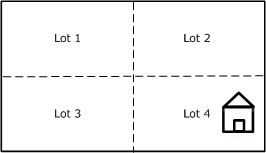

Example: Subdivision

1 May 2016: Andrew buys a large plot of land which has a house on it. Andrew lives in the house.

1 June 2017: Andrew subdivides the land into four lots. Lot 4 contains the house Andrew lives in.

1 July 2017: Andrew sells Lot 1.

Andrew cannot use the main home exception for Lot 1 because it does not have a dwelling on it.

Trusts

5.11 A significant number of family homes in New Zealand are owned by family trusts. Accordingly, the main home exception has been drafted to allow for this possibility, so that a home owned by a trust can be regarded as a main home. However, when a person’s family members live in different dwellings, there is a risk of trust ownership being used to claim the main home exception for more than one residence.

5.12 To prevent the inappropriate use of the main home exception by trustees, we suggest that property owned by a trust is not eligible for the exception if a settlor of the trust:

- separately owns a main home; or

- is a beneficiary of another trust that owns the main home for the settlor.

Example: Student flat

Dave has two properties, a family home which he lives in, and a student flat which his son lives in while studying on a three-year course.

Dave puts the student flat into a trust and makes his son a discretionary beneficiary of the trust.

The trust cannot use the main home exception because the settlor of the trust (Dave) has another main home.

Regular pattern of acquiring and disposing

5.13 The current residential exclusion does not apply to a person who engages in a regular pattern of acquiring and disposing of dwellinghouses. This is intended to ensure habitual renovators cannot utilise the residential exclusion (those who repeatedly purchase property with an intention of resale, occupy the property, renovate it and then sell it).

5.14 For the purposes of the bright-line test we consider that this provision would be unnecessary as the “habitual renovator” would be captured by the intention test in the current land sale rules. It would also be overly harsh for a person who genuinely has to move homes multiple times due to circumstances outside of their control.