Chapter 3 - Date of acquisition and disposal

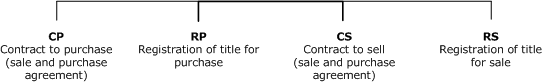

3.1 Under the suggested changes, the bright-line test would apply to sales of property when the property is acquired and disposed of within two years. For most sales of residential property there are four relevant dates for acquisition and disposal.

3.2 There are two key objectives for defining the date of acquisition and disposal:

- providing a certain date so that sellers and Inland Revenue know if the sale falls within the bright-line test; and

- minimising opportunities for people to avoid the bright-line test by artificially deferring sales.

Date of acquisition

3.3 Under the current land sale rules the acquisition date is the date that a person enters into a sale and purchase agreement (CP). Using this date for the bright-line test is problematic. Where a seller has a different lawyer or conveyancer for the sale than they had for the purchase, the seller may not have access to the original sale and purchase agreement. This can mean it is difficult for the seller to know the original date they entered into a sale and purchase agreement, and for Inland Revenue to verify that date. This means that using the contract to purchase date as the date of acquisition would create uncertainty.

3.4 For the bright-line test, we think that the date of acquisition should be the date that title is registered for the purchase (RP). This provides a definite date recorded on Landonline[2] that can be easily used by sellers and Inland Revenue to know when the bright-line period starts.[3]

Date of disposal

3.5 We think the date of disposal should be the date that a person enters into a contract to sell the property. This date is available to the seller at the time of the sale so provides certainty.

3.6 This would mean that the relevant date is different for acquisition and disposal. We think this is necessary, as using the date of registration for disposal leaves open an opportunity to avoid the bright-line test by artificially deferring a sale.

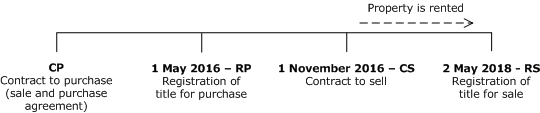

Example: If date of disposal was registration

1 May 2016: Alex acquires residential property (registration - RP)

1 November 2016: Alex wants to sell the property to Bob. However the sale is profitable, and Alex does not want to be caught by the bright-line test.

To avoid the bright-line test, Alex enters into a deferred sale and purchase agreement with Bob. Under the agreement, registration is deferred until 2 May 2018. Alex agrees to rent the property to Bob until the date of registration.

3.7 As the example above shows, the registration date could be deferred while still having the same economic outcome as a sale. This would provide a significant avoidance risk. As a result, we consider the date for disposal should be the date a person enters into a contract to sell the property.

Disposals with no contract to buy

3.8 Under the suggested changes, where a disposal does not involve a contract to sell (for example, a gift), the date of disposal will be determined according to ordinary rules.

Subdivision of an existing title

3.9 For the purposes of the bright-line test, the date of acquisition for subdivided land by an owner is the original date of acquisition of the undivided land by the owner. An example is a person who acquires residential land in February 2016, subdivides the land in 2022, and sells the back section in 2023. The sale of the back section will not be subject to the bright-line test. The treatment is appropriate because the sale of the existing title would not be subject to the bright-line test because it would have occurred more than two years after the land was acquired. However, if the back section had been subdivided and sold in 2017, the sale would be caught by the bright-line test.

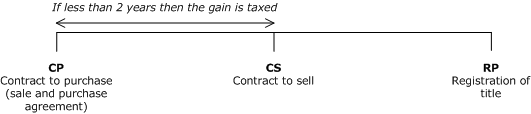

Sales of the right to sell

3.10 An additional rule is needed for sales of the right to buy property (including sales “off the plan”).

3.11 A sale of the right to buy property is when a person sells their interest in property before the date of registration. When a sale of the right to buy property occurs within two years of acquiring that right, it is intended that the bright-line test should apply.

3.12 To capture these sales, we suggest that the bright-line test applies when a person:

- disposes of residential property before taking legal ownership (RP); and

- the disposal was within two years of the seller entering into a sale and purchase agreement (CP).

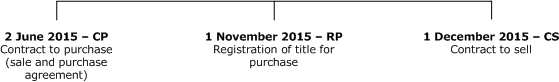

Transitional rules

3.13 The bright-line test would apply to properties for which an agreement for sale and purchase is entered into from 1 October 2015, and which are subsequently disposed of. When the property was acquired other than by way of sale, the bright-line test would apply to properties for which registration of title occurs after 1 October 2015.

Example: Contract to buy before 1 October 2015

This transaction would not be covered by the bright-line test as the relevant sale and purchase agreement was entered into before 1 October 2015.

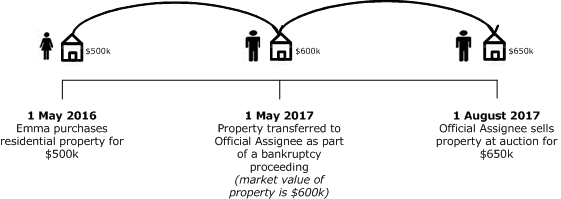

Disposals under insolvency

3.14 Disposals also occur as a result of individual or corporate insolvency. Officials welcome submissions on how the bright-line should apply to disposals in these situations.

Example: Bankruptcy

2 http://www.linz.govt.nz/land/landonline

3 A definite date would also assist implementing a withholding tax. With a definite date it is easier for purchasers of property to know whether they need to withhold because the sale is subject to the bright-line.